Why You May Consider “Big Yellow” (OTCMKTS:BYLOF)

Onur round

Dear subscribers,

I believe European REITs are more volatile than US REITs. While it’s certainly justified that some of them are destabilized by exposure to things like CRE, I also think many of them are somewhat misunderstood. Icade(OTCPK:CDMGF) is a good example. This is a REIT I’ve been buying more of recently. Post me (OTCPK:GECFF) is another good example. While the European real estate sector is currently in a recession, we believe this will be an excellent investment opportunity over the next 5-15 years.

That’s why I’m buying the French REIT I mentioned earlier, and looking at other REITs as well.

The UK or UK is a great market for me. There is no dividend withholding tax, so investing there is much more hassle-free than most other European markets I invest in. In the current situation, 99.8% of all withholdings are refunded within 12 months (specific DTS situations in Sweden).

However, these UK/UK investments also come at a significant discount. That’s what we’ll look at today.

The discounted UK REIT, called Big Yellow Group, trades on the London Market and ADR (OTCPK:BYLOF) under the ticker BYG.

Let’s take a look at what’s here.

Big Yellow Group – What is this?

I can start with the group’s excellent basic principles. Never miss an analyst’s estimate It has been more than five years of negative results during one of the most challenging environments not only for the market, but especially for the UK.

But instead, let’s look at what they do first.

Big Yellow Group PLC Self-storage business in the UK.

Big Yellow IR (Big Yellow IR)

It is also the largest self-storage business across the UK and is part of the FTSE 250 index. Listen to LSE. According to a survey by the UK Self-Storage Association, Big Yellow We boast the largest brand recognition in the UK self-storage sector.

The company was founded 26 years ago, is headquartered in Bagshot (British cities often have funny names), and manages operating revenues of over £180M. It’s smaller than many smaller US-based REITs and has fewer employees (465), but even knowing that some of the company’s KPIs have declined this year, this is still a very impressive operation. .

Unlike American REITs, Big Yellow does not provide investors with quarterly insights. They usually do a two-and-a-half year interim period of one quarter, and then a full year. This usually comes out around May of the following year.

The company converted to a REIT in 2007 and has grown nearly ever since.

Big Yellow Group IR (Big Yellow Group IR)

What is so attractive about the UK self-storage industry that Big Yellow should be considered some kind of “buying” potential?

well, The UK remains an underpenetrated market and major city trade remains low. There is very little new supply coming to the market in key areas due to low space availability and other dynamics.

Big Yellow also demonstrated broad resilience during the last recession. before The self-storage industry is as well-established today as it is today.

That’s why self-storage in the UK is attractive. Big Yellow is particularly attractive because of its market position and the fact that it is already largely digital (over 90% of inquiries are made online) and has prominent stores on high streets and spaces.

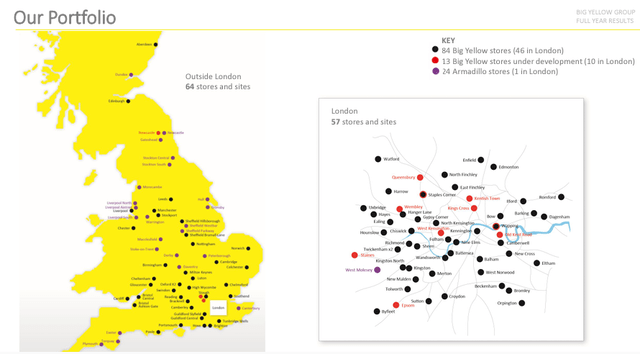

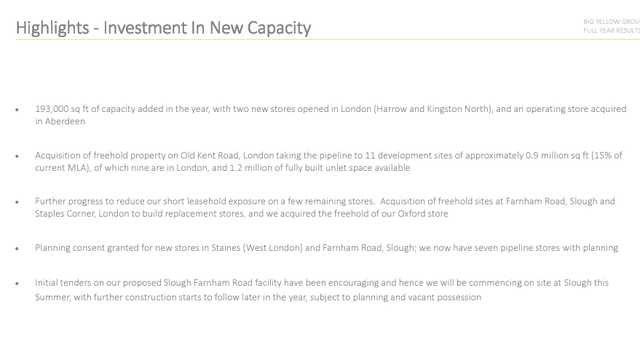

Big Yellow has and currently manages one of the stores with the highest customer satisfaction ratings. Covering 6.3m sq ft in the UK, with a further 900,000 sq ft under development.. The company’s assets are primarily freehold RE concentrated in highly populated areas such as London and the South East.

Below are the latest half-year returns showing growth.

