Emerging Market Links + The Week Ahead (March 4, 2024)

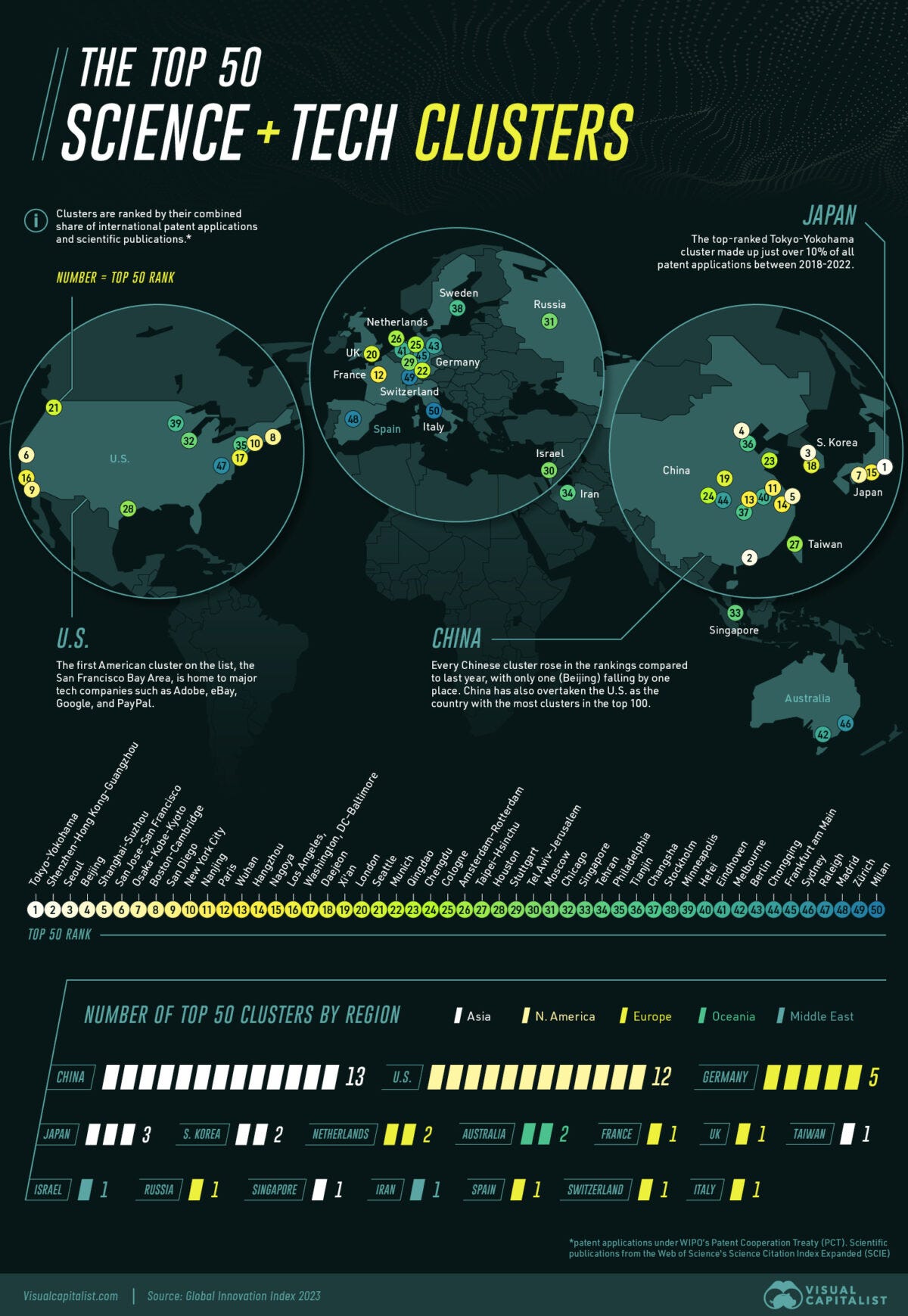

A recent Visual Capitalist infographic mapped the world’s top 50 science and technology hubs with many of them concentrated in China. The Asset also has an interesting article about Shenzhen’s success due to it’s support of innovative local businesses – something that the tech manufacturing hub of Penang in Malaysia has not been that successful at doing.

Nevertheless, there was an interesting essay in the Financial Times (What China can learn from the ashes of my boat 🗃️) written by someone who just had their boat destroyed by a Chinese lithium-ion battery overheating or exploding (apparently something that more than 1% of them now do globally). The article’s by-line and conclusion which he tied back to the performance of the Chinese stock market: Quality matters because wooing investors requires trust.

(Note that I am typing this while looking a Fangor portable flat screen that’s in front of the flickering screen on my Lenovo Group (HKG: 0992 / FRA: LHL / LHL1 / OTCMKTS: LNVGY / LNVGF) laptop that spent much of the COVID pandemic as a brick due to a faulty chip on the motherboard and a not-so international warranty only honoured in the USA where it was purchased… Oh and the hard drive has also been replaced in it – that’s usually the first thing that fails on a laptop…)

He had also written this which really hit home with me and something investors should keep in mind:

Not a day passes without me screaming at televisions, pepper grinders, lawnmowers or Tupperware. Such poor design. So badly executed. If only Steve Jobs or Sir James Dyson had made you, damn it!

