Risk Assessment is the Key Difference Between Successful and Unsuccessful Traders | Exchange places with Tom Bowley

The development of this secular bull market is overwhelming anyone who tries to disrupt it. That’s why I always say don’t bet on anyone. Trying to sell this type of bull market is financial suicide. I usually have background music playing while I work, and on Friday, as the stock market closed, Elton John’s “I’m Still Standing” started playing. I thought, “Wow, this is timely!” Everything has been thrown into this secular bull market and it still remains “better than ever.”

Resilience is a key component of bull market movements and we have clearly seen this. But bull market or not, we need to lower our expectations right now. I will certainly remain fully invested, but try not to be too bearish when we inevitably enter a period of consolidation or (gasp!) selling. Historically, the first half of the first three quarters are much more optimistic than the second half of the first three quarters. Here’s a breakdown of the S&P 500’s annualized returns by quarters 1 through 3 during the current long bull market that began in 2013.

- 1st to 3rd quarter: +18.14%

- 1st to 3rd quarter 2nd half: -3.37%

This is a very large difference in performance and was calculated over 11 years of data. We know what drove the major indices higher. It was the Magnificent Seven and friends. The 70-page seasonality PDF I provided to everyone at the 16 largest market capitalization companies shared a huge amount of seasonal information with each. Following the theme of the first and second half of the year, we will share the quarterly annual returns for each of these 16 companies.

1st to 1st half of 3rd quarter:

- AAPL: +50.54%

- MSFT: +37.67%

- Google: +50.42%

- AMZN: +51.51%

- NVDA: +75.63%

- Meta: +56.44%

- TSLA: +62.69%

- AVGO: +18.26%

- Cost: +25.50%

- Abe: +33.82%

- CSCO: +18.85%

- AMD: +72.48%

- NFLX: +47.21%

- INTC: -1.11%

- AMGN: +21.81%

- SBUX: +17.13%

Second half of the first to third quarters:

- AAPL: +9.52%

- MSFT: +12.35%

- Google: -8.70%

- AMZN: +13.29%

- NVDA: +47.80%

- Meta: +8.93%

- TSLA: +40.41%

- AVGO: +40.21%

- Cost: +9.64%

- Adbe: +20.37%

- CSCO: +2.69%

- AMD: +26.77%

- NFLX: +19.45%

- INTC: +13.98%

- AMGN: +2.52%

- SBUX: -4.05%

Of these 16 stocks, only AVGO and INTC performed better in the second half of the quarter.

We’ve intentionally ignored the fourth quarter this year because both quarters have a long history of being quite strong. But in the first three quarters, we simply need to recognize historical patterns and lower our expectations. Especially after a significant uptick since the end of October 2023.

