Helix Energy Solutions: Mediocre 2024 Outlook Provides a Buying Opportunity (NYSE:HLX)

Vladimirovich

memo:

i covered Helix Energy Solutions Group, Inc. (New York Stock Exchange:HLX) Previously, investors should consider this as my update. previous coverage of the company.

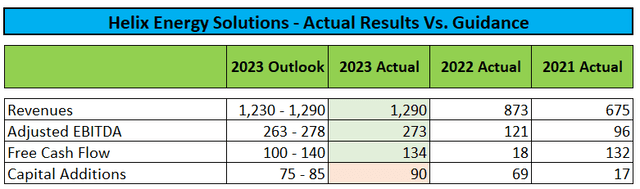

After Tuesday’s session, Helix Energy, a leading marine energy specialist services provider. Solutions Group, Inc. (“Helix”) reported fourth quarter and full year 2023 results largely within the scope provided by management in its third quarter presentation.

company presentation

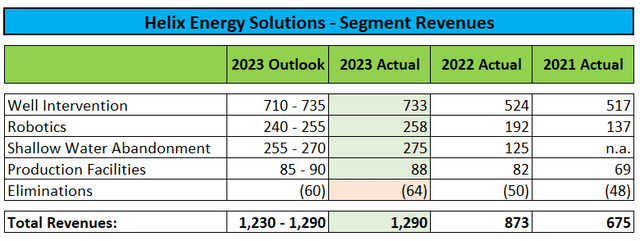

In fact, the company’s three main service segments (well intervention, robotics and shallow water abandonment) each performed at or above the top level.

company presentation

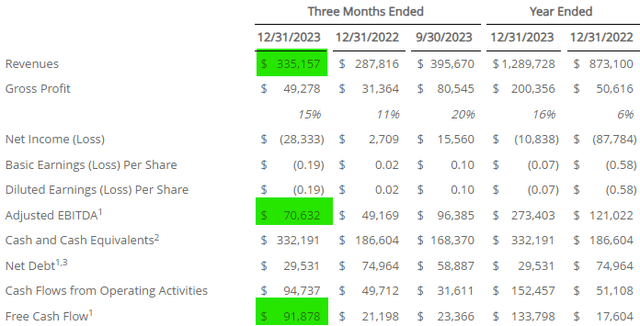

After accounting for one-time costs, both fourth-quarter revenue and profitability exceeded analyst expectations. The company also generated free cash flow of about $92 million, its highest level in more than a decade.

company press release

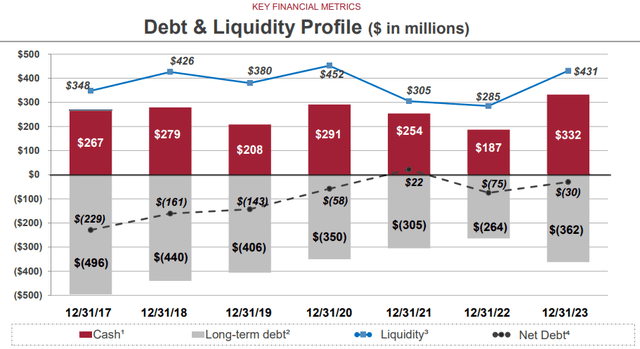

Helix ended the year with liquidity of $431. million, with cash and cash equivalents of $332 million and net debt of just $30 million.

company presentation

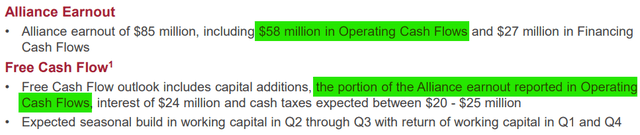

However, the company’s cash position is expected to take a temporary hit in the first half of the year due to an $85 million earnout payment related to the 2022 acquisition of Helix Alliance’s shallow organic business.

The company also expects to use an additional $40 million to repay the remaining 6.75% convertible notes.

Helix also expects to leverage $20 million to $30 million in share buybacks this year.

Total funded debt is expected to decline to approximately $324 million by the end of this year.

