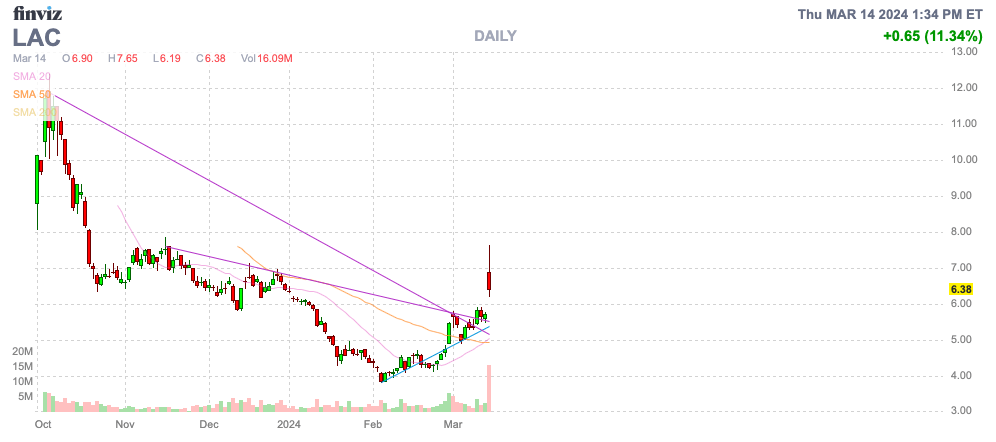

Lithium Americas: Lithium Weakness Burdens (NYSE:LAC)

That Chapel

Sharp weakness in electric vehicle (“EV”) demand has caused lithium stocks to plummet, but companies such as: Lithium Americas Corporation (New York Stock Exchange: LAC) is ultimately prepared to bring its lithium mines online when demand is expected to recover. that much The long-term EV story has not changed as some range jitters and buyer incentives are resolved over time. my investment thesis It is extremely bullish on its stock trading at rock-bottom levels and has de-risked itself by taking out a DOE loan to finance mine development.

Source: Finviz

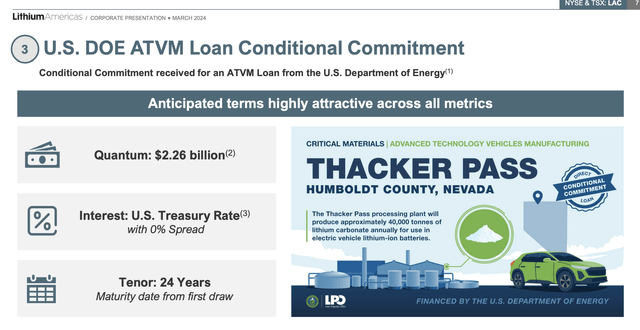

Key loan approval

Spin-off from Lithium Americas Lithium Americas (Argentina) (LAAC) to receive U.S. DOE funding and investment for a mine development project at Thacker Pass. general motors (GM). The company just announced that it has been tentatively approved for a $2.26 billion loan from the U.S. DOE Advanced Technology Vehicle Manufacturing Program.

Source: Lithium Americas March 2024 Presentation

Together with the GM investment, Lithium Americas will retain the majority of its cash to fund anticipated capital expenditures to build the Thacker Pass lithium mine. Estimated capital costs are now $2.93 billion, up from the original estimate of $2.27 billion.

In addition to the DOE loan, Lithium Americas must secure a $320 million Tranche 2 investment from GM. In total, the company will raise $2.58 billion from these funding sources during construction.

Lithium Americas will spend $194 million on mine construction in 2023. The company ended the year with a cash balance of more than $200 million, although the company update did not provide financial details.

The loan will accrue interest at the U.S. Treasury rate during construction, with an estimated cost of $290 million over three years. The goal is to begin lithium mining in 2027 and achieve a full capacity of 40,000 tonnes LCE in 2028, about a year after mining begins.

Lithium Americas still has the option to secure an additional 40,000 tonnes of LCE to pursue Phase 2.

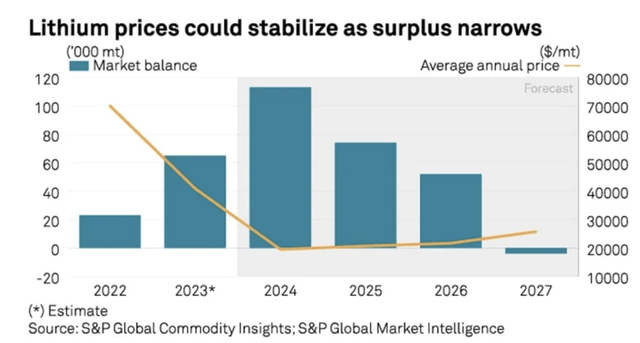

lithium price

Despite Lithium Americas producing enough lithium to power 800,000 EVs, current inventories are at rock bottom due to lack of demand for lithium. Lithium prices have fallen below $15,000 per ton.

Falling prices are forcing China’s high-cost miners to close mines and scale back new projects. The LCE production cost of these lepidolite mining projects in China is 80,000 to 120,000 yuan to process 1 ton of LCE, which is much higher than that of Thacker Pass.

For Lithium Americas, the real question is the price of lithium in 2027/28, when the Thacker Pass mine begins production. S&P Global estimates that lithium prices will begin to rise again in 2025 as market surplus decreases due to increased demand for electric vehicles.

Source: S&P Global

The investment appeal is that many of the long-term demand drivers for lithium will be sorted out over the next few years. Globally, EV demand remains strong, and as EV charging stations expand, U.S. consumers will eventually become more accustomed to charging issues.

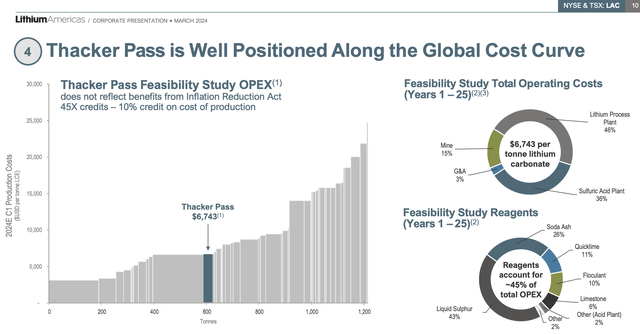

The biggest advantage of the Thacker Pass project is that total operating costs are in the mid-range of the global cost curve. The Nevada mine’s cost is estimated at just $6,743 per tonne of LCE.

Source: Lithium America March 2024 presentation

The real question is how much cash flow Lithium Americas can generate with such low operating costs. The company expects baseline EBITDA of $171 million at a $12,000/LCE price during Phase 1. But ultimately, a $24,000/LCE price (similar to S&P Global estimates) would generate $1.15 billion in annual EBITDA after completion of Phase 2 construction.

For a company with the potential to generate annual adjusted EBITDA in excess of its market capitalization, its stock currently has a market capitalization of less than $1 billion. Based on recent lithium prices and the potential for supply shortages by the end of the decade when mining begins, Lithium Americas has the potential to produce adjusted EBITDA close to $2 billion per year based on $36,000/LCE.

takeout

The key takeaway for investors is that with Thacker Pass construction underway and the DOE loan in place, Lithium Americas’ risks are much lower. The biggest risk right now is the lithium market dynamics, which are expected to improve further with new mines coming online within three years.

Investors probably shouldn’t chase a 10% gain in stocks today. However, Lithium Americas Corp. is an attractive investment at its current valuation. Lithium prices are likely to become more volatile over the next decade depending on the ebbs and flows of supply and demand, and investors should capitalize on weakness to invest in long-term positive arguments.