Disney: Trian protests at Eiger cathedral gate demanding reforms (DIS)

Heykirdi

Disney Proxy Voting Date: April 3rd

Trian Partners’ 130-page “white paper” is a protest against this. the walt disney company (New York Stock Exchange:DIS) Executive team that spares no detail – much more than the need for two board seats.

agreement: Obviously so. It’s a tall order to compare the 130-page condemnation penned by Disney proxy challenger Nelson Peltz to that October day in 1517 when Martin Luther nailed a protest to a church door, supposedly. We believe the metaphor of challenge and defense provides context for the battle for board seats and beyond.

We believe this frames Peltz’s challenge as a direct attack on the fundamental beliefs of current Disney executives and truth-telling shareholders about what makes today’s entertainment/media IP successful.

For this reason, it is best for DIS holders and prospective investors to take their time and hope for the best. through a grand presentation Trian website. In this age of increasing human attention spans, according to the work of Bill Gates, who was once characterized as being shorter than a goldfish, that’s a bit of a heavy task.

The facts reflect the context of events from over 500 years ago in that they represent:

It is a kind of attack on the mother church through the media. Disney has indeed been the dominant entertainment provider globally for decades due to its reach, power, and scale. The organization penetrates the public consciousness more deeply than any of its peers.

Trian’s argument is that the DIS mother church has lost its way, so to speak. And in the process, shareholders became victims of entrenched policy failures. His goal is to go beyond the two board seats and position him, Radulo and partner Issac Perlmutter (a former Marvel and Disney executive) as whistleblowers of “church” policies – the Martin Luther role players of the show.

Google

Above: A modest recovery in prices from the 80s lows could work in favor of DIS incumbents, but we are still far from off the highs.

Trian 130-Page Protest: Now We Know The Details

According to the Trian Partners document, Disney squandered its “magic,” its resources and its future with financial mistakes that undermined its financial health and further sent its stock price down 60% from its peak.

This screed delves into every possible indicator and what, in the judgment of Iger and his board, characterizes as poor decisions. For those who don’t have the time or inclination to look at the presentation in detail, I’ve summarized the challengers’ key main arguments here.

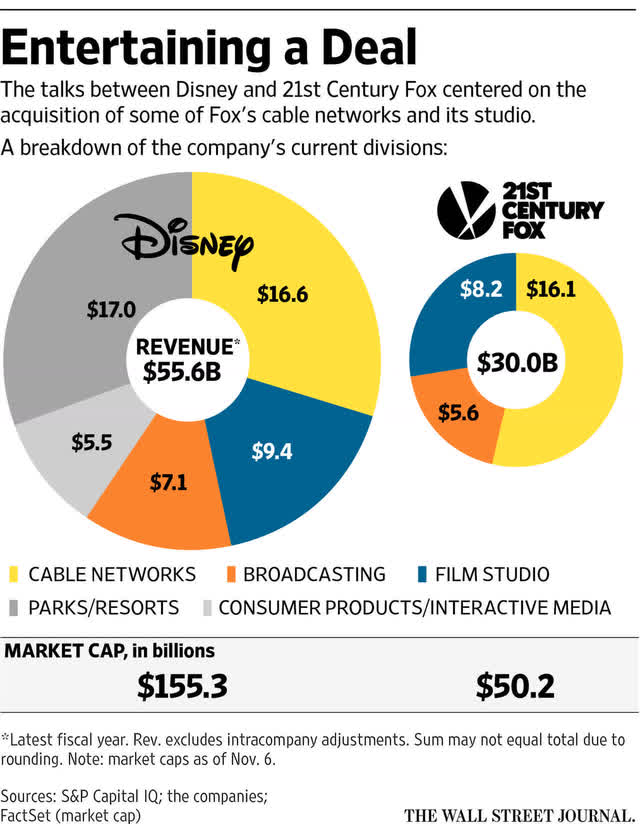

Since 2018, DIS has invested $200 billion in a variety of bad deals and policies with dire results. Starting with gifts on a scale that other competitors did not have, the company underperformed its competitors. A prime example of a disastrous investment was the company’s acquisition of 21 companies.castle Century Fox was acquired for $71 billion in a questionable effort to gain size, adding $21 billion in debt to its already lopsided balance sheet in the process.

Additionally, Disney has lost and continues to lose a disproportionate amount of money from streaming and Netflix (NFLX). Given the abundance of IP, it should be a leader in subscriber count. Bob Chapek (2020-2022) CEO Chair round trip is the basis for failure in the succession planning process. The Trian report calls for a concrete timeline and succession plan immediately after Iger, not vague promises. They argue that the creative capacity that underpinned DIS leadership for many years has been depleted. An in-depth analysis of the relevant executives is guaranteed as soon as possible.

