Stabilizing Forces: How Bitcoin ETFs Respond to Price Volatility

11 approved Bitcoin ETFs have given new legitimacy to the pioneering cryptocurrency. With official blessing from the Securities and Exchange Commission (SEC), barriers to institutional investment have been abolished.

With these barriers removed, financial advisors, mutual funds, pension funds, insurance companies, and retail investors can now receive Bitcoin exposure without the hassle of dealing with a direct custodian. More importantly, Bitcoin has been decontaminated, previously likened to “tulip fever,” “rat poison,” or “money laundering index.”

After an unprecedented domino of cryptocurrency bankruptcies throughout 2022, the price of Bitcoin returned to its November 2020 level of $15,700 by the end of 2020. After the massive FUD reservoir was depleted, Bitcoin slowly recovered in 2023, reaching $45,000 levels in 2024, and first visited in February 2021.

With the fourth Bitcoin halving in April and ETFs setting new market dynamics, what should Bitcoin investors expect next? To see this, we need to understand how Bitcoin ETFs increased BTC trading volume, effectively stabilizing Bitcoin’s price volatility.

Understanding Bitcoin ETFs and Market Dynamics

Bitcoin itself symbolizes the democratization of money. Bitcoin’s decentralized network of miners, which are not part of a central authority like the Federal Reserve, and algorithmically determined monetary policy ensure that the limited supply of 21 million coins cannot be tampered with.

For BTC investors, this means gaining exposure to an asset that is not on an inherent depreciation trajectory, which stands in stark contrast to all the existing fiat currencies in the world. This is the basis of Bitcoin’s perceived value.

Exchange-traded funds (ETFs) offer another path to democratization. The purpose of an ETF is to track the prices of assets represented by stocks and, unlike actively managed mutual funds, allow for trading throughout the day. The passive price tracking of ETFs lowers fees, making them an accessible investment vehicle.

Of course, it will be up to Bitcoin custodians like Coinbase to enact sufficient cloud security to instill investor confidence.

