Sapphire Strat Maker – How to Create Your Own Strategy (Part II) – Analysis and Forecasts – March 9, 2024

1. Introduction

This is what follows sapphire strat maker Expert Advisor – This is an EA that allows you to create your own strategy without coding. That’s the beauty of this expert advice. Create your own strategy, be creative and no longer be tied to a single strategy. Optimize the parameters to find the best set and you are ready to go!

2. Establish your own strategy

It is designed for simple purposes. Insert your desired indicators and define the series/bar for which you want to retrieve prices. Customize your risk management settings and go.

Let’s create a simple strategy. Volume Weighted Moving Average and RSI (Relative Strength Index). This strategy is Not optimized. The goal now is not to create a profitable strategy, but simply to show you how to create one.

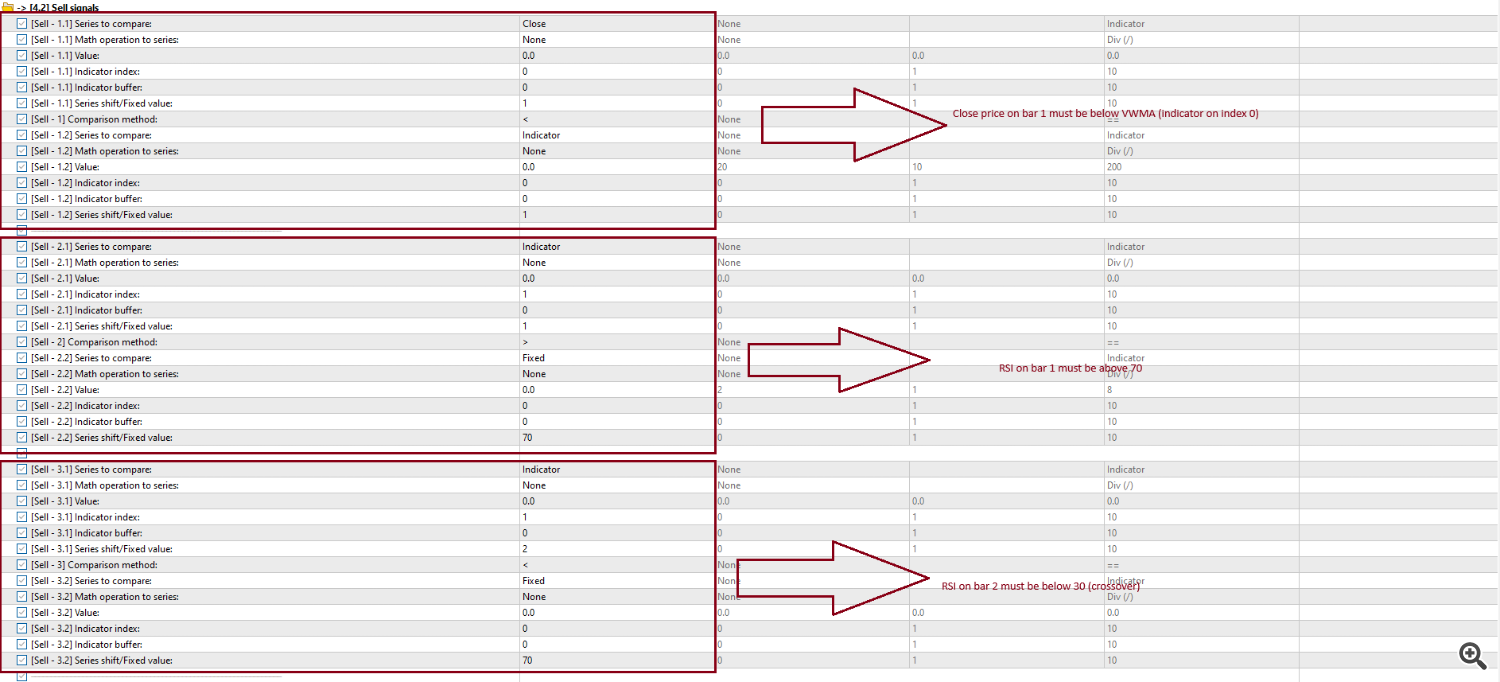

This strategy opens a new buy position when RSI crosses below the 30 level and the closing price is above the VWMA. If RSI is above 70 and the closing price is below VWMA, a new sell position is opened.

First, while reading this tutorial, please read the documentation in the attached file.

after that Basic-Sapphire Strat Maker.set Input Parameters will then clear all parameters and set them to 0/None. This allows us to collaborate with EA.