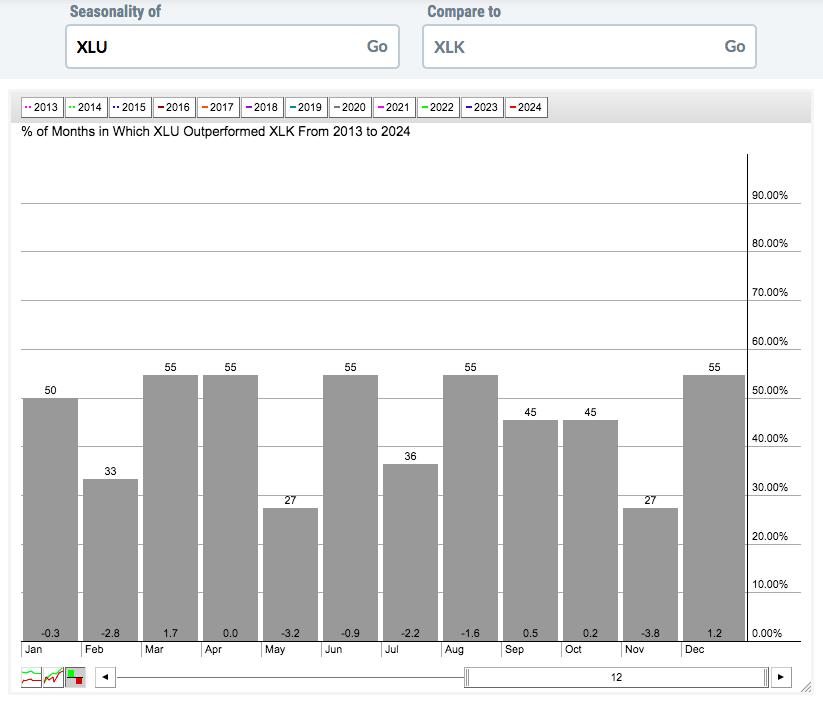

We are still seeing a “risky” market environment that favors the bulls. If you start to see relative strength in more defensive sectors, perhaps that’s a signal to take less risk. You can use StockCharts.com’s seasonality tool to compare defensive utility (XLU) and ultra-offensive skill (XLK) since 2013.

It’s not often that utilities outperform technology, but it seems to happen somewhat often in the three months of a quarter. See March, June, September and December above. March is the month with the best performance of XLU compared to XLK. However, the second months – February, May, August and November – are heavily favored by technology!

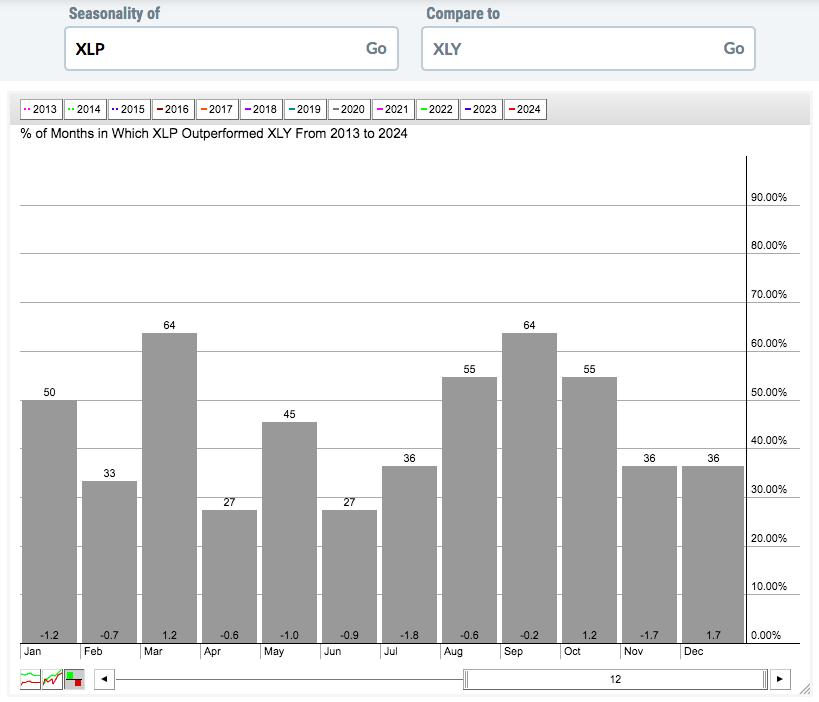

Now let’s look at Consumer Staples (XLP, defensive) and Consumer Discretionary (XLY, aggressive) using the same seasonality chart since 2013.

Again, this is the third month of the quarter in which the defense area has seen relative strength and the second month in which we have seen tremendous relative weakness. To become better traders, we need to recognize these seasonal patterns and know when it is appropriate to take more risk and when it is not.

Based on all this, it seems a bit prudent to me to be more cautious now. I’m not saying our major indices are headed for a big decline. Instead, I would like to point out that we are living in a time of heightened risk this year. What this means for your trading and/or investing is up to each individual.

By the way, I am continuing to offer a free seasonal PDF, “Bowley Trend.” Click here and request your copy!

Happy trading!

tom

Tom Bowley is Chief Market Strategist at EarningsBeats.com, a company that provides a research and education platform for both investment professionals and individual investors. Tom writes a comprehensive Daily Market Report (DMR) to provide guidance to EB.com members each day the stock market is open. Tom has been providing technical expertise here at StockCharts.com since 2006 and also has a fundamental background in public accounting, giving him a unique blend of skills to approach the U.S. stock markets. Learn more