Weekly Outlook: Technical setup remains weak; NIFTY may come under corrective pressure at higher levels | India analysis

After six weeks of modest gains with intermittent corrections, Indian stocks finally took a breather and succumbed to the corrective move, ending the week on a negative note. The previous weekly technical outlook clearly noted that the market is still prone to a correction retracement. As per this analysis, the headline index Nifty 50 showed significant technical retracement from higher levels. The trading range extended from the expected line with the index oscillating in the range of 620.-5 points. Ending the week near its low point, the benchmark index closed with a weekly net loss of 470.20 points (-2.09%).

The technical setup doesn’t paint a good picture. Given the price action of the past week, the high of 22525 can now be considered an intermediate high for the market, unless presented very convincingly. Moreover, we are seeing a bearish divergence in the RSI on the weekly chart, which may suggest that the market correction is here to stay for some time. The most important pattern support lies at the upper edge of the ascending channel that Nifty broke through, which also converges with the 20-week MA located much below at 21264. The market has a wider range of volatility in the coming weeks.

Next week may get off to a lukewarm start. The market may see a mild technical bounce, but it may remain largely tentative. The 22300 and 22410 levels could act as potential resistance points. Support is provided at the 21900 and 21680 levels.

Weekly RSI is 64.86. A new 14-period low has been formed with a downward trend. This shows a bearish divergence in RSI versus price. The weekly MACD remains positive but is on the verge of a negative crossover, as evidenced by the sharply narrowing histogram.

A large candle at a high after a significant rise also increases the likelihood of a temporary break in the uptrend.

Looking at the pattern analysis of the weekly chart, it appears that Nifty, which broke out of the rising channel after breaking through 20800, is showing fatigue. Unless there is a convincing removal, the 22525 level can now be considered a temporary high. The large black candle at the top suggests a temporary break in the uptrend. The closest pattern supports holding well below current levels.

The markets will be on the defensive next week. Whenever a technical bounce occurs, it is more likely to continue to face corrective pressure. Defensive sectors such as IT, pharmaceuticals and FMCG may see a notable improvement in relative strength, which may lead to these groups showing resilience or relative performance to the broader market. It is recommended to approach the markets cautiously and reduce leverage exposure. A cautious outlook is advised for next week.

Next week’s sector analysis

