Hammer – Price Action Patterns – Analysis and Forecast – March 2, 2024

hammer

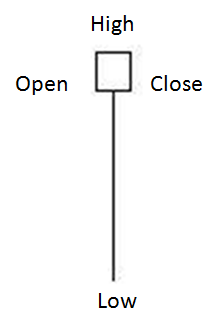

hammer price action The pattern means the market is more likely to move higher than lower and is a bullish signal primarily used in rising markets. Here’s an example of what a hammer candle looks like:

The hammer shows sellers driving the market to new lows. However, the sellers are not strong enough to choose to stay low and maintain their positions. This causes the market to bounce back and buyers to enter the market as well. Both the opening and closing prices must be located at the top of the candle. Traditionally, the closing price can be lower than the opening price, but if the closing price is higher than the opening price, it is a stronger signal.

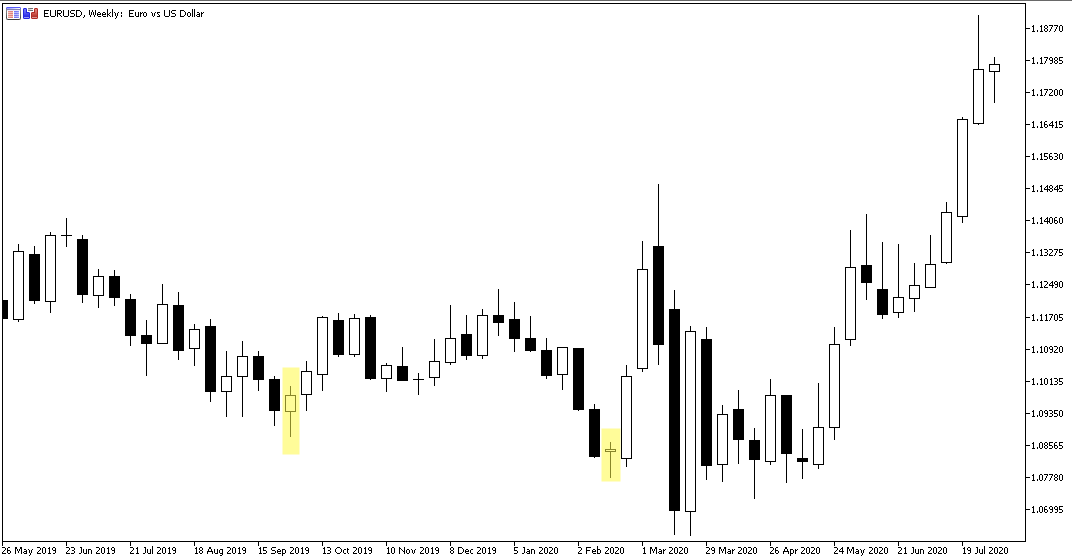

The EUR/USD price action forex chart above shows two examples of the hammer pattern highlighted on the gold box. By analyzing the open, close, high and low levels, the pattern suggests the potential for further upside. In these highlighted examples, the price moved higher after the candle formed. Of course, this isn’t always the case and there are examples of this in the same chart. But how could you trade these highlighted indicators?

item: Price level at which you can participate in the transaction, may be the next price level candle I finally succeeded in breaking the height of the hammer candle. The hammer candle highlighted second above (formed the week of February 16, 2020) has a high of 1.0863. So the entry price could be 1.0864.

stop loss: possible prevent loss The level may be lower than the hammer candle. If the market triggers the entry price but no other buyers step in, this is a warning sign that the market may need to move lower to find a buyer. So you don’t want your stop loss to be too close to your entry point. The hammer candle’s low is at 1.0777, so a possible stop loss could be 1.0776.

target: If a trade is in profit, there are several ways to exit a profit trade, including exiting at the close of the candle, targeting support or resistance levels, or using a trailing stop loss. In this case, targeting the previous swing high level would result in a target price of 1.1095.

Trade: If the entry price is 1.0864 and the stop loss price is 1.0776, the total risk of the trade is 88 pips. Trading with 0.1 lots means that if this trade triggers the entry price and then hits the stop loss, your total loss will be $88. In this case, the market traded above the target price, resulting in a trading profit of approximately $231.

Subscribe to learn more about price action trading and other trading-related topics. our channel.