Incyte Stock: Potential GARP Superstar (NASDAQ:INCY)

Blackjack 3D

At first glance, Incyte(NASDAQ:INCY) is a great value stock to buy growth at a reasonable price, GARP. Over the past 10 years, revenues have recorded a very enviable compound annual growth rate (CAGR) of 26.4% and are expected to continue to grow. Years. Although the growth rate is expected to exceed the industry average, FY24 PER is 13.4 times, lower than the industry average of 19.3 times. PS is 3.3 times, which is lower than the industry average of 4.0 times. Is this a great GARP company or a potential value trap? 70% of total revenue comes from a single product called Jakafi (ruxolitinib), which faces a patent cliff in late 2028. We dug a little deeper to find that the company is on the right track in diversifying its product offerings and revenues. brook.

the company

Incyte is a biopharmaceutical. The company specializes in the discovery, development and commercialization of hematology/oncology, blood cancer treatment, inflammation and autoimmune treatments. Insight’s medicines, such as Jakafi, are used to treat polycythemia vera, a type of blood cancer, and myelofibrosis, a bone marrow cancer that interferes with the production of blood cells. Pemazyre treats bile duct cancer in adults.

Incyte employs more than 2,500 people, with more than 1,000 involved in research and clinical development. Science magazine ranked Incyte second among the Best Employers of 2023.

price/performance

Insight’s price performance was disappointing, trading down 22% compared to the same period last year and down 29% compared to five years ago. Because stock prices are roughly the same, investors receive no reward for holding stocks for more than 10 years.

finance

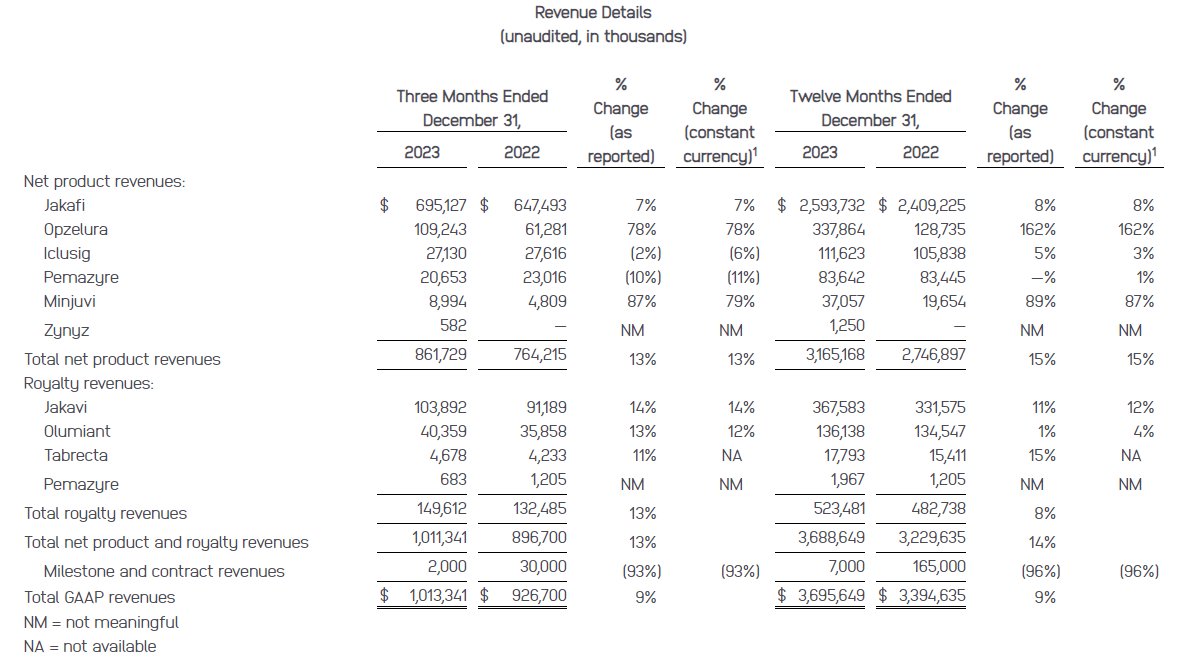

Incyte reported FY23 results earlier this month, with revenue up 9% from $3.4 billion to $3.7 billion and non-GAAP EPS up 27% from $2.8 to $3.56. Revenues for its flagship product, Jakafi, increased by 8%, while Opzelura grew by an even more impressive 162%.

