Tracking Carl Icahn’s 13F Report – 4th Quarter 2023 Update (NASDAQ:IEP)

Nielsen Bernard

This article is part of a series providing ongoing analysis of quarterly changes to Carl Icahn’s 13F portfolio. This is based on Icahn’s Regulatory Form 13F filed on February 14, 2024. Visit Tracking Carl Icahn’s portfolio series. his investment philosophy and our Previous update About fund movements during the third quarter of 2023.

The number of shares held in 13F filings remained steady at 14. The top five holdings in the filing are Icahn Enterprises, CVR Energy, Southwest Gas Holdings, Occidental Petroleum warranty and Bausch Health.

Carl Icahn is best known for building significant stakes in companies and then driving change to increase shareholder value. To learn more about his investment style and philosophy, check out “King Icahn: Biography of a Renegade Capitalist.”

Note 1: Icahn’s 13F It cannot be considered an inventory of his possessions. Carl Icahn is the majority. Owner of Icahn Enterprises (NASDAQ:IEP) has several business entities, which in turn have IEPs. His 13F is an integrated report. IEP investor presentation (Slide 5) provides details of our business structure.

Note 2: Regulatory filings since the end of the quarter show that it owns ~10% of JetBlue Airways (JBLU).

New Stakes:

American Electric Power Company (AEP): AEP is a small 0.90% stake that was founded this quarter at prices between ~$71 and ~$84, and the stock is currently trading just above that range at ~$85.

Disposal of shares:

Crown Holdings (CCK): CCK was a 0.76% of the portfolio stake set in Q3 2022 at prices between ~$80 and ~$102. Disposal prices this quarter ranged from ~$77 to ~$93. The stock is currently trading at $76.32.

Stake reduction:

First Energy (FE): FE is ~2% of the portfolio position purchased in Q1 2021 at prices between ~$29.50 and ~$35.60. Q2 2023 saw ~25% sales at prices between ~$37 and ~$42. It then declined ~60% this quarter, with prices ranging from ~$32.60 to ~$38.50. The stock is currently trading at $36.50.

Increase your stake:

Icahn Enterprises (IEP): IEP status has continued to increase over the years. Position size increased from 98 million shares to 120 million shares in 2013, 190 million shares in 2014, 117 million shares in 2015, 130 million shares in 2016, 158 million shares in 2017, and 100 million shares in 2018. 75.4 million shares, increasing to 197 million shares in 2018. 222 million shares in 2019 and 2020, 257 million shares in 2021, 300 million shares in 2022, and 368 million shares as of the fourth quarter of 2023. The stock is currently trading at ~$20. This compares to a NAV of ~$11.55 per share as of Q4 2023.

Note 1: Last May, IEP stock fell sharply following a brief report from Hindenburg Research.

Note 2: Share growth over the past few years has primarily been due to consideration of dividends paid in additional shares rather than cash. The dividend was cut by 50% to $1 per unit in early August.

Stay steady:

CVR Energy Inc. (CVI): CVI was the top three companies initially purchased in the fourth quarter of 2011, accounting for 19% of 13F portfolio positions. The majority of the current position (71.2 million shares: 71% of the total business) was purchased through a tender offer at $30 per share in the first half of 2012. Last quarter saw a ~6% trimming at an average price of ~$35.20 per share. The stock is currently trading at $32.77.

Note 1: Two MLPs were separated following the 2012 bid. CVR Refining, the refining segment, and CVR Partners (UAN), the nitrogen fertilizer unit. CVR Energy held majority stakes in both companies. In August 2015, CVR Partners agreed to merge with Rentech Nitrogen. In the second quarter of 2018, there was a public offering in which new CVR Energy shares were exchanged for CVRR at a common value of $24.26 per unit (0.6335 shares of CVI per CVRR). ~22 million new shares issued.

Note 2: The implied cost basis of approximately $30 is greatly exaggerated due to spin-offs and special dividends paid over the years.

Southwest Gas Holdings (SWX): SWX is 6.40% of the portfolio position set at prices between ~$63 and ~$72 over two quarters through Q3 2021. In the third quarter of 2022, the stake was increased by approximately 75% through a tender offer at $82.50 per share. This was followed by a further ~60% increase in Q1 2023, with prices ranging from ~$59 to ~$67. The stock is currently trading at $69.61. The stake increased by about 3% in the second quarter of 2023 and by about 2% in the last quarter.

Note 1: They hold a 15.4% stake in the business.

Note 2: This position was disclosed in an October 2022 regulatory filing opposing Southwest’s acquisition of Questar Pipeline, Dominion Energy’s (D) transportation and storage division.