$ = behind a paywall

-

🇨🇳 🇭🇰 CMBI Research China & Hong Kong Stock Picks (January-February 2024) Partially $

-

February: iQIYI, JNBY Design, Baidu, Shengyi Tech, ZTE, BeiGene, Li Auto, Yancoal Australia, Trip.com, New Oriental Education, Amazon.com Inc, Microsoft, NIO Inc, Tongcheng Travel Holdings, XPeng, Xiaomi Corp, Guangzhou Automobile Group, Yum China, Alibaba, FIT Hon Teng, Q Technology (Group) Company, Jiumaojiu International Holdings, PICC Property and Casualty Co Ltd, China Yongda Automobile Services Holding & Unity Group Holdings International Ltd

-

January: Stella International Holdings Ltd, Sunny Optical, China MeiDong Auto Holdings, BYD Electronic International Co Ltd, Zhongji Innolight, GigaCloud Technology, JD.com, Netflix, Sinotruk Hong Kong Ltd, Weichai Power, Tencent Music Entertainment Group, Tencent, Kuaishou Technology, Shanghai Henlius Biotech, Inner Mongolia Yili Industrial Group, Horizon Construction Development, WuXi Biologics, Geely Automobile Holdings, Prada SpA, Sirnaomics Ltd, FriendTimes Inc, Xtep, Kingdee International Software Group, ANTA Sports Products & Samsonite International

-

20+ high conviction stock ideas: Li Auto, Geely Automobile, Weichai Power, Zhejiang Dingli, CR Power, CR Gas, JNBY, JS Global, Vesync, Kweichow Moutai, BeiGene, PICC P&C, Tencent, Alibaba, Pinduoduo, Amazon.com, Netflix, Kuaishou, GigaCloud, CR Land, BYDE, Luxshare, Innolight & Kingdee

-

-

🇰🇷 Shinhan Financial Group (NYSE: SHG): Low PBR with a Strong Balance Sheet, But Has US Commercial Real Estate Exposure $

-

EM Fund Stock Picks & Country Commentaries (March 3, 2024) $

-

Emerging & Eastern Europe has room to grow further; accessing China via Korea-Taiwan; Taiwan semiconductor inventories stabilize; research on Kaspi, KSOE, Kia, Bajaj Holdings, Elite Material, etc.

-

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 (PDD Holdings Inc. (PDD US, BUY, TP US$178) TP Change): Fine-Tuned Extraction of Merchant Profits (Smartkarma) $

We expect PDD Holdings (NASDAQ: PDD) or Pinduoduo to report CY4Q23 top-line and non-GAAP net income 14.3% and 21.2% vs. consensus. Main model changes are increased Temu revenue per order and PDD take-rate;

Temu continued increasing prices despite the holiday shopping season, and merchants reported that Temu began charging service fees. PDD upgraded its ads tools, which we expect boosted China take rate.

We maintain our BUY rating and raise our TP to US$ 178.

🇨🇳 Alibaba Cloud slashes prices as previous cuts underwhelm, executive says (Caixin) $

China’s public cloud market is in the early stages of another price war. Alibaba (NYSE: BABA)’s cloud unit kicked off the offensive on Thursday with its second bout of steep discounting within a year.

Alibaba Cloud has slashed the prices of more than 100 products by up to 55% as growth in the sector, and the company’s market share, has diminished.

🇨🇳 Lenovo future hinges on four letters: AI PC (Bamboo Works)

Analysts lowered their price targets for the Chinese PC giant after it reported its revenue rose just 3% and its profit fell 23% year-on-year in its latest fiscal quarter

Lenovo Group (HKG: 0992 / FRA: LHL / LHL1 / OTCMKTS: LNVGY / LNVGF)’s profit fell 23% in its third fiscal quarter to $340 million

The PC maker expects its new AI PC models to fuel its next revenue boom

🇨🇳 Li Auto charges ahead in fourth quarter as slowdown looms (Bamboo Works)

The NEV maker’s revenue from vehicle sales rose 134% in the fourth quarter, but it forecast its overall revenue growth would slow to about 70% in the first quarter of 2024

Li Auto (NASDAQ: LI) posted triple-digit revenue growth in the fourth quarter and improving margins, but forecast a sharp slowdown in the growth rate in the current quarter

The Chinese NEV sector’s rapidly slowing growth could accelerate on growing consumer worries following a recent string of negative headlines about the technology

🇨🇳 Li Auto (LI US): 4Q23, High Growth and Profit, A Winner of Market Concentration, Upgraded to Hold (Smartkarma) $

In 4Q23, revenue grew by 136% and operating profit was significantly higher than the market consensus.

Li Auto (NASDAQ: LI) grew the most rapidly among the top-ten Chinese NEV sellers.

We believe Li Auto will be one of the winners after the market gets more concentrated. Upgrade to Hold.

🇨🇳 Chinese cinema projector maker says electric vehicles have box office potential (FT) $ 🗃️

🇨🇳 Now all grown up, should Daqo consider privatizing? (Bamboo Works)

The polysilicon maker has more than enough cash to purchase all of its outstanding shares, as its stock remains stubbornly undervalued by investors

Daqo New Energy’s (NYSE: DQ)’s output rose 80% in the fourth quarter with the addition of new capacity, but its profit tumbled on plunging polysilicon prices

The global solar power sector is likely to enter a new phase of no growth between 2024 and 2028, following several years of strong expansion, according to Wood Mackenzie

🇨🇳 Haier Smart Home: The failed arbitrage play (Simon’s Substack)

Completely apart from the D-share project, currently companies from China are speeding up their foreign listings by leveraging Global Depositary Receipts (GDR), with a preference for a listing in Switzerland.

In summary, if Haier Smart Home (HKG: 6690 / SHA: 600690 / OTCMKTS: HSHCY / OTCMKTS: HRSHF) truly wanted to reduce the price spread between D- and H-shares, they would have options. Starting with free convertibility, buybacks of the D-shares instead of the expensive H- or A-shares, and also, more active IR work.

Haier is not a victim of circumstances here, instead, they have consciously decided to just dip a small toe in the pond. The D-shares trade at a discount because Haier lets them trade at a discount.

🇨🇳 In tight times, Vipshop wows investors with dividend policy (Bamboo Works)

The discount e-commerce company, which has been consistently profitable since 2013, said it will return $250 million to investors through a dividend this year

Vipshop Holdings (NYSE: VIPS) said it will pay $250 million to investors this year under a newly announced dividend policy, equaling a relatively low payout ratio of about 23%

The company looks relatively well situated to weather China’s economic downturn due to its focus on bargain-priced clothing and relatively small average order size

🇨🇳 China Sportswear (Part 2: Anta) (East Asia Stock Insights)

Industry-leading brand portfolio and execution

In Part 1, we discussed why China’s homegrown sportswear brands are interesting to look at. Now, we will go deeper into the individual names: ANTA Sports Products (HKG: 2020 / FRA: AS7 / OTCMKTS: ANPDY / OTCMKTS: ANPDF) and Li Ning (HKG: 2331 / FRA: LNLB / FRA: LNL / OTCMKTS: LNNGY / LNNGF).