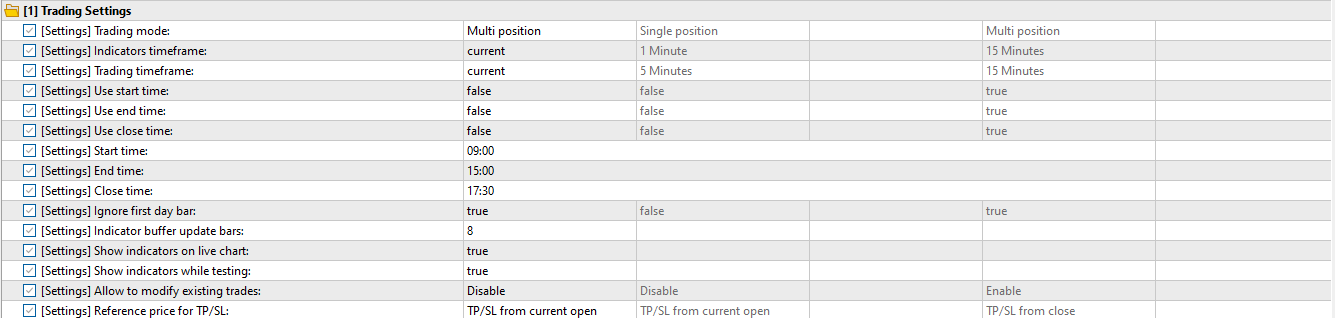

It does not change the parameters of the section. (1) Transaction setup; So leave it alone as it is :

Since we are not optimizing EA, the same applies to: (2) Tester settings group.

at (3) Indicator, set the indicator at index 0 to Volume Weighted Moving Average (VWMA) and define its parameters. According to the manual (attached), Parameter 1 It is a period, Parameter 2 It’s a shift, Parameter3 is the applied price Parameter 4 This is the applied volume (since we are dealing with forex, tick volume). I chose the following values:

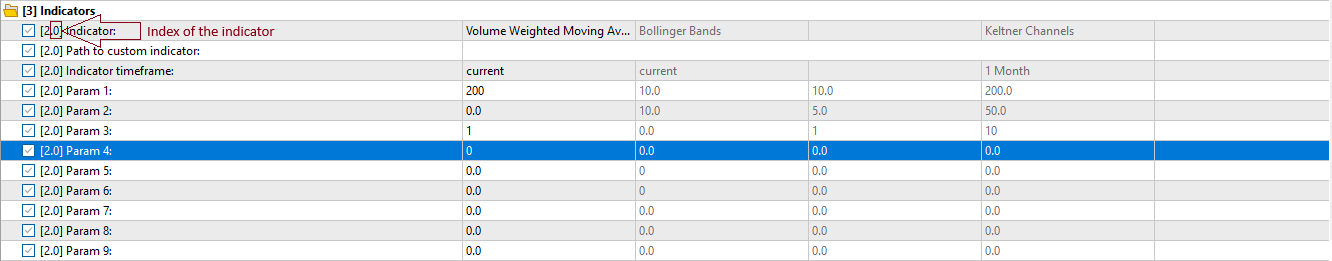

Do the same for the indicator at index 1. Set this to RSI and set its parameters (Parameter 1 It’s a period Parameter 2 Applicable price):

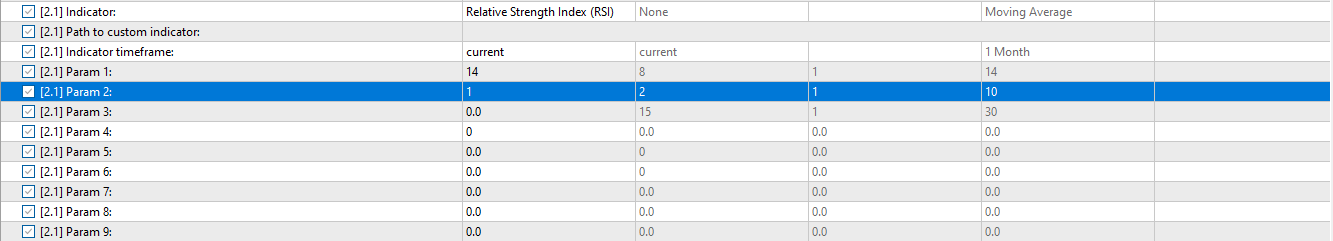

In section (4) Entry signal; It accepts both buy and sell signals, so leave it alone.

