Runway Growth Stock: Venture Growth BDC Is Selling After Q4 Earnings (NASDAQ:RWAY)

Klaus Vedfelt/DigitalVision via Getty Images

While there are many publicly traded BDCs for investors to choose from, only a few focus on venture capital and lending to late-stage growth companies. one of the biggest and Arguably one of the best is Hercules Capital (HTGC). Others include TriplePoint Venture Growth (TPVG) and Trinity Capital (Trin), a relatively new entrant to the publicly traded BDC space. The group’s newest group is Runway Growth Finance Corp (NASDAQ:RWAY), which is the topic of this article.

Who is Runway Growth Finance?

Runway provides financing to later-stage and growth companies seeking alternative lending options, according to the company’s website.

Runway Growth Finance Corp. is a growing specialty finance firm focused on providing flexible capital solutions to late-stage and growth companies seeking alternatives to raising capital. Our mission is to support Passionate entrepreneur building innovative businesses. The company lends capital to businesses seeking to finance growth while minimizing dilution. As a result, Runway Growth Finance seeks to generate favorable risk-adjusted returns for shareholders.

Runway was founded in 2015 by venture capitalist David Spreng, who is currently on medical leave. The company went public in October 2021. The total value of the Company’s portfolio is just over $1 billion, consisting of $978 million in term loans and more than 99% senior secured first lien investments as of December 31, ’23. Since its inception, the company has a total committed capital of $2.5 billion across 77 companies.

4th quarter 2023 results

RWAY reported its Q4 2023 results yesterday, March 7th, and investors were not satisfied with the results, with the stock down -14% as of this writing on March 8th. In my opinion, this is a stock for which the market is set to report a weak quarter, as NAV has fallen significantly from $14.08 at the end of the third quarter to $13.50 at the end of the fourth quarter. A large portion of the decline in NAV was due to a one-time charge-off of the company’s debt investment in Pivot3, which resulted in a realized loss of $17 million in the fourth quarter, according to comments on the earnings call from the CFO and Acting President/COO. Tom Ratterman.

The decline in NAV is primarily the result of unrealized losses of $7.7 million on our CareCloud preferred stock holdings. We saw an opportunity for future capital appreciation and decided to hold, which also resulted in our $17 million realized loss. Debt Investing in Pivot3. Of this amount, $6.4 million was reflected as unrealized losses in the third quarter 2023 financial statements.

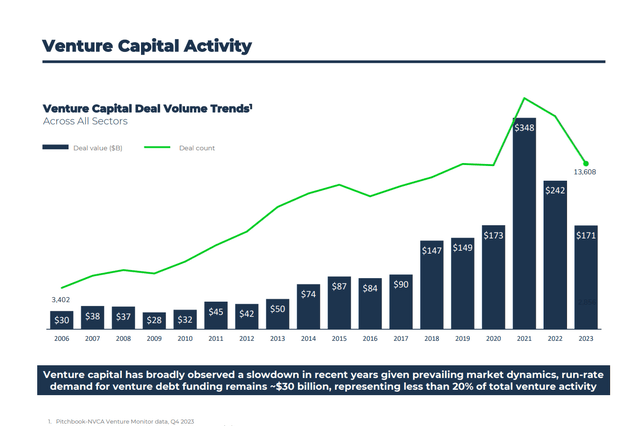

2023 has not been a good year for venture capital financing, but bank failures at Silicon Valley Bank and Signature Bank in March and First Republic Bank in May have made lenders reluctant to provide financing, especially to growth-stage companies. I became even more hesitant. This slide from the RWAY Q4 investor presentation graphically shows how the slowdown in venture capital deals may actually hit the brakes in 2023 after rising over the past decade.

RWAY 4th quarter presentation

As a result, Runway’s focus shifted to credit quality, resulting in fewer deals closing in the first half of 2023, particularly as available opportunities did not meet the company’s underwriting criteria. In the fourth quarter, the company executed eight transactions representing $154.6 million in borrowings, three of which were new investments.

“In 2023, Runway Growth took a prudent portfolio management approach to drive shareholder returns while maintaining industry-leading credit quality,” said Greg Greifeld, Acting CEO of Runway Growth and Runway’s Chief Investment Officer and Head of Credit. growth capital. …

Our strategy for 2023 was to ensure meaningful repayment, reduce leverage and increase access to dry powder.

Total investment income for the fourth quarter amounted to $39.2 million, with NII of $18.3 million, or $0.45 per share. NAV at the end of the quarter was $13.50. A total of $63.4 million in proceeds were received for principal repayment during the quarter.

Fiscal 2023 results included NII of $78.3 million, or $1.93 per share.

A regular dividend of $0.40 per share for the first quarter of 2024 and an additional first quarter dividend of $0.07 per share have been announced.

There were no loans in non-accrual status at the end of the quarter, but one loan was placed on non-accrual status after the end of the quarter, which may also be one of the reasons for the negative market reaction. Earnings Report. From the press release:

As of January 1, 2024, the Company had one loan outstanding to Mingle Healthcare Solutions, Inc. This equates to a fair market value of $3.8 million as of December 31, 2023, representing $4.3 million of outstanding principal. The loan consisted of $0.37. % of the total fair value of the Company’s investment portfolio, excluding U.S. Treasury securities, as of December 31, 2023.

In my opinion, this loan is not a big deal (representing less than 0.5% of the overall portfolio value) and is typical of investments in venture-stage growth companies, but it may portend future problems with other investments in the portfolio.

Cash and liquidity at the end of the quarter included $281 million, with borrowing capacity of an additional $278 million. During the quarter, the secondary offering was completed in November with the sale of 3.7 million shares of common stock owned by Oaktree. Oaktree has been a partner of Runway since 2016, and despite the public stock sale, it actually continues to own a significant number of shares, amounting to 40% of shares outstanding as of December 31, 2023, according to Yahoo Finance.

yahoo finance

Acting CEO Greg Greifeld summarized the fourth quarter results on an optimistic note for 2024.

