QQQ, how overextended are you? | a cautious investor

We’ve highlighted all the warning signs as this bull market phase is nearing exhaustion. We’ve shared bear market news, including the scary Hindenburg Omen. And how have major growth stocks grown? Shows suspicious patterns. But despite all these signs of market exhaustion, our growth-driven benchmarks are running much higher.

Nvidia’s explosive earnings report this week seemed to ignite market euphoria through gasoline, and the AI-led bullish frenzy seemed to continue into the weekend. Other areas of the stock market have seen more constructive price action and volatility remains fairly low, so questions remain as to when and how this relentless market rally will finally peak.

I would argue that the bearish impact of the breadth weakening along with the bearish divergence and overbought conditions remains largely unchanged following NVDA’s earnings report. S&P 500 Seasonality Chart Notice that March is actually one of the weakest months of the election year. So will the Nasdaq 100 follow its usual seasonal pattern, or will the power of AI euphoria push this market even higher into the second quarter?

By the way, we conducted a similar exercise on the Nasdaq 100 last November. Guess what scenario actually played out??

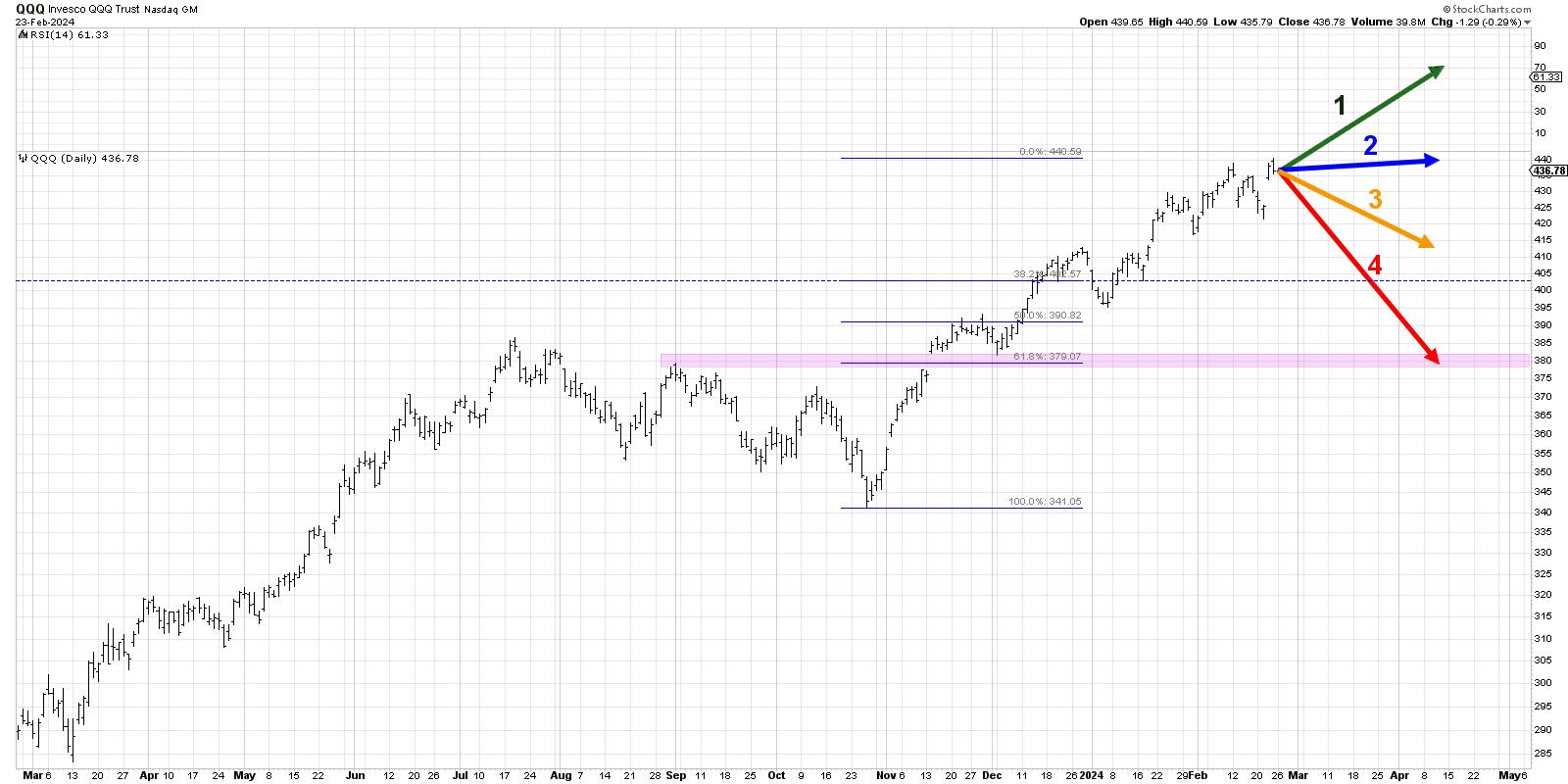

Today we’ll present four potential outcomes for the Nasdaq 100. As I share each of these four future paths, I’ll explain the market conditions that may be involved and also share projected probabilities for each scenario. . And remember, the point of this exercise is three-fold.

- Consider all four potential future paths for the index, think about what could cause each scenario to unfold in terms of macro drivers, and examine which signals/patterns/indicators confirm the scenarios.

- Decide which scenario you think is most likely and why. Don’t forget to leave me a comment and let me know your vote!

- Consider how each of the four scenarios would affect your current portfolio. How would you manage the risk in each case? When and how will you take steps to adapt to this new reality?

Let’s start with the most optimistic scenario, which includes many more all-time highs over the next 6-8 weeks.

Option 1: Highly optimistic scenario

The most optimistic scenario here would mean that the Nasdaq basically continues on its current trajectory. This would imply another 7-10% rise by April, with QQQ threatening the $500 level, with major growth stocks continuing to lead significantly. Nvidia’s strong earnings release spurs additional buying, and the market doesn’t really care what the Fed says at its March meeting. Because life is that good.

In this highly optimistic scenario, value-oriented stocks, including industrials, energy, and financials, would probably move higher in this scenario, but would still lag the growth leadership, which would run much higher.

Dave’s vote: 15%

Option 2: Mildly bullish scenario

What happens if the market is still on the rise, but the pace slows significantly? This second scenario would mean Magnificent 7 stock takes a big breather and more leadership changes are on the horizon. Value stocks are outperforming, with industrials and healthcare stocks improving. However, our benchmarks remain fairly close to current levels because the valuations of large growth companies are not dropping too much.