Earlier this month, I travelled to Beijing and had the opportunity to conduct some store visits. Through this, I also aim to provide an authentic and up-to-date analysis on these names.

🇨🇳 China Sportswear (Part 3: Li-Ning) (East Asia Stock Insights) $

Li Ning (HKG: 2331 / FRA: LNLB / FRA: LNL / OTCMKTS: LNNGY / LNNGF) was established in 1990 by the legendary gymnast Li Ning, becoming China’s first well-known sportswear brand. Li was a gymnast who won six medals at the 1984 Summer Olympics, cementing him as one of the most decorated Chinese athletes of all time.

Li-Ning is largely a single-brand company today. While management often talks about this as a strategy, a more accurate explanation is that it resulted from the company’s previous failures to develop acquired brands.

🇨🇳 Haidilao tastes profit success with budget hotpot chain (Bamboo Works)

The Chinese restaurant sector is continuing a run of upbeat results and earnings forecasts, with hotpot giant Haidilao saying its profits surged last year

Haidilao International Holding (HKG: 6862 / FRA: 8HI / OTCMKTS: HDALF) predicted its net profit for 2023 would reach at least 4.4 billion yuan, a rise of nearly 170%

The hotpot leader has rolled out cheaper options to tempt budget-conscious consumers in China’s weakening economy

🇨🇳 Profit setback for Simcere Pharma in novel drugs quest (Bamboo Works)

The pharmaceutical company’s profits have been buffeted by erratic returns on an equity stake in a fellow developer of innovative drugs

Simcere Pharmaceutical Group (HKG: 2096 / FRA: S2P / OTCMKTS: SMHGF) holds a 9% stake in 3D Medicines Biotechnology (HKG: 1244), making it the firm’s second-biggest shareholder. It chose not to cash out any of its holdings when the stock was surging

Simcere slashed the price of its oral Covid drug Xiannuoxin by 27% to get the product into China’s health insurance program, which will squeeze future profits

🇨🇳 Ispire finds success straddling U.S.-China divide. But are its cannabis dreams just hot air? (Bamboo Works)

The U.S.-based vaping company with China roots says its revenue could balloon over the next five years on the fast-growing cannabis market

Recently listed Ispire Technology (NASDAQ: ISPR) co-CEO Michael Wang estimates his company’s revenue could grow to $2 billion in five years, from an expected $200 million in its current fiscal year

Much of the vaping company’s growth could come from cannabis hardware sales, which rose 149% in the company’s latest quarter, making up nearly half its revenue

🇨🇳 Xinyi Glass (868 HK): Resilient FY23 Results; A Nice Dividend Play (Smartkarma) $

Xinyi Glass Holdings (HKG: 0868 / FRA: XI9 / OTCMKTS: XYIGY / XYIGF) reported FY23 results, with net profit up 5% yoy and sales up 4% yoy.

The company announced a final dividend of HKD0.37 per share, resulting in a full year dividend of HKD0.63 per share, which is a yield of 8%.

Overall the results look resilient, with auto glass segment a bit weaker than expected and float glass segment stronger than expected.

🇨🇳 Sinotrans (598.HK), a Shining Example of SOE Reform (Smartkarma) $

Sinotrans Ltd (SHA: 601598 / HKG: 0598 / FRA: SIY / OTCMKTS: SNOTF)

A Profit-Oriented State Owned Enterprise that is walking the walk.

Management incentives are aligned with shareholders, a rarity in China.

Plenty of upside remains despite the market outperformance to date

🇨🇳 China Airports: Beijing Capital Airport Offers Best Risk/Return Payoff (Smartkarma) $

Recent newsflow and company results suggest China outbound travel is on track to recover to pre-pandemic level by the end of this year.

China airports have different exposures to outbound travel, which largely determines the scale of their duty-free shopping business and earnings upside amidst this recovery cycle.

Beijing Capital International Airport Co Ltd (HKG: 0694 / FRA: BJ1 / OTCMKTS: BJCHY / BJCHF) offers best risk/return profile among listed China airports in our view as current valuation does not fully capture even a conservative scenario of recovery in outbound travel.

🇭🇰 Cathay Pacific – Reported Air China Interest Prompts Assessment of Structural Disadvantages (Smartkarma) $

We publish a deep dive on historical margin management at Cathay Pacific Airways Limited (HKG: 0293 / OTCMKTS: CPCAY) following Bloomberg reports that Air China (SHA: 601111 / HKG: 0753 / FRA: AD2 / LON: AIRC / OTCMKTS: AIRYY) is considering raising its 29.99% stake.

We see Cathay’s consistent underperformance of the global industry as due to structural disadvantages competing against lower cost competitors without the benefit of attractive joint ventures or M&A.

Our deep dive comparing margin generation to ten major global peers highlights weak pricing power without sufficient offset from staff cost/other cost efficiencies as the key problem.

🇭🇰 Plover Bay Technologies’ (1523.HK) 2023 results show solid earnings trajectory (Pyramids and Pagodas)

Shares up 13% despite moderate revenue growth, while profits surge. Stock’s strength lies in consistent dividends, growing recurring revenues, and niche market offering.

Yesterday, we hopped on Plover Bay Technologies (HKG: 1523 / OTCMKTS: PBTDF) (“Plover Bay”) FY23 earnings call to see how our long-term bullish thesis on the Company is holding up.

The full-year results came on the heels of our well-received interview with the Company’s founder and CEO, Alex Chan, in which he shared his insights on leadership, vision, and growth prospects. For those of you who didn’t tune in. Plover Bay manufactures routers and sells subscriptions for always-on 5G connectivity, accessible from anywhere in the world.

🇭🇰 Jeju Shinhwa operator flags wider loss for 2023 (GGRAsia)

Hong Kong-listed casino developer Shin Hwa World Ltd (HKG: 0582) says it expects the group’s consolidated net loss for full-year 2023 to more than double from the prior year. The company runs a resort called Jeju Shinhwa World with foreigner-only casino in Jeju, South Korea.

In other news, the firm said in a Monday filing before the Hong Kong bourse opened, that trading in its shares was being halted at its own request with effect from 9am that day.

