Amid institutional surge and ETF consolidation, will Bitcoin turn into just another stock?

As we navigate the sea of change in the cryptocurrency market, the investment game is experiencing tremendous changes. Spot Bitcoin ETFs already exist, signaling Bitcoin’s leap into mainstream finance and tying it closer to existing investment structures. We will look at the current correlation between Bitcoin, stocks and gold, as well as the tip of the iceberg to imagine its true depth. We will try to find out whether traditional markets are actually pushing Bitcoin away from its decentralized position, or if there is still a path to hope that Bitcoin can maintain its own path.

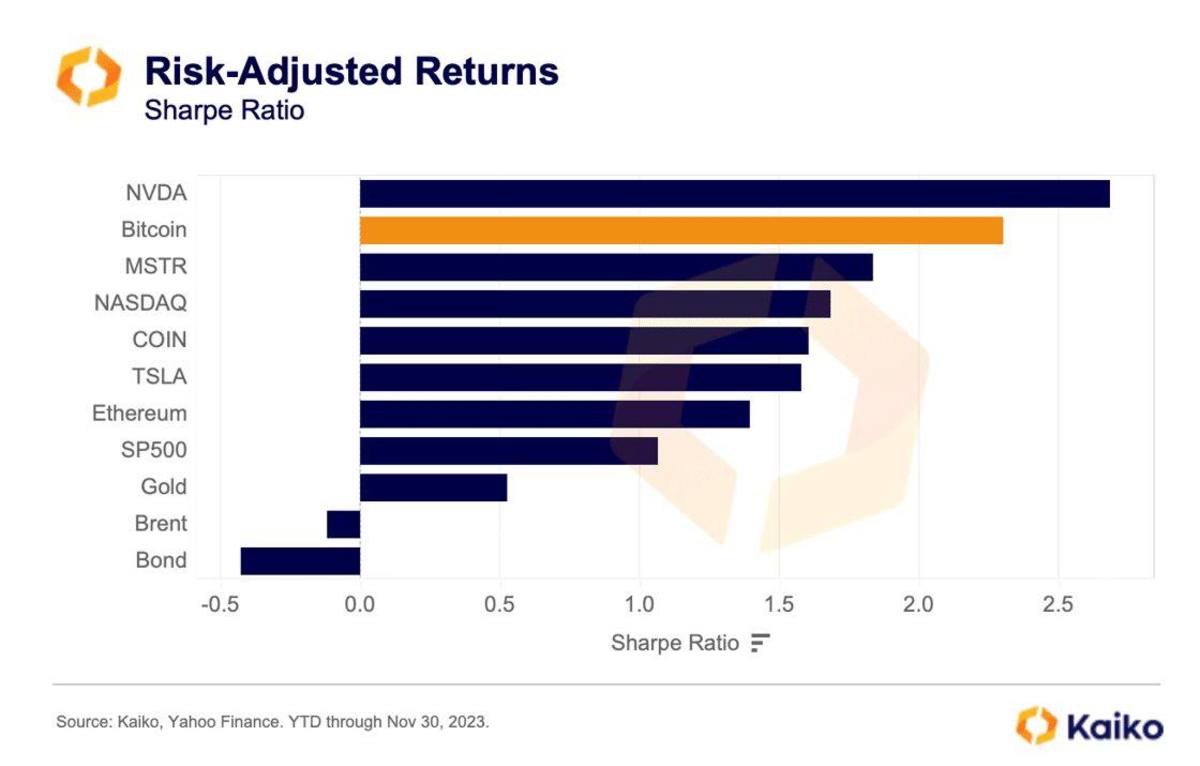

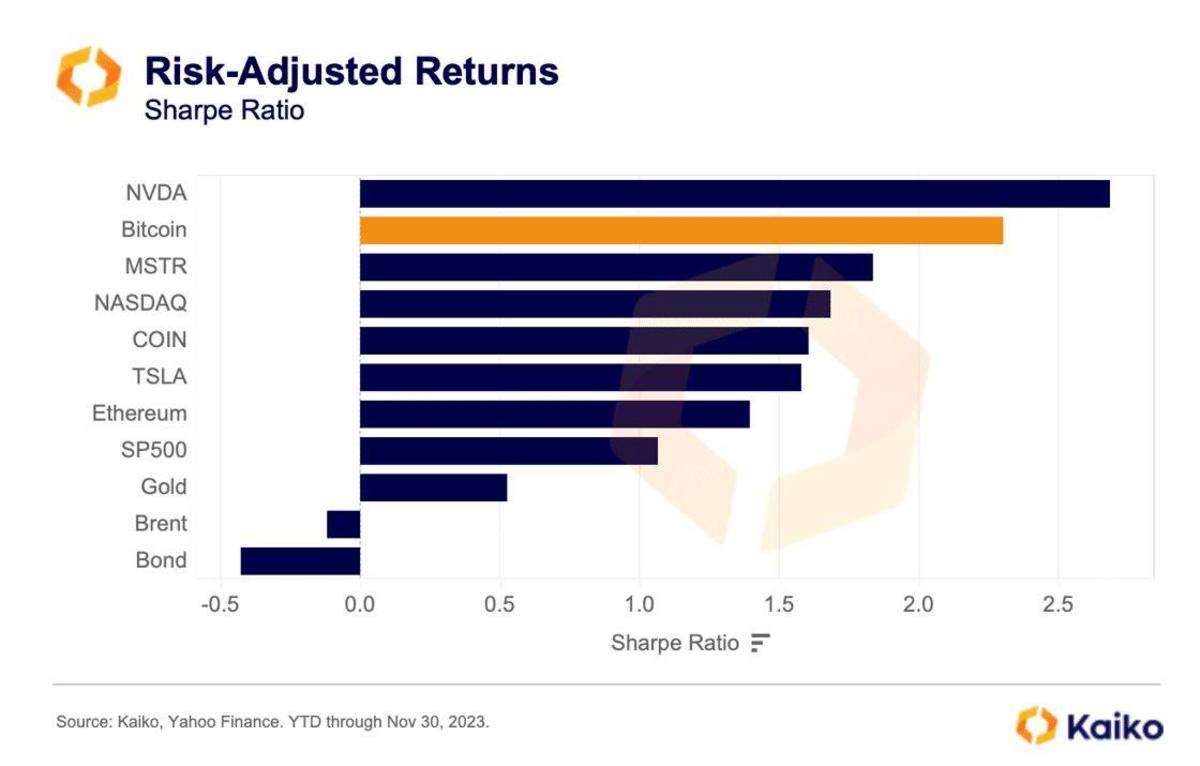

Kaiko data shows that Bitcoin’s risk-adjusted returns have outperformed traditional assets. Nvidia had the highest return on a risk-adjusted basis, while Bitcoin impressively lagged, surging in value by more than 160% on a risk-adjusted basis, outperforming major traditional assets such as the S&P 500 and Gold.

Meanwhile, according to the IMF Crypto Cycle and U.S. Monetary Policy study, 80% of cryptocurrency price movements and their increasing correlation with stock markets have coincided with the entry of institutional investors into cryptocurrency markets since 2020. In particular, institutional cryptocurrency trading volume increased by more than 1,700% (from about $25 billion to more than $450 billion) on exchanges during the second quarter of 2020 and the second quarter of 2021. Research shows that U.S. monetary policy impacts the cryptocurrency cycle just as much as the global stock cycle. But surprisingly, only the US Federal Reserve’s monetary policy matters and other major central banks do not. This is probably because the cryptocurrency market relies heavily on USD.

Additionally, according to the 2023 Institutional Investor Digital Asset Outlook Survey, 64% of investors plan to increase their stake in the cryptocurrency space within three years, allocating up to 5% of their AUM to cryptocurrencies. Over the past year, many institutions invested for the first time, while others increased their existing investments. The study highlights that 41% of asset managers are increasing their investments in cryptocurrencies, but only 27% of asset owners appear to be increasing their stake.

