Emerging Market Links + The Week Ahead (February 26, 2024)

Chinese New Year has concluded with Chap Goh Mei on Saturday. In Kuala Lumpur, despite the massive return of tourists and Chap Goh Mei falling on a Saturday, there was subdued participation in this year’s “multicultural” Prosperity Walk through the city along with celebrations on Jalan Alor (just the usual stage sponsored by Loong Kee Dried Meat with no other celebrations sponsored by businesses elsewhere on the street albeit the street was packed with people eating…):

With the Ringgit touching lows not seen since 1998 (the RM4.80 to US$1 level), the Murray Hunter Substack asked: Why is the Ringgit falling? The simple answer is that the Ringgit keeps falling for the same reason inflation keeps rising in the USA etc: Out of control spending along with money supply and debt increases that have not stopped since the end of COVID.

This comes as a time when the Chinese plus global economies remain sluggish. And many in Beijing policy circles apparently blame the 2009-10 stimulus and the flood of cheap liquidity it created as a root cause of their current slowdown. In other words, don’t hold your breath for more stimulus by Beijing.

With that said, Argentina’s Milei has shown its possible to reign in government spending and the money supply as his government has managed to produce the first monthly surplus in over a decade (albeit much more needs to be done to restore any resemblance of sanity or confidence in the country).

Finally, its worth noting that the year of the dragon has also proven to be good historically for the Hang Seng index – something investors in Chinese and Hong Kong stocks can be optimistic about.

$ = behind a paywall

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 Meituan prepares for overseas voyage with CEO Wang Xing as captain (Bamboo Works)

The online-to-offline service provider’s founder will personally lead his company’s global pivot, hoping to imitate the success of other Chinese internet majors

Meituan (SEHK: 3690) is launching a major restructuring that will place its core local business and new business units under two of its senior vice presidents

Founder and CEO Wang Xing will lead the company’s overseas charge, which dates back to the launch of its KeeTa takeout delivery service in Hong Kong last year

🇨🇳 ZhongAn weathers feeble economy with business from online shoppers, travelers (Bamboo Works)

The digital insurer posted solid gross written premium growth for January and all of 2023, likely on the back of its popular insurance products for online shoppers and travelers

ZhongAn (HKG: 6060 / FRA: 1ZO) collected 2.4 billion yuan in gross written premiums in January, up about 20% from a year earlier

The popularity of its insurance against online shopping and travel-related mishaps is driving its revenue growth

🇨🇳 EU Launches Anti-Subsidy Probe on CRRC Unit in Bulgarian Train Deal (Caixin) $

The European Union has opened an unprecedented investigation into a unit of China’s state-owned train maker CRRC Co. Ltd. (SHA: 601766 / HKG: 1766 / FRA: C2L / OTCMKTS: CRCCY) over alleged unfair subsidies.

The European Commission announced the probe Friday on CRRC unit Qingdao Sifang Locomotive and Rolling Stock Co. Ltd. over its bid for a €610 million ($657 million) public procurement contract in Bulgaria to provide electric trains along with maintenance and staff training.

🇨🇳 Trip.com (9961 HK): Looks to Reap More Recovery Benefits (Smartkarma) $

Trip.com (NASDAQ: TCOM) has a remarkable 4Q23 with adjusted net profit surged 437.1% YoY. Higher volume and better market efficiency have resulted in massive margin expansion.

Net cash has ballooned to about 15% of its share price, and this has allowed it to carry out a massive US$300m Capital Return Program in 2024.

Business has outperformed the industry in CNY, with domestic hotel and air business volume increased by 60% and 50% YoY. Its overseas platform also saw double-digit growth.

🇨🇳 Maoyan shines in spotlight of rebounding China box office (Bamboo Works)

The country’s top ticket seller said its revenue doubled last year, as income from film production overtook its older ticketing business to become its top revenue source

Maoyan Entertainment (HKG: 1896 / FRA: 9ME / OTCMKTS: MAOFF) said it expects to report its revenue roughly doubled last year on a strong rebound in China’s box office, while its profit soared more than eightfold

Despite the strong gains, analysts see the company’s revenue growth slowing to 16% this year as consumers become more cautious and foreign films regain market share

🇨🇳 TH International expansion plans slow on need for ‘more capital’ (Bamboo Works)

The operator of the Tim Hortons chain in China is falling behind its aggressive expansion plans amid disagreement with the brand’s owner about new investment