Occidental Petroleum (OXY) Weight: ~6% of the portfolio position was established in Q3 2020 when 19.3 million warrants (Exercise 22, expiration August 3, 2027) were purchased at ~$2.75 per warrant. The stake recorded sales of approximately 20% in the third quarter of 2021. There was a slight increase over the five quarters until the first quarter of 2023. The warrant is currently trading at $39.34.

Note: They also represented a large portion of OXY’s common stock, but were sold in the first quarter of 2022.

Bausch Health (BHC): 2.55% of the portfolio’s BHC position was purchased in the fourth quarter of 2020 at prices between ~$15.30 and ~$21, and increased by ~575% in the following quarter at prices between ~$21.25 and ~$34.40. The stock is currently trading well below its purchase price range of $9.89.

Note: They own 34.7 million shares (about 10% of the business). Two Icahn nominees are on the board.

Dana Co., Ltd. (and): The 1.91% DAN stake was established in Q4 2020 at prices between ~$13.25 and ~$20 and increased by ~200% in the following quarter at prices between ~$19 and ~$27. The third quarter of 2021 also saw stakes increase by up to 20% at prices between $20.90 and $24.60. The stock is currently trading at $12.74.

Note: Icahn controls about 10% of Dana Inc.

Conduent (CNDT): The small portfolio stake of 1.28% arose as a result of the Conduent spinoff from Xerox that closed in January 2017. Under the terms, Xerox shareholders must receive Condient shares in a 1:5 ratio. Icahn owned 99 million shares of Xerox, for which he received 19.8 million shares of Conduent. CNDT started trading at ~$15 and is currently trading at $3.34. In the second quarter of 2019, the stake increased by about 60% to about $9 per share. This was followed by a ~20% increase in Q4 2019 to ~$6.50 per share.

Note: Our ownership interest in Conduent is approximately 18% of the business.

Sandridge Energy (SD): SD is a 0.60% portfolio activist stake, founded in Q4 2017, priced between $16 and $21, with a current stock price of ~$13.

Note: Icahn holds a ~13.5% ownership stake in the business. He lobbied the board and succeeded in closing the Bonanza Creek acquisition on December 28, 2017. In June 2018, Icahn won a proxy battle and took control of Sandridge’s board.

Illumina (ILMN): ILMN is priced between ~$194 and ~$233, representing a 0.55% portfolio stake set in Q1 2023, with the stock currently trading at ~$141.

Bausch + Lomb Corp (BLCO): BLCO is a spin-off of Bausch Health that began trading in May 2022 at ~$18 per share. The stock is currently trading at $16.47. In June 2022, two Icahn candidates joined the board of directors.

International Fragrances and Fragrances (IFF): IFF is a mere 0.48% of the portfolio stake, founded in Q1 2022, priced between ~$116 and ~$150, with the stock currently trading at $75.88.

Newell Brands (NWL): NWL currently represents only 0.47% of the portfolio position. It was founded in the first quarter of 2018 at a cost basis of $27.40 per share. The current stock price is $7.55. In the second quarter of 2018, shares increased by up to 10% at prices between $23 and $28, and in the following quarters shares increased by up to 15% at prices between $20.50 and $28. In the first quarter of 2022, the repurchase agreement with the company reduced it by approximately 25% to $25.86 per share. Then, in the last quarter, about 80% of sales occurred at prices between $8.61 and $11.09.

Note: In April 2019, rival activist Starboard Value reached an agreement with Carl Icahn to take control of Newell’s board.

Note: Icahn also owns about 90% of Viskase Companies (OTCPK:VKSC). He is also known to have a position at Fannie/Freddie (OTCQB:FNMA)(OTCQB:FMCC).

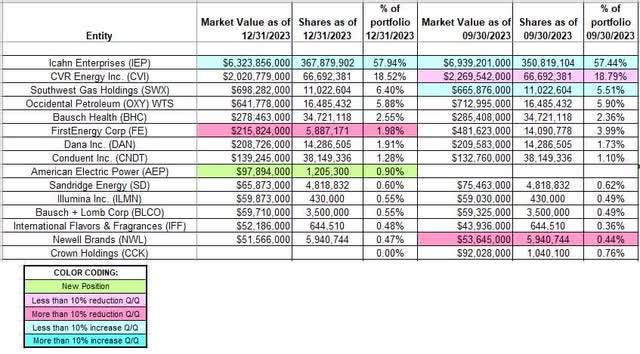

The spreadsheet below highlights changes to Icahn’s 13F stock holdings in the fourth quarter of 2023.

Carl Icahn’s Portfolio – Q/Q Comparison of Q4 2023 13F Reports (John Vincent (Author))

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.