Tencent FY 2024 Earnings Preview: Undervaluation and China Rebound

never

Tencent (OTCPK:TCEHY) is currently struggling due to China’s economic slowdown, but its full-year 2023 results look set to cap off a promising year, indicating a slow recovery in sustained future growth after a difficult 2022. . that much The stock is currently significantly undervalued from a long-term perspective, but investors shouldn’t expect exceptional growth.

Overview and future directions

Tencent Holdings is a Chinese multinational conglomerate that focuses on various fields including entertainment and AI. Not only is it known as the world’s largest video game supplier, it also holds significant stakes in social media, venture capital, and investments. It operates Tencent QQ and WeChat and owns assets including Tencent Music.

Recently I started paying attention to the term ”. “Immersive fusion.” A white paper produced in conjunction with Accenture (ACN) sets out our future plans. Deepening the integration of the digital economy and the real world. The white paper proposes the advancement of five key technologies to achieve this: digital twins, remote interaction, ubiquitous intelligence, trusted platform modules, and infinite computing power. By 2040, remote interactions are expected to evolve into full-sensory experiences by leveraging IoT, real-time communications, extended reality, multisensory interaction, and multimodal fused sensing technologies.

Fourth quarter performance preview

For fourth-quarter earnings, expected to be released post-market on March 20, 2024, analysts expect normalized earnings per share of $0.60, a significant improvement from last year’s $0.44. Tencent’s full-year full-year EPS estimate is $2.25, which translates to a growth rate of 30.85% for the year. Tencent’s struggles in fiscal 2022 were significantly reversed in fiscal 2023, a year in which Tencent regained some of its growth momentum.

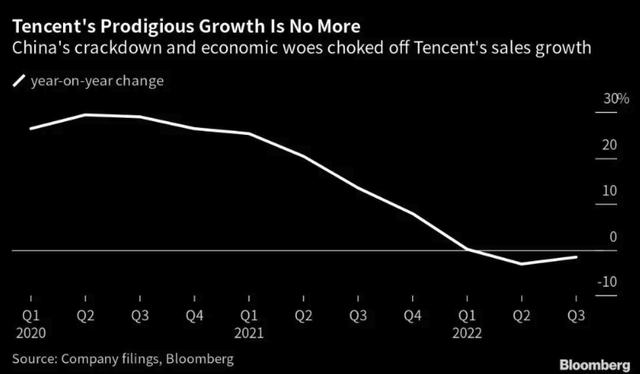

Tencent historical sales growth chart (Bloomberg)

Growth was driven by a combination of gaming, ad sales, and fintech services throughout 2023. In the first quarter, the company’s sales rose 11% as China’s economy began to recover. International gaming revenue increased 25%.

Through the third quarter, Tencent had recorded three consecutive quarters of revenue growth. The company rebounded after a regulatory crackdown on China’s technology sector, with revenue from Tencent’s online advertising business rising 20%.

At this time, there are significant value opportunities, which are discussed in the ‘Value Analysis’ section below. This is driven in part by the unfolding Chinese economic rebound, as well as strong future earnings estimates that indicate the potential for high growth to resume. . I estimate that an EPS CAGR of 15% over the next 10 years is reasonable. This not only helps the general growth trends expected to resume across the Chinese economy, but has also been largely supported by the growth of Tencent’s technology and high levels of digitalization trends. plays an important role in.

long term outlook

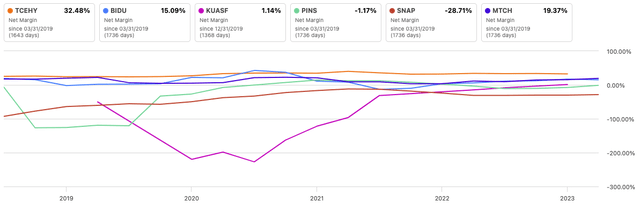

one of the following Tencent’s The most powerful factor is high profitability. At the time of this writing, net profit margin is 32.48%, while the sector average is 3.07%. Although it ranks well above its peers, it is much larger than most companies of a similar nature, so it has a much richer moat in terms of the scope of its operations.

net profit margin (Look for alpha)

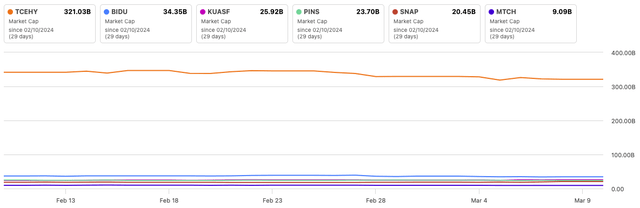

market capitalization (Look for alpha)

Due to its high level of net income relative to its peers, the company is well positioned to continue to outperform the technology and entertainment sectors over the next decade. An improving Chinese economy could greatly facilitate this, but

