AAON: This HVAC manufacturer’s rating should be cooling. (NASDAQ:AAON)

people image

introduction

Aon Co., Ltd. (NASDAQ:AAON) is an American HVAC equipment manufacturer. Last week, the company announced its fourth quarter 2023 results, and although the company reported good results for both revenue and EBITDA. The company’s growth rate is slowing and the stock is likely to fall short of its current trading multiple. In this article, I will discuss recent results, my outlook, the company’s valuation, and my thoughts on the risks of the investment thesis.

Company Overview

AAON is an HVAC equipment manufacturer. HVAC stands for Heating, Ventilation, and Air Conditioning, so its products include everything from heat pumps, air handling systems, clean room systems, chillers, condensing units, and related parts to service these types of equipment. AAON is diversified in both its product offerings and customer base, selling to a wide range of customers in the retail, commercial, manufacturing, healthcare and government sectors.

AAON is a really attractive company. If you’re not familiar with the company’s history, I highly recommend reading an article by the company’s founder, Norm Asbjornson. Norm founded the company 30 years ago making semi-custom equipment for HVAC spaces. Because semi-custom equipment was very expensive in the 1980s and 1990s, the company’s founders sought to create more efficient manufacturing processes that would lower costs and lower the barrier to entry for customers. Through cost-effective solutions, the company began gaining market share and solidifying its position as an industry leader. Today the company is still more of a competitively priced mainstream operator than a niche player.

background

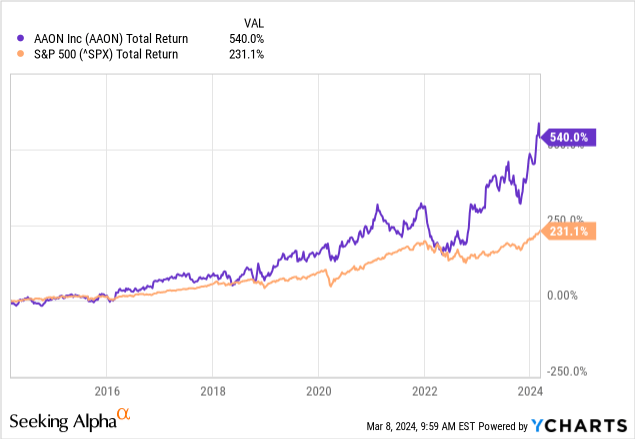

Looking at AAON’s past stock performance, the company’s stock price has significantly outperformed the index. Over the past 10 years, AAON stock has delivered a total return to shareholders of 540%, compared to just 231% for the S&P 500. With an average annual return of 20.4% during this period, investors who were able to hold out for the long term earned above-average returns.

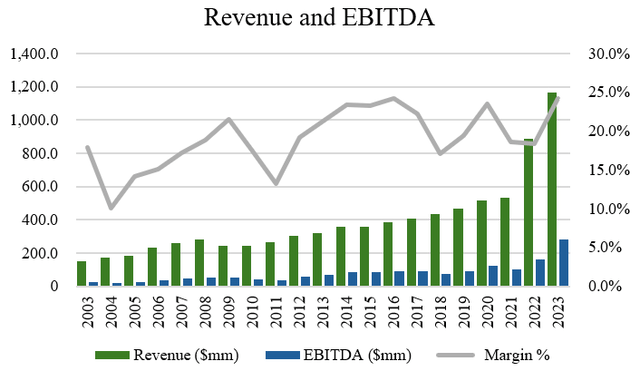

With a 19% share count decline, 10.9% revenue CAGR, and 12.6% EBITDA CAGR over the past 20 years, the fantastic stock price performance is almost a direct result of the company’s continued growth in finances and growth. Stock repurchase. The 10-year CAGR of revenue and EBITDA is 13.8% and 15.3% over the past 20 years, indicating that the company’s growth rate has accelerated in recent years. We’ll discuss later why we don’t expect this to continue.

Author, based on S&P Capital IQ data

Latest Results

An analysis of AAON’s full-year and fourth quarter 2023 results shows that the company surpassed analysts’ expectations, posting $0.04 EPS and $12.29 million in revenue for the quarter. Revenue for the quarter was $306.6 million, up 20.4% from the previous year. Total sales this year were $1.17 billion, a 31.5% increase over last year.