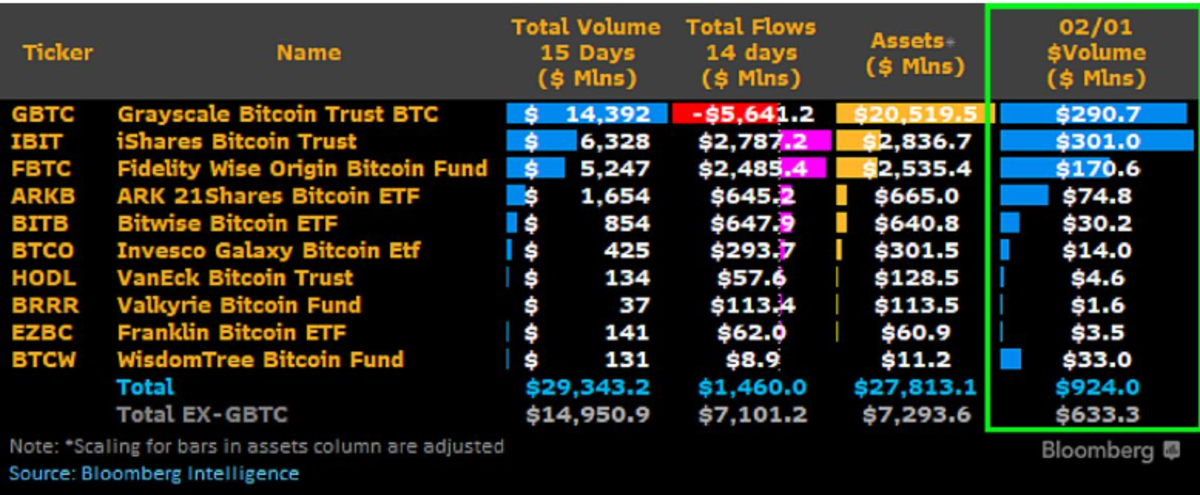

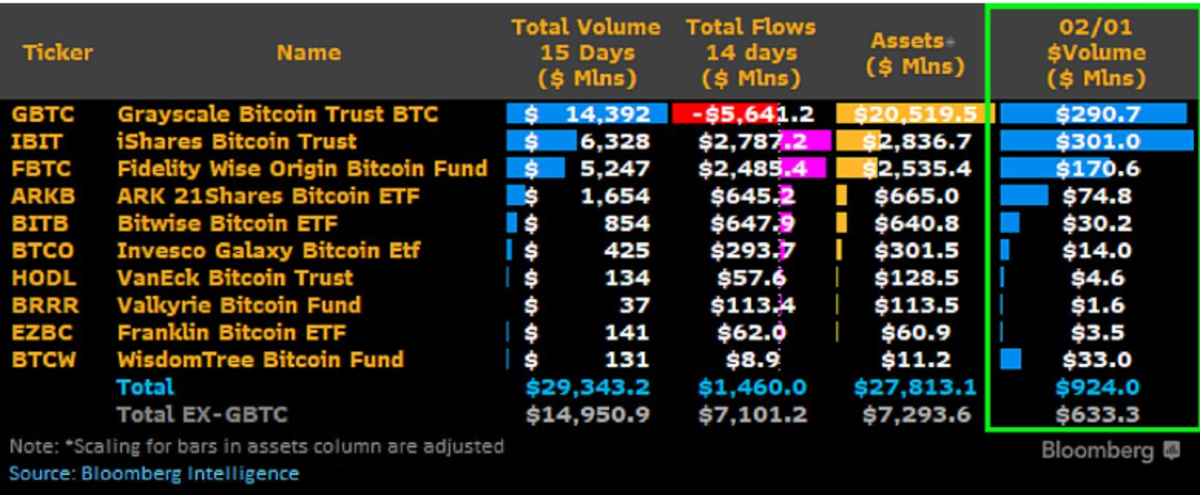

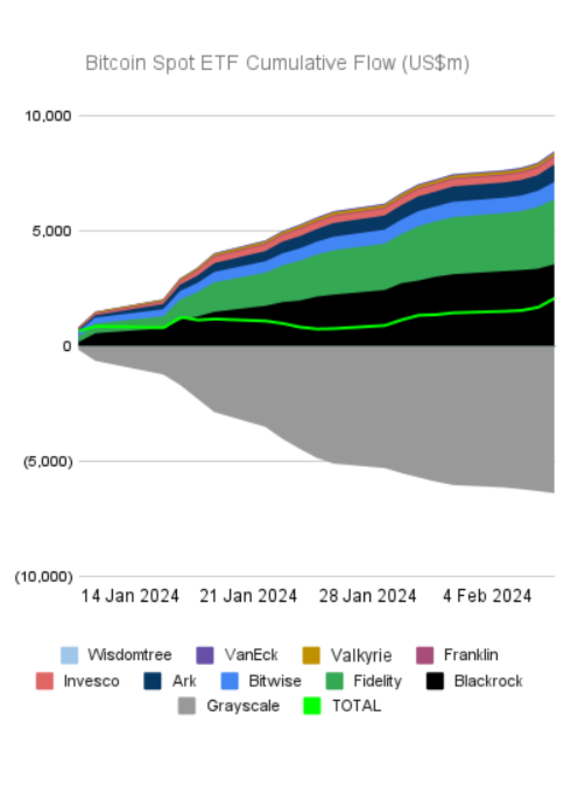

In the ETF world, Bitcoin ETFs have demonstrated strong demand for decentralized assets that resist centralized dilution. Over the past 15 days, Grayscale Bitcoin Trust BTC (GBTC) has recorded a total trading volume of $29.3 billion against pressure of $14.9 billion.

This is not surprising. As the price of Bitcoin rose due to Bitcoin ETF hype, 88% of all Bitcoin holders entered profit territory in December 2023, eventually reaching 90% in February. As a result, GBTC investors cashed out, putting $5.6 billion worth of downward pressure on the Bitcoin price.

Moreover, GBTC investors took advantage of the lower fees of the newly approved Bitcoin ETF to move funds away from GBTC’s relatively high 1.50% fee. In the end, BlackRock’s iShares Bitcoin Trust (IBIT) was the bulk winner with a 0.12% fee, which will rise to 0.25% after the 12-month waiver period.

