Emerging Market Links + The Week Ahead (December 4, 2023)

According to WikiLeaks, premier Li Keqiang once stated: “GDP figures are ‘man-made’ and therefore unreliable” (In other words, like USA GDP figures – see Shadow Government Statistics for more accurate estimates…). His approach to measuring China’s economy relied on three key indicators with the so-called Li Keqiang Index becoming a good jumping-off point from which Western economists have since added other elements of consideration.

Perhaps some other indicators that could be added is the “slowdown” in Chinese outbound tourism and how Chinese borrowers are starting to default in record numbers…

Meanwhile, Venezuela just had a bizarre Saddam Hussein style election over whether to invade their oil rich neighbor Guyana (see: CGX Energy (CVE: OYL / FRA: GXCN / OTCMKTS: CGXEF): A Speculative Guyana Oil Small Cap Stock and Frontera Energy (TSE: FEC / FRA: 3PY3 / OTCMKTS: FECCF): Hit By Colombia Unrest But Sees Coming Profitability and Operational Improvements) with 95%+ of voters giving their approval of each measure (Venezuelans approve takeover of oil-rich region of Guyana. What happens next?). Whether such an invasion will occur or whether its an excuse to get even more leverage over the Biden Administration remains to be seen.

Finally, I am waiting for my first order from Pinduoduo or rather PDD Holdings (NASDAQ: PDD)’s Temu. The prices on there for items that are relatively inexpensive to begin with compared with Amazon (Can Temu challenge Amazon or become the next Amazon?) are too good to pass up and worth giving the site a try – something I will write about probably later this month…

$ = behind a paywall / 🗃️ = Archived article

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 China’s Bank of Communications added to global too-big-to-fail banks list (Caixin) $

🇨🇳 Pinduoduo (PDD US): TEMU at Center Stage (SmartKarma) $

Stock rally on strong revenue growth suggests TEMU will be at center stage of the investment thesis for PDD Holdings (NASDAQ: PDD) down the road.

Besides soaring GMV, TEMU achieved blowout performance likely due to much higher-than-expected take-rate and disciplined marketing, resulting in narrower-than-expected losses.

We expect the company’s growth will even accelerate in 4Q23 and generate adjusted net profit of US$12 bn for FY24, with a target market cap of US$240 bn (20xPE).

🇨🇳 Cango shifts gears with merger of platforms, focus on inventory risk control (Bamboo Works)

The company said it will combine its new and used car services into a single platform, as a growing number of dealers engage in both businesses

Cango (NYSE: CANG) will merge its new and used car platforms onto a single service, in a major tweak to its new business model as a car-trading services provider

The company forecast its fourth-quarter revenue would drop sharply as it becomes more conservative in the current market where half of dealers are losing money

🇨🇳 East Buy ditches tuition to become pure e-commerce player (Bamboo Works)

The former leader in online education is shedding its remaining tutoring business to concentrate on livestreaming and online product sales

East Buy Holding (HKG: 1797 / OTCMKTS: KLTHF) is selling its tutoring business to its parent, New Oriental Education (NYSE: EDU), at a high price while also raising HK$1.63 billion from an in-group share placement

The company has set up a paid membership system for e-commerce livestreaming in China, emulating Walmart’s “Sam’s Club”

🇨🇳 ATRenew chases new growth with refurbishment, new Apple partnership (Bamboo Works)

The recycling specialist said its sales of refurbished products more than doubled in the third quarter, as it ramps up business under its new recycling partnership with Apple

ATRenew (NYSE: RERE)’s revenue rose 28% in the third quarter, as its refurbishment business and its move into non-electronics recycling gained momentum

The company has begun ramping up its acquisitions of used iPhones, its biggest product area, through its recent partnership with Apple in Mainland China

🇨🇳 Zepp leaves investors guessing with return to profits, tumbling own-brand sales (Bamboo Works)

The maker of Amazfit wearable sports devices reported its revenue tumbled in the third quarter as it weans itself from a third-party licensing relationship with Xiaomi

Zepp Health Corp (NYSE: ZEPP) returned to profitability in the third quarter for the first time since 2021, as its margins jumped with the development of its own Amazfit brand