🇲🇴 Rolling the dice on Macau gaming stocks and bonds (The Asset) 🗃️

US-affiliated casino operators boast strong fundamentals that outweigh generally gloomy market sentiment

Both in fixed income and equity, Macau gaming companies, particularly those with US-based parents such as (Sands China (HKG: 1928 / FRA: 599A / OTCMKTS: SCHYY / OTCMKTS: SCHYF)) Las Vegas Sands (NYSE: LVS, (Wynn Macau Ltd (HKG: 1128 / FRA: 8WY / OTCMKTS: WYNMY / WYNMF)) Wynn Resorts Ltd (NASDAQ: WYNN), and Studio City International Holding Ltd (NYSE: MSC), provide investors with strong fundamentals that outweigh the generally downbeat market sentiment.

Bonds, both high yield and investment grade, of US-affiliated Macau gaming companies are currently trading at 7% to 10% yields. The spread between the bonds of the US-based parent companies and those of their Macau-based affiliates trading in Hong Kong has widened.

🇲🇴 Galaxy Ent 4Q EBITDA US$359mln, announces dividend (GGRAsia)

Macau casino operator Galaxy Entertainment (HKG: 0027 / OTCMKTS: GXYEF) reported fourth-quarter 2023 adjusted earnings before interest, taxation, depreciation and amortisation (EBITDA) of just under HKD2.81 billion (US$358.7 million). The result was up 1.4 percent sequentially, and compared with a negative figure of HKD163 million in fourth-quarter 2022.

He added: “We are the first Macau concessionaire to resume dividends and return capital to shareholders after the border reopened. These dividends demonstrate our continued confidence in the longer-term outlook of Macau and for the company.”

🇰🇷 Alpha Generation Through Share Buybacks in Korea: Bi-Monthly (Jan and Feb 2024) (Smartkarma) $

In this insight, we discuss the alpha generation through companies that announced share buybacks in Korea in January and February 2024.

We provide a list of 22 stocks in the Korean stock market that have announced share buyback programs in the past two months.

Major companies that have announced share buybacks in Korea in the past two months include Shinhan Financial Group (NYSE: SHG / KRX: 055550), Hyundai Mobis (KRX: 012330), and Samick Musical Instruments Co Ltd (KRX: 002450). All three have outperformed the market.

🇰🇷 Celltrion (068270 KS): Solid Performance in Core Business in 2023; Eyes 60% Sales Growth in 2024 (Smartkarma) $

Celltrion (KRX: 068270) has reported 12% YoY growth in its core business of biosimilars in 2023. Growth was mainly driven by new portfolios including Remsima SC and Yuflyma.

Operating profit and operating margin improved slightly YoY, led by an increase in high-margin biosimilar sales. Biosimilar products contributed 67% of total revenue in 2023, up from 57% in 2022.

The company is targeting more than 60% global sales growth to KRW3.5 trillion in 2024. Celltrion is eyeing KRW1.6 trillion EBITDA and more than 40% EBITDA margin in 2024.

🇰🇷 HYBE Invests Additional 104 Billion Won in SM Entertainment – Why? (Smartkarma) $

After the market close, it was announced that HYBE (KRX: 352820) acquired a 3.7% stake (868,948 shares) in SM Entertainment Co Ltd (KOSDAQ: 041510) for 104.3 billion won.

HYBE’s acquisition of shares was accomplished through the exercise of a put option by SM Entertainment’s founder Lee Soo-Man. After this purchase, HYBE will own 12.6% stake in SM Entertainment.

We like SM Entertainment at current levels. Valuations are attractive and there is a strong pipeline of new music/songs to be launched by its artists in 2Q 2024.

🇸🇬 Yangzijiang Financial: a free mystery box (Value Zoomer)

We’re going back for some classic deep value in this month’s article with Singaporean financial company Yangzijiang Financial Holding Ltd (SGX: YF8 / OTCMKTS: YNGFF). A recent spinoff with some Chinese real estate exposure and management turnover, that’s trading at an incredibly cheap valuation and returning capital. The intrinsic value is opaque, but it’s an extremely interesting situation with an attractive risk/reward profile.

🇸🇬 Our thoughts on Grab’s 2023 Q4 and Full Year results (Momentum Works)

On Thursday (22 Feb), Grab Holdings Limited (NASDAQ: GRAB) released financial results for the fourth quarter and the full year of 2023, recording a first quarterly profit – of US$11 million – benefiting from an “accounting accrual reversal”.

With ample cash on hand, Grab announced it would repay term loans and initiate a share buyback programme – the first time for Grab or any listed Southeast Asian tech major.

Some thoughts:

🇸🇬 ST Engineering’s 2023 Core Net Profit Jumped 24% Year-on-Year: 5 Highlights from its Latest Earnings Report (The Smart Investor)

The engineering specialist reported a strong set of earnings with a robust order book that sets the stage for continued good performance this year.

Here are five salient highlights from Singapore Technologies Engineering Ltd (SGX: S63 / FRA: SJX / OTCMKTS: SGGKF)’s latest earnings report that investors should know about.

A robust financial performance

The commercial aerospace division is taking off

A strong order book for the Defence & Public Security division

A downbeat performance for the Urban Solutions and Satcom division

Bulking up its order book

🇸🇬 SATS More Than Doubled its Core Net Profit for 3Q FY2024: 5 Things Investors Need to Know About its Latest Business Update (The Smart Investor)

SATS Ltd (SGX: S58 / FRA: W1J / OTCMKTS: SPASF)

The ground handler cum food caterer is going from strength to strength as it benefits from the air travel rebound.

Here are five things investors need to know about its latest 3Q FY2024 business update.

A surge in core net profit with positive free cash flow

Lower reliance on Food Solutions

Stronger operating metrics

Encouraging business developments

A bright outlook

🇸🇬 OCBC’s 2023 Net Profit Hit a Record S$7 Billion, Ups Dividend: 5 Highlights from the Bank’s Latest Results (The Smart Investor)

Oversea-Chinese Banking Corp (SGX: O39 / FRA: OCBA / FRA: OCBB / OTCMKTS: OVCHY)

The lender, like its peers, also delivered a strong set of earnings and increased its 2023 dividend.

