Sell Consol Energy Stock (NYSE:CEIX) to Buy Other Coal Names

Indigo Division

outline

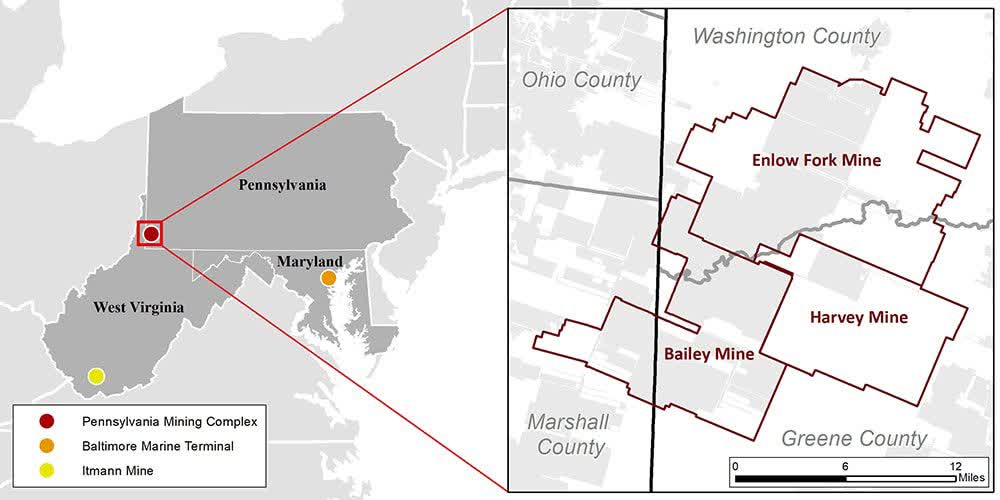

Console Energy (New York Stock Exchange: CEIX) is a thermal power and coal producer with 150 years of history. The company has some of the leading coal assets in North America, with its flagship Pennsylvania Mine Complex (“PAMC”) producing up to 28.5 million tons of coal annually. PAMC Two railroads operate, and Consol Energy also owns its own coal terminal in Baltimore. The expected reserve life of the PAMC is more than 20 years. It is important to note that Consol Energy mines low-sulfur coal that can be blended for industrial use. Accordingly, the company’s share of domestic power generation sales has decreased from 61% to 27% since 2017.

PAMC (CEIX website)

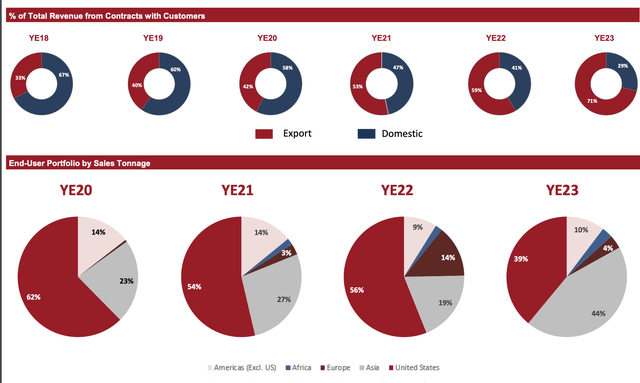

export focus

Consol Energy has fundamentally changed over the past three years by focusing on export markets. The company is Demand in the United States is structurally declining. This transformed the country into an export powerhouse. 71% of sales in 2023 came from export markets. In contrast, only 33% of sales in 2018 came from export markets.

CEIX Investor Presentation February 6, 2024

4th quarter 2023 results

On February 6, 2024, CEIX reported its fourth quarter and full-year results. For the most part, revenues met expectations.

Revenue increased 1.9% year over year to $649.4 million. The company also reported GAAP diluted earnings per share of $5.05. Finally, the company reported quarterly free cash flow of $165 million. Perhaps the only questionable part of the earnings report was how much money was spent on stock buybacks and debt repayment. We will discuss this later in the article.

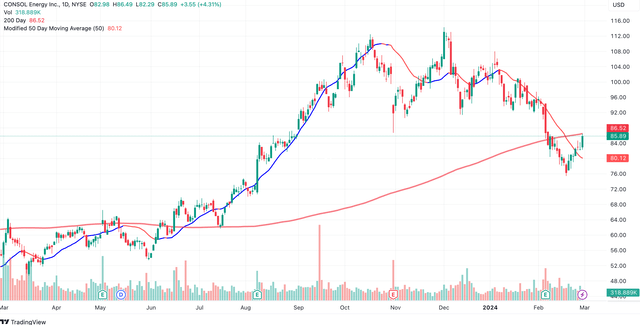

CEIX stock chart (Trading View)

Stock prices have been falling since late fall and have surpassed the 200-day moving average.

2024 Guidelines

The guidance for fiscal 2024 also met expectations. The company expects PAMC coal sales volume to be 25 to 27 million tons. Average realized revenue per tonne sold is expected to range from $62.50 to $66.50, compared to an average cash cost of coal sold per tonne of $36.50 to $38.50. The company has an 87% contract for 2024. That said, there shouldn’t be any surprises in the returns. However, it is important to note that the company has only contracted for 51% of its 2025 production.