The company’s shares initially rose sharply after the report, but then fell even more, as investors worried about a big drop in sales of its own-brand products

🇨🇳 Kanzhun’s World Cup marketing bet keeps paying dividends (Bamboo Works)

China’s leading online recruitment platform has posted its third straight quarterly profit, reaping the rewards of an advertising campaign during last year’s soccer championships

Kanzhun (NASDAQ: BZ) doubled its profits in the third quarter and surprised investors by paying out around $80 million in special dividends

The market for blue-collar jobs has become the company’s main growth driver, supplying 35% of revenue

🇨🇳 Pair Trade: Want Want (151 HK) And Mengniu (2319 HK) (SmartKarma) $

Want Want China Holdings (HKG: 0151 / FRA: 4HQ / OTCMKTS: WWNTY / WWNTF) and China Mengniu Dairy Company (HKG: 2319 / FRA: EZQ0 / EZQ / OTCMKTS: CIADY / CIADF) are both fairly liquid names in the China consumer staples sector.

Both companies trade at virtually the same forward PE of 14x. However, I expect Want Want’s near term sales growth to be lower than market expectations.

The upside risk for Want Want could be its overseas expansion efforts, as overseas sales now account for mid to high-single-digit of sales and grew high-teens yoy in FY1H24.

🇨🇳 RLX stabilizes as air clears in new regulatory environment (Bamboo Works)

Burned by a wave of regulation in China over the last two years, the e-cigarette maker says it’s hoping to find new growth overseas

RLX Technology (NYSE: RLX)’s revenue totaled 428 million yuan in the third quarter, up slightly from the previous quarter, while its profit fell 15% over that period

The company terminated its non-compete agreement with Relx on Nov. 10, paving the way for it to expand its e-cigarette business outside China

🇨🇳 2024 High Conviction: China Tourism Group (601888 CH, BUY, TP:CNY106): See the Forest for the Trees (SmartKarma) $

China stock market despair has brought down China Tourism Group Duty Free (HKG: 1880 / SHA: 601888) to its lowest forward valuation in the past ten years

Poised for long-term growth, Chinese are buying albeit more prudently, government supportive on promoting domestic consumption, efficiency enhancements will lower cost and boost margins

Using the company’s lowest recorded PE ratio in the past 10 years of 23.2x into FY24, we derive a target price of CNY106 (+21% UPSIDE)

🇨🇳 Asian Dividend Gems: Fufeng (SmartKarma) $

Fufeng Group (HKG: 0546 / FRA: FFO1)‘s core businesses include food additives such as MSG, animal nutrition, high-end amino acids, and colloid such as xanthan gum.

Xantham gum is increasingly becoming popular as millions of people around the world purchase gluten free foods.

Fufeng’s dividend yield averaged 7.5% annually from 2018 to 2022. Its current dividend yield is about 11-12%. Fufeng is trading at P/E of 2.9x and EV/EBITDA of 1.8x in 2024.

🇨🇳 DDC Enterprise IPO fails to whet investor appetites on Wall Street (Bamboo Works)

After a failed attempt at a SPAC listing a year ago, shares of cooking content and prepared foods maker DayDayCook plummeted in their New York trading debut

Shares of DDC Enterprise (NYSEAMERICAN: DDC), also known as DayDayCook, priced below their earlier indicated range and fell 27% on their New York trading debut

The Chinese cooking company is repositioning itself as a global supplier of Asian food and content with a series of recent acquisitions

🇭🇰 LH Group (1978 HK) (Oriental Value)

What’s next after a special dividend?

With that out of the way, let’s dive into LH Group (HKG: 1978), another catering group listed in the Hong Kong Stock Exchange besides Taste Gourmet (8371.HK) which we discussed previously.

There are of course exceptions, which we can summarize in the following points:

Unique business models and thoughtful operational philosophies that can lower probability of failure (e.g. Food & Life/Sushiro (TYO: 3563 / FRA: 2G0 / OTCMKTS: SGLOF), Saizeriya (TYO: 7581))

Products that can be standardized and travel well, usually in the form of franchises (e.g. McDonald’s (MCD), Domino’s Pizza (DPZ), Starbucks (SBUX) etc.)