Overall, AAON’s 2023 growth has been somewhat unprecedented and unusual compared to historical growth rates. For a company that typically grows around 10-12% per year, I’d say this growth is impressive, especially excluding tough competition in 2022, when sales increased 66.3%.

Importantly, most of this growth has been organic rather than growth funded through acquisitions, highlighting organic growth of 14.5% in 2023. About half of the growth can be attributed to volume increases and the other half to price increases.

Moving down the income statement, the increase in profitability did not disappoint, with gross margin increasing 560 basis points for the quarter compared to last year and quarterly EPS of $0.56, 19.1% higher than last year.

In terms of what’s driving AAON’s growth, the company is doing well in integrating its three divisions. AAON has been moving some production from its new location in Parksville, Missouri to its Longview, Texas location.

As the expansion project progresses, the company believes it will have more capacity and be better positioned to meet future demand. The Longview Texas facility is expected to add approximately 50% more capacity, and the expansion project at the Redmond, Oregon location is expected to add 15% to existing capacity.

AAON has invested in SG&A beyond facilities. Product innovation remains at the core of AAON, but the company is placing a much greater emphasis on training and marketing new reps. Tulsa’s new training facility will allow the company to provide better customer service and help sell the value proposition of the company’s products and services. Additional marketing will also help build your company’s brand in the market. As a smaller player in the industry, the company’s market efforts will help build trust among potential customers. Historically, AAON hasn’t invested much in marketing, so it will be interesting to see how this investment plays out over time.

Finally, regarding its balance sheet, AAON had just $9m in cash on its balance sheet. This may seem unusually low, but given its cash cycle for receivables and payables, this is typically the case for AAON, with the company holding less than $10 million in cash at any given time. Working capital was strong at $282.2 million, and AAON had only $38.3 million in revolver debt at the end of the quarter, paying off more than $40 million of debt during the quarter. With very little debt, the company’s balance sheet looks very healthy.

eyesight

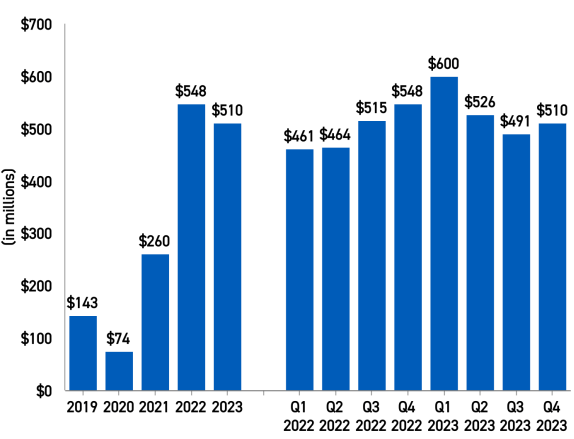

In my outlook for the company, AAON’s investment in new facilities and marketing will position the company for future growth. But there are also concerns that growth rates are not sustainable. If you look at the company’s backlog, it’s actually down 6.9% year over year. This doesn’t mean that revenues will be lower, but it certainly suggests that growth rates are slowing here. AAON provides services to many thriving industries, including data centers and manufacturing, but I am personally concerned about the exposure of our corporate offices.

AAON backlog (Investor presentation)

According to a report by McKinsey Global Institute, demand for offices could decline by up to 13% by 2030 due to lower office attendance as more people choose to live in less urban areas and work from home. Office attendance has remained steady at 30% below pre-pandemic norms, according to the report, and it seems unlikely that this trend will return. This can negatively impact the HVAC replacement cycle in office towers.

Overall, the construction industry was sluggish. With modest to downward growth expected, it is unclear whether non-residential construction will rebound anytime soon. This may impact demand for new HVAC equipment. AAON’s results speak for themselves, but this is definitely a risk factor to monitor.