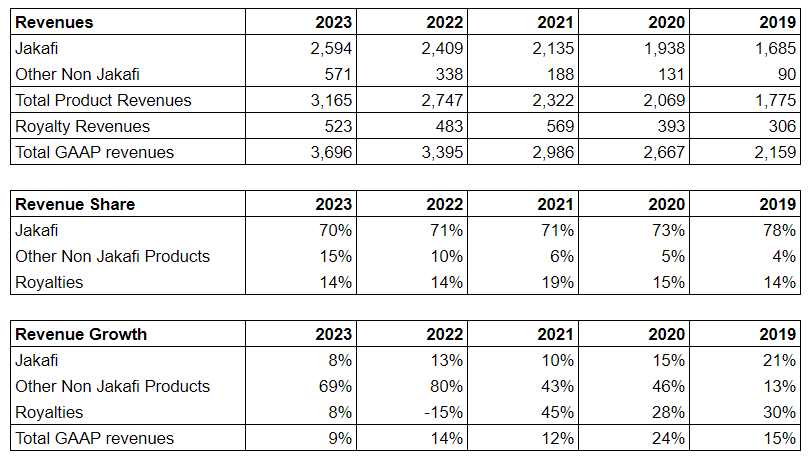

Incyte FY23 Revenue Analysis (Incyte)

Excluding ‘milestone and contract revenue’, product and royalty revenue alone increased by 14%. Net profit margin improved significantly from 18.3% to 21.5%.

Incyte has a strong balance sheet with $5.2 billion in shareholder equity, of which only $280 million is intangible assets. Shareholder equity has grown significantly over the past decade from negative $87 million. As of December 2023, it has virtually no debt and cash assets of $3.7 billion. The company also has strong cash generation capabilities, allowing it to dispose of up to $5.5 billion in additional retained earnings over the next four years.

For pharmaceutical companies, R&D is essential to discovering new treatments, and it’s even more important for Incyte ahead of Jakafi’s patent cliff in 2028. R&D expenses in FY23 were $1.6 billion, representing 44% of revenue. There are currently 8 approved products, 7 are in critical stages and 19 have completed clinical proof-of-concept.

Profit and Growth

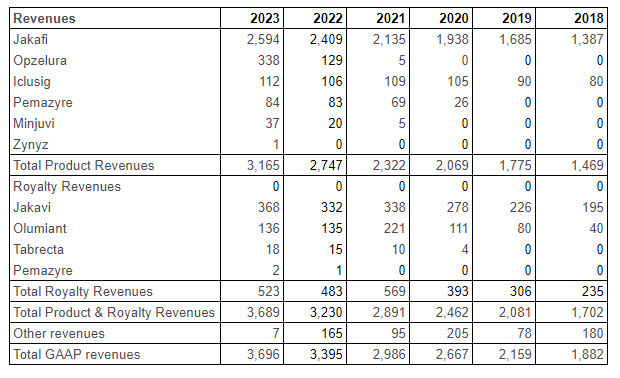

Before we continue with the growth, let’s take a look at how Incyte’s earnings have developed over the past five years.

Incyte Earnings Analysis (Author and Incyte 10K Statement)

In addition to Jakafi, Incyte has several other revenue-generating products and royalty revenues. Simplify this to get a clearer picture of your revenue share and growth.

Incyte Revenue and Growth Analysis (Author and Incyte 10K Statement)

Jakafi accounted for 70% of total revenue in FY23, compared to 78% in FY19. Royalties remained relatively constant, accounting for 14% in FY23. Other products share increased from a low base of 4% in FY19 to 15% in FY23. This is an area that has seen significant growth. In FY20, Jakafi and Iclusig were the only revenue-generating products, with four new products starting to contribute to revenue. This increased from $90 million in FY19 to $571 million in FY23, representing an impressive CAGR of over 45%. Sales of non-Jakafi products increased by 69% in FY23, primarily driven by a 162% increase in Opzelura. Ozelura is an inhibitor ruxolitinib for the topical treatment of non-segmental vitiligo and mild to moderate atopic dermatitis.