Capable management that can keep a brand fresh and that is detail-oriented in cost control

Depressed valuation for various reasons

🇭🇰 Tam Jai ladles up its rice noodles overseas as its home markets slow (Bamboo Works)

Hong Kong’s top rice noodle chain is looking to new markets and a wider product portfolio to keep growing in the face of China’s economic slowdown

Tam Jai International (HKG: 2217 / FRA: 29S) is slowing down its expansion in Hong Kong and Mainland China, and eyeing overseas markets in Australia and the Philippines

The company received rights to open Marugame Udon noodle stores in Hong Kong as part of its effort to expand beyond its traditional rice noodles

🇭🇰 🇯🇵 Despite limp sales, Nissin tastes growing profits on falling costs, price hike (Bamboo Works)

The instant noodle maker registered year-on-year profit growth in the third quarter thanks to price adjustments and falling raw material costs

Nissin Foods (HKG: 1475 / TYO: 2897 / FRA: NF2 / OTCMKTS: NFPDF)’ revenue declined by nearly 3% year-on-year in the third quarter, but its profit rose 38%

The company is stepping up promotional activities, including 30,000 face-to-face, in-person events so far this year

🇰🇷 Korean Air (003490 KS): Cheap, but a Value Trap (SmartKarma) $

Korean Air (KRX: 003490) is cheap, against peers and its own history. The impending merger with Asiana Airline is a major overhang

Business is good, with steady passenger loads and yields, and cargo showing decent signs of recovery. Lower fuel prices could surprise on the upside

Target Price KRW23,868 based on FY24 P/BV of 0.81x (1SD below mean). Too little upside for the level of uncertainty. PASS

🇰🇷 Dentium (145720 KS): Economic Health of China Is the Key to Bring Back Smiles (SmartKarma) $

Dentium (KRX: 145720) earns more than 50% of its total revenue from China. The company’s revenue from China reported a CAGR of 32% during 2018–2022.

Despite concern over China slowdown and lower ASP due to VBP, in 3Q23, Dentium reported 12% YoY revenue growth in China, similar growth rate reported in 2Q23, driven by volume.

Economic slowdown is lingering over the global as well as Chinese dental implant sector, especially the premium brands. Dentium is positioned at the upper price portion within the value segment.

🇸🇬 5 Singapore Blue-Chip Stocks Falling More Than 20% Year-to-Date: Can They Recover? (The Smart Investor)

🇸🇬 3 Singapore Stocks to Watch Out for in December (The Smart Investor)

🇸🇬 4 Singapore Aviation and Tourism Stocks That Could See a Better 2024 (The Smart Investor)

🇸🇬 Wilmar International: It’s Premature To Be Bullish (Seeking Alpha)

Wilmar International (SGX: F34 / FRA: RTHA / RTH / OTCMKTS: WLMIF / WLMIY)‘s shares are attractively valued with its forward P/E at the lower end of its historical trading range.

The stock has potential catalysts associated with the new central kitchens business and margin recovery, but the catalysts will likely be realized at a later time.

It is too early to be bullish on Wilmar International stock now, so I choose to rate WLMIF as a Hold.

🇮🇳 Concord Biotech Ltd (658823Z IN): Q2 EBITDA and PAT Triples on Operational Efficiencies (SmartKarma) $

Concord Biotech Ltd (NSE: CONCORDBIO / BOM: 543960) reported robust performance in Q2FY24. Revenue grew 65% YoY to INR2.6 billion, while EBITDA and PAT jumped more than 3x compared to year-ago quarter.

The company has increased capacity utilization at all the three manufacturing facilities. Operational efficiencies have helped the bottom line to achieve faster growth than the top line.

With a high runway for growth and improving market scenario, especially for Indian pharma companies, the company remains highly optimistic to surpass its historical 18% revenue CAGR this year.

