DCG responds to NYAG lawsuit, claims fraud claims are baseless

Key Takeaways

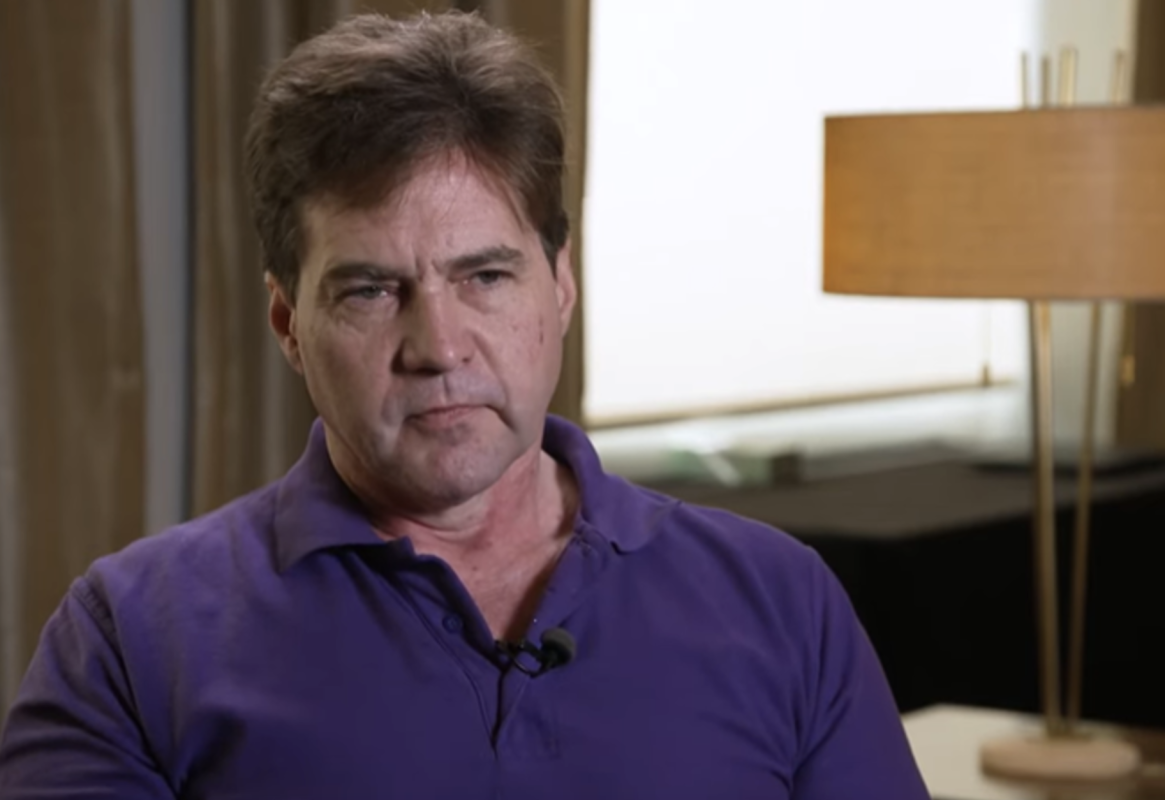

- DCG and CEO Barry Silbert have filed a motion to dismiss NYAG’s $3 billion lawsuit, calling the fraud allegations baseless.

- The legal dispute stems from NYAG’s claims that DCG and related entities misled investors through the Gemini Earn program.

- DCG highlights its efforts to support Genesis following the collapse of 3AC and defends its financial measures as lawful.

Digital Currency Group (DCG) and CEO Barry Silbert take legal action $3 billion lawsuit dismissed This is a document submitted by the New York Attorney General’s Office (NYAG) in October 2023.

The lawsuit targets cryptocurrency companies Gemini, Genesis, and DCG. Accused of defrauding more than 230,000 investors Through the Gemini Earn program, 29,000 of these were New York residents.

Did you know?

Do you want to become smarter and richer with cryptocurrency?

Subscribe – We post new cryptocurrency explainer videos every week!

Genesis, a DCG subsidiary, settled with NYAG on February 8, shortly before NYAG expanded its complaint to again include DCG and Genesis, and DCG contested the settlement on February 21.

DCG and Silbert filed a motion to dismiss NYAG’s condemnation on March 6, saying:

The allegations are a thin web of baseless innuendo, blatant misunderstandings, and unsupported concluding statements.

DCG’s statement strongly defends its actions and denies the lawsuit. Try to find a “headline-worthy scapegoat.” Because of the loss, they could not find the cause.

The company and its CEO claim: Support for Genesis, Especially after the collapse of Three Arrows Capital (3AC). It was a sincere and good-faith effort to stabilize the market.

According to DCG,his support We have received full support and approval from our respected advisors and board of directors. We emphasize our commitment to responsibly resolve the liquidity crisis. it was emphasized “Investment of hundreds of millions of dollars”“ It includes a promissory note worth $1.1 billion.

DCG and Silbert expressed confidence in the legality and integrity of their actions, stating:

We will continue to aggressively fight these claims and look forward to addressing these issues as we focus on the tremendous growth opportunities for our industry in 2024 and beyond.

With DCG taking a firm stance on the allegations, the outcome of this motion to dismiss could set a precedent for how similar disputes are resolved in the future.

The ongoing tension between cryptocurrency companies and regulators has also manifested itself in a legal battle between the Securities and Exchange Commission (SEC) and Binance.US. The cryptocurrency exchange recently revealed that it is drastically reducing its workforce and facing a severe drop in revenue following the SEC’s temporary restraining order.

With a master’s degree in Economics, Politics, and Culture in East Asia, Aaron wrote a scientific thesis analyzing the differences between Western capitalism and collective capitalism after World War II.

With nearly 10 years of experience in the fintech industry, Aaron understands all of the biggest issues and challenges cryptocurrency enthusiasts face. He is a passionate analyst with an interest in data-driven and fact-based content, as well as content targeting both Web3 native users and industry newcomers.

Aaron is our go-to guy for all things digital currency. With a huge passion for blockchain and Web3 education, Aaron is working to transform the space as we know it and make it more accessible to complete beginners.

Aaron has been quoted in several popular media outlets and is a published author himself. In his spare time, he enjoys researching market trends and looking for the next supernova.