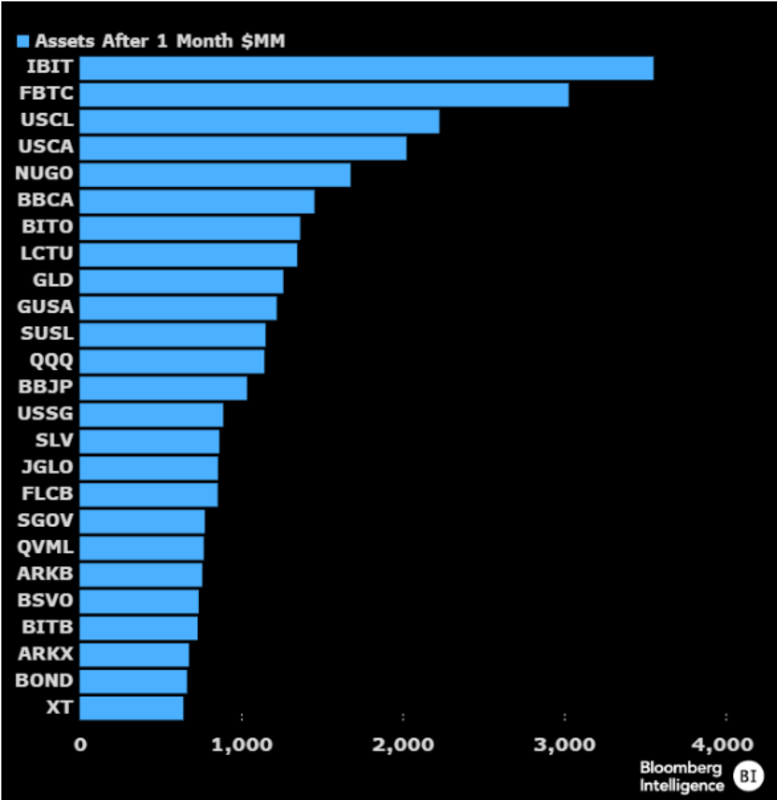

To place this in the context of the broader ETF world, IBIT and FBTC outperformed the iShares Climate Conscious & Transition MSCI USA ETF (USCL), which launched in June 2023, after one month of trading.

This is especially topical considering that Bitcoin’s history is one of attacks coming from a sustainability direction. We remind you that shortly thereafter, in May 2021, the price of Bitcoin fell 12%. Elon Musk tweeted. Tesla no longer accepts BTC payments due to environmental concerns.

During January, IBIT and FBTC ranked 8th and 10th, respectively, as the ETFs with the most net asset inflows, led by the iShares Core S&P 500 ETF (IVV), according to a Morning Star report. With ~10,000 BTC streaming into the ETF each day, this represents a significant skew in demand over ~900 BTC being mined per day.

Going forward, steady flows of funds into Bitcoin ETFs are poised to stabilize the BTC price as GBTC outflow pressure decreases and inflow trends increase.

stabilization mechanism

With 90% of Bitcoin holders entering profit territory, the highest since October 2021, selling pressure could come from a variety of sources, including institutions, miners, and retail. The Bitcoin ETF’s trend of higher inflows is a bulwark against this, especially heading into another hyped event: the fourth Bitcoin halving.