Big Yellow IR (Big Yellow IR)

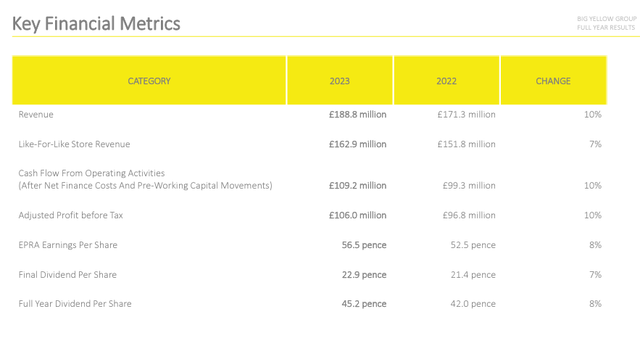

During that period, occupancy rates decreased slightly, but rent levels rose by nearly double digits. So it’s likely that some of that is due to that. What I want to focus on in this revenue is increasing store revenue, increasing net rent by square footage by 10%, and EBITDA margin up to 10%. 71.8%, This represents an increase of 70bps and increased cash flow. The company also increased its annual dividend by 8%.

The company also refinanced a £120M loan over seven years and a new shelf facility of £225M at attractive rates. New investments are also being made.

Big Yellow IR (Big Yellow IR)

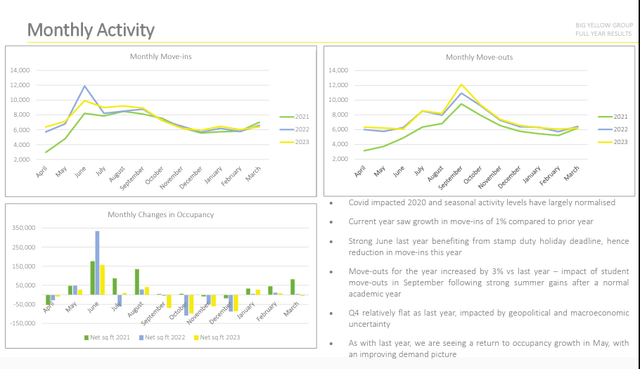

Except for a few months, the overall monthly trend is fairly stable. The volatility we saw during COVID-19 is gone.

Big Yellow IR (Big Yellow IR)

The key trends we should look for for Big Yellow are similar to other self-storage REITs. We are talking about the development of occupancy rates, rent growth levels and operating costs.

For the time being, all these trends point in the right direction: growth. The company may increase rents by at least 8.3% during the 2022-2023 period, even in units/facilities with occupancy rates below the company’s lowest level of 70-85%. For properties with the highest demand and occupancy rates above 90%, rent increases are as follows: 9.7% and 13% in 2022-2023 and 2021-2022, respectively. (Source: Big Yellow Group IR)

What about the cost?

The company’s year-end expense increase of 5% prior to the one-time move was lower than rent increases and revenue growth. This increase came primarily from G&A, some from employees, but mostly Insurance costs have increased 86% since 2022. This is also related to Armadillo’s M&A, where the increase is noteworthy.

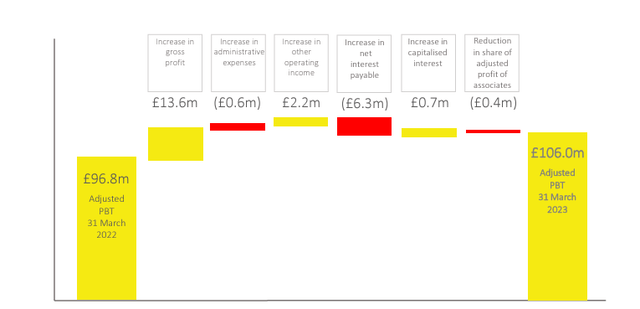

You can see the company’s PBT development process here.

Big Yellow IR (Big Yellow IR)

Moving to this REIT capital structure, the company has very good fundamentals. we’re talking As of 2023, the company’s leverage/debt to total real estate assets remains below 20%. Adjusted net worth is less than 22%. Our leverage is less than 25%, which is already under pressure from valuation, based on market cap, which is what you’ll see at valuation.

Big Yellow Group’s OCF cash flow coverage before interest expense ratio is as follows: 7.7x. I see this as very positive and conservative.

I think this UK REIT is a very interesting play. This is true even if the company does not have an S&P Global credit rating, which it does not have.

Here, we will look at valuation, which is the core of investment theory.

Big Yellow Group’s valuation – there is room for premium upwards.

So the first question we should always ask is how do we want to discount the company here? On a FFO/AFFO basis, the company generally tends to average an average multiple of 19x, which is lower than the US market leaders in this sector. At the same time, these US market leaders have an A+ rating, have more than 20 times the market capitalization of the £2B UK REITs, and have somewhat higher yields. At current prices, Big Yellow is managing a yield of roughly 4.4%, which is decent, but certainly nothing to write home about when you can buy a market-leading triple net with a yield of 4-5.5%.

So, I would like to say the same to myself who thinks Big Yellow Group is fun. Other European REITs are more interesting. Icade and Gecina certainly do. So now I’m buying more.

But there is a positive side to Big Yellow, and if we see the company decline back to the levels we saw in the fall, I I would definitely buy this UK REIT.