TH International (NASDAQ: THCH) needs to ‘commit more capital’ to expand its Tim Hortons business in China “in an exciting way,” according to the CEO of Tim Hortons brand owner RBI

Previous company data showed TH International had 909 Tim Hortons stores in China in mid-January, short of the 1,000 it had previously targeted by the end of 2023

🇨🇳 Chinese education giant urged to repay bondholders early as default fears mount (Caixin) $

Some global investors are urging Chinese private education giant XJ International Holdings (HKG: 1765 / FRA: HE1) to redeem half of its $350 million in bonds before maturity, as the creditors fear the Hong Kong-listed firm may intentionally default on repayments.

The bonds are due in 2026, but the creditors asked for the early redemption to be completed by March 2 in a letter sent to the Chinese company last month by their legal adviser, Chicago-headquartered global law firm Kirkland & Ellis LLP.

🇨🇳 Venus Medtech still seeking cure for governance problems (Bamboo Works)

The transcatheter maker’s shares were suspended last November, and it must still meet several conditions from the Hong Kong Stock Exchange before trading can resume

Venus MedTech HangZhou (HKG: 2500 / OTCMKTS: VMTHF) disclosed governance and disclosure issues last May that forced it to halt trading in its stock six months later after an internal investigation

The company is losing money, but analysts expect its loss to narrow by half this year and its revenue growth to accelerate to 45%

🇨🇳 With no cure in sight, drugs firm LianBio begins exit strategy (Bamboo Works)

The biotech, which obtained rights to novel drugs for use in the Chinese market, has announced a plan to wind up its business and delist from the Nasdaq just four years after being founded

The drug maker will sell its remaining pipeline assets, phase out ongoing clinical trials and pay a special dividend of $4.80 per share

LianBio (NASDAQ: LIAN) has failed to deliver any product to the market since it was established in 2020

🇨🇳 Futu Holdings: Slower Growth Ahead (Seeking Alpha) $

Futu Holdings Ltd (NASDAQ: FUTU) will likely report a more moderate pace of growth for Q4 2023, taking into account the high base in Q4 2022 and elevated costs relating to overseas market expansion.

The company’s 2024 results might be negatively impacted by rate cuts as a result of lower interest income.

A Hold rating for FUTU is maintained considering the slower growth outlook.

🇭🇰 Russian buyer of Tigre de Cristal ends deal: Summit Ascent (GGRAsia)

Hong Kong-listed Summit Ascent Holdings Ltd (HKG: 0102) says that the previously-announced sale of its Tigre de Cristal casino operations to a Russian firm has been terminated at the request of the would-be buyer.

Following the news on the sale of the Tigre de Cristal operations, a total of all but one of the Summit Ascent’s six directors had resigned. The reason given was their “disapproval” of the deal. As per the latest available information, only regional casino investor Andrew Lo Kai Bong is a director, as well as chairman, of Summit Ascent.

In an August filing to the Hong Kong bourse, Summit Ascent said it had swung to a loss of HKD16.1-million (US$2.1-million) in the first half to June 30, compared to a HKD85.2-million profit in the prior-year period.

🇭🇰 Perfect Medical (1830 HK) (Oriental Value)

Perfect Medical Health Management (HKG: 1830 / OTCMKTS: PFSMF) stands as one of the major players in the beauty service sector in Hong Kong.

Companies like Perfect Medical provide sales commissions to staff members when they successfully sell beauty vouchers. Generally, these vouchers have a limited validity period, and if customers fail to utilize them and complete their purchased treatments, the vouchers expire. In the case of Perfect Medical, these vouchers remain valid for one year. Expired vouchers are considered revenue and contribute to pure marginal profit for the company.

This prepaid model allows Perfect Medical and its peer Water Oasis (HKG: 1161 / OTCMKTS: WOSSF) to maintain a negative working capital and net cash balance sheet.

🇲🇴 Gearing easing to take time for some Macau ops: Fitch (GGRAsia) & Higher Inbound Tourism Positive for Macao’s Casino Operators (Fitch Ratings)

See our Macau ADRs list.

Deleveraging “will take time” for some of the Macau casino operators, “despite the improvements” in the sector’s business outlook, said Fitch Ratings Inc in a Wednesday memo, offering some commentary following the Chinese New Year trade.