Dave’s vote percentage: 25%

Option 3: Bearish scenario

Both bearish scenarios would involve declines in key growth companies, and stocks like NVDA would quickly give back some of their recent gains. Perhaps some economic data will come out stronger than expected, or inflation signals may rise again and the Fed may begin to repeat its “higher for longer” approach to interest rates through 2024.

I take this slightly bearish scenario to mean that QQQ remains just above the first Fibonacci support level of $400. These levels are based on the October 2023 low and assume the Nasdaq does not rise significantly above current levels before dropping slightly. While defensive sectors like utilities may not be outperforming, it’s clear that stocks are taking a serious break from the AI craze in early 2024.

Dave’s vote percentage: 45%

Option 4: Super bearish scenario

Now we get to the really scary option. This week’s uptrend ends with an explosive rally that sends stocks from bullish to bearish with a sudden and surprising surge. QQQ will fall about 10-15% from current levels and retest the price gap from November 2023. This represents a 61.8% retracement of the recent uptrend. As the market tracks traditional seasonal patterns, defensive sectors are outperforming and investors are trying to find safe havens. Maybe gold prices will finally break above $2,000 per ounce, and investors will start talking about how a break below the October 2023 lows could be just the beginning of a new bearish phase.

Dave’s vote percentage: 15%

What probability would you assign to each of these four scenarios? Check out the video below, then leave a comment telling us which scenario you chose and why!

RR#6,

dave

P.s Are you ready to upgrade your investment process? Check out our free behavioral investing course!

David Keller, CMT

Chief Market Strategist

StockCharts.com

disclaimer: This blog is for educational purposes only and should not be construed as financial advice. You should not use any of our ideas and strategies without first evaluating your personal and financial situation or consulting a financial professional.

The author had no positions in any securities mentioned at the time of publication. All opinions expressed herein are solely those of the author and do not in any way represent the views or opinions of any other person or entity.

David Keller, CMT, is Chief Market Strategist at StockCharts.com, where he helps investors minimize behavioral bias through technical analysis. He is a frequent host of StockCharts TV and links mindfulness techniques to investor decision-making on his blog, The Mindful Investor. David is also President and Chief Strategist at Sierra Alpha Research LLC, a boutique investment research firm focused on risk management through market awareness. He combines strengths in technical analysis, behavioral finance, and data visualization to identify investment opportunities and strengthen relationships between advisors and clients. Learn more