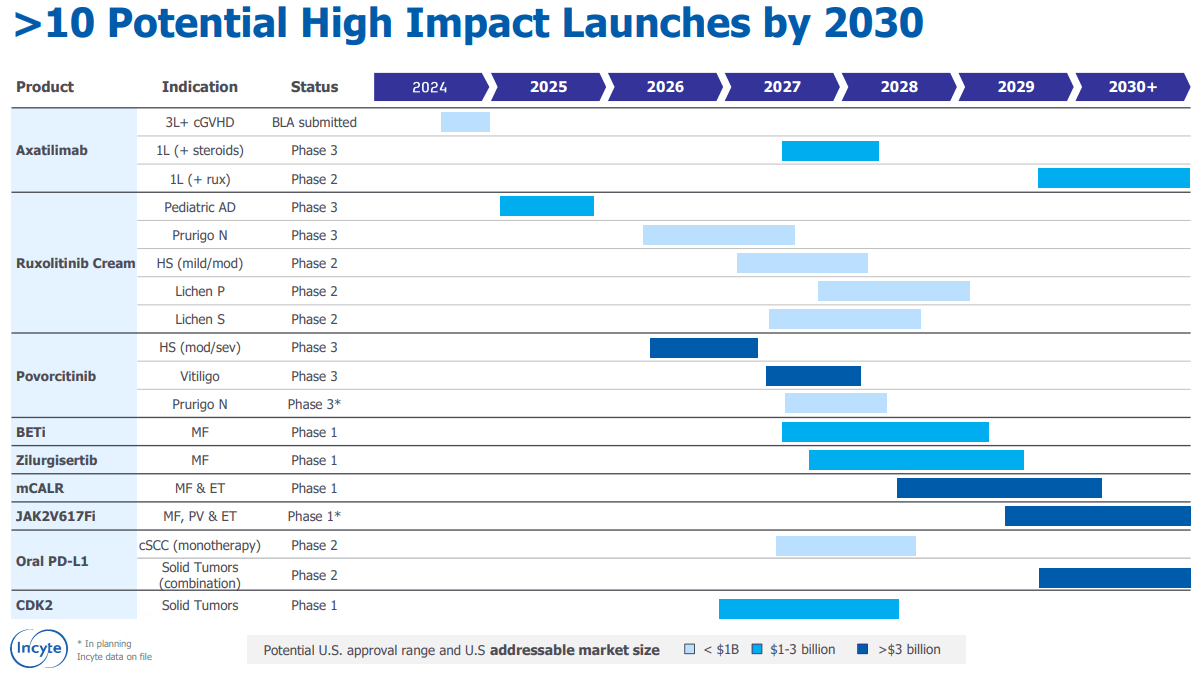

As Jakafi’s 2028 patent cliff approaches, management is committed to supporting growth drivers. Incyte is planning promising and potentially high-impact launches by 2030. In December 2023, Incyte announced positive data from a pivotal clinical trial of axatilimab, used to treat graft-versus-host disease, and is currently being submitted to the FDA for approval. The stock reacted positively to the news, rising 17% from $54.7 to $64.2 over the next three trading sessions.

Incyte Q4 2023 Presentation (Incyte)

If Incyte can bring new products to market and maintain the growth trajectory of its non-Jakafi-related products, the drop off the 2028 patent cliff could become manageable.

The biggest risk facing Incyte is not being able to bring new products to market quickly and receive FDA approval. Another risk is the inability to maintain profits from Jakafi, a highly dependent product. On the positive side, management is committed to diversifying its revenues and has $3.7 billion in cash on its balance sheet with the potential to add up to $5.5 billion in retained earnings over the next four years. Not only does this help speed up R&D, but it can also be used for acquisitions.

evaluation

Looking at a traditional valuation matrix, Incyte is in many respects at a significant discount to the sector average. It is trading at a forward PER of 13.3x compared to the industry average of 19.3x and 3.3x compared to the average PS of 3.96x.