Here are five highlights from the bank’s latest financial results.

Net profit at a record high

A steady rebound in NIMs

Higher non-interest income

Well-controlled costs along with a lower NPL ratio

An increase in dividends

🇸🇬 City Developments Reports Record Revenue and Declares a Final Dividend of S$0.08: 5 Highlights from the Property Giant’s Latest Earnings (The Smart Investor)

The real estate giant is advancing on its GET strategy even as it pays out a dividend to reward shareholders.

Here are five highlights from City Developments Limited (SGX: C09 / FRA: CDE / OTCMKTS: CDEVY)’s latest 2023 earnings.

Record revenue and higher core net profit

Healthy Singapore property sales with a promising launch pipeline

Ongoing asset enhancements, redevelopments and revamps

Stronger results for hotel operations

Boosting recurring income streams

🇸🇬 CapitaLand Investment Limited Reports a Lower Core Net Profit But Maintains Dividend of S$0.12: 5 Things You Need to Know (The Smart Investor)

Capitaland Investment (SGX: 9CI / FRA: 5NU / OTCMKTS: CLILF)

The property investment giant sees headwinds ahead but remains confident of its recurring income generation capability.

Here are five highlights from the group’s latest earnings that you need to know.

Weaker core earnings offset by higher recurring revenue

FUM growth led by a jump in private fundraising

Lodging management division reports a record year

A challenging environment for the real estate investment business

Setting new targets

🇸🇬 Raffles Medical Group’s 2023 Net Profit Tumbles 37% Year on Year: 5 Highlights from the Integrated Healthcare Player’s Latest Earnings (The Smart Investor)

The integrated healthcare player sees better days ahead with its latest Vietnam hospital acquisition.

Here are five highlights from Raffles Medical Group (SGX: BSL / FRA: 02M1 / OTCMKTS: RAFLF)’s latest financial statements that investors should know about.

Weaker net profit offset by steady free cash flow generation

Addressing evolving patient needs in Singapore

Gestational losses for China hospitals

Higher loss ratio for its insurance division

A reduction in the final dividend

🇲🇾 GEN Malaysia 4Q profit tops US$46mln, to pay dividend (GGRAsia)

Global casino operator Genting Malaysia (KLSE: GENM) reported fourth-quarter net profit of MYR217.6 million (US$48.6 million), compared to a loss of MYR372.4 million in the prior-year period. Judged sequentially, net profit was up 22.7 percent, according to a Thursday filing to Bursa Malaysia.

Revenue in the three months to December 31 reached nearly MYR2.72 billion, flat sequentially, and up 11.8 percent from a year ago.

Genting Malaysia operates Resorts World Genting (pictured in a file photo), Malaysia’s only licensed casino property. The group also runs casinos in the United States, the Bahamas, the United Kingdom, and Egypt.

🇳🇴 🏴 DNO (ToffCap)

DNO has assets in the North Sea, Kurdistan and West Africa (total 2P + 2C reserves roughly at 540 mmboe – that is, million barrel of oil equivalent), but the company is mostly exposed to the semi-autonomous region of Kurdistan, holding the operatorship and working interests in the Tawke license (75%) and the Baeshiqa license (65%). Production from Tawke and Baeshiqa is transported via the Iraq-Turkey (Ceyhan) pipeline, a very important conduit for oil transport in the region, which provides Iraq access to the international oil markets (which means more volumes and better prices).

🇬🇷 Aeropuerto Internacional de Atenas – Una tesis a lo Peter Lynch (HerediaLaso | Inversión GARP)

Note: In Spanish. Use a browser translator to translate.

This is an investment idea in the purest “value” style in which we can buy something for much less than what it is worth for its fundamentals. However, no one can guarantee that this gap will one day close. Edit 27/02/2024:

In the meantime, we can expect sitting on an approximate 5% dividend yield.On the other hand, I don’t expect big growth or strong emotions. If the gap closes with the valuation, it will be time to dismantle the position.

The company has, however, quite a positive option, as there are still 24 airports with 100% public management. Athens International Airport SA (FRA: 9O1) has the “call” of being granted one of these airports. However, I believe that they are more likely to be awarded to Fraport Greece because of its greater experience managing regional airports.

🇿🇦 Woolworths’s half-year earnings plunge despite resilience to SA headwinds (IOL)

Retailer Woolworths (JSE: WHL / OTCMKTS: WLWHY)’s resilience against plummeting economic conditions in South Africa helped its revenues for the interim period to end December 2023, although its Australian and New Zealand operations suffered from depressed consumer sentiment as shopping trends shift away from spending on goods and services.

Looking ahead, Woolworths is anticipating the remainder of the current financial year “to remain challenging”, although it expected inflation to ease gradually. “Interest rates across both geographies are likely to remain elevated, placing continued pressure on consumer disposable income. In South Africa, the ongoing energy crisis, port and infrastructure challenges are expected to further constrain economic activity,” the company said.

🌎 Arcos Dorados: Expanding With Solid Fundamentals (Seeking Alpha) $

Arcos Dorados Holdings Inc (NYSE: ARCO) is the largest quick-service restaurant chain in Latin America and the Caribbean, with a strong market presence and capacity to serve over four million customers daily.

ARCO demonstrated robust performance in FY23, capitalizing on expansion and improving efficiency, leading to double-digit revenue growth and expanding margins.

The company’s solid growth prospects, including plans to open new restaurants, improving macroeconomic indicators, and decent liquidity levels, make it an attractive investment opportunity.

🇰🇾 Consolidated Water: Good Growth Prospects And The Stock Is Oversold (Seeking Alpha) $

Consolidated Water Company Ltd (NASDAQ: CWCO) is well-positioned to benefit from the growth trend in the desalination and water treatment plant markets.

The company has a good cash position which adds hidden value to the valuation.

Consolidated Water’s stock is slightly discounted.

🇧🇷 Rumo: Chugging Ahead With Brazil’s Largest Railway Network (Seeking Alpha) $

Rumo (BVMF: RAIL3) exhibits a unique growth potential in the railway sector in Brazil, boasting extensive infrastructure and a dominant market position.