🇮🇱 Tel-Aviv Stock Exchange (TASE) (Special Situation Investing)

A small exchange with lots of upside

The Tel-Aviv Stock Exchange (TLV: TASE / OTCMKTS: TVAVF) is Israel’s only stock exchange. It’s wholly owned subsidiaries include the Tel-Aviv Stock Exchanges Clearing House, the MAOF (Derivatives) Clearing House, and the Tel-Aviv Stock Exchange Nominee Company, which provides the clearing and settlement infrastructure for Israeli securities registration services. In its July 2019 IPO, TASE transitioned from a not for profit and largely bank owned exchange to a for profit publicly traded corporation.

Beyond the benefits that accrue to exchanges generally there are several specific advantageous that could act as catalyst to the valuation of TASE itself over the next several years.

🇦🇪 Yalla Profit Zooms On Gaming Jump, Enhanced Efficiency (Seeking Alpha) $

(A Middle Eastern social networking and gaming company)

Yalla Group’s (NYSE: YALA)’s revenue rose 6.4% in the third quarter, fueled by a 31% jump in revenue from its gaming operation.

The company’s paying users posted a rare decline in the quarter as Yalla shifted its focus to higher-spending users.

Yalla is a relatively conservative company with little debt and large cash reserves that totaled $545 million at the end of September.

🇹🇷 Hepsiburada – is Turkey’s “Amazon” a turnaround play? (Undervalued Shares)

At first sight, it looks like an incredible bargain.

D-MARKET Electronic Services & Trading or Hepsiburada (NASDAQ: HEPS) has 12m active customers in Turkey, a country with hugely attractive growth prospects for e-commerce.

The company’s market cap is just USD 430m. Yes, you read that right.

When Hepsiburada went public in 2021, it raised USD 800m of additional equity from investors. At its peak, the company was valued at nearly USD 5bn.

Given how bombed-out the stock is today and Turkey’s undoubted potential for e-commerce, could it be an interesting turnaround play with an upside of several times its current price?

🇳🇬 Nigeria’s Access Bank plans to launch in Asia in first quarter of 2024 (Semafor)

Lagos-based Access Bank or Access Holdings PLC (NGX: ACCESSCORP), one of Africa’s biggest banks, is close to finalizing a regulatory process to launch its first full banking service in Asia in the first quarter of 2024, the chief executive of its holding company told Semafor Africa.

Wigwe and his team have built Access from a small Nigerian operator into the largest banking group in the country through an aggressive and ambitious acquisitive approach. The lender accounts for 16% of the banking system’s assets at the end of 2022, according to ratings agency Fitch.

It has also expanded rapidly across the continent over the last half decade. Most recently, it snapped up the banking operations of Standard Chartered in Angola, Cameroon, The Gambia, Sierra Leone, and Tanzania.

Johannesburg-based Standard Bank (JSE: SBK / FRA: SKC2 / OTCMKTS: SGBLY) — Africa’s largest bank by assets with $75 billion at the end of June — has spent most of the last two decades consolidating and selling off ventures outside Africa other than major centers including London, Dubai, and New York. But, after years of acquisitions across Africa, it now expects to expand by organic growth on the continent, according to CEO Sim Tshabalala.

🇵🇱 The Quick Read #3 (ToffCap)

But I wanted to briefly focus on the UK opportunity, which is now uncapped after the deal with Menzies Distribution in May. In contrast to many markets, such as Poland, InPost (AMS: INPST / LON: 0A6K / FRA: 669) UK’s ‘problem’ has always been on the supply side, not demand. We know that our UK friends love shopping online, and that the returns market is very strong. This, combined with densely populated areas, makes it a very suitable market for the (automated parcel machines) APM proposition.

InPost’s UK operations have been purposely throttled as they did not have the necessary infrastructure to optimally service their APM network, but that all changed after the Menzies deal. Management now claims to have ‘uncapped capacity for the next five years’. And indeed, volumes have exploded since May.

🇵🇱 Wsparcie procesów logistycznych i produkcyjnych (value at risk newsletter)

Note: In Polish. Google Translator or a browser translator can be used to translate it.