Overall visitor arrivals to Macau during the eight-day Chinese New Year (CNY) festivities reached almost 1.36 million, the Macao Government Tourism Office (MGTO) announced on Sunday. The average hotel occupancy rate for the period stood at 95.2 percent, as detailed in the same press release.

Fitch stated in its update: “This influx reinforces our expectation of a recovery in Macau’s gaming sector for the rest of the year, despite the economic headwinds facing China.”

🇰🇷 Sole S.Korea-locals casino eyes Taiwan, Philippine clients (GGRAsia)

See: Kangwon Land (KRX: 035250): Shares Are Still Down Despite a Mass Gaming Revenue Recovery

Kangwon Land (KRX: 035250)’s new arrangements are with: Taiwan-based Far East International Co Ltd, said to be a sales agent there, for South Korean air carrier Fly Gangwon, and for Vietnam airline Vietjet Air; and with Philippines-based Rakso Travel, a sales agent for that country’s flag carrier, Philippine Airlines. Rakso is said to specialise in package trips to South Korea.

🇰🇷 Asian Dividend Gems: Youngone Holdings (Asian Dividend Stocks) $

Youngone Holdings (KRX: 009970) is an attractive deep value stock. Net cash (including short term investments) was 1.1 trillion won at the end of 3Q 2023 (79% of market cap).

Youngone Holdings is the holding company of Youngone Group. Youngone Corp (KRX: 111770) is best known for its OEM apparel business for major branded companies such as The North Face and Patagonia.

🇰🇷 Hyosung Corp (004800 KS): Spin-Off & KOSPI200 Index Implications (Smartkarma) $

(Industrial chaebol – chemical industry, industrial machinery, IT, trade, and construction) Hyosung Corporation (KRX: 004800) has announced that it is spinning off part of its business holdings to Hyosung New Holding Corporation in a 0.818:0.182 ratio.

The stock will remain suspended from late June to late July. We expect Hyosung Corporation (004800 KS) to maintain its index membership while the New Entity will not be added.

The dynamics between listed ETFs and non-listed passive trackers differ and we take a look at the potential index flows.

🇰🇷 Hyundai Rotem: Passage of Export-Import Bank Act To Support Korean Defense Companies (Smartkarma) $

On 21 February, it was announced that the long awaited amendment to the Export-Import Bank Act was passed by the Korean National Assembly.

As a result of this passage, the capital limit of the Export-Import Bank of Korea will be raised from the current 10 trillion won to 25 trillion won.

The revision of this law is expected to benefit major defense companies in Korea including Hyundai Rotem (KRX: 064350), Hanwha Aerospace (KRX: 272210), LIG Nex1 Co (KRX: 079550), and Korea Aerospace Industries (KRX: 047810).

🇸🇬 GEN Singapore 2023 rev up 40pct, profit tops US$456mln (GGRAsia)

Casino operator Genting Singapore (SGX: G13 / FRA: 36T / OTCMKTS: GIGNF / GIGNY) posted annual net profit of nearly SGD611.6 million (US$456.0 million) for full-year 2023, up 79.8 percent from the prior year. That was on revenue that rose 40.1 percent year-on-year, to just below SGD2.42 billion, according to unaudited results published on Thursday by the firm.

Genting Singapore is the operator of Resorts World Sentosa (pictured in a file photo), one of Singapore’s two casino resorts. The firm is a subsidiary of Malaysian conglomerate Genting Berhad (KLSE: GENTING / OTCMKTS: GEBHY).

🇸🇬 GEN Singapore uptick post 4Q amid China tourism: analysts (GGRAsia)

Two brokerages acknowledged in respective Friday notes that Genting Singapore (SGX: G13 / FRA: 36T / OTCMKTS: GIGNF / GIGNY), promoter of Singapore casino complex Resorts World Sentosa, had missed quarter-on-quarter market forecasts for earnings before interest, taxation, depreciation and amortisation (EBITDA) in the fourth quarter.

“We think that the upcoming first-quarter results will be better, barring any blips in VIP hold rate, due to seasonally strongest gaming volumes, the mutual Singapore-China visa waiver starting February, non-recurring one-off items, and concert-led tourism boom,” wrote the Nomura analysts, referring latterly to supporting factors relating to Singapore’s tourism sector.

For its part, JP Morgan stated: “We don’t feel the equity story of Genting Singapore is changing which is primarily based on ‘undemanding valuation’ even based on current run-rate, with ‘unmodelled optionality’ from the return of Chinese players near-term, and RWS 2.0 long-term.”