The company’s strategic investments in key projects, such as network renovation and expansion, reinforce its competitive edge and contribute to sustainable long-term growth.

With low competition and high entry barriers, Rumo benefits from increased revenue predictability and reduced risk of substitute products, further bolstering its market position.

Rumo’s ongoing deleveraging efforts and anticipated profitability, driven by favorable crop harvests, underscore its financial strength and potential for future growth.

🇧🇷 Braskem – Catching BAK Up (Calvin’s thoughts) $

The company is showing signs of improvement on multiple fronts, while a binding buyout offer could be on the way

2023 ended with hope for Braskem (NYSE: BAK) bulls close to a 52 week low. To catch you up on one of my largest exposures, I’ll provide a timeline.

So where are we today? Why has the Braskem share price recently been appreciating again? In this post I’ll bring you up to speed and share my views on where things go from here.

🇧🇷 Out of Petrobras (Calvin’s thoughts) $

Great run, but time to move on

Petrobras (NYSE: PBR) was widely hated when I entered the position last December on Lula’s election. It’s still cheap, but with lower payouts and more money going into non core investments as per Prates comments today, there’s less of a reason to own it.

🇧🇷 PagSeguro: Q4 Earnings – Solid Results, Favorable Guidance, And Attractive Valuations (Seeking Alpha) $

PagSeguro Digital (NYSE: PAGS)‘s Q4 earnings showed robust growth in Total Payment Volume, profits, and banking risk management, bolstered by favorable macroeconomic conditions in Brazil.

Despite trading at a discount compared to peers, PAGS’s valuation remains attractive, supported by its conservative growth profile and significant buyback activity.

Market indicators, including the RSI and moving averages, suggest a bullish trend for the Company’s shares post-earnings, reinforcing optimism in the company’s performance.

With a strategic focus on integrating payment and banking services and achievable annual guidance, PagSeguro presents a compelling investment opportunity with more favorable macroeconomic trends in Brazil.

🇧🇷 XP Inc.: Needs A Risk-On Environment (Seeking Alpha) $

XP Inc (NASDAQ: XP) is a Brazilian broker/dealer with an emerging general retail finance business as well as an investment banking arm.

The company’s new verticals in general banking and investment banking are performing well, driving all the growth together.

XP is reasonably valued compared to US peers and the Brazilian Real should do decent against the US Dollar.

Growth prospects owed to the more emerging and less penetrated market make the multiple relatively quite interesting, although a Brazil discount should remain.

In general, the business is growing nicely, but for the stock to really perform, it’s going to need a risk-on environment in Brazil, which starts with looser financial conditions that are probably coming soon.

🇨🇱 Insight: Inside a copper output plunge at No. 1 global producer Codelco (Reuters)

Detailed article with a number of charts and graphics…

Chile is the world’s largest supplier of the red metal and Codelco accounts for just over a quarter of the country’s output.

The overhaul at PMCHS should extend the mine’s lifespan by 50 years but the underground mine has been dogged by delays, collapses and construction difficulties.

Reuters spoke to more than a dozen Codelco employees at key mines, headquarters and unions, and reviewed hundreds of pages of internal company reports, financial statements and regulatory documents and investigations to assess the causes behind the delays.

🇨🇴 Presentation on Parex Resources & Parex Resources – Brilliant Tax Strategy Will Pay Huge Dividends (Calvin’s thoughts) $

I created this 40 minute presentation to present my thesis on Parex Resources (TSE: PXT / FRA: QPX / OTCMKTS: PARXF) I believe it’s a world class compounder trading at absurdly cheap valuations despite having some of the highest earnings quality of any company in the world. I have ~40% of my portfolio allocated long.

🇲🇽 Grupo Aeroportuario Del Centro Norte Stock Remains Attractive (Seeking Alpha) $

Nearshoring trend in Mexico presents opportunities for increased manufacturing and economic activity, benefiting Grupo Aeroportuario del Centro Norte, known as OMA (NASDAQ: OMAB / BMV: OMA).

Risks include stalling economic growth affecting manufacturing output and capacity cuts for airlines due to downtime of GTF-powered airplanes.

Despite challenges, OMAB stock remains a compelling investment opportunity with a projected price target of $111.70.

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 Increases in Large Reinvestment Budgets by American Companies Observed Cautious Optimism Found in 2024 AmCham South China Study (The American Chamber of Commerce in South China)

The American Chamber of Commerce in South China (AmCham South China) today released its 2024 Special Report on the State of Business in South China. The release was attended by over 200 government officials, business executives and members of media including over 40 foreign consulates mostly represented by their consuls general. This publication can be downloaded free of charge from the Chamber’s website at http://www.amcham-southchina.com/amcham/static/publications/specialreport.jsp

Key Takeaways of the 2024 Special Report on the State of Business in South China:

🇨🇳 Cover story: Chinese pharma turns to global deals to cure capital crunch (Caixin) $

After enduring the chill of a prolonged capital winter, China’s drugmakers have begun to feel a thawing breeze.

Deal-making has surged in 2024, with the nation’s pharmaceutical industry attracting increased attention from international rivals for their innovative treatments. Last year, Chinese drugmakers set a record for new drug out-licensing deals — in which a company allows another party to use its product, technology or intellectual property — and saw the first-ever acquisition of a domestic biotech firm by a multinational pharmaceutical giant.

The resurgence comes as China’s drugmakers face a sustained investment contraction, mirroring a wider pullback by investors amid the country’s stock market slump. Over the past three years, Chinese pharmaceutical shares have lost $600 billion in market value.

🇨🇳 Charts of the Day: China’s Lithium Miners Cut Output as Demand Falls (Caixin) $

China’s lithium carbonate miners have been cutting production, as prices of the key electric vehicle (EV) battery material continue to drop amid weaker demand.

Factory operating rates dropped to 45.73% on Friday from 52.5% on Feb. 9, the day before the Lunar New Year holidays began, according to data from Shandong Longzhong Information Technology Co. Ltd.

🇨🇳 China’s securities regulator promises strict crackdown on financial fraud (Caixin) $

China’s top securities watchdog denied market speculation that the regulator will retrospectively review initial public offerings (IPOs) made over the past 10 years but said a strict check will be kept on IPO companies to catch any violations.