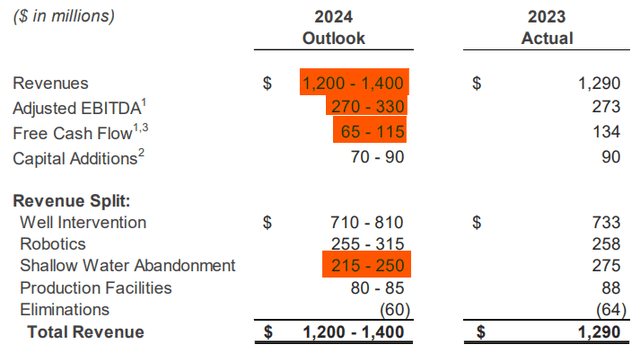

While the company’s fourth quarter and full-year 2023 results hit the upper end of expectations, Helix Energy Solutions’ 2024 outlook wasn’t anything to write home about:

company presentation

At the midpoint of the top-line range provided, revenue is essentially flat while adjusted EBITDA increases by approximately 10%.

Free cash flow guidance of $65 million to $115 million looks much worse, but that figure includes about $58 million related to the income payments discussed above.

company presentation

However, even adjusting for income payments, free cash flow is unlikely to improve meaningfully from the $134 million figure reported for 2023.

Estimates for 2024 are expected to be revised lower due to analyst expectations calling for a very significant increase in revenue and profitability at the top end of the provided range.

Perhaps the most disappointing part of the company’s 2024 outlook was its expectation that its recently acquired Shallow Water Abandonment segment would see a significant year-over-year decline immediately after the end of its accrual period.

On the conference call, executives acknowledged a temporary decline in demand in the Gulf of Mexico but did not expect the decline to last long.

We forecast that the shallow water market will generate EBITDA levels similar to those we guided for in 2023. This represents a meaningful decrease in EBITDA contribution compared to the previous year. However, we expect meaningful increases starting in 2025 and believe there will be a strong shallow water market in the Gulf of Mexico in the coming years.

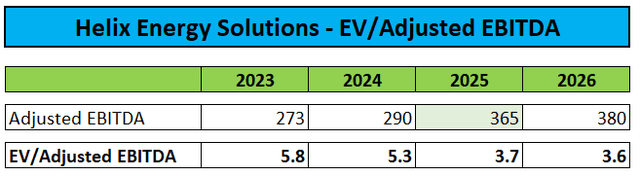

In addition to the expected recovery in the Gulf of Mexico, the company’s 2025 performance will benefit from a variety of high-performance well intervention assets (Siem Helix 1, Siem Helix 2 and Q7000) Transitioning from low-margin legacy contracts to standard charter rates is expected to result in annual EBITDA benefits of more than $75 million.

However, following somewhat disappointing guidance this year, we slightly lowered our 2025 adjusted EBITDA expectations from $375 million to $365 million.

About Us / Author Estimated

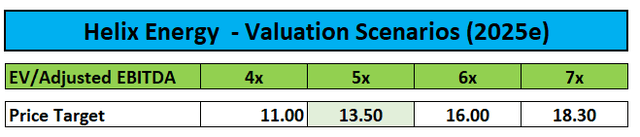

Assigning a multiple of 5x to our 2025 EV/Adjusted EBITDA estimates would result in a $13.50 target price for the stock (down from $14.20 previously) and provide approximately 50% upside after Tuesday’s selloff.

Author’s estimate

Therefore I “Buy“Stock valuation.

main risk factors

Offshore drilling and professional services stocks remain highly correlated with oil prices (CL1:COM), so it’s almost certain that Helix Energy Solutions’ stock price will take another hit if commodity prices continue to decline.

conclusion

Helix Energy Solutions reported decent fourth-quarter results, but the company’s 2024 outlook fell short of expectations, sending the stock selling off more than 10% on Tuesday.

However, 2025 is still likely to be a year of significant earnings volatility, so we reiterate our ‘buy’ rating on the stock while slightly lowering our price target to $13.50.