🇸🇬 7 Singapore Stocks That Will Benefit from Budget 2024 (The Smart Investor)

This year’s Budget includes a raft of measures that will benefit different sectors of the economy.

Part of these CDC vouchers can be used in approved supermarkets to purchase groceries and necessities, thereby benefiting supermarket operator Sheng Siong Group (SGX: OV8 / OTCMKTS: SHSGF) and pan-Asian retailer DFI Retail Group (SGX: D01 / FRA: DFA1 / OTCMKTS: DFIHY), which operates Cold Storage and Giant outlets.

This move should benefit preschool operators such as Mindchamps Preschool (SGX: CNE) as it should generate more demand for childcare services.

Companies that stand to benefit from this AI boost include test specialist AEM Holdings (SGX: AWX) and blue-chip electronic manufacturing services provider Venture Corporation (SGX: V03 / FRA: VEM / OTCMKTS: VEMLF).

These healthcare initiatives under Age Well SG, along with Healthier SG, should benefit hospital and clinic operators such as Raffles Medical Group (SGX: BSL / FRA: 02M1 / OTCMKTS: RAFLF) and IHH Healthcare Bhd (KLSE: IHH / SGX: Q0F / OTCMKTS: IHHHF).

🇸🇬 Singapore Airlines – Onset of Earnings Normalization to Heighten Focus on Efficiency (Smartkarma) $

We cut our Singapore Airlines (SGX: C6L / FRA: SIA1 / OTCMKTS: SINGY / SINGF) operating profit by 9% to S$2.6bn in FY24 and by 17% to S$1.5bn in FY25 versus consensus of S$2.1bn.

SIA’s cost control is under-examined and we publish a deep dive on a concerning level of inflation relative to key peers, which actually escalated in 3Q24.

Cargo broke even in peak season, and Scoot’s margins present a conundrum as it may need to be further utilization to help SIA with cost management.

🇸🇬 Singapore Airlines Reports Record Operating and Net Profit for 9M FY2024: 5 Highlights from the Airline’s Latest Earnings (The Smart Investor)

🇸🇬 UOB Reports Record Net Profit and Raises its Final Dividend to S$0.85: 5 Highlights from the Bank’s 2023 Earnings (The Smart Investor)

The lender is optimistic that its loan book and fee income can continue to grow this year.

After DBS Group (SGX: D05 / FRA: DEVL / DEV / OTCMKTS: DBSDY / DBSDF) reported a sparkling set of earnings for 2023, United Overseas Bank (SGX: U11 / FRA: UOB / UOB0 / OTCMKTS: UOVEY / UOVEF), or UOB, is next in line to announce its full-year results.

Here are five highlights from the bank’s latest earnings report.

A robust financial performance

Higher fee income from increased card spending

Lower net interest margin with flat loan growth

Higher cost-to-income ratio offset by lower non-performing loans ratio

Higher dividends

🇸🇬 iFAST Reports a More Than 10-Fold Increase in Net Profit for 4Q 2023: 5 Highlights from the Fintech’s Latest Earnings (The Smart Investor)

The fintech is optimistic that revenue and earnings will continue to grow this year.

iFAST Corporation Limited (SGX: AIY / FRA: 1O3 / OTCMKTS: IFSTF) recently announced its fourth quarter 2023 (4Q 2023) and full-year earnings report.

Here are seven highlights from the fintech’s latest earnings report.

A stellar financial performance

AUA hits a new record high

A significant boost from the Hong Kong ePension contract

iFAST Global Bank targets breakeven by 4Q 2024

Maintained its final dividend

🇰🇭 🇭🇰 Cambodia GGR recovery to up pace this year: NagaCorp (GGRAsia)

Cambodia is likely to receive more visitors from mainland China this year as direct-flight capacity grows, which might aid recovery of the gross gaming revenue (GGR) of that nation’s casino industry in general, and of NagaCorp (HKG: 3918 / FRA: N9J / OTCMKTS: NGCRF) in particular, said on Tuesday Mike Ngai, the group’s chief operating officer.

His comments were at a media briefing in Hong Kong, following Monday’s release of the group’s full-year results. They showed its 2023 GGR at only circa 30 percent of 2019 level, i.e., the trading period prior to the Covid-19 pandemic.