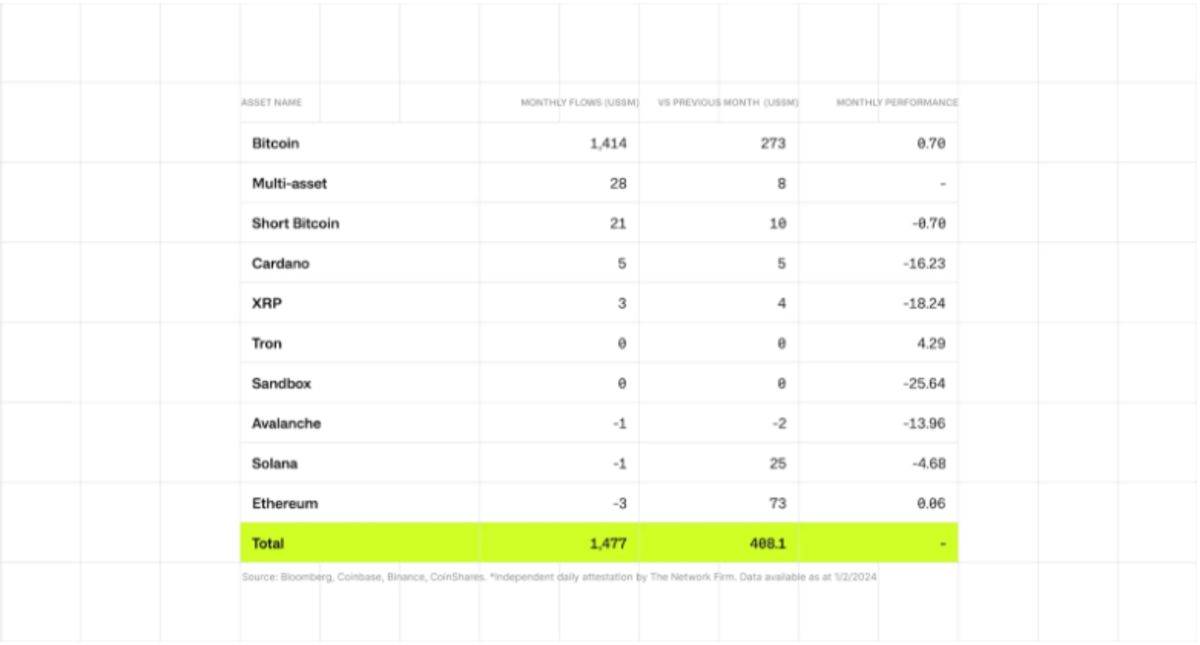

Higher trading volume means higher liquidity, which smooths out price fluctuations. This is because temporary imbalances are absorbed when trading volume from both buyers and sellers increases. During January, a report by CoinShares showed Bitcoin inflows of $1.4 billion, along with $7.2 billion in newly minted US-based funds, compared to GBTC outflows of $5.6 billion.

Meanwhile, large financial institutions are setting new liquidity standards. As of February 6, Fidelity Canada set its Bitcoin allocation at 1% within its All-in-One Conservative ETF fund. Given the “conservative” moniker, this indicates a larger percentage of allocations to non-conservative funds going forward.

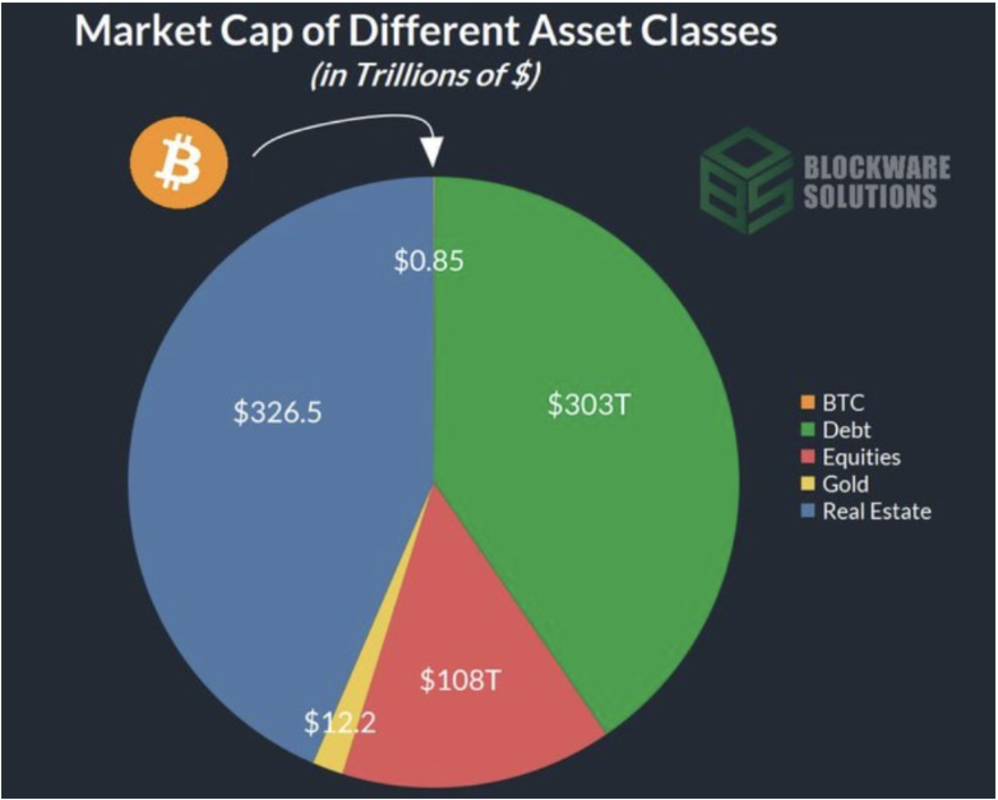

Ultimately, if Bitcoin taps 1% of the $749.2 trillion market pool of various asset classes, Bitcoin’s market capitalization could increase to $7.4 trillion, pushing the Bitcoin price to $400,000.

