Why Bitcoin Price is Soaring – Sets a New Record with ETF Inflows

A perfect storm is brewing for Bitcoin as ETF inflows continue to surge ahead of the all-important halving.

Bitcoin price topped $56,000 today, its highest since December 2021.

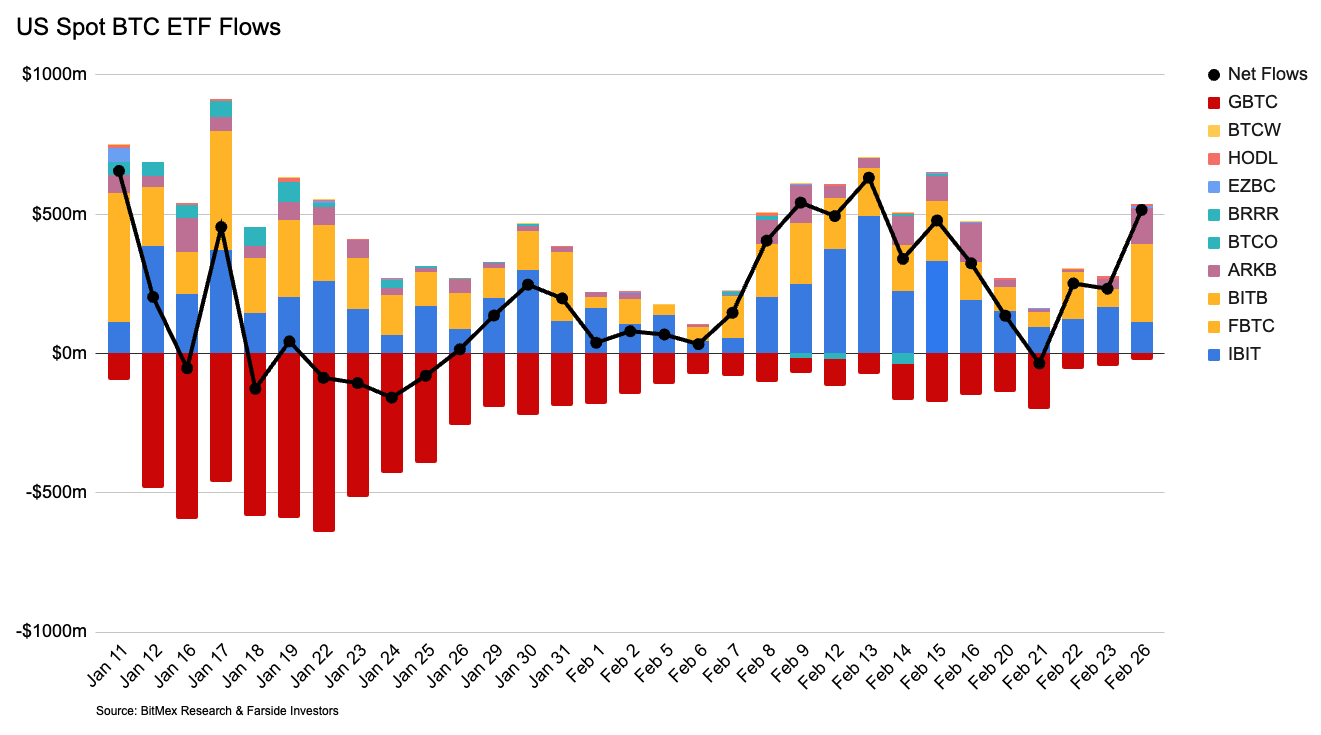

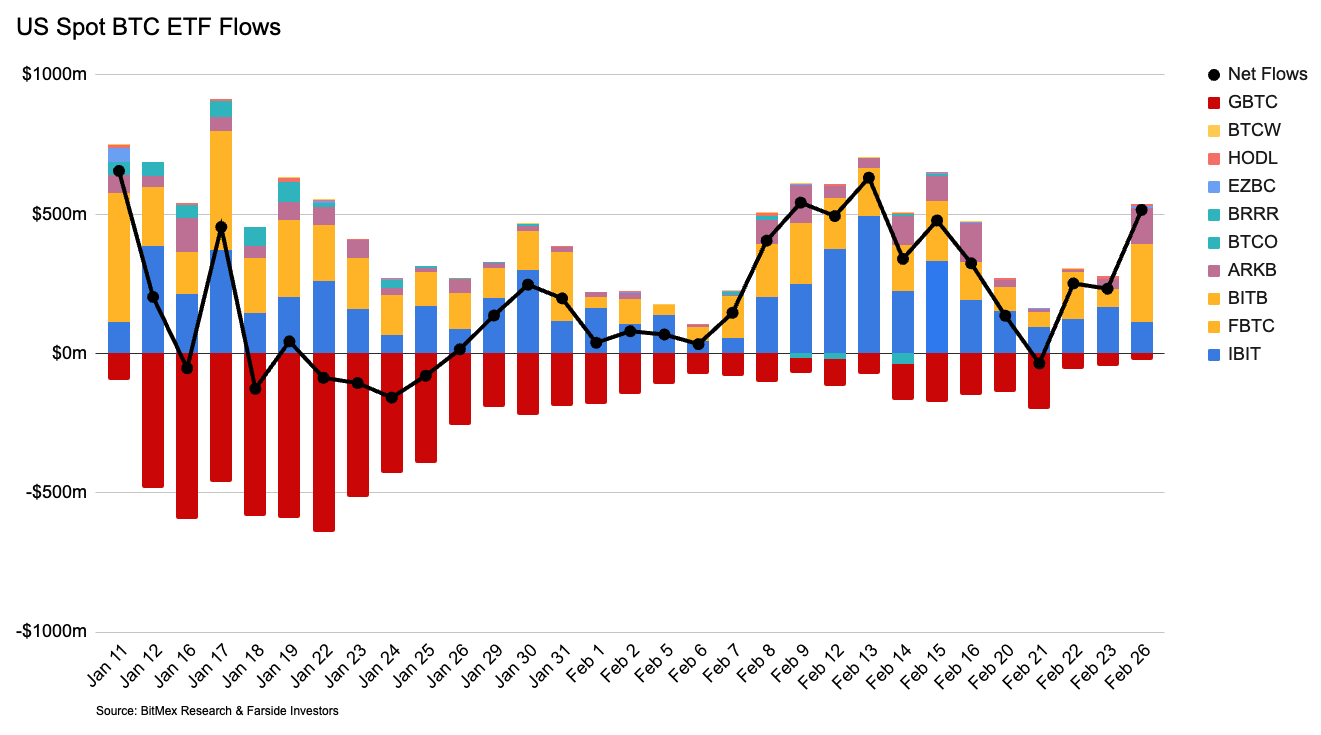

These gains reflect a 10.6% increase over the past 24 hours, consistent with record net BTC ETF inflows.

Selling pressure also appears to be subsiding, with outflows from the GBTC ETF reaching a record low of $22.4 million. BitMEX Research.

According to data from Blockworks, the amount of BTC held in spot ETFs has now surpassed $46 billion, or approximately 821,000 BTC.

Bitcoin spot ETFs work by purchasing “real” BTC on the open market and holding it on behalf of the ETF buyer.

Read more: 7 Best Cryptocurrency Exchanges and Apps of 2024

Henrik Andersson, Apollo Capital’s chief investment officer, predicts that the impact of ETF purchases will have a net “multiplier” effect.

Apollo Capital’s research estimates that for every dollar that flows into the BTC ETF, the price of Bitcoin will rise by $50 (a multiple of 50).

As of last week, the multiplier was 40x, or about $40 for every dollar invested in the BTC ETF.

This week’s price surge is closer to 50 times estimates. This shows the impact the spot ETF is having on the broader Bitcoin market.

Bitcoin supply halved in 57 days

Crypto traders are bracing for a supply shock as new BTC issuance is scheduled to be cut in half on April 19, 2024.

This means that the amount of new Bitcoins created decreases from 6.25 BTC to 3.125 BTC every 10 minutes.

This process occurs every four years and is a fundamental component of Bitcoin’s value proposition.

This means that Bitcoin’s money supply is deflationary, unlike other assets that can be variable (e.g. gold) or inflationary (e.g. the US dollar).

Bitcoin proponents also advocate self-custodial rights, meaning assets are often held in personal wallets rather than on exchanges.

Doing so would further reduce BTC’s liquidity supply and again increase the likelihood of a supply shock as the price surges toward all-time highs.

Bitcoin has never hit an all-time high before the halving, which could make this year one of the most historic years in Bitcoin’s decade-plus history.