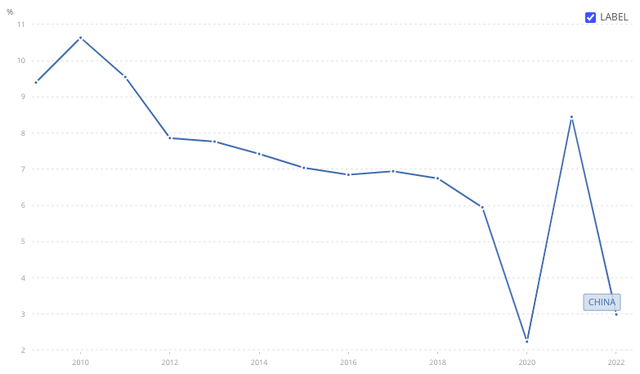

The Peterson Institute for International Economics (PIIE) highlights some of the long-term challenges facing China.Representative examples include declining productivity, aging workforce, and restrictions on overseas technology transfer. However, the possibility of a serious economic contraction in the long term is low, and the possibility that domestic demand is strengthening, including a slight increase in imports and household consumption in urban areas, was also mentioned. If the Chinese economy includes measures to support increased household consumptionDeflationary pressures could be addressed through government-backed consumer vouchers, tax cuts, faster wage increases, and improved social safety nets. As a result, Tencent can benefit from improvements in technology and entertainment consumption.

GDP Growth (annual %) – China (World Bank Open Data)

However, we believe investors need to be cautious at this point as there is some uncertainty about how China’s economic situation will be managed. There is significant evidence of China’s continued success, and given Tencent’s scale, we believe the two conditions are highly correlated. At this point, I think it may be a prudent bet on a rebound in the Chinese economy and appropriate valuations, but I also believe there are better investments in China. There are also smaller but higher reward companies that have slightly higher risk.

However, Tencent is well-positioned financially for long-term success as economic conditions improve. Consider a balance sheet with an equity-to-assets ratio of 0.74. Compare this to some of the companies we used in our peer analysis. It was revealed that Tencent’s level of debt management was staggering.

- Baidu (BIDU): The equity to assets ratio is 0.6.

- Kuaishou (OTCPK:KUASF): Equity to assets ratio is 0.47.

- Pinterest (PINS): Equity to assets ratio is 0.86.

- snap (SNAP): Equity to assets ratio is 0.3.

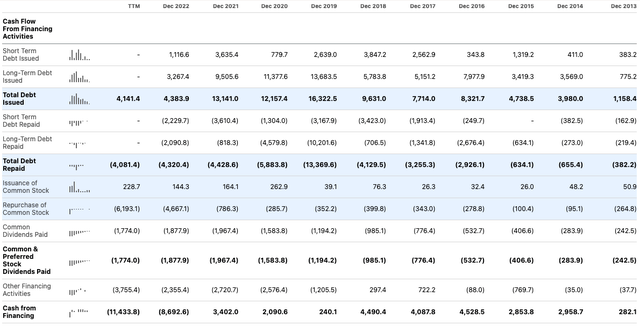

Tencent’s strong balance sheet is evidenced by its focus on long-term debt repayment. In fact, we issue them frequently, but manage them carefully. Additionally, common stock buybacks that far exceed the issuance of those shares are, in my opinion, great and have significantly improved shareholder value over time. The evidence suggests that this is a well-run company and is expected to actually outperform the S&P 500 over the next decade, especially if you buy it now. This is primarily a result of high growth prospects at an attractive valuation at the time. writing.

pursue alpha

value analysis

For the valuation analysis, we used a classic discounted cash flow model, as opposed to the P/E multiple analysis sometimes used for companies with very high price premiums, which is common among America’s elite technology companies. In this case, I don’t think Tencent has that premium.

For DCF analysis, we considered the following metrics:

- The diluted EPS growth rate is 16.9% on average for 3 years, 17.61% for 5 years, and 28.67% for 10 years.

- Full-year regular EPS for fiscal 2023 is $2.25.

- My projected regular EPS growth rate over the next 10 years is 15% per year.

- After the 10-year growth phase, the average annual EPS growth rate for the next 10 years is 4%.

- This is an 11% discount rate.

Applying the above factors to the discounted cash flow calculation, the fair value estimate is $42.01, which represents a 17.85% margin of safety relative to the stock price of $34.51.

Risk Analysis

The biggest risk I see in my thesis about the long-term opportunities associated with current good growth and significant stock undervaluation is the challenges China faces economically and especially geopolitically. I believe that investors would be wise at this time to try to diversify their holdings away from China, the United States, and other world powers. Although my current portfolio is concentrated in the United States, I believe there are excellent investments, particularly in small-cap stocks from other parts of the world, which I believe provide a sustained competitive advantage, attractive valuations, and protection from current economic tensions.

I also believe that Tencent will have significant difficulty maintaining high growth and may be at a competitive disadvantage compared to the capabilities of Western technology companies. Nvidia’s CEO noted that China is 10 years behind the United States on this front.

These two concerns make me cautious in my valuation analysis of Tencent’s more moderate growth potential over the next decade. This is the result of significant disruption that could temporarily lead to high volatility in the technology sector due to the escalation of global military conflicts. Especially in China and the United States.

conclusion

This is one of the lower risk opportunities in China that I think is a good value investment. However, I believe investors would be wise to consider some of the risks inherent in China’s current economic downturn. Although I believe there are geopolitical risks that are not currently reflected in the stock price, I rate Tencent stock a Buy due to the company’s outstanding valuation and high long-term growth that I expect to see.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.