Bitcoin was born from the idea of distributing power evenly, but recent studies have shown that it is slowly becoming dominated by a select few giant corporations.

Changing correlation dynamics

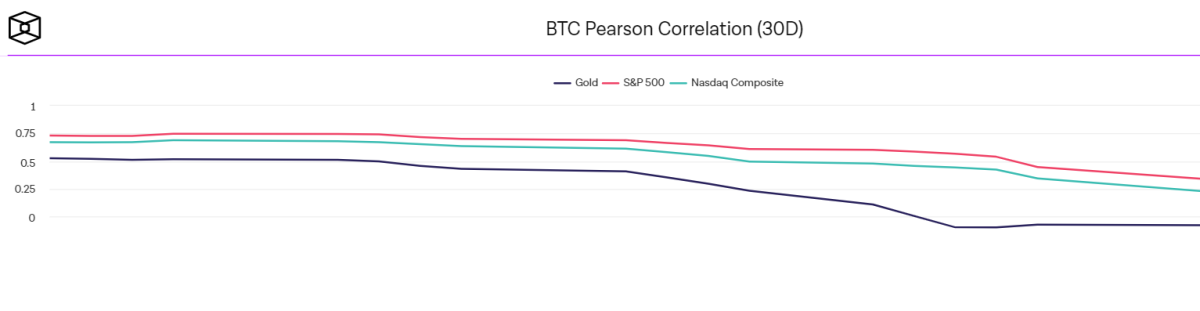

Interestingly, Bitcoin moves in sync with the S&P 500 and Nasdaq, showing an impressive correlation. Meanwhile, in contrast to claims that investors view cryptocurrencies as safe havens or hedges against inflation, a role traditionally played by gold, the correlation between Bitcoin and gold has declined sharply recently.

In particular, the correlation between Bitcoin and gold showed a positive correlation of 0.83 on November 7, 2023, but decreased to -0.1 on January 10, 2024, and then reached a slightly higher positive level on February 9, 2024. It rebounded to 0.14. The S&P 500 reached a positive correlation of 0.57 in January 2024, after showing a negative correlation of -0.76 on November 11, 2023. This change from negative to positive correlation indicates a changing perception of Bitcoin among investors.

The Nasdaq Composite Index, known for technology and growth stocks, also showed a variable correlation with Bitcoin. The negative correlation, which was -0.69 on October 30, 2023, moved to a positive correlation of 0.44 in January. Traders seem to be linking the rhythm of Bitcoin to the pulse of the tech sector, hinting at a new relevance for investment strategies.

The increasing correlation between Bitcoin and traditional stock markets such as the S&P 500 and Nasdaq, while its decreasing correlation with gold suggests that Bitcoin is behaving more like a risk asset rather than a safe haven. When investors feel adventurous, they often turn to stocks and digital coins to find opportunities to earn more profits.

As institutional and retail investors increasingly participate in both the stock and cryptocurrency markets, the price movements of these assets may become aligned as they make buying and selling decisions at the same time.

Spot Bitcoin ETF, which has received approval, appears to be gaining appeal for larger investors, who are already planning to step up their Bitcoin game. Bitcoin converting to an ETF could cause Bitcoin to behave more like a stock, as those funds play a big role in the world of stocks.

Amid these developments, the essence of cryptocurrencies, including Bitcoin, which are outside the framework of the traditional financial system, may be undermined. Moreover, these changes could expose Bitcoin to the very systemic risks it originally sought to escape.

Closing Thoughts

Looking at how a spot Bitcoin ETF could shake up Bitcoin’s role in the market and its current relationship with stocks, we balance possible growth while staying true to Bitcoin’s core with expectations of more large players jumping in. must be observed keenly. The principle of no central control. Bitcoin’s move toward a more centralized investment environment could shake up markets and provide bright opportunities, but it could also present difficult challenges ahead.

This is a guest post by Maria Carola. The opinions expressed are solely personal and do not necessarily reflect the opinions of BTC Inc or Bitcoin Magazine.