Without Bitcoin, Your Financial Planning Could Be More Risky

This article originally appeared on the Sound Advisory blog. Sound Advisory specializes in providing financial advisory services and educating and guiding clients to become financially successful in the Bitcoin-based world. Click here for more information.

“Faith is a wise bet. If a belief cannot be proven, what harm will it do you if you gamble on its truth and it turns out to be false? You get everything when you get it. If you lose, you lose nothing. Then do not hesitate to assure us that He exists.”

– Blaise Pascal

Although Blaise Pascal lived until the age of 39, he became world famous for his many contributions to the fields of mathematics, physics, and theology. The above quote summarizes Pascal’s Wager, or the philosophical argument for the Christian belief in the existence of God.

The upshot of this argument is that rational people should live as if God exists. Even if the odds are low, the reward is worth the risk.

Pascal’s Wager to Justify Bitcoin? Yes, I am aware of the fallacies of false dichotomies, appealing to emotions, begging the question, etc. That’s not the point. The point is Dichotomous results lead to extreme resultsAnd the game theory of money suggests that it is a winner-takes-all game.

Pascal Investor: A Rational Approach to Bitcoin

Humanity’s adoption of “best money over time” mimics A/B testing, a series of binary outcomes.

Throughout history, inferior forms of money disappeared as better alternatives emerged (see India’s failed transition to the gold standard). And if Bitcoin tries to become the best currency in the future, it may succeed or it may fail.

“If you are not first, you will be last.” -Ricky Bobby, Talladega Nights, Money makes success over time.

So we can look at Bitcoin success similarly to Pascal’s bet. Let’s call this Satoshi’s bet. The translated content is as follows:

- If you own Bitcoin early and it becomes a globally valuable currency, you can make huge profits. 😀

- If you own Bitcoin and it fails, it has lost its value. 😢

- If you don’t hold Bitcoin and it goes to 0, there is no pain or gain. 😐

- If you succeed without owning Bitcoin, you will miss out on a major financial revolution in our lifetime and be left relatively behind. 😡

If Bitcoin succeeds, it will have a much higher value than it currently has and will have a huge impact on your financial future. If you fail, your losses will be limited to exposure only. The most you can lose is the money you invested.

It is hypothetically possible that Bitcoin could be worth 100 times more than it is now, but it would only lose 1x its value if its price goes to zero. The concept being discussed here is asymmetric top – Significant benefits have been achieved with relatively limited downsides. This means that the potential rewards of an investment are greater than the potential risks.

Bitcoin offers asymmetric advantages that make it a smart investment for most portfolios. Even small allocations provide potential protection against extreme currency depreciation.

salt, gasoline and insurance

“Don’t put too much salt on your steak, put too much gas on the fire or take out too much insurance.”

A little goes a long way, and it’s easy to overdo it. The same is true when looking at Bitcoin in the context of financial planning.

Bitcoin’s asymmetric rise gives it “insurance-like” properties, and that insurance performs very well when printing money. This is the case in 2020, when Bitcoin’s value increased by more than 300% in response to pandemic money printing, far outperforming stocks, gold, and bonds.

Bitcoin offers similar asymmetric upside today. Bitcoin’s supply is limited to 21 million coins, preventing inflation from falling. In contrast, the dollar’s purchasing power continues to decline due to unlimited money printing. History has shown us that society prefers money that is difficult to inflate.

If the recent rampant inflation cannot be contained and the dollar system falters, Bitcoin is well positioned as a successor. This global currency A/B testing is still in its early stages, but considering the size of each, a little bit of Bitcoin could go a long way. If successful, early adopters will gain enormous benefits over latecomers. Of course, there are no guarantees, but the potential reward justifies reasonable exposure despite the risk.

Let’s imagine Nervous Nancy, an extremely conservative investor. She wants to invest, but she also wants to take as little risk as possible. She invests 100% of her own money in short-term cash equivalents (short-term Treasury bills, money market bonds, CDs, cash in coffee cans, etc.). With this investment allocation, she is almost certain to recoup her initial investment and receive a modest amount of interest as her profits. However, she has no guarantee that the investment money returned to her will purchase the same amount as before. Inflation and money printing mean that each dollar can buy less and less over time. Depending on the severity of inflation, you may not be able to buy anything at all. In other words, she didn’t lose any dollars, but the dollars did lose their purchasing power.

Now let’s salt her portfolio with Bitcoin.

99% short-term government bonds. 1% Bitcoin.

With a 1% allocation, if Bitcoin goes to zero overnight, you’ll only lose 1 penny on the dollar, and Treasury interest rates will quickly make up the gap. It’s not at all disastrous for her financial future.

But if the above hypothetical hyperinflation scenario were played out and Bitcoin’s purchasing power increased 100x, she would have saved everything. Figuratively speaking, her entire dollar house burned down, and her “Bitcoin insurance” is what made her whole. strong. A little Bitcoin salt goes a long way.

(It’s important to remember that when protecting against legacy systems, you need to get your Bitcoin out of the system. Storing your Bitcoin on an exchange or with a counterparty is of no use if that entity fails. If you view Bitcoin as insurance, , it is essential to store your Bitcoin in cold storage and keep the key, otherwise it will become someone else’s insurance.)

All you need is a hammer and everything looks like a hammer.

Construction jokes:

There are only three rules in the configuration: 1.) Always use the right tool for the job! 2.) A hammer is always the right tool! 3.) Anything can be a hammer!

huh. I thought so too. A bit fun and mostly useless.

But if you spend enough time swinging the hammer, you’ll eventually realize that more is possible than it first appears. Not everything is a nail. A hammer can knock down walls, break concrete, knock objects into place, and shake other objects. The hammer can create and destroy. It builds tall towers and humbles novice fingers. The use cases expand depending on the carpenter’s skills.