The group said in Tuesday’s update, it might scale down the cost and size of the Naga 3 extension for NagaWorld, in favour of building up its capital.

🇻🇳 VinFast: Financial Situation Gets Scarier (Seeking Alpha) $

VinFast Auto Ltd. (NASDAQ: VFS), the Vietnamese electric vehicle company, saw its shares collapse after its SPAC merger mega-rally, and its latest results indicate further potential losses.

The company plans to expand globally, but it likely will need a lot more capital to do so.

VinFast reported significant losses, negative gross margins, and a weak balance sheet, while the valuation still seems stretched.

🇰🇿 Freedom Holding: Ruling Out Allegations, No Market Reaction On Strong Results (Seeking Alpha) $

Freedom Holding Corp. (NASDAQ: FRHC) has outperformed the S&P 500 Index by a factor of 2 over the past 3 years.

Hindenburg Research’s allegations of sanctions evasion and illegal activities were not supported by evidence in an external audit of FRHC.

FRHC reported substantial revenue growth in Q3 FY2024 and is experiencing significant growth driven by diversified revenue streams and expansion in various regions.

With a favorable valuation indicating a potential upside of 24.43% and a positive growth trajectory, FRHC is a compelling buying opportunity for investors seeking exposure to emerging markets.

I therefore reiterate my ‘Buy’

🇿🇦 Market gives cold shoulder to Pick n Pay’s capital raise and Boxer IPO (IOL)

See: Pick ‘n Pay (JSE: PIK / FRA: PIK): Value Stock Characteristics as South Africa Continues to Deteriorate

The market gave Pick ‘n Pay (JSE: PIK / FRA: PIK) the cold shoulder yesterday after it announced a capital raise and its intent of an initial public offering (IPO) of its discount supermarket stores Boxer.

The move comes amid a growing debt burden, muted sales and the loss of market share.

The shares closed the day 16% lower at R21.71.

The move comes as the recently appointed CEO of one of the country’s biggest retailers, Pick n Pay’s Sean Summers, has hit the ground running to turn around the retailer that has been losing market share amid muted sales.

🇿🇦 Anglo American is not spinning off problematic South African assets (IOL)

The Anglo-American (LON: AAL / JSE: AGL / OTCMKTS: NGLOY) board is fully behind the restructuring of its operations under Anglo American Platinum (JSE: AMS / FRA: RPHA / FRA: RPH1 / OTCMKTS: AGPPF / ANGPY) and Kumba Iron Ore (JSE: KIO / OTCMKTS: KIROY / KUMBF), although the diversified resources miner was not inclined to separating the problematic South Africa companies from its other global units.

There has been speculation over the past few weeks that Anglo Platinum could be considering a split of its South African and southern African businesses – including operations in Zimbabwe – from the rest of the diversified entity. South Africa has been particularly challenging for Anglo American, which faces power supply constraints and inabilities to move ore, which had forced Kumba to cut its production for the next two years.

🇰🇾 🌎 Patria: High-Yield, High-Growth, Strong Track Record (Seeking Alpha) $

Patria Investments Limited (NASDAQ: PAX) is successfully executing an ambitious consolidation strategy in the Latin American alternative asset management landscape, driving steady AUM growth and EPS expansion.

The company has a resilient business model with stable revenue from management fees and the potential for significant performance fees.

With a dividend yield of 7%, the stock offers attractive capital appreciation potential combined with a solid recurring income.

🇱🇺 🇦🇷 Corporación América Airports: Risks Exist But A Cautious Buy (Seeking Alpha) $

Corporación América Airports (NYSE: CAAP) is recovering well from the pandemic, reaching 96.2% passenger traffic of its 2019 levels.

Despite a difficult period during the pandemic, the company has managed to improve its return metrics and decrease dependence on borrowings.

Compared to its peers, it is underpriced, but trailing multiples suggest the future growth in return metrics to slow.

An alternative valuation technique confirms the statement that the company is a “Buy.”

🇧🇷 BrasilAgro Earnings Review: Exercising Caution After Persistent Challenges (Rating Downgrade) (Seeking Alpha) $

Brasilagro – Co Brasileira De Proprieda (NYSE: LND) reported a quarter marked by weakened revenues, with a year-over-year retraction and a significant compression of margins.

The company faced challenges from declining commodity prices and rising agricultural costs.

Dividend distribution for the year could be compromised, with a potential yield close to 5%, rendering the investment thesis unattractive in the short term.