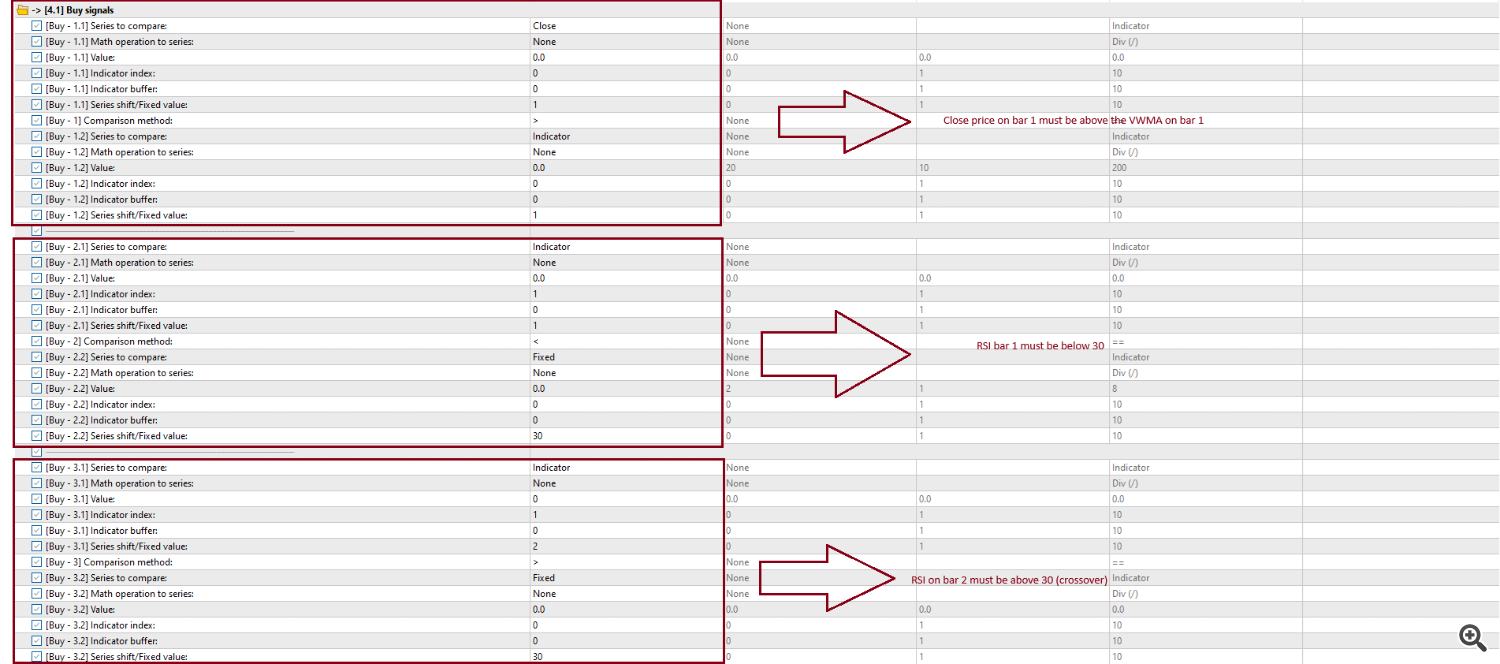

group (4.1) Buy signal It goes like this:

Group (4.2) sell signals are defined as follows:

We do not use common signals (signals that we check before opening buy and sell positions). Therefore, (4) in the Entry Signals group, the Entry common signal fill mode must be maintained as follows: Meet all conditions.

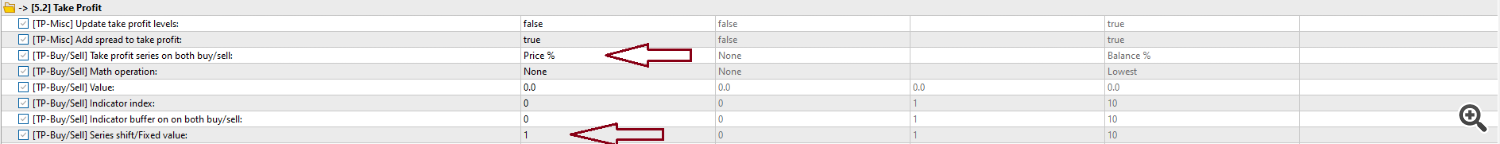

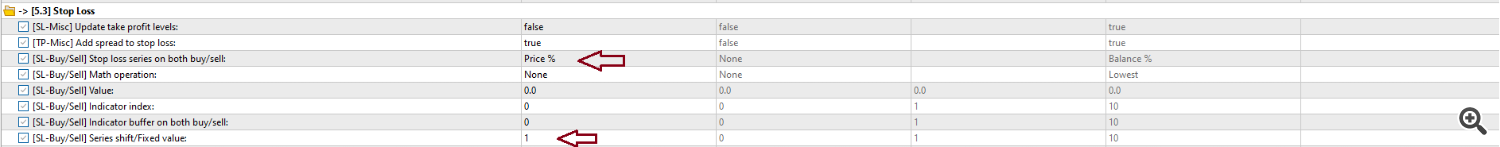

In ~ (5.2) Take Profit and (5.3) stop loss, we set (TP-Buy/Sell) Please note that both Buy/Sell take profit. and (SL-Buy/Sell) Stop Loss Buy/Sell Note to price % (Check the documentation for other possible parameters), This indicates using a certain percentage of the entry price as tp and sl. at Fixed Take Profit/Bar and Fixed stop loss/bar, Set the desired ratio. I’m going to set this to 1. Therefore, both tp and sl are placed at a distance of 1% from the current price.

In ~ (5.5.1) volume; (Volume) When you calculate volume by setting the calculation type to % of balance, the stop loss is defined as a certain % of balance and the default lot size is defined as a number that fits your balance (I think U$ 1,000.00 == 0.1).

![]()

Now you are ready to deploy your strategy and get started!

Just out of curiosity, here’s how this simple strategy performed in the end: 2 years at For a U$ 1,000.00 account, it takes 20 minutes.:

Optimize parameters such as moving average period, tp/sl level or use custom period and find the settings that work best for you!

In the attached file preset Strategy using Moving averages, ADX and ATR. This strategy is favorable For the last two years during the M5 period – However, please note that different brokers may provide slightly different data (from different market data providers) so your results may vary. By optimizing the parameters your broker.