The activities of the Quantum Software Group (WSE: QNT) focus on creating and selling software supporting logistics and production processes. The most important product of the Group is the Qguar system, the first version of which was premiered in 1998. Qguar consists of numerous modules belonging to the SCM (Supply Chain Management) software class. Implementing the system allows you to optimize processes related to storage, distribution and production logistics.

🇵🇱 Poland’s incoming coalition faces early test with energy bill (FT) $

Donald Tusk maps out boost for wind turbines and tougher approach to state energy company Polski Koncern Naftowy ORLEN Spólka Akcyjna (WSE: PKN / FRA: PKY1)

The Civic Coalition wants to freeze energy prices for consumers in the first half of next year, a subsidy to be funded by Orlen. The plan has sent Orlen’s share price down 6.6 per cent since it was set out on Wednesday. Orlen, which is Poland’s largest company, went on an acquisition spree under the PiS government.

🇦🇷 Why We Are Avoiding Despegar Despite Shares Looking Cheap (Seeking Alpha) $

Despegar.com Corp (NYSE: DESP) had a successful debut on Wall Street, with its stock closing 24% higher on its first day of trading. Since then, shares have fallen significantly.

The company appears to have a very low average customer satisfaction, with many negative reviews found on sites like Trustpilot.

While shares look cheap, we believe it could be a value trap and that the company will face increased competition from the likes of Airbnb and Booking.

🇦🇷 Banco Macro: Cautious Ahead Of Argentina’s Milei Era (Seeking Alpha) $

Helped by its investment gains, Banco Macro Sa (NYSE: BMA) delivered a resilient quarter despite the macro headwinds.

With Javier Milei’s anti-establishment platform winning the election, though, big changes are afoot for the bank.

Having rallied massively post-election, the stock now offers a limited margin for error ahead of a potentially challenging fundamental outlook.

🇧🇷 Gol Linhas Aereas Likely To Greatly Dilute Its Shareholders (Seeking Alpha) $

Gol Linhas Aereas Inteligentes Sa (NYSE: GOL / BVMF: GOLL4) has seen margin expansion due to cheaper jet fuel and recovery in the Brazilian airline market.

However, the company’s margin expansion may be limited due to more expensive fuel and increased competition.

Gol’s recapitalization plan through convertible debt and warrants will lead to significant dilution for future shareholders.

🇧🇷 Embraer: Getting More Attractive (Seeking Alpha) $

Embraer SA (BVMF: EMBR3 / NYSE: ERJ) affirms 2023 guidance for deliveries, margins, and FCF, with increased deliveries expected in 2024.

The company’s stake in Eve Holding should be considered a free option and a way to gain exposure to the eVTOL sector.

ERJ’s operating update shows higher revenue in Service & Support, increased deliveries in Commercial Aviation and Executive Jet segments, and improved margins.

Viña Concha y Toro – LATAM Stocks Investment Analysis #22 (LATAM Stock)

Viña Concha y Toro (SSE: CONCHATORO) is the largest wine producer in Latin America and one of the Largest in the world. They are Chile’s largest wine exporter.

There is no way to sugarcoat the current state of affairs in the wine industry.

The global wine industry is currently in a downturn and Concha y Toro is no exception. Revenues and volumes are down.

When I started this write up I was expecting to find an ugly situation. I wanted to cover the Chilean wine industry for readers because Chile is a huge, and largely unknown, wine market, as well as a globally relevant exporter.

I wasn’t expecting much in terms of stocks worth buying.

But the situation at Concha y Toro isn’t all doom and gloom. They are sound financially. Their balance sheet is healthy and they should have no problem weathering the current downturn in the wine industry.

🇲🇽 Cemex: 4 Reasons Why Historical Underperformance Is Set To Continue (Seeking Alpha) $

CEMEX (NYSE: CX) has significantly underperformed global equity indexes over the past 10 years.

The company operates in a highly competitive industry which makes it hard to generate high profit margins and attractive returns on capital.

CX is focused on improving its balance sheet but the company remains highly levered and is exposed to significant risks in the event of economic weakness.

CX trades at a below market valuation but this is warranted due to significant historical earnings volatility.

I am initiating CX with a sell rating.

