Owl Smart Levels Strategy Trading Review for the Week of January 30 – February 3, 2023 – My Trades – March 16, 2024

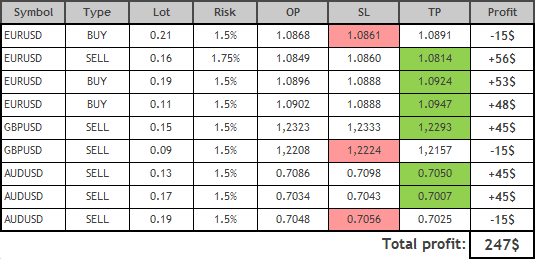

Today I present an overview of trades made using the Owl strategy – smart levels for the EURUSD, GBPUSD and AUDUSD currency pairs for the week from January 30 to February 3, 2023. This is a difficult time for trend strategies because the market has been stuck in a small channel for a long time and is not moving anywhere. This means that trend strategies can give many false signals. But let’s see what we got.

For convenience and timely signal reception, I use: Owl Smart Level Indicator. The main trading time frame is M15, while the H1 and H4 time frames are used to confirm the trend direction on higher time frames.

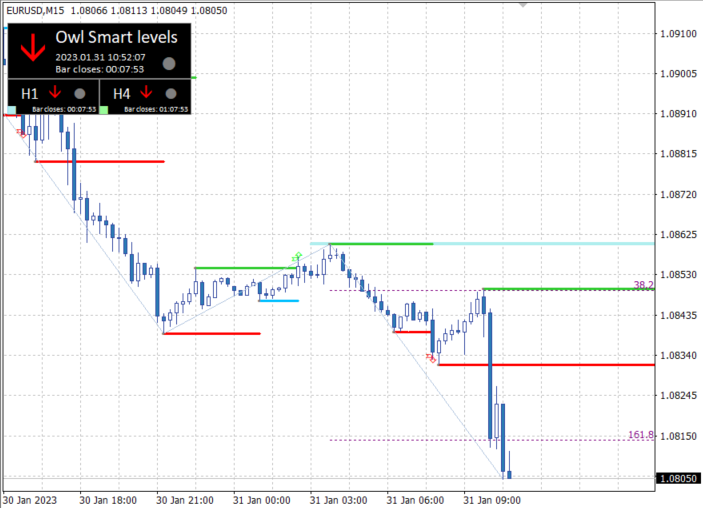

EURUSD Review

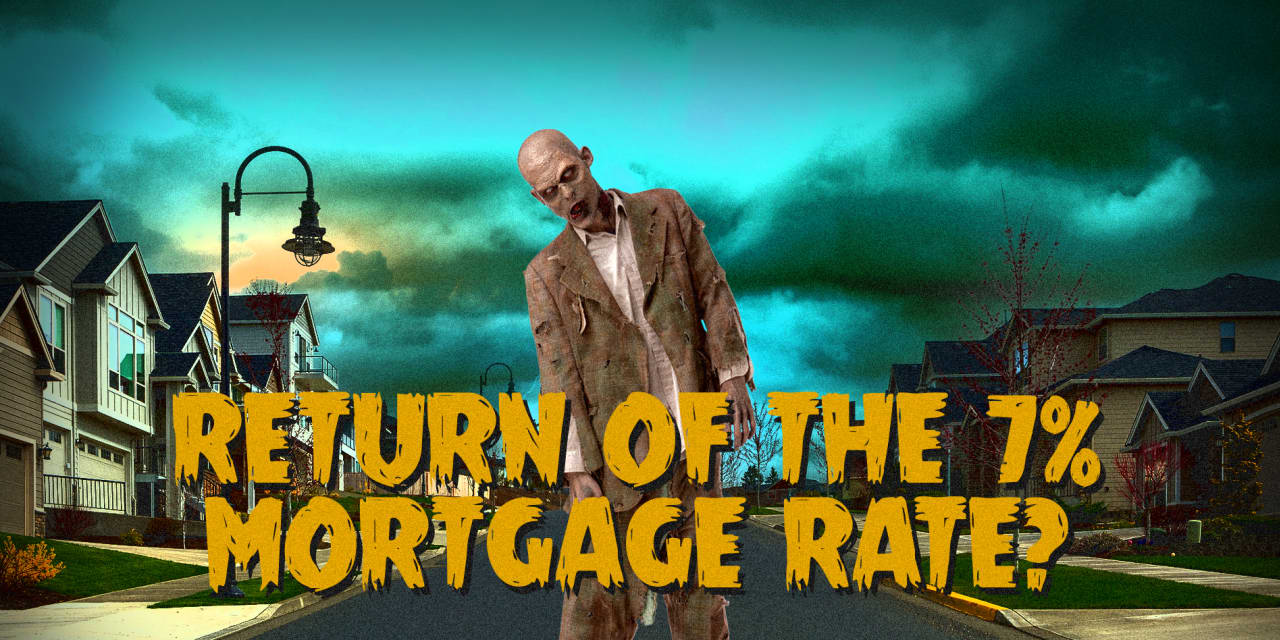

The start of the week for the Euro was within the “Dead Zone” (the red area of the Owl Smart Levels Indicator where trading is not recommended), but the first buy signals appeared already at 7:00 on January 30. The euro showed up against the dollar. The trade closed at a loss. This led to the addition of a new rule: no trading on Monday mornings. The market has just opened, there are few major players, and many traders are just looking at the market closely and trying to make a trading plan for the week.

Figure 1. EURUSD BUY 0.21, OpenPrice=1.0868, StopLoss=1.0861, TakeProfit=1.0891, Profit= -15$