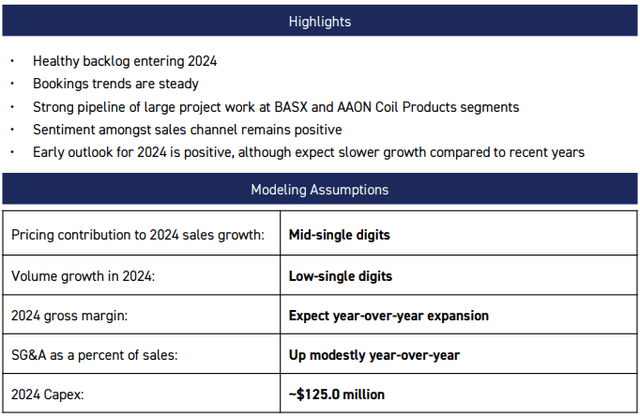

Finally, despite expected higher capital expenditures of approximately $125 million in 2024, the company’s guidance suggests only moderate revenue growth in 2024, with price increases contributing in the mid-single digits and volume growth expected to increase in the mid-single digits. It contributes less than an order of magnitude. Therefore, an estimate of 10-12% growth in 2024 appears to be slowing growth, especially as management expects both first quarter sales and earnings to be lower compared to the fourth quarter of 2023. In the next section, I think the company doesn’t deserve a high multiple as its growth rate slows.

AAON Information (Investor presentation)

Evaluation and Finalization

As far as I know, there is only one analyst covering AAON’s stock, and that’s from DA Davidson. The analyst has set a price target of $105.00 per share, which implies an upside of about 29% from the current price, excluding the company’s 0.4% dividend yield, which suggests the stock is undervalued at its current price (Source: TD Securities).

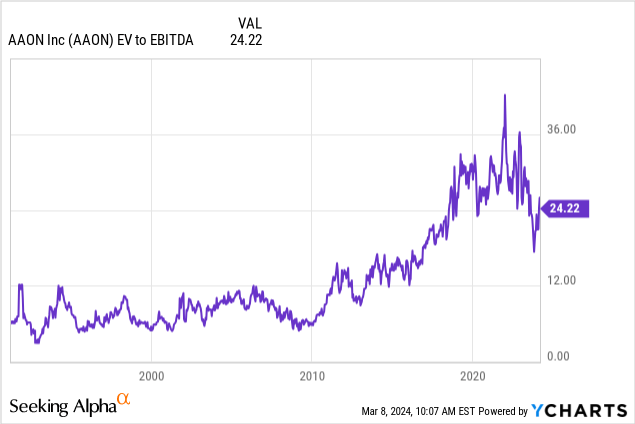

However, in my opinion, AAON’s stock does not represent good value today. If we look at the historical valuation range to see what valuation the company has previously traded at, we can see that the company’s current EV/EBITDA multiple is nearly two times higher than its historical average. Also keep in mind that D&A (or capex if you want to use real numbers) in this business is a real cost, and over the past five years, capex has averaged $75 million per year, reducing EBITDA by about 30%. Increase the multiple before interest expense and taxes by 30x.

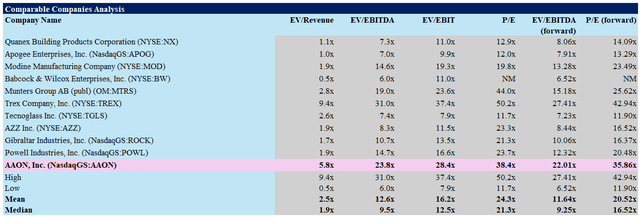

When comparing AAON to its peers, AAON trades at a double multiple of its peers. Given its better balance sheet, higher ROE, and above-average growth rate, we think it deserves a premium multiple. However, considering 22.0x forward EBITDA and 36.0x revenue, it seems a little rich for my preference.

Author, based on S&P Capital IQ data

I’m not arguing that AAON isn’t a high-quality business, but an EBITDA multiple of 24.2x seems like too expensive a multiple to pay for a company that can grow in the low teens at best. why? From 2010 to 2018, before the pandemic, the company’s sales CAGR was approximately 7.4%. So, despite some margin expansion and some share buybacks, it’s hard to justify why investors would pay 38.0 times earnings for this business. Considering all the aforementioned risks at current prices, it is better for investors not to pay attention to the company’s stock.