Financial audits remain a top priority in the daily supervision of listed companies, Yan Bojin, chief risk officer of the China Securities Regulatory Commission (CSRC) and head of the department of public offering supervision, said at a Friday press conference.

🇨🇳 What China can learn from the ashes of my boat (FT) $ 🗃️

Quality matters because wooing investors requires trust

Not a day passes without me screaming at televisions, pepper grinders, lawnmowers or Tupperware. Such poor design. So badly executed. If only Steve Jobs or Sir James Dyson had made you, damn it!

I was pondering the issue of quality and China’s woeful stock market performance even before my boat was destroyed by fire on Monday. The cause was a Chinese lithium-ion battery overheating or exploding — as more than 1 per cent of them now do globally, according to Gitnux data. Luckily no one was killed.

Recent viral videos of angry Chinese buyers smashing up defective robot vacuum cleaners may seem trivial. But they add to the lack of trust in local stocks which are already down 15 per cent over the past 12 months.

🇨🇳 Shenzhen success due to indigenous innovation (The Asset) 🗃️

When it comes to converting foreign direct investment into income growth and technological upgrading, Shenzhen, China, has been far more successful than Penang, Malaysia. The reason is simple: Shenzhen, unlike Penang, supported the rise of innovative local businesses

🌐 Mapped: The World’s Top 50 Science and Technology Hubs (Visual Capitalist)

🇰🇷 South Korea unveils reforms to unlock value of listed companies (FT) $ 🗃️

🇮🇳 A tale of two bull markets (FT) $ 🗃️

🌐 Ep 6. Finding opportunities in crisis – Interview with veteran emerging and frontier market investor, Michael McGaughy (Pyramids and Pagodas)

In search of companies trading at generational lows, Michael scours some of the world’s most volatile markets and outperform major emerging and frontier market indices

In this episode, Michael McGaughy, Head of Research at Hong Kong based Fusion Wealth Management. Fusion manages Research Alpha – a long-only, absolute return equity fund that invests globally in undervalued quality companies, particularly in emerging and frontier markets. Research Alpha’s investments run the gauntlet of places that give conventional investors nightmares – think Argentina, Egypt, and Nigeria.

🌐 Big Macs, Mercantilism and the Commodity Curse (The Emerging Markets Investor)

We look below at the annual volatility of currencies over this period. We highlight the stability of champion exporters of manufactured goods like Germany, Korea, Taiwan, Singapore, Mexico, and Malaysia.

Brazil and the United States, two countries now enthusiastically pursuing neo-mercantilist agendas, are interesting cases with similarities. Both have severely deindustrialized while at the same time expanding energy production aggressively. Both went from being large importers of oil to self-sufficiency since 2010, which, all else being equal, should translate into stronger currencies. The implication is that neo-mercantilist policies may be pursued at a high cost, without the luxury of a weak currency.

🌐 Global elections in 2024: What do expats expect? (Expat.com)

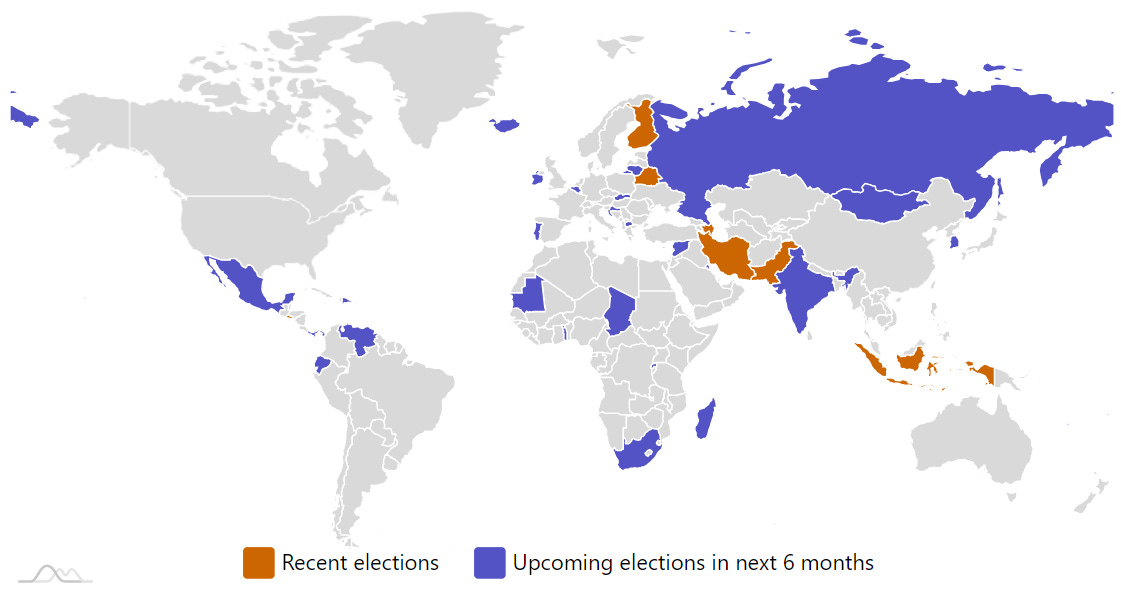

Taiwan, Finland, Comoros, Indonesia, and seven other countries have already held their elections since the beginning of 2024. Over 50 other states are yet to go, with elections scheduled almost every month throughout the year. Portugal in March, South Korea in April, South Africa in May, the European Union in June, and undoubtedly, the most awaited election globally: the American presidential election. How do expats feel about all this?