Despite challenges, BrasilAgro’s long-term outlook remains optimistic, though strategic shifts may introduce short- to medium-term volatility.

🇧🇷 Cielo: Limited Upside Potential On The Verge Of A Public Buyback Offer (Seeking Alpha) $

CIELO SA Instituicao de Pagamento (BVMF: CIEL3), a payments company in Brazil, has implemented cost-reduction measures and seen a gradual recovery in profitability.

The company’s two controlling shareholders, Banco Bradesco (NYSE: BBD) and Banco do Brasil (BVMF: BBAS3 / FRA: BZLA / OTCMKTS: BDORY), have proposed a public buyback offer to privatize Cielo.

A proposed takeover bid to privatize the company at around $1 per share for its ADR suggests limited upside potential.

Despite being undervalued compared to peers, DCF analysis indicates Cielo’s limited upside potential.

🇧🇷 Embraer Stock: Still A Buy Despite Downgrade And Miss (Seeking Alpha) $

Embraer SA (BVMF: EMBR3 / NYSE: ERJ)‘s airplane deliveries for 2023 fell short of guidance, with 1-6 units fewer commercial airplanes and 5-15 units fewer executive jets delivered.

Analysts are expecting stable year-over-year revenues and a 472% growth in earnings per share for Embraer’s Q4 2023 earnings.

Despite missing delivery guidance, analysts still consider ERJ stock a buy, but management’s comments on supply chain health and 2024 deliveries will be crucial.

🇧🇷 Telefonica Brasil’s Q4 Earnings: Strong Buy For Income Investors (Seeking Alpha) $

Telefônica Brasil (NYSE: VIV) has been upgraded from a buy to a strong buy following strong Q4 earnings and robust financial improvements in 2023.

Accelerated organic growth in mobile and fixed services and a commitment to shareholder returns drove the upgrade.

Expectations for increased profits, double-digit shareholder yield, and fair valuation make Telefonica Brasil an attractive income stock for investors.

🇨🇱 LATAM Group – Strong Momentum and Strategic Opportunities (Smartkarma) $

LATAM Airlines Group (SSE: LTM / FRA: LFL / OTCMKTS: LTMAY) surprised the market with strong guidance for 2024 earnings growth following upgrades through 2023. We raise our 2024 EBITDAR 14% to $2.8bn.

A successful restructuring under Chapter 11, and market leadership in key regions, is paying off for LATAM as demand remains robust.

Such a strong recovery positions it to make further strategic gains, particularly with the risk that competitor Gol Linhas Aereas Inteligentes Sa (NYSE: GOL / BVMF: GOLL4) must shrink its fleet through its own CH11 processs.

🇲🇽 Coca-Cola FEMSA: Still A Buy After A Bubbly Rally, Q4 Earnings On Tap (Seeking Alpha) $

Consumer Staples sector valuations are high, with Coca-Cola Femsa SAB de CV (NYSE: KOF) trading at 18.7 times 2024 earnings estimates, leaving just a modest amount of intrinsic upside potential.

Coca-Cola FEMSA is the largest bottler for The Coca-Cola Company outside the US, with strong profit strength and positive free cash flow.

KOF stock has a bullish trend, with a history of beating EPS estimates and positive share-price reactions, but the valuation could become a risk.

With high momentum and free cash flow strength, in addition to its high yield, I keep my buy rating heading into earnings this week.

I outline key price levels to monitor on the chart.

🇺🇾 🌎 Arcos Dorados: Leading McDonald’s Franchisee Is Fairly Valued (Seeking Alpha) $

Arcos Dorados Holdings Inc (NYSE: ARCO) is the largest franchisee in the McDonald’s system, operating and sub-franchising over 2,300 restaurants.

ARCO has been able to generate superior net profits through its ability to sub-franchise within its geographical regions, allowing it to earn attractive franchise fees.

Valuing Arcos Dorados using a sum-of-the-parts analysis, the company appears to be fairly valued at $3.9 billion.

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 China’s playbook no longer involves a big stimulus bazooka (FT) 🗃️

Take the recent social media posting of a People’s Daily article, the mouthpiece of China’s ruling Communist party, from the lunar new year of 1960. It told of harvests up “28.2 per cent” at a time when — as educated Chinese now know — the country was in fact sunk in a desperate famine that may have killed as many as 40mn.

