Ethereum’s issuance model

Ether (ETH), the cryptocurrency that powers decentralized applications on the Ethereum platform, is minted at a constant annual linear rate through a block mining process. This rate is 0.3 times the total amount of ETH you will purchase in the presale.

The best analogy for ETH is “fuel to run the contract processing engine”, but for the purposes of this post we will treat ETH purely as a currency.

There are two common definitions of “inflation.” The first is related to prices and the second is related to the total amount of money in the system (money base or supply). The same goes for the term “deflation.” In this post we will distinguish between “price inflation”, which is an increase in the general price level of goods and services in an economy, and “money inflation”, which is an increase in the money supply of an economy due to some kind of issuance mechanism. . Currency inflation is often, but not always, the cause of price inflation.

Although the issuance of ETH is fixed each year, the rate of growth of the monetary base (currency inflation) is not constant. This currency inflation rate decreases every year, making ETH disinflationary Currency (in terms of currency base). Disinflation is a special case of inflation where the amount of inflation decreases over time.

The amount of ETH that will be lost each year due to transfers to addresses that are no longer accessible is expected to amount to approximately 1% of the monetary base. ETH may be lost if the private key is lost, the owner dies without sending the private key, or if the relevant private key is intentionally destroyed by sending it to an address for which it was not created.

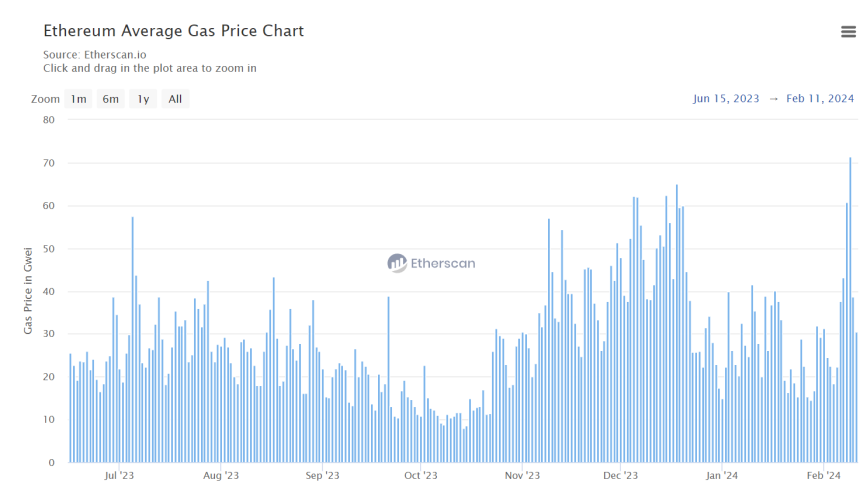

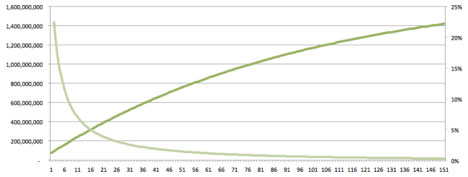

Assuming Ethereum sells 40,000 BTC worth of ETH in the presale and the average price is 1500 ETH/BTC, 60,000,000 ETH will be created in the genesis block and allocated to buyers. Each year, 18,000,000 ETH are permanently minted through the mining process. Taking into account both the creation of new ETH and the loss of existing ETH, this represents a monetary inflation rate of 22.4% in the first year. In the second year, this rate drops to 18.1%. In the 10th year, the interest rate is 7.0%. It reaches 1.9% in the 38th year. And in the 64th year, it reaches the 1.0% level.

Figure 1. Amount of ETH present on left axis (dark green curve). Base currency inflation rate on the right axis (light green curve). Years on the horizontal axis. (Edited with gratitude from Arun Mittal)

Bitcoin’s monetary base is expected to decline from that point on, as BTC will cease to be issued around 2140 and some BTC will likely be lost each year.

At about the same time, ETH’s expected annual loss and destruction rates will balance out with its issuance rate. Under these dynamics, a metastable state is reached and the amount of existing ETH no longer increases. If demand for ETH is still increasing at that point due to economic expansion, the price will be in a deflationary regime. Since ETH is theoretically infinitely divisible, this is not an existential problem for the system. As long as the price deflation rate is not too fast, the pricing mechanism will adjust and the system will operate smoothly. Wage rigidity, the traditional main objection to a deflationary economy, is unlikely to be a problem because all payment systems are flexible. Another frequent objection, borrowers being forced to repay loans in a currency whose purchasing power grows over time, would not be a problem if the system continued. Because the loan terms will be defined to account for this.

Currency inflation remains greater than zero for many years, but price levels (tracked by price inflation and deflation) depend on supply and demand and are therefore related to, but not fully controlled by, the speed of issuance (supply). Over time, the growth of the Ethereum economy is expected to significantly outpace the growth of ETH supply, which could increase the value of ETH relative to traditional currencies and BTC.

One of Bitcoin’s biggest value propositions was the total issuance of the currency, which was fixed according to an algorithm that ensured that only 21,000,000 BTC were ever created. In an era of printing legacy currencies in an exponential attempt to overcome the fact that there is so much debt in the global economic system (and more debt), a universally accepted cryptocurrency that could eventually be used as a relatively stable cryptocurrency. The outlook is as follows: Store of value is attractive. Ethereum recognizes this and strives to emulate this core value proposition.

Ethereum also recognizes that any system that seeks to serve as a decentralized, consensus-based application platform for global economic and social systems must place a strong emphasis on inclusivity. One of the many ways we seek to foster inclusion is by maintaining a publishing system with some churn. New participants in the system can purchase new ETH or mine new ETH, whether in 2015 or 2115. We believe we have achieved a good balance between the two goals of fostering inclusivity and maintaining reliable storage of assets. value. And especially in the beginning, due to the constant issuance, using ETH to build a business in the Ethereum economy will be more profitable than hoarding it speculatively.