What happened to NVIDIA (NVDA)? | decision point

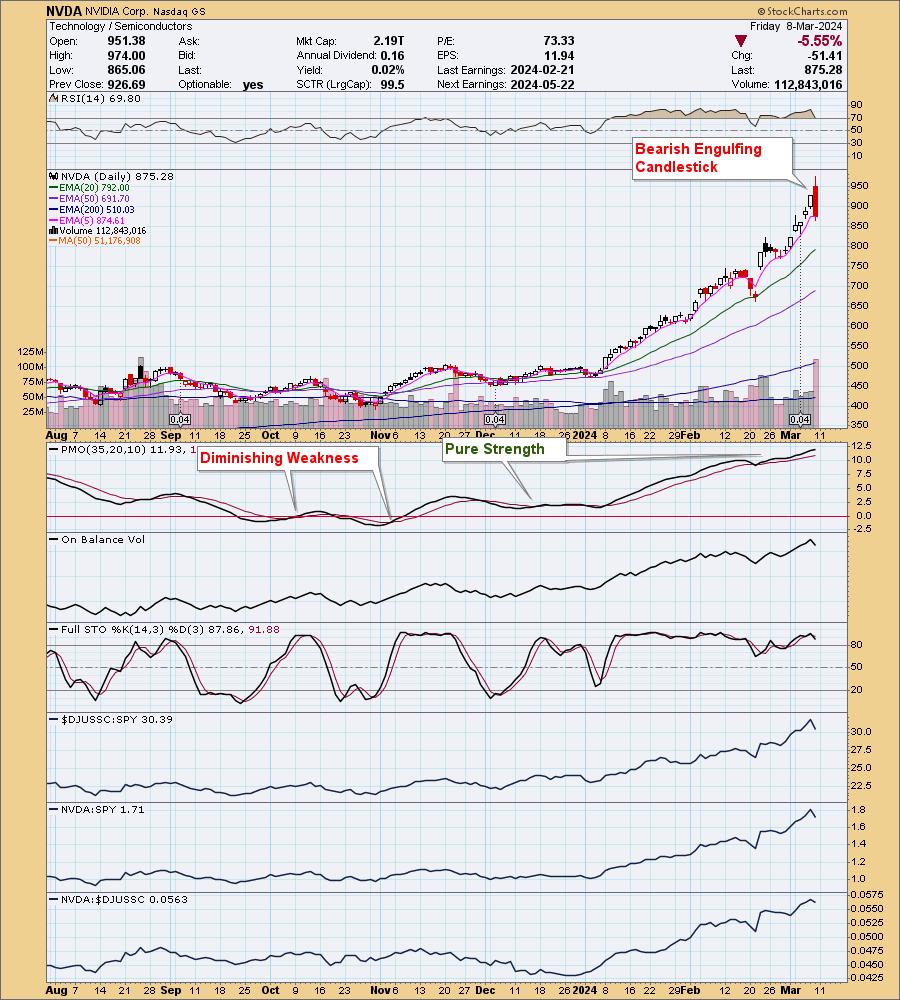

NVIDIA (NVDA) was enjoying a significant rally to start the day. All seemed right with the world. Someone recently said to me about another company that they were “victims of their own success.” This happened to NVDA.

The limit appears to have been reached for investors who are prepared to take profits and move on. Over the past six days of trading, NVDA is up more than 19%. It was time to profit.

Today’s decline sets up a bearish candle that hints at more declines on Monday. But does this really portend more sales? We’ve seen declines before profits, but they haven’t done much. Now is the time for withdrawal or at least integration. But we wouldn’t be at all surprised if this powerhouse stopped defying gravity. It is not a bad idea to set a stop here to preserve profits in case this indicates a further concerted downtrend.

Learn more about DecisionPoint.com:

Watch the latest episodes. DecisionPoint Trading Room On DP’s YouTube channel here!

Try it for 2 weeks with a trial subscription!

Use coupon code DPTRIAL2 at checkout!

Technical analysis is a windbreaker, not a crystal ball. –Carl Swenlin

(c) Copyright 2024 DecisionPoint.com

disclaimer: This blog is for educational purposes only and should not be construed as financial advice. You should not use any of our ideas and strategies without first evaluating your personal and financial situation or consulting a financial professional. All opinions expressed herein are solely those of the author and do not in any way represent the views or opinions of any other person or entity.

DecisionPoint is not a registered investment advisor. Investment and trading decisions are solely your responsibility. DecisionPoint newsletter, blog or website materials should not be construed as a recommendation or solicitation to buy or sell any security or to take any particular action.

Useful DecisionPoint links:

trend model

Price Momentum Oscillator (PMO)

balance volume

Swenlin Trading Oscillators (STO-B and STO-V)

ITBM and ITVM

SCTR Ranking

Bear market rules

Erin Swenlin is the co-founder of the DecisionPoint.com website with her father, Carl Swenlin. She started the DecisionPoint daily blog with Carl in 2009 and currently serves as a consulting technical analyst and blog contributor at StockCharts.com. Erin is an active member of the CMT Association. She holds a master’s degree in information resources management from the Air Force Institute of Technology and a bachelor’s degree in mathematics from the University of Southern California. Learn more