Like a hammer, Bitcoin is a monetary tool. And 1-5% allocators to assets generally see “speculative insurance” use cases as valid. Bitcoin is speculative insurance, but it is not only speculative insurance. People invest and save in Bitcoin for a variety of reasons.

We’ve seen people use Bitcoin to pursue all of the following use cases:

- Hedging against financial collapse (speculative insurance)

- Saving for your family and future (long-term general savings and safety net)

- Increased home down payment (mid-term specific savings)

- Trying for the moon (gambling) in the same way as winning the lottery

- Withdrawal from a government-run, bank-controlled financial system (financial option)

- Make money fast (short term trading)

- Escape from a hostile country (escape property)

- Confiscating property that cannot be confiscated (property preservation)

- As a means to influence opinion and gain followers (social status)

- Fix Money, Fix the World (Mission and Purpose)

Keep this in mind when seeking financial advice from others. They are often playing a different game than you. They have different goals, upbringing, worldviews, family dynamics, and situations. Even if they use the same hammer as you, it may be used for completely different tasks.

finish

A large allocation to Bitcoin may seem crazy to some, but it makes perfect sense to others. The same goes for the 1% allocation.

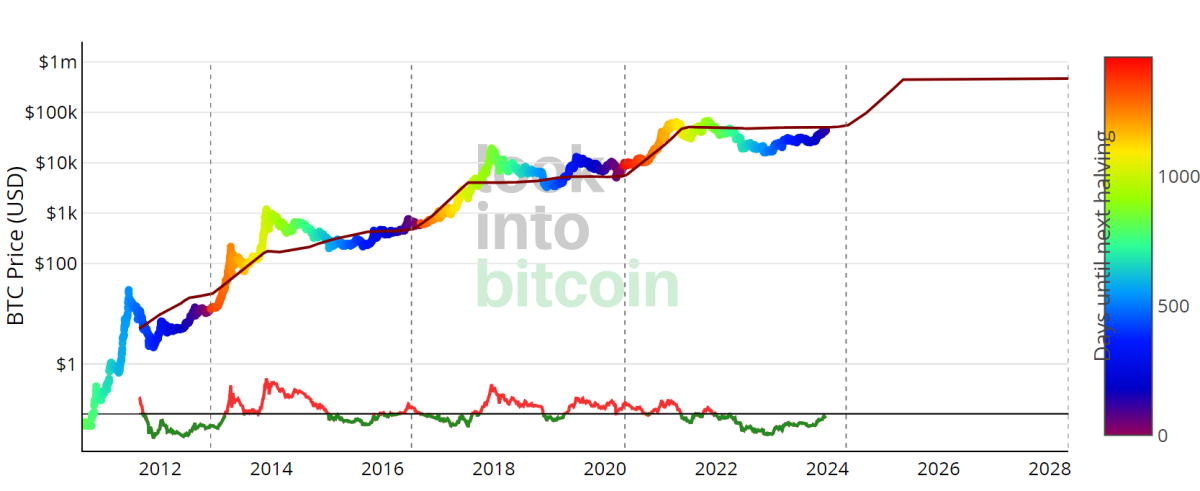

However, given today’s macroeconomic environment and Bitcoin’s trajectory, there are few use cases where 0% Bitcoin makes sense. By not owning Bitcoin, you are implicitly saying that you are 100% certain that Bitcoin will fail and go to zero. Given 14 years of history so far, it’s a good idea to tone down your confidence. No one is 100% right forever. A little salt goes a long way. Your financial plans may be more risky without Bitcoin. Diversify accordingly.

“We have to learn our limits. We are all something, but none of us is everything.” – Blaise Pascal.

contact

Office: (208)-254-0142

408 South Eagle Road

Int. 205

Eagle, ID 83616

hello@thesoundadvisory.com

Check a financial professional’s background on FINRA’s BrokerCheck. Content has been developed from sources believed to provide accurate information. The information in this material is not intended as tax or legal advice. Please consult your legal or tax professional for specific information regarding your individual situation. Some of this material was developed and produced by FMG Suite to provide information on topics that may be of interest. FMG Suite is not affiliated with any named representative, broker (dealer), or state or SEC registered investment advisory firm. The opinions expressed and material provided are for general information and should not be considered a solicitation to buy or sell any security.

We take protecting your data and privacy very seriously. Effective January 1, 2020, the California Consumer Privacy Act (CCPA) proposes the following links as additional measures to protect your data: Do Not Sell My Personal Information

Copyright 2024 FMG Suite.

Sound Advisory, LLC (“SA”) is a registered investment adviser providing advisory services in the State of Idaho and other exempt jurisdictions. Registration does not imply a specific level of skill or education. The information on this site is not intended as tax, accounting or legal advice, an offer or solicitation of an offer to buy or sell, or an endorsement of any company, security, fund or other securities or non-securities offering. . You should not rely on this information as the sole factor in your investment decisions. Past performance is not indicative of future results. Investing in securities involves significant risk and may result in partial or total loss of your invested funds. You should not assume that any recommendations presented will be profitable or equal the performance stated on this site.

The information on this site is provided “as is” and without warranties of any kind, either express or implied. To the fullest extent permissible pursuant to applicable law, Sound Advisory LLC disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and fitness for a particular purpose.

SA does not warrant that the information on this site is error-free. Your use of the information is entirely at your own risk. In no event will SA be liable for any direct, indirect, special or consequential damages arising from the use or inability to use the information provided on this site. This applies even if SA or an SA-approved representative has been notified. The possibility of such damages occurring. The information contained on this site should not be considered a solicitation to buy, an offer to sell or a recommendation for any security in any jurisdiction in which such offer, solicitation or recommendation is unlawful or unauthorized.