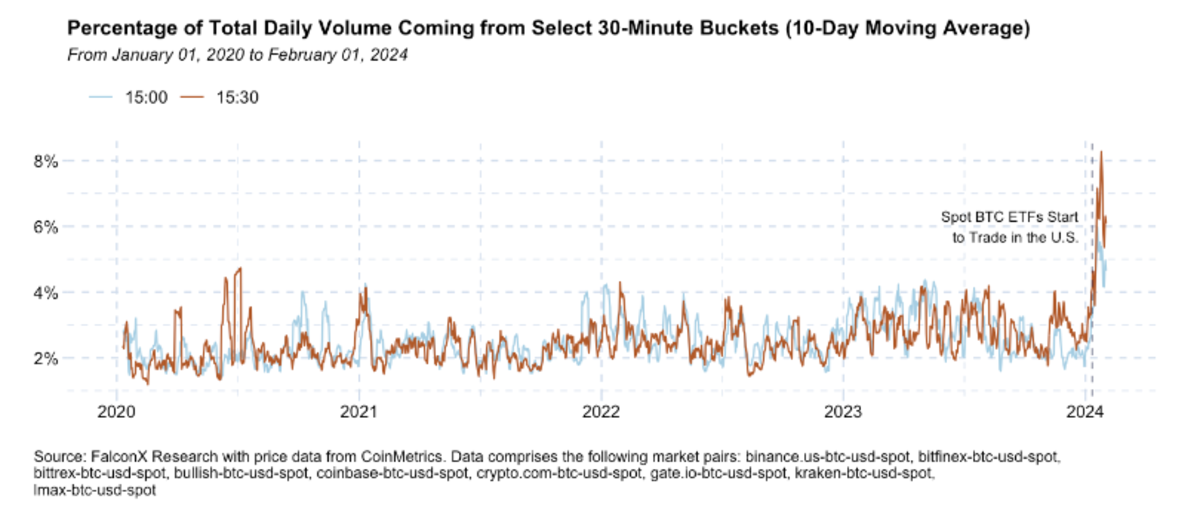

Given that Bitcoin ETFs provide a consistent and transparent market price reference point, large aggregate trades reduce the market impact of potential shorting by miners. This can be seen from FalconX Research, which has seen a significant increase in daily counts that were previously averaging 5% and tending to range between 10-13%.

In other words, the market regime driven by the new Bitcoin ETF is reducing overall market volatility. So far, Bitcoin miners have been the main driver holding down prices on the other side of the liquidity equation. According to Bitfinex’s latest weekly on-chain report, miner wallets were responsible for an outflow of 10,200 BTC.

This coincides with the aforementioned Bitcoin ETF’s ~10,000 BTC inflows, providing relatively stable price levels. Another stabilizing mechanism, options, may come into play as miners reinvest and upgrade their mining equipment ahead of the fourth halving.

While the SEC has not yet approved an option for a spot-traded BTC ETF, this development will further expand ETF liquidity. Ultimately, as the spectrum of investment strategies centered on hedging increases, liquidity on both sides of the transaction increases.

As a forward-looking indicator, implied volatility in options trading measures market sentiment. However, with the increased market maturity that we will inevitably see following the introduction of the BTC ETF, the prices of options and derivative contracts in general are likely to become more stable.

Inflow and market sentiment analysis

As of February 9, the Grayscale Bitcoin Trust ETF (GBTC) holds 468,786 BTC. Last week, BTC price rose 8.6% to $46,200. In line with previous predictions, this means that the BTC dumping is likely to spread into multiple rallies after the fourth halving.

As of February 8, Bitcoin ETFs have recorded $403 million in inflows, bringing the total to $2.1 billion, according to the latest figures provided by Farside Investors. GBTC outflows totaled $6.3 billion.