Aside from the chilling absurdity of a huge lie, the post’s impact rested on the fact that in 2024 — as in 1960 — the national output of Panglossian propaganda is once again outstripping a more meagre reality. Official censors clearly recognised the satire — they deleted the article this month.

Indeed, that 2009-10 stimulus is still blamed in Beijing policy circles as a root cause of the current slowdown. The flood of cheap liquidity contributed to the continuing local government debt crisis, nurtured a network of underground banks, inflated property prices to unsustainable levels and spurred overcapacity in a host of industrial sectors.

🇨🇳 In Depth: China quant funds in firing line over stock market volatility (Caixin) $

A three-day trading suspension imposed on a well-known domestic quant fund manager by Chinese regulators this week has shone a spotlight on the activities of investors that rely on complex mathematical models, algorithms and automated trading, and renewed concerns over their role in stoking sudden drops in the country’s stock markets.

The punishment of Ningbo Lingjun Investment Management Partnership by the Shanghai and Shenzhen stock exchanges, announced on Tuesday, was quickly followed by a pledge from both bourses to strengthen supervision of quant, especially high-frequency, trading as well as institutions such as private quant fund management firms.

🇨🇳 Crack down on abnormal trading does not restrict selling, says China’s securities watchdog (Caixin) $

China’s securities watchdog said Thursday that the regulatory measures taken by the Shanghai and Shenzhen stock exchanges against abnormal trading behavior aim to fulfill the responsibility of trading supervision, not to restrict selling.

China Securities Regulatory Commission (CSRC) made the comment at a press briefing Thursday in response to media reports about the selling ban.

🇨🇳 China’s bond funds outshine equity peers amid stocks slump (Caixin) $

China’s mutual funds produced a mixed bag of performance last year. Publicly offered equity funds endured a second straight year of losses, grappling with a prolonged stock market rout. Bond funds, on the other hand, had a comparatively stellar year.

The uptick in bond fund flows fueled a shift in China’s asset management landscape, with mutual funds emerging as the most preferred asset management avenue, outstripping banking wealth management for the first time.

🇭🇰 Hoping for better luck, HK stocks enter the Year of the Dragon (Bamboo Works)

The Hang Seng Index plunged 28.6% in the year of the rabbit, hurt by China’s slow economic recovery and simmering tensions with the United States. Investors will be looking for a rebound under the auspicious sign of the dragon

Since its launch in 1969, the Hang Seng has always risen in the dragon years, with gains averaging around 14%

But any rally this time could be hampered by uncertainties over the U.S. presidential election and interest rate policy

🇮🇩 Indonesia to wipe out global nickel rivals, warns French miner Eramet chief (FT) 🗃️

🇦🇷 Argentina markets double down on Milei as investors ‘start to believe’ (Reuters)

Amid a painful economic downturn and with the government strapped for cash, Milei has made tough austerity a key focus since taking office in December, helping the country post its first monthly fiscal surplus for over a decade in January, music to the ears of investors after years of over-spending.

The South American country’s debt, however, remains risky with Argentina having defaulted nine times, most recently in 2020 before a major restructuring. Milei’s economic fixes face serious hurdles and push-back on the streets and in Congress.

But sentiment has been helped by improving exports, with a trade surplus in two straight months on stronger grains production after last year’s harvest was battered by drought.

Meanwhile, moves to mop up pesos in the market, including via short-term Treasury bills, have bolstered the currency and trimmed the gap between the controlled official exchange rate and popular parallel markets where dollars are more expensive.