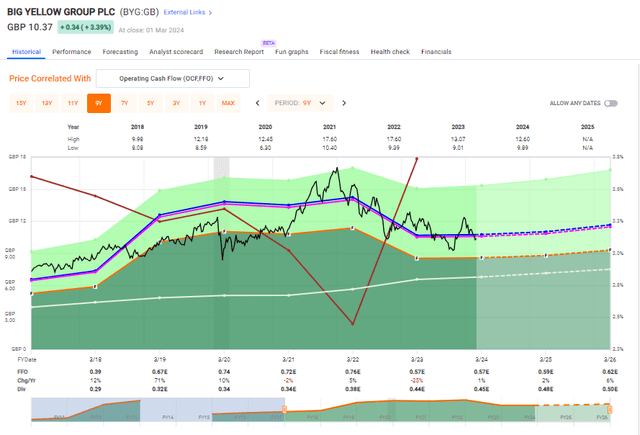

By the fall of 2023, the company had fallen below 16.5x P/FFO, roughly the lowest level not seen since COVID-19. We have already risen from that level, but are now falling again.

Big Yellow Valuation (FAsT graph)

Simply put, whenever a company goes down. Native’s single-digit share price; This should be on your watch list. Even at a price below £11/share, the company could easily be bought with upside that is thought to be in the double digits, including the company’s dividend.

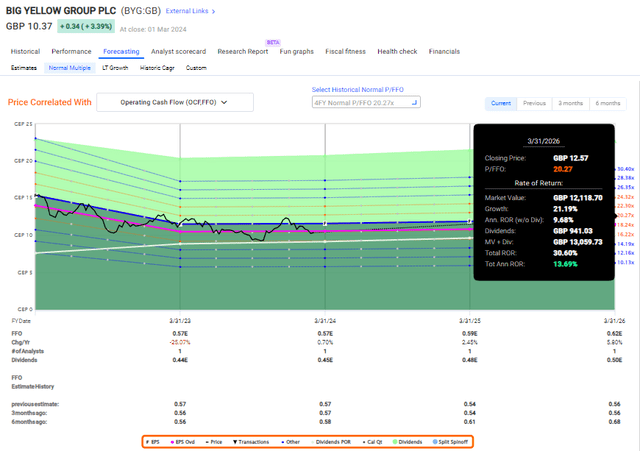

Large yellow group rising (FAST graph)

As you can see, 12-14% per annum is the most you can get here, even if you accept companies trading for 20x P/FFO or more. And I don’t think anything higher than that is interesting. I think that’s excessive.

It’s pretty clear what other analysts think is interesting about this company. Big Yellow is currently followed by 15 analysts, seven of whom have given the company a positive “buy” or “outperform” rating. These are available from a low PT of around £9 to a high PT of around £14.3. The average is £12.1, which gives an upside of around 16%.

I would also like to point out a very important point here. EPRA purchases the company at a discount to its NAV. The company’s NAV is currently £11.08 per share (Source: Author’s calculations, Big Yellow Group IR), which is 0.94x NAV/share, i.e. a 6% discount to conservative NAV. company.

I think this is a very attractive company that can be purchased at a discount of 10% or less, and unless something changes, it is a company that should be purchased at a discount of 20% or less.

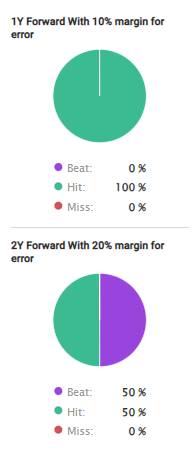

But conservatively speaking, the company is excellent at achieving its goals. Take a look at how we have managed despite COVID-19 in our somewhat limited 5-year history.

FAST Graph Large yellow group (FAST Graph)

Overall, I think this company is a very good investment at the right price. But the right price is a different matter. I’d say you could buy this company here and would rate it a “buy” with PT at NAV for around £11 per share, but I think it also makes sense to wait for a better valuation.

I provide the following introductory paper to the company:

proposition

- Big Yellow Group is the UK’s largest self-storage REIT and appears to be still in its base growth phase. The company has a bright future and good prospects for further growth both inorganically and organically as its services expand to other cities and regions of the UK.

- I would also like to point out the company’s fundamental principles, which are actually quite solid. Although a company may lack a formal credit rating, it nonetheless offers a degree of safety that is considered sufficient to invest in. The company is so diversified that it is unlikely to experience a sudden downturn in any one market. Unlikely, except perhaps in London.

- I consider Big Yellow Group a “buy” with a PT of £11 per share and a P/FFO target of up to around 18-20x, with things getting more interesting as it falls below 18x.

Remember. I do the following:1. Buy undervalued companies at a discount, normalize them over time, and reap capital gains and dividends along the way.

2. If the company becomes overvalued far beyond normalization, take profits and replace the position with another undervalued stock and repeat step 1.

3. If the company doesn’t become overvalued, but stays within fair value or falls back to undervalued, buy more as time allows.

4. I reinvest any profits I earn from dividends, workplace savings, or other cash inflows listed in #1.

Here are my criteria and how my company meets them (in italics):

- This company is quality overall.

- The company is fundamentally safe, conservative, and well-run.

- The company pays a generous dividend.

- This company is cheap right now.

- This company has realistic upside based on earnings growth or multiple expansion/reversion.

Aside from the fact that the company isn’t cheap (which I currently don’t think it is), I would consider Big Yellow Group a “buy” here based on a target price of around £11 per share.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.