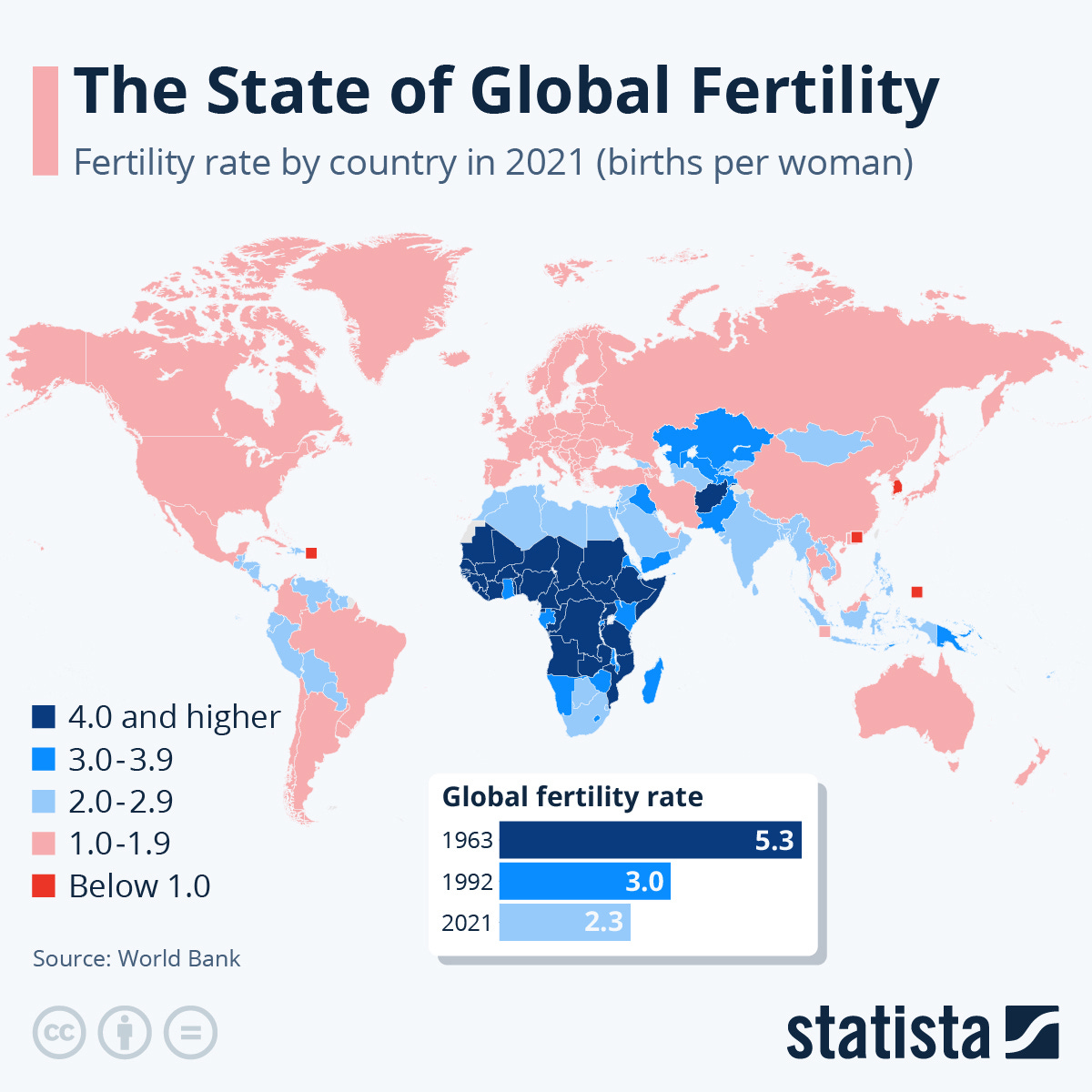

🌐 The State of Global Fertility (Statista)

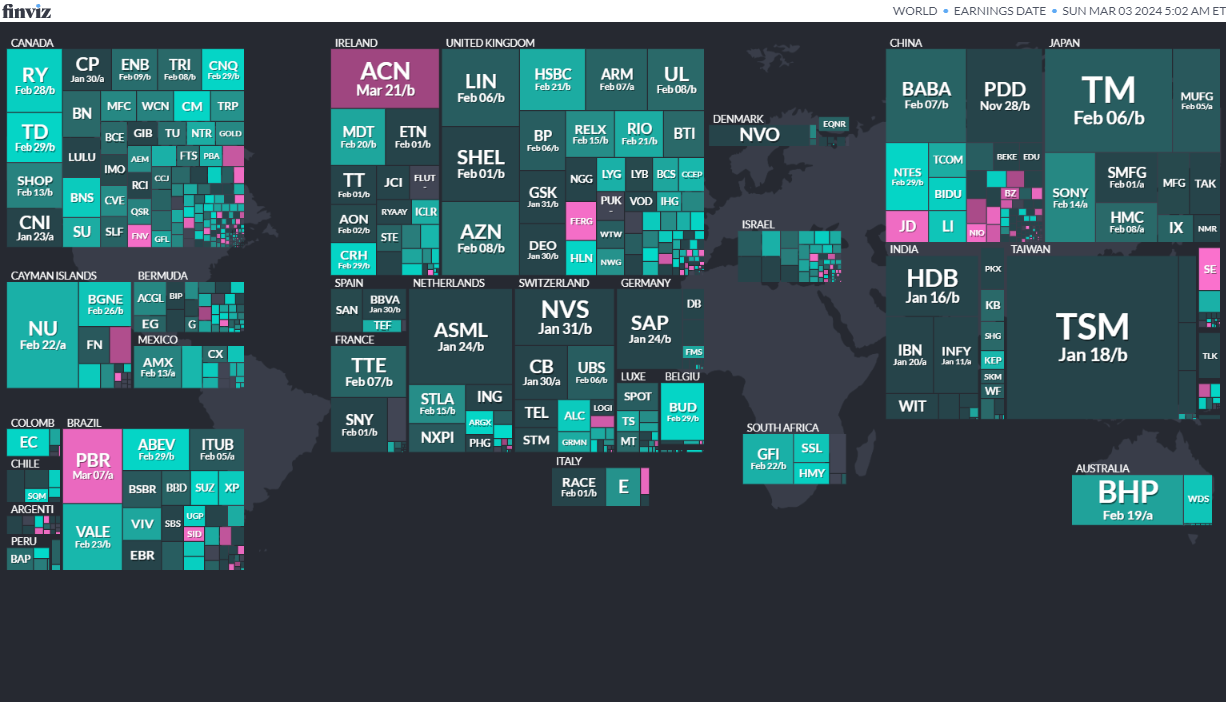

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

-

Russian Federation Russian Presidency Mar 17, 2024