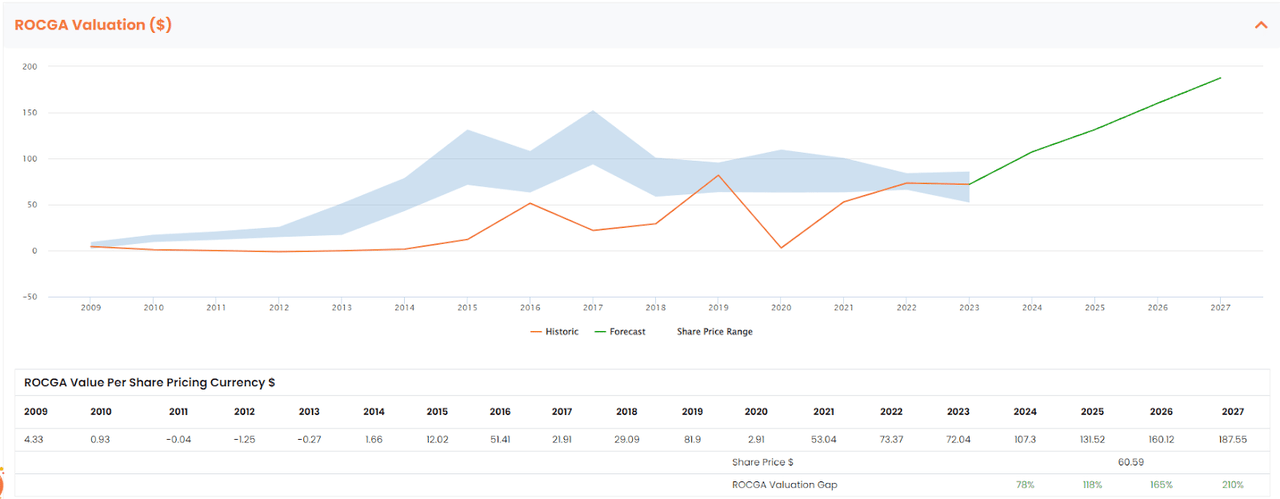

We will also use a unique cash flow return on investment based DCF perspective to identify and examine Incyte. More information on how to calculate cash flow returns on investments, including total cash, total assets, and revenue, can be found in Bartley Madden’s paper “The CFROI Life Cycle.” Bartley Madden has contributed significantly to the cash flow return on investment methodology. We used and expanded on this concept in a previous article.

Return on cash-generating assets (ROCGA) uses the same methodology as cash flow return on investment and is a measure of economic return. Another way to look at a business is as the ratio of its economic return to its cost of capital. This should be directly aligned with the company’s values. The larger the spread, the higher the stock price should be. This can be expressed as the spread between EV and the assets used to generate income.

In the first step, you model the company, backtest its valuation for correlation with past stock prices, and once you’re confident, use the same model to forecast the future. Value is a function of the profits a company achieves, its rate of diminishing returns over its cost of capital, and its growth. The total value of a company is the present value of its existing assets plus the present value of its growth. For mature companies, most of the value lies in existing assets, while for high-growth companies, the value lies in the current value of growth assets.