Our team continues to see a strong pipeline of opportunities. Despite challenging markets and deal activity, our pipeline of qualified and executable deals increased compared to 2022. This shows that our discipline has been strengthened and our credit boxes have become tighter. In the first quarter of the year, which tends to be our slowest seasonally, we issued several term sheets with new borrowers. 2024 is already off to a fast start between Cadma and its newly formed joint venture and trading activities.

Announcement of new joint venture

On March 7, Runway announced the formation of a new joint venture with Cadma Capital Partners. From the press release:

“… The Company has formed a joint venture (“JV”) with Cadma Capital Partners (“Cadma”), a credit financing platform for the venture and growth ecosystem, an affiliate of Apollo Global Management. Cadma provides asset-backed financing to venture and growth lenders, high-growth companies, and financial sponsors.”

The newly formed joint venture, Runway-Cadma I LLC, will be an equal partnership between Runway and Cadma. With a financing capacity of up to $200 million, the joint venture will focus on financing late- and growth-stage companies with private and sponsor support.

According to one comment on RWAY News of this new JV, this new revenue stream will result in higher yields than regular portfolio loans. On the earnings call, CFO Tom Raterman explained how the JV will be funded in response to questions.

In terms of how much we’re investing, we’ve initially arranged for each of us to invest $35 million in equity and then raise the financing to potentially take that up to $200 million or more. This is the initial cap structure we have in mind. And in terms of focus, that’s really what we’re doing. We see this as an opportunity to remain in the market, especially with later-stage companies where deals tend to be larger in situations where we are unable to access the stock market. Our interest in JVs allows us to diversify our portfolio and add new revenue streams through those JVs.

risk and competition

Other BDCs providing loans to venture stage and growth companies such as HTGC, TPVG and TRIN reported mixed results for Q4 and FY23. HTGC reported record net profit in Q4 and FY23, but net debt investments declined from Q3 to Q4. Results were very good overall and the market drove HTGC shares higher following the performance.

TPVG, on the other hand, produced a less-than-stellar report on March 6, with NAV losses, realized losses of $50 million and increased non-cash/PIK income. The price of TPVG also plummeted on March 7 after the earnings announcement.

TRIN has better reports than TPVG or RWAY, but probably not as good as HTGC. The March 6 TRIN report recorded a 15% YOY increase in NII, a slight increase in NAV from $13.17 to $13.19, and total investment commitments of $340.7 million.

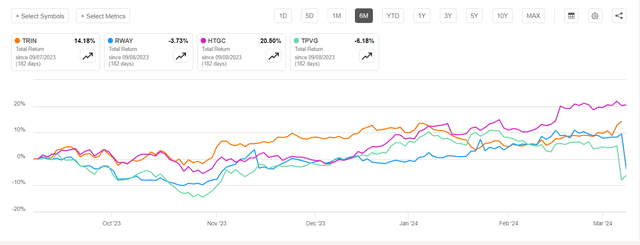

pursue alpha

Comparing total returns over the past six months, it becomes clear that HTGC and TRIN have performed well while TPVG and RWAY have struggled.

With Jerome Powell warning Congress that there will be more bank failures, perhaps the venture-stage BDC market is becoming more cautious overall. The latest jobs report also allayed investor concerns that a rate cut may not be possible. However, a rate cut in June may have a negative impact on the future earning potential of RWAY’s floating rate loans.

summary

There are several aspects to the Q4 earnings report, news of a new JV with committed capital, concerns about non-performing loans, etc., all of which could be the reason for the significant drop in RWAY stock price today. Additionally, while lower interest rates may erode the company’s future earnings potential, and while that reaction is somewhat understandable, we believe the market reaction was overdone and presents an opportunity for income investors to buy shares of well-run BDCs. It’s still paying a decent dividend.

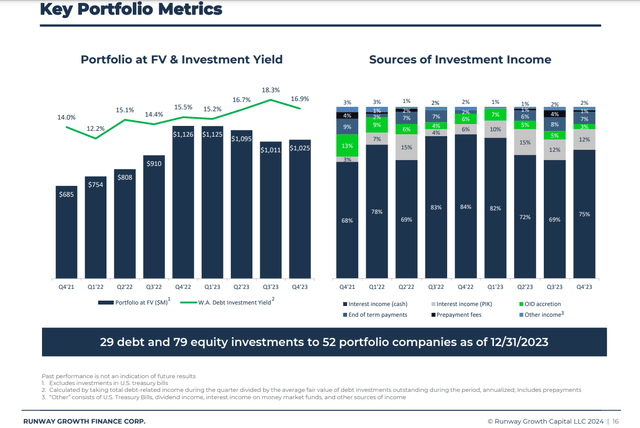

The following slides from the fourth quarter presentation show key portfolio metrics investors should consider before dismissing BDCs as bad investments.

RWAY 4th quarter presentation

With a 16.9% fourth quarter investment return and strong, diversified investment income streams, RWAY is well-positioned to support a sustained high-yield dividend, currently approximately 14% per annum, based on its most recent quarterly base dividend of $0.40 (with no additional top-ups). assumed). dividends are paid). As a RIC, the company must pay at least 90% of its taxable income each year. With a quarterly NII of $.045 in the fourth quarter, the underlying dividend is still well covered. The outlook for 2024 is very positive with a strong balance sheet, ample liquidity and prospects for additional high-yield revenues from the new JV.

I rate RWAY a Strong Buy at the current market price of approximately $11.50 per share as of this writing on Friday, March 8th. Please do your own research and do not invest without understanding the risks involved.