🇲🇽 Coca-Cola FEMSA: Buy Growth At A Reasonable Price (Seeking Alpha) $

Coca-Cola Femsa SAB de CV (NYSE: KOF) is the largest bottler of Coca-Cola beverages in the world based on volume.

The company has a high-quality, recession-resistant business model with a wide moat and solid growth potential.

KOF is attractively valued compared to peers and offers an attractive dividend with potential for growth.

I am initiating KOF stock with a buy rating.

🇵🇦 Copa Holdings: Underfollowed, Underappreciated, Undervalued (Seeking Alpha) $

(Parent company of Panamanian carrier Copa Airlines and its subsidiaries, Colombian carriers Copa Airlines Colombia and Wingo.)

Copa Holdings (NYSE: CPA) reported strong third-quarter results, with industry-leading operating margin, cost controls and strong revenue performance.

The company continues to pay an attractive dividend and recently authorized a new share repurchase program.

Its performance continues to be largely dismissed by the market, but over time should become clearer as core operations drive results.

$ = behind a paywall

🇨🇳 Overcoming Chinese Communist GDP Myths (Mises Wire)

According to WikiLeaks, Li stated, “GDP figures are ‘man-made’ and therefore unreliable.” Consequently, he used proxy data to attempt to quantify the economy. Li’s approach relied on three key indicators: electricity consumption, railway cargo volume, and bank lending. His rationale was that if electricity usage was up, then the factories must be working. The same is true of rail cargo if the trains are busy taking products to distributors and seaports. Finally, the volume of bank lending suggests how many new factories or expansions of existing businesses are being undertaken.

In 2014, the Chinese government claimed a 7.5 percent GDP growth, but Citibank economists had their doubts. The bank decided to apply the Li Keqiang Index with these specific weightings: railway freight traffic (25 percent), electricity consumption (40 percent), and medium—and long-term loans (35 percent). Sure enough, the index suggested that the GDP growth was much lower than Beijing’s claims. Citibank then looked at other proxies, such as commodity prices. China alone accounts for such a significant percentage of world demand for commodities that increased industrial and construction activity in China drives up world prices. However, in 2014, those prices were coming down.

The Li Keqiang Index is a good jumping-off point, but Western economists have added other elements of consideration, such as nighttime lights measured by satellites.

Interesting Tweet:

🇨🇳 Nomura caution on China economy, China tourism in Asia (GGRAsia)

Banking group Nomura says it has a “more cautious view on China’s economic performance,” which it adds is consistent with recent data for outbound tourism from China to regional destinations including the casino jurisdiction of Singapore, and also for Thailand, another usually-popular place with Chinese.

There had been a “slowdown” in Chinese outbound tourism, noted analysts Euben Paracuelles and Charnon Boonnuch, in a Monday memo.

🇨🇳 Chinese borrowers default in record numbers as economic crisis deepens (FT) $

A total of 8.54mn people, most of them between the ages of 18 and 59, are officially blacklisted by authorities after missing payments on everything from home mortgages to business loans, according to local courts.

That figure, equivalent to about 1 per cent of working-age Chinese adults, is up from 5.7mn defaulters in early 2020, as pandemic lockdowns and other restrictions hobbled economic growth and gutted household incomes.

🇨🇳 The human cost of China’s property crisis (FT) $

One of the world’s biggest real estate collapses has hurt buyers, households and families across the country

The stories of four individuals who invested in the Chinese property market illustrate the wide impact of the crisis.

🇨🇳 China Life and NCI join hands in $7 billion fund for stock investments (Caixin) $

China’s leading state-owned insurers, China Life Insurance (HKG: 2628 / SHA: 601628 / OTCMKTS: CILJF) and New China Life Insurance (NCI) (SHA: 601336 / HKG: 1336), plan to jointly establish a 50-billion-yuan ($7 billion) private fund to invest in publicly traded stocks, following Beijing’s call for insurance funds to help stabilize the volatile market.

Shanghai and Hong Kong-traded NCI said in a Wednesday filing that it will partner with China Life, with each contributing 25 billion yuan for the private securities investment fund under the tentative name Honghu Private Securities Investment Fund Co. Ltd.