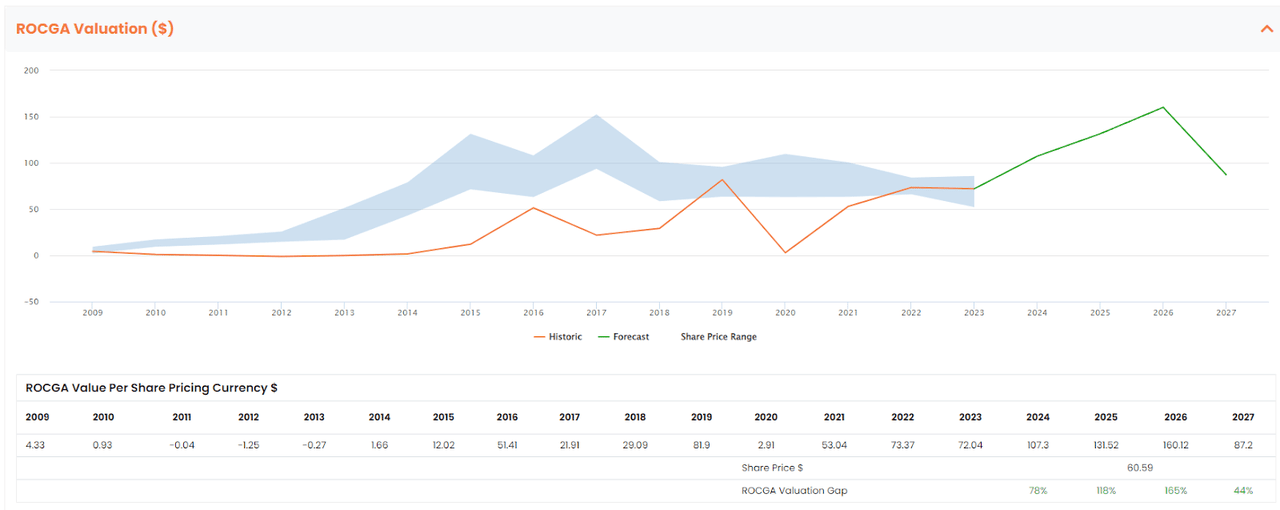

The blue band below represents the highest and lowest stock prices for the year, while the orange line represents historical valuation according to the DCF model. The green line is the predicted guaranteed value derived using the same model along with consensus revenue and underlying self-sustaining organic growth. Self-sustaining organic growth is the ratio of investable surplus cash to total assets.

Basic ROCGA Valuation (Chart created by author using ROCGA Research platform)

The theory of mean reversion applies, which states that over time profits revert to the cost of capital. Companies make profits, and theoretically, the higher the profits, the higher the valuation. The company cannot maintain high profits over a long period of time. Companies with stronger competitive advantages will be able to sustain these profits a little longer before they begin to fade. This indicates the strength of the business. Mature companies’ profits will disappear faster, while companies with faster life cycles will disappear at a lower rate. The model also ensures that the company is neither overvalued nor undervalued during the various business cycle stages.

More information about how modeling and quantitative evaluation work can be found here.

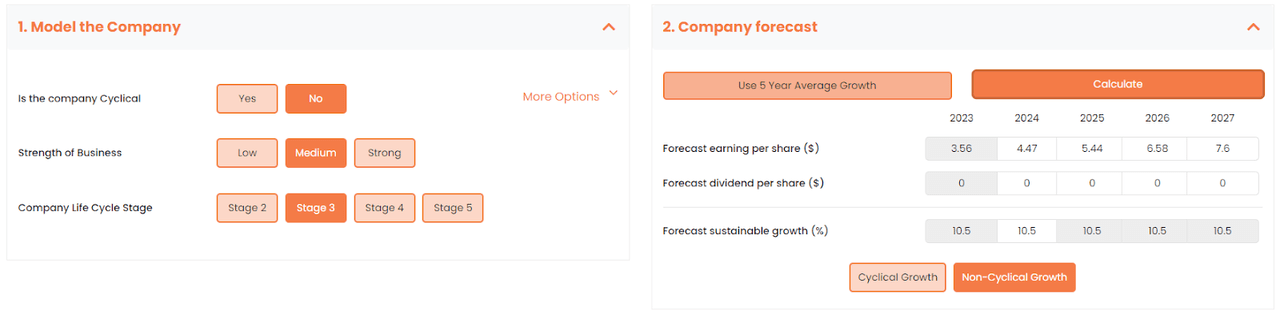

The assumptions used in this particular model are that the company’s earnings are not cyclical, it has moderate business strength (competitive advantage), and is in an early business cycle lifecycle stage.

Financial Modeling Assumptions (ROCGA Research and Author)

From the valuation graph above, Incyte looks cheap as of late and has a 78% upside potential for FY24 considering its default mode. We know there is a patent cliff pending in 2028. Our model doesn’t scale that far, so we assume revenue declines in FY27 and use a conservative EPS of $2.5.

Adjusted ROCGA Valuation (Chart created by author using the ROCGA Research platform)

This brings the adjusted insured value to $87 in FY27.

You can also view Incyte as separate components, the first of which is Jakafi, which has strong cash-generating capabilities. However, that patent is scheduled to expire in 2028, after which we can expect sales and profits to decline significantly. We can value this part at a very basic $3.7 billion in cash and $5.5 billion in retained earnings over four years. The second is non-Jakafi-related product revenue, which grew at an impressive 69% in FY23. We apply a conservative 10x PS for this portion, which gets us about $5.5 billion. Third is royalty-related revenue, which is at $500 million but growing only slowly. The sector average of 4x PS gives us $2 billion. Combined, this amounts to $16.7 billion, less than the DCF valuation above, but still a potential upside of 23%.

conclusion

Although there are risks involved, given its low stock price, strong balance sheet, and strong pipeline of promising products, we believe Incyte should trade at a higher multiple. All valuation methodologies we have used indicate that Incyte is undervalued. We start with the Buy rating.