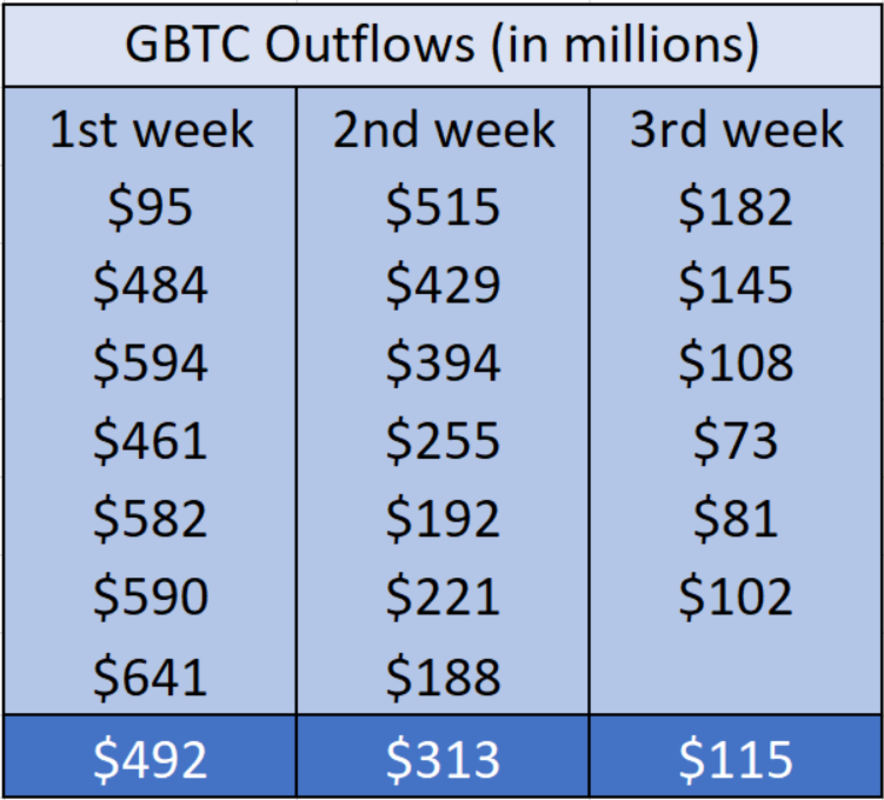

From January 11 to February 8, GBTC outflow steadily decreased. It averaged $492 million in its first week. The second week saw GBTC outflows averaging $313 million, and the third week ended with an average of $115 million.

On a weekly basis, this represents a 36% decrease in selling pressure from week 1 to week 2, and a 63% decrease from week 2 to week 3.

As the GBTC FUD unfolded through February 9, the Crypto Fear and Greed Index rose 72 points to “Greed.” This would mean a revisit of the 71-point mark from January 12th, just a few days after the Bitcoin ETF approval.

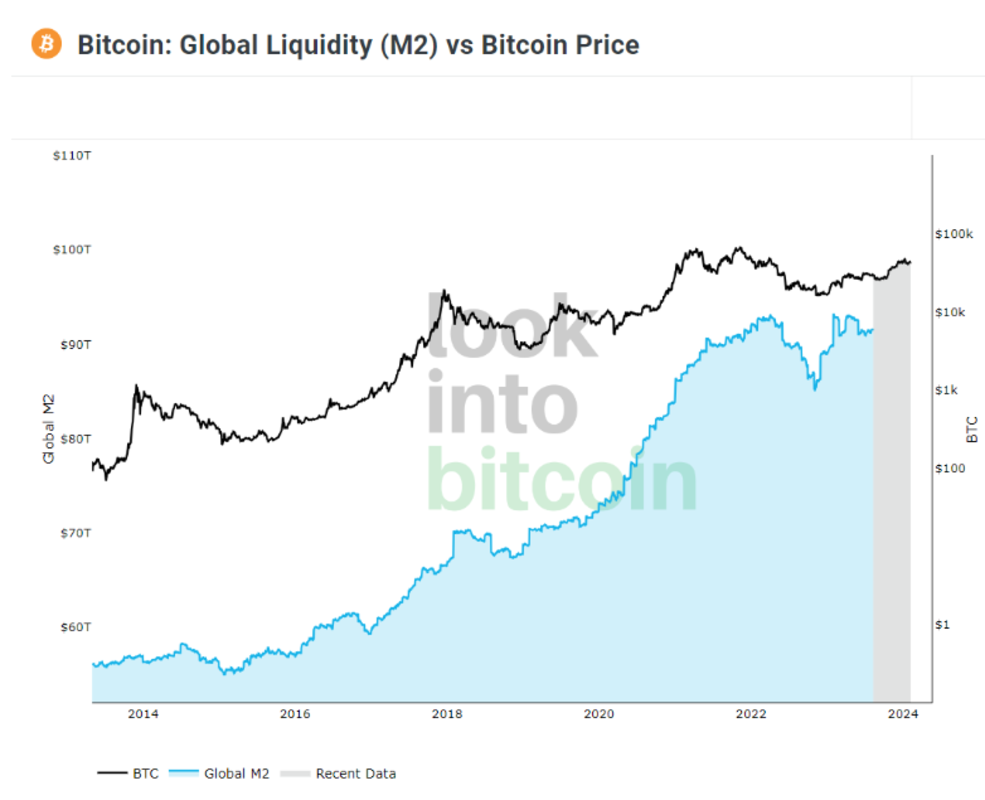

It is worth noting that the Bitcoin price going forward will depend on global liquidity. Ultimately, the Fed’s interest rate hike cycle in March 2022 led to a surge in cryptocurrency bankruptcies and the collapse of FTX. Currently, federal funds futures expect the cycle to end in May or June.

Moreover, it is extremely unlikely that the Fed will move away from the money printing process. And in those cases, the Bitcoin price followed suit.

Given the insurmountable national debt of $34 trillion, Bitcoin is establishing itself as a safe haven asset as federal spending continues to outpace revenues. It is waiting for capital to flow into its limited supply of 21 million coins.

Historical Context and Future Implications

Gold Bullion Securities (GBS), a similar safe haven asset, was launched as the first gold ETF on the Australian Securities Exchange (ASX) in March 2003. The next year, SPDR Gold Shares (GLD) were launched on the New York Stock Exchange (NYSE).

Within a week from November 18, 2004, GLD’s total net assets increased from $114,920,000 to $1,456,602,906. By the end of December, this amount had decreased to $1,327,960,347. It took GLD until November 22, 2005 to reach BlackRock’s IBIT market cap of $3.5 billion.

Although not adjusted for inflation, this indicates the superiority of market sentiment for Bitcoin compared to gold. Although Bitcoin is digital, it is based on a global proof-of-work mining network. Its digital nature means portability that cannot be compared to gold.

The USG demonstrated this in 1933 when President Roosevelt issued Executive Order 6102 allowing citizens to sell gold bullion. Likewise, unlike Bitcoin, new veins of gold are frequently discovered that weaken its limited supply.

Beyond these basics, Bitcoin ETF options have yet to materialize. Nonetheless, Standard Chartered analysts expect Bitcoin ETFs to reach $50 billion to $100 billion by the end of 2024. Moreover, larger companies have yet to follow MicroStrategy’s lead by effectively converting stock sales into depreciating assets.

Even a 1% BTC allocation across mutual funds is poised to send BTC prices soaring. Advisors Preferred Trust, for example, has set a 15% range allocation to indirect Bitcoin exposure through futures contracts and the BTC ETF.

conclusion

After 15 years of doubt and criticism, Bitcoin has reached the pinnacle of trustworthiness. The first wave of believers in sound money ensured that no version of the blockchain was lost from the coding history repository.

By now, Bitcoin investors have built on their confidence and formed a second wave. Bitcoin ETF milestones represent third wave exposure milestones. Central banks around the world continue to erode trust in money by forcing governments to focus solely on spending.

With so much noise being made around the exchange of value, Bitcoin represents a return to sound monetary roots. The saving grace is digital, but also physical proof of work as energy. Barring any extreme actions by the U.S. government to disrupt institutional exposure, Bitcoin may surpass gold as a traditional safe haven asset.

This is a guest post by Shane Neagle. The opinions expressed are solely personal and do not necessarily reflect the opinions of BTC Inc or Bitcoin Magazine.