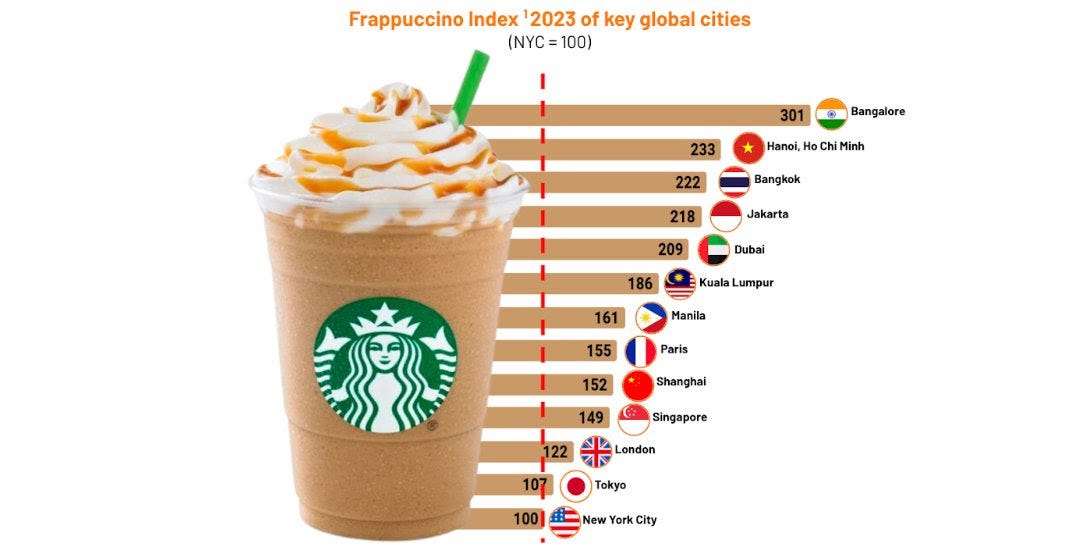

🌐 Introducing the Frappuccino index, a fresh lens on global purchasing power (and affluence) (Momentum Works)

The Frappuccino Index provides a lighthearted perspective for assessing economic status, affordability, and the premium placed on global brands in various locales and can be interpreted as such:

Consumer Economic Status (affluence): The proximity to the base reflects the similarity in consumers’ purchasing power to that of NYC.

Brand Perception: The closer to the base, the less premium Starbucks is seen in the city, offering insights into local consumer culture and the brand’s integration into consumers’ daily lives

Market Penetration: The nearer to the base, the broader the consumer base for Starbucks products, implying successful market penetration and competitive pricing with NYC.

🇲🇽 The city where Mexico’s nearshoring hype is becoming reality (FT) $

🇲🇽 Mexico is wasting its nearshoring opportunity (FT) $

🇲🇽 Mexico takes stock of five years of AMLO (GIS)

The outgoing president remains popular despite a term marked by unfulfilled promises, lackluster economic growth, corruption, violence and a deepening migrant crisis.

2024 will likely usher in Mexico’s first woman president

The election will test the popularity of AMLO’s party

Expect the next government to favor closer U.S. ties

🇻🇪 🇬🇾 Latin America On Edge As Venezuela’s Maduro Holds Referendum Whether To Invade Oil-Rich Neighbor Guyana (Zero Hedge)

That said, analysts question whether Venezuela will genuinely seek to annex the territory. They argue the referendum exercise is aimed at bolstering Maduro’s domestic support ahead of elections that Venezuela agreed to hold in exchange for relief from debilitating sanctions imposed by the US.

“Political calculations are driving Maduro to escalate tensions in an attempt to stir up nationalist sentiment, but those same political calculations also limit his military options,” said Theodore Kahn, director for the Andean region at the consultancy Control Risks.

The referendum will put five questions to Venezuela’s public. One seeks approval for granting all residents of the Essequibo region Venezuelan citizenship and creating a new state within Venezuela, while another asks voters if they recognise the jurisdiction of the ICJ to rule on the matter. Both would likely lead to a military invasion.

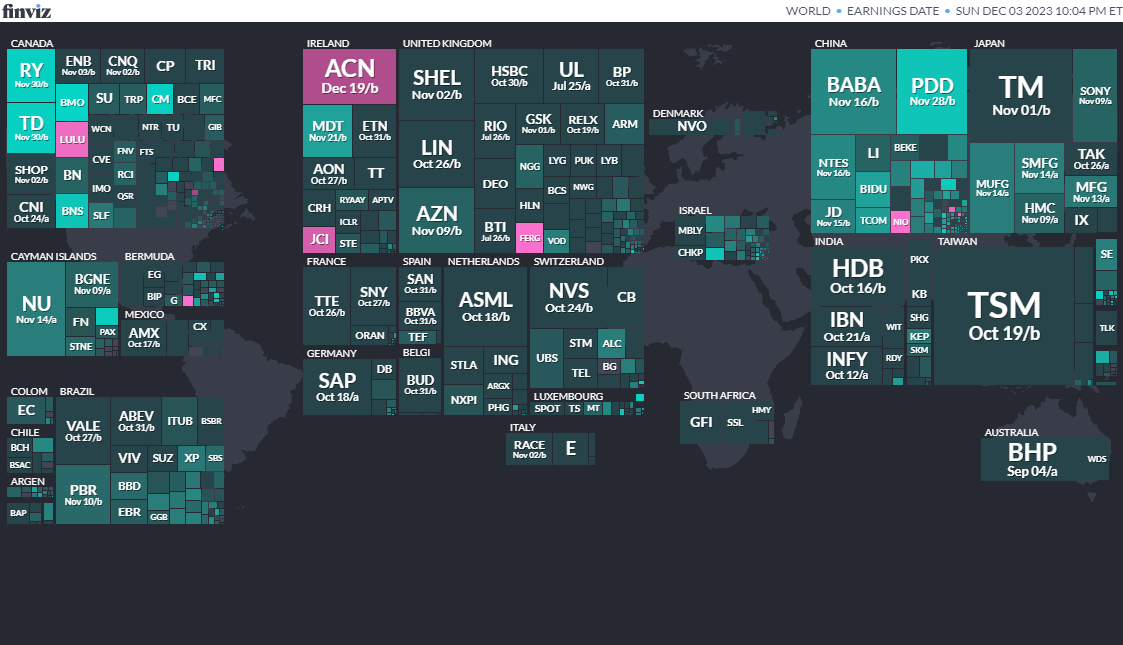

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

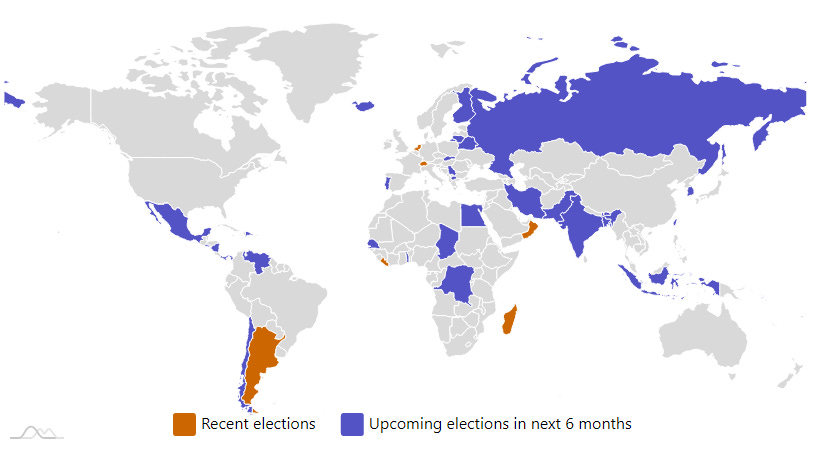

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

-

VenezuelaReferendumDec 3, 2023 (d) Confirmed Feb 15, 2009 -

Egypt Egyptian Presidency Dec 10, 2023 (d) Confirmed Mar 26, 2018

-

Chile Referendum Dec 17, 2023