Earnings decline: FY18 EPS: $7.08 FY23: $3.76 FCF18: $19 billion FCF23: $4.8 billion Dividend: FY18: $1.68 FY23: $0.30 ROIC vs. peers: NFLX: 15%; Warner Bros. Discovery (WBD): 6% DIS: 4%. Market cap after 2021: $200 billion vs. $80 billion. There is currently no clear goal to turn DTC into revenue.

Trian cites a series of theatrical film failures. Haunted Mansion, Marvels, Light Year, Indiana Jones 5, Wish, Not cited, but similar to them in our view.The Little Mermaid—probably break even at best). The newspaper claims that the current board of directors is not comprised of directors with substantial expertise in the entertainment industry.

Google

Above: Shows 21st Century Fox’s relative position before the deal closed. Trian cited the $71 billion price tag as a key mistake by DIS management.

Nowhere in the Trian document was there any direct or even discreet mention of the DIS revenue generated by Awakened content and casting. This is a tricky and potential rabbit hole that Trian understandably avoided. But this is an implicit criticism of Trian’s alleged failures in his creative output.

The Trian paper makes no mention of the tsunami that swept across the media/entertainment space.

Clearly, the 130-page document made no direct or even discreet mention of the massive macro destruction inflicted on all of our peers in the sector. Linear cord cutting and declining ad revenue, DTC subscription scramble, and churn suppression costs. Add to the mix a shift toward ad-supported content with no clear long-term results and a decline in theatrical movie attendance due to COVID. DIS Park’s performance has held up despite growing rumors about its prices. The cruise continues to have a capacity of 90 or more people.

The Trian documentation is a detailed and well-argued basis for the changes Trian made to the DIS statement. It’s an advocacy document that sticks to partisan political rhetoric that conveniently omits mitigating measures against enemies. Likewise, the Disney dismissal documentation on the proxy voting issue is mostly a happy story of happy prospects, improved performance, and lots of hugs and kisses to the current board.

While DIS can’t completely hide behind the tsunami sweeping the entire sector, investors should give management a pass on whether more can be done. To date, obtaining a clear path to optimal returns appears to be difficult for many holders.

At the same time, Trian’s case is undeniably strong in that it is based on hard facts and an analysis of the consequences of those facts. But the solution raises as many questions as it answers the big dilemma.

Create a book about your results: I think it’s close, but DIS wins.

DIS has the advantage of incumbent holders in that it has withstood the stock price crash because long-term holders are true believers that the “magic” will return. The recent slight rise in the stock will likely contribute to the decision to support management. Mr. Market seems to be relying on the premise that Iger’s moves so far will set things right when the time comes.

Last October, DIS was trading at ~$80. At the time of writing, it is up to $112. The high watermark for 2021 is over $200, with some analysts suggesting a price target (“PT”) of $234 to $250. As usual, big holders tend to be swayed by threats to the status quo unless they foreshadow the kind of disruption they think they can exploit through a hedge play, or that they can sniff out the company at play.

On the other hand, we have noticed real anxiety among many DIS holders who have clearly lost trust in their boards and management. Trian’s protest gives them a compelling reason to vote for Peltz without question. For Peltz and his group, winning two seats on the board isn’t going to be a panacea. But success as a firebrand (or a fly in the ointment, take your pick) for so many issues can set the tone for a real change in corporate direction. If Trian wins, Iger’s days are numbered and the check has been cut but not yet signed.

That’s right. This is, first and foremost, a referendum on surveillance of the Eiger. In both cases, we learned that neither Trian nor DIS presented a truly compelling case for the status quo or revolutionary change.

As I mentioned in a previous Seeking Alpha post, with the sector currently in a precarious situation, the best outcome I have seen is to reduce DIS to a cost-effective and manageable size. A small DIS with a short period of management control and exponentially decreasing debt makes much more sense to investors than anything management or Peltz can realistically offer.

First, investors and executives must recognize that DIS’s business model today was built in a world addicted to endless sequels and acquisitions that values mere size and scale. It was a world where linear TV was still going strong, cable TV was growing rapidly, and theater attendance and ticket prices were strong and on the rise. That world is now a dead planet. Oxygen no longer exists.

For DIS, there’s a strong case to be made for selling ESPN, converting the parks business to a REIT, selling or spinning off ABC, selling off the cable business, and forgetting about retail. What investors will get is a DIS focused on parks, DTC builds, and a studio for IP creation. And the key is to split off at least half or less of DIS’ debt, diverting huge amounts of cash to provide interest to banks. Instead, these saved funds will actually foster bigger IPs that bring back the magic of restoring creative works.

If Peltz wins, like Luther did 500 years ago, it won’t just mean two board seats, it will mean a real shake-up of the company transitioning into a new world, and for investors it will mean a higher valuation. If he loses, the fight will be a valuable teaching moment that will force Iger and the company to achieve better results for shareholders going forward.

Here’s the bottom line for the stock: If Walt Disney Company executives win, we could see a $4-$5 surge in the near term. If Peltz wins, Mr. We can see that the DIS skeptics in the market are also claiming the same upside.