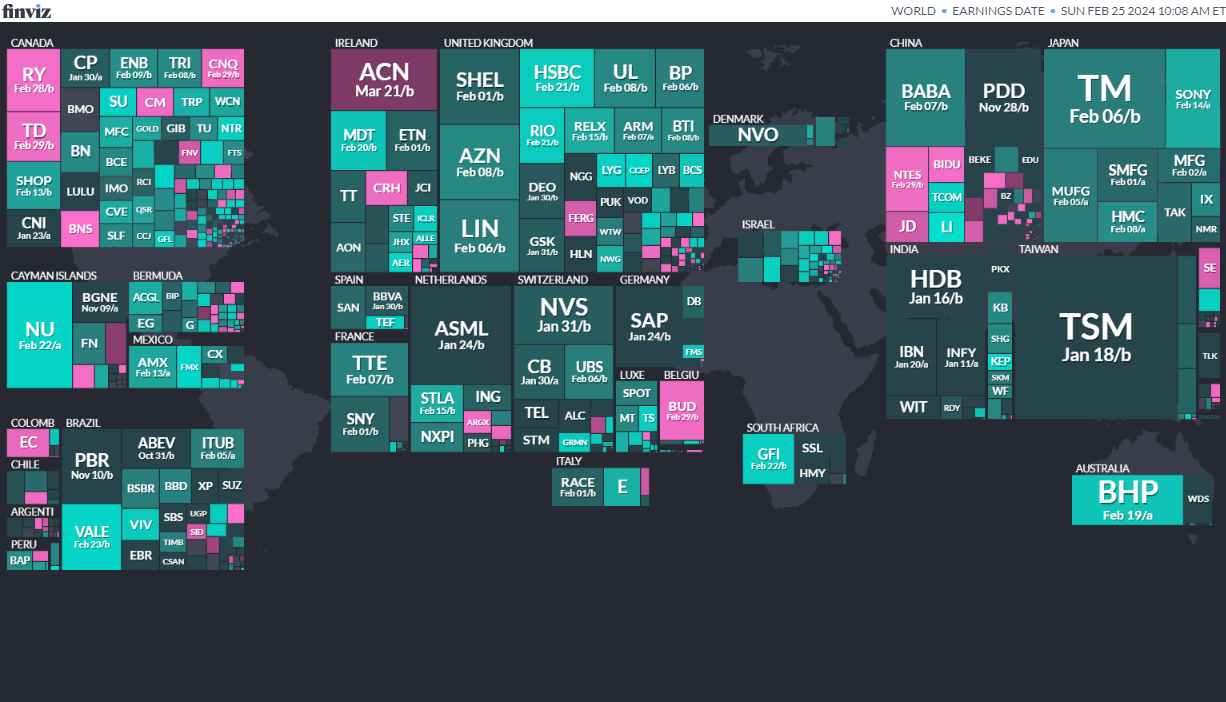

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

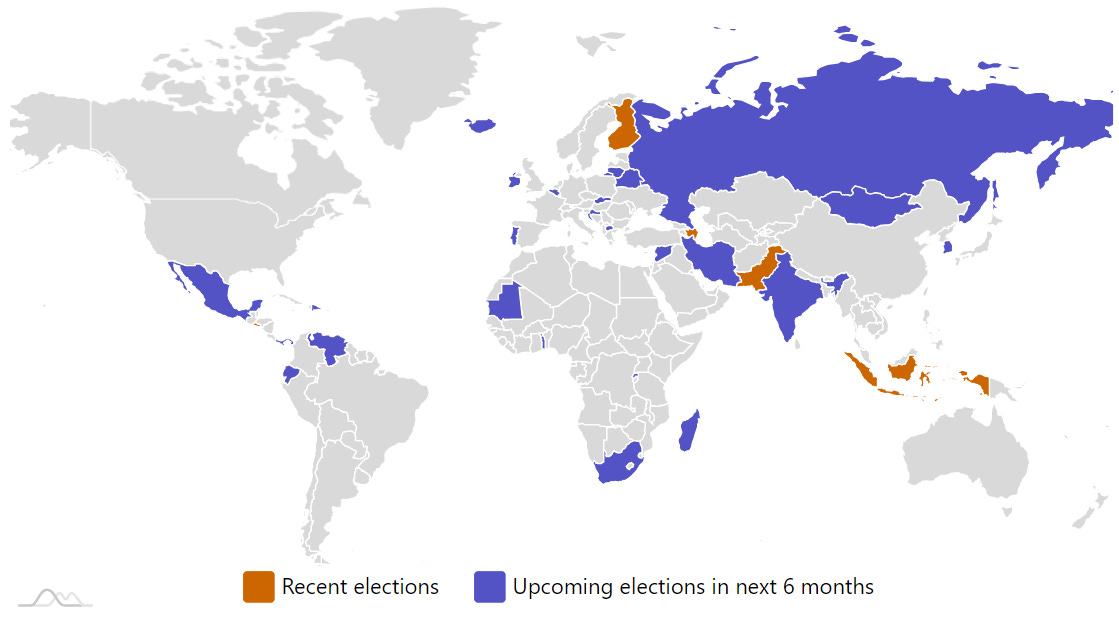

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

-

Russian Federation Russian Presidency Mar 17, 2024