Looking at 2025 Rotterdam coal futures, it’s not a particularly bullish chart. Mild winter weather and high inventory have driven prices down. There are concerns that if it is not a hot summer, sales in 2025 may fall unexpectedly.

Rotterdam Coal Futures (Trading View)

Clearly, the Russian embargo created a huge short-term spike that greatly benefited CEIX. However, I am worried that profits will normalize in the range of $500 million to $600 million in the future.

Finally, the company projected total capital expenditures to be between $175 million and $200 million, roughly in line with 2023.

Smart money value investors own CEIX.

Consol Energy is unique among coal names in that it is included in the portfolios of “smart money” value investors. As of December 31, 2023, CEIX was the second-largest holding in David Einhorn’s portfolio, accounting for 10.34%. It is important to note that he has been reducing this position over the past two quarters.

Likewise, value investor Mohnish Pabrai holds 14.95% stake in CEIX as of the last reporting date. He has also reduced the size of this position from 24.53% of the portfolio in recent months.

Einhorn and Pabrai find that share repurchases are an important catalyst for value creation in value stocks like CEIX. A few years ago, Einhorn shifted to buying companies with sizable stock buyback programs instead of simply buying cheap stocks that were struggling to close valuation gaps. He said in his Q2 2022 investor letter: “We do not rely on other active investors to purchase the shares we own. Instead, by recognizing these dynamics and operating and buying back shares at very low prices.”

Pabrai gave an interesting presentation on the power of share buybacks. “How to increase your investment by more than 10 times by purchasing stocks”. Because CEIX is not a beneficiary included in many ETFs or other passive investment vehicles (the ETF owns about 33% of the company), it is important to close the valuation gap through share buybacks.

Share buybacks and balance sheet

Consol Energy has committed to allocating 75% of its free cash flow to share buybacks or dividends. The current dividend yield is 5.34%.

In its most recent conference call, management said it chose to buy back stock instead of paying down debt.

“We generated $858 million in cash flow from operations, of which $168 million was used for capital expenditures and $687 million was available as free cash flow. “28% was used to repay debt and 68% was used for shareholder returns, which equates to approximately $22 per share based on our year-end 2023 share count.”

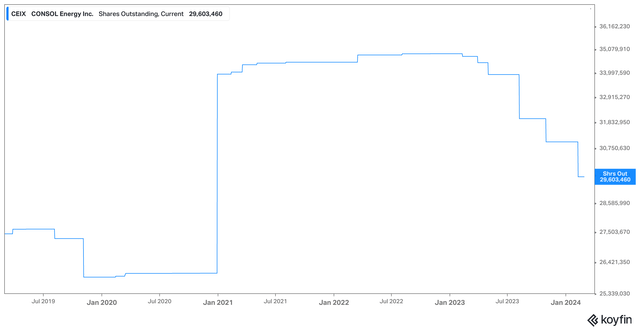

CEIX Stock Excellent (coy pin)

As you can see, the company has been buying shares rapidly over the last year, and this will likely continue to be its plan in 2025.

Some may question why the company continues to carry $186 million in debt while spending $467 million on share buybacks. Given that the stock was repurchased at ~$100/share versus its current $85 stock price, some investors are understandably upset by the capital allocation decision. However, as mentioned above, many value investors are adamant that free cash flow machines with little ETF ownership should buy back shares rather than pay down debt.

evaluation

Consol Energy is valued at $2.4 billion. The consensus estimate for 2024 EBITDA is $790 million. The consensus EV/EBITDA ratio is approximately 3.1x. Certainly, we cannot say that CEIX is overvalued on that metric.

But I’m more interested in 2025 pricing, which would see revenues normalize in the $550 million range. This would result in CEIX’s EV/EBITDA ratio being 4.4x. Although it doesn’t seem abundant by general market valuation, it’s not particularly cheap for the coal industry either. We could switch to some coal producers with EV/EBITDA ratios of 3x, which could provide more upside.

A major heatwave, mainly in Europe, is likely to deplete existing thermal coal stocks. Last winter was unexpectedly mild, and power generation coal prices traded at levels from five years ago. Moreover, there is always the threat of further Russian export bans or geopolitical tensions that could shake up the seaborne coal market and lead to higher prices. This is an upside catalyst that could negate my sell rating.

conclusion

I intend to tilt the portfolio more towards pure Met Coal producers, which I will cover in a future article. Although CEIX has deftly navigated the structural downturn in domestic power generation coal demand, there are other coal companies that we believe are more attractive at the moment. I believe that Consol Energy’s stock could trade in the $70-$90 range (4X EV/EBITDA) next year, unless there is a massive summer heatwave that dramatically clears existing inventory and drives up coal prices. For this reason, I just sold my stake in Consol Energy and will allocate the proceeds to other coal producers.