After the chaotic fluctuations on January 31, the EURUSD market has moved lower and formed a signal, but is already selling: OpenPrice=1.0849, StopLoss=1.0860, TakeProfit=1.0814. Since the previous transaction was not profitable, the transaction was started with a risk of 1.75% of the deposit amount (the first time was 1.5% of the deposit amount). The euro handled this signal very well and profits were locked in in open trading.

FIG. 2. EURUSD SELL 0.16, OpenPrice=1.0849, StopLoss=1.0860, TakeProfit=1.0814, Profit= +56$

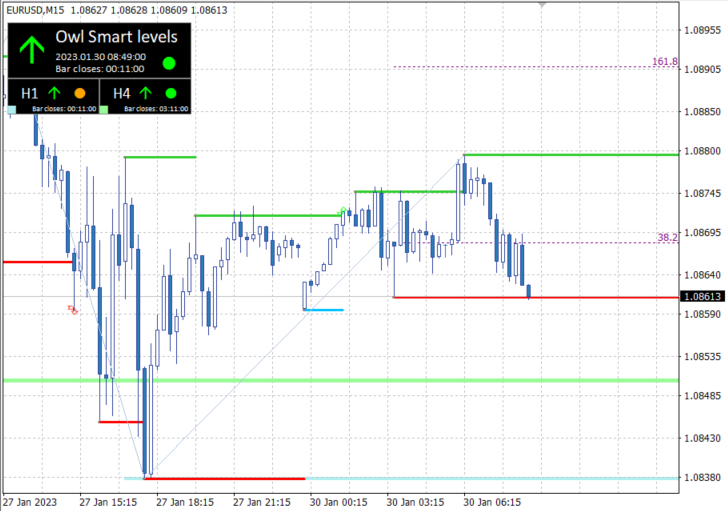

After some fluctuations and another move into the dead zone, the upward movement recovered. On 1 February at 15:03 GMT a buy trade was opened with a minimum stop size of 8 points (place = 4). The profits from this trade were locked in very quickly and the market is already expecting another rally.

Figure 3. EURUSD BUY 0.19, OpenPrice=1.0896, StopLoss=1.0888, TakeProfit=1.0924, Profit= +53$

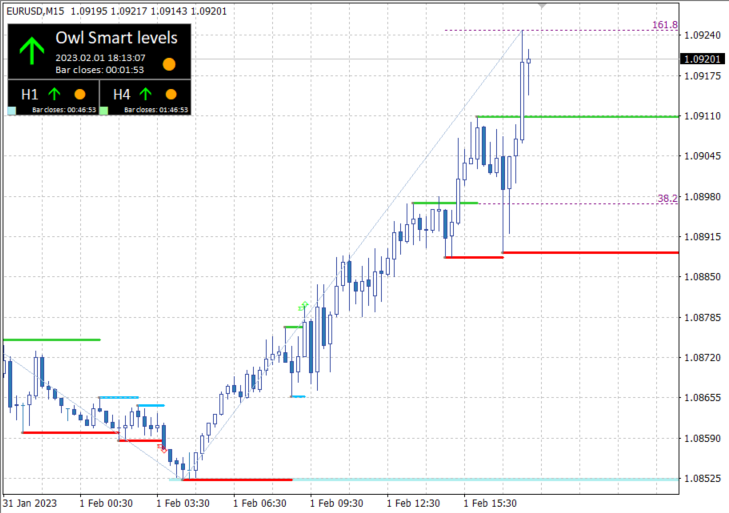

At 21:01 another buy trade was opened, which closed very quickly but made everyone nervous as the market was falling and we were literally 1 point away from StopLoss. Then the EURUSD pair rose very significantly and the correction had to wait until the next day. Then, on February 2nd, the dead zone reappeared, making trading impossible until the end of the week. At 13:30 on the Non Farm Payrolls news, all EURUSD time frames started showing a downward trend direction. However, it is better not to enter the market after such news comes out. Because the market is very volatile and unpredictable.

Figure 4. EURUSD BUY 0.11, OpenPrice=1.0902, StopLoss=1.0888, TakeProfit=1.0947, Profit= +48$

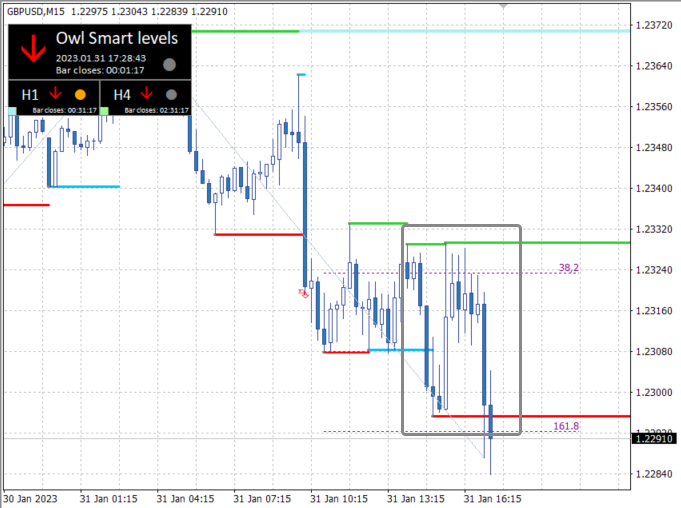

GBPUSD Review

The British pound, like the euro, opened the week in the red zone, with no trading allowed throughout the day on January 30. And due to the confusing multi-faceted movement, the first TARD was not opened until 9:45 on January 31st. She went from the profit zone to the loss zone for a very long time, creating a tense atmosphere, but eventually she reached TakeProfit.

Figure 5. GBPUSD SELL 0.15, OpenPrice=1.2323, StopLoss=1.2333, TakeProfit=1.2293, Profit= +45$

The next sell signal didn’t take long, but there are rules. The idea is not to enter a trade earlier than 10 candles after the previous signal closed. So I skipped the next transaction.

Figure 6. Rule – Do not enter a trade earlier than 10 candles after the last candle closes.

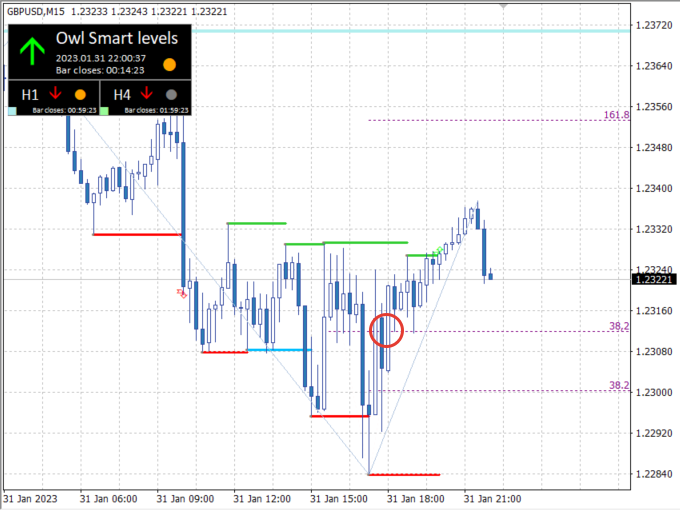

Moreover, the market behaved chaotically. The strategy did not give an entry signal and eventually a dead zone was formed in the afternoon. Only after 17:00 on February 2 was it possible for the British pound to get out of the dead zone, but on this day the strategy did not form a signal.

It was not possible to enter the market until 9 o’clock on February 3rd. GBPUSD ended the trade with a loss and fell back into the danger zone. After that I decided not to trade the GBPUSD currency pair anymore this week and besides, the strategy did not give any more signals.

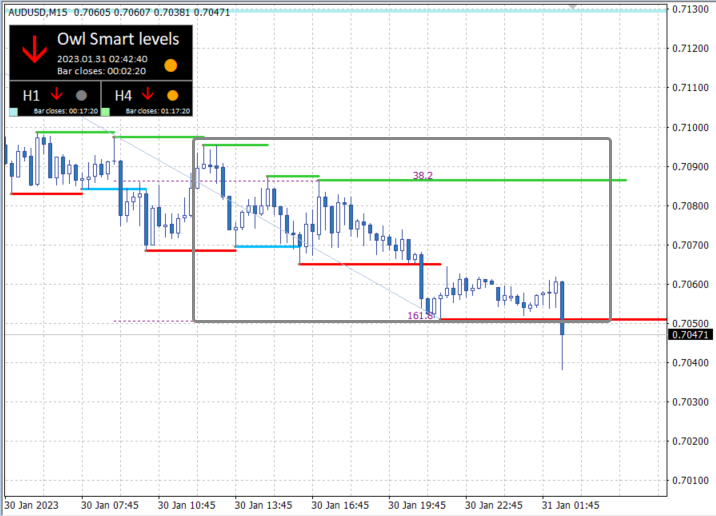

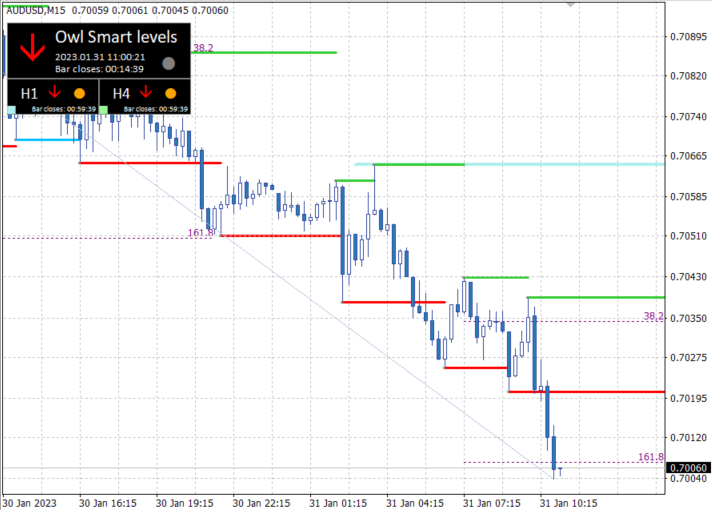

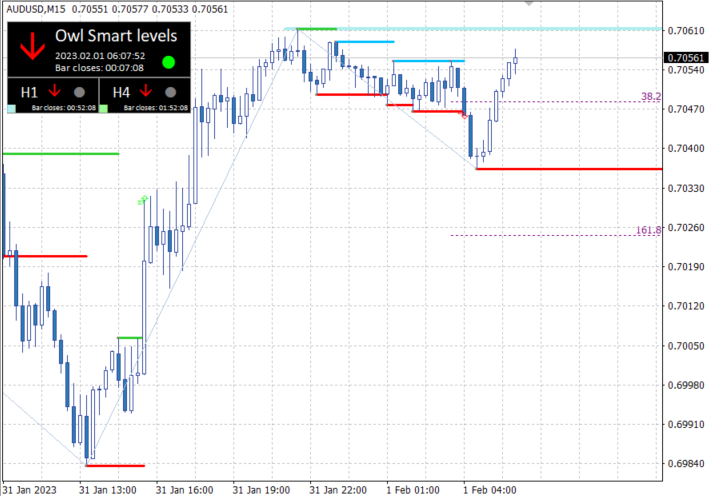

AUDUSD Review

The first trade in the Australian dollar opened at 10:00 on January 30 and closed profitably only at 00:30 the next day. Almost immediately another sell signal appeared, but this signal was ignored due to the rule of not trading 10 candles after the close of trading.

Figure 7. AUDUSD SELL 0.13, OpenPrice=0.7086, StopLoss=0.7098, TakeProfit=0.7050, Profit= +45$

The next perfect signal occurred at 7:45 on January 31st. Profits were confirmed within 1 hour of open positions. This is what I call the “perfect entry signal”, where the market bounces from the level without moving left or right and then immediately heads towards TakeProfit.

Figure 8. AUDUSD SELL 0.17, OpenPrice=0.7034, StopLoss=0.7043, TakeProfit=0.7007, Profit= +45$

The market then began to correct upwards and after one false signal that resulted in losses, the Australian dollar entered the dead zone. The market only broke out of the red zone on Friday, but trading is not recommended after the US jobs news and there are no further signals.

Figure 9. AUDUSD SELL 0.19, OpenPrice=0.7048, StopLoss=0.7056, TakeProfit=0.7025, Profit= -15$

result:

I think the week from February 6 to February 10, 2023 will have stronger signals for the Night Owl strategy. There were two fundamental pieces of news last week: US interest rates and decisions on non-farm payrolls. I believe this will set the course for the dollar correction move we have been waiting for.

Next week we’ll take a look at what it has to offer and how Owl Smart Levels works.

See other reviews of the Owl Smart Levels strategy:

I am Sergey Ermolov, Follow me so you don’t miss out on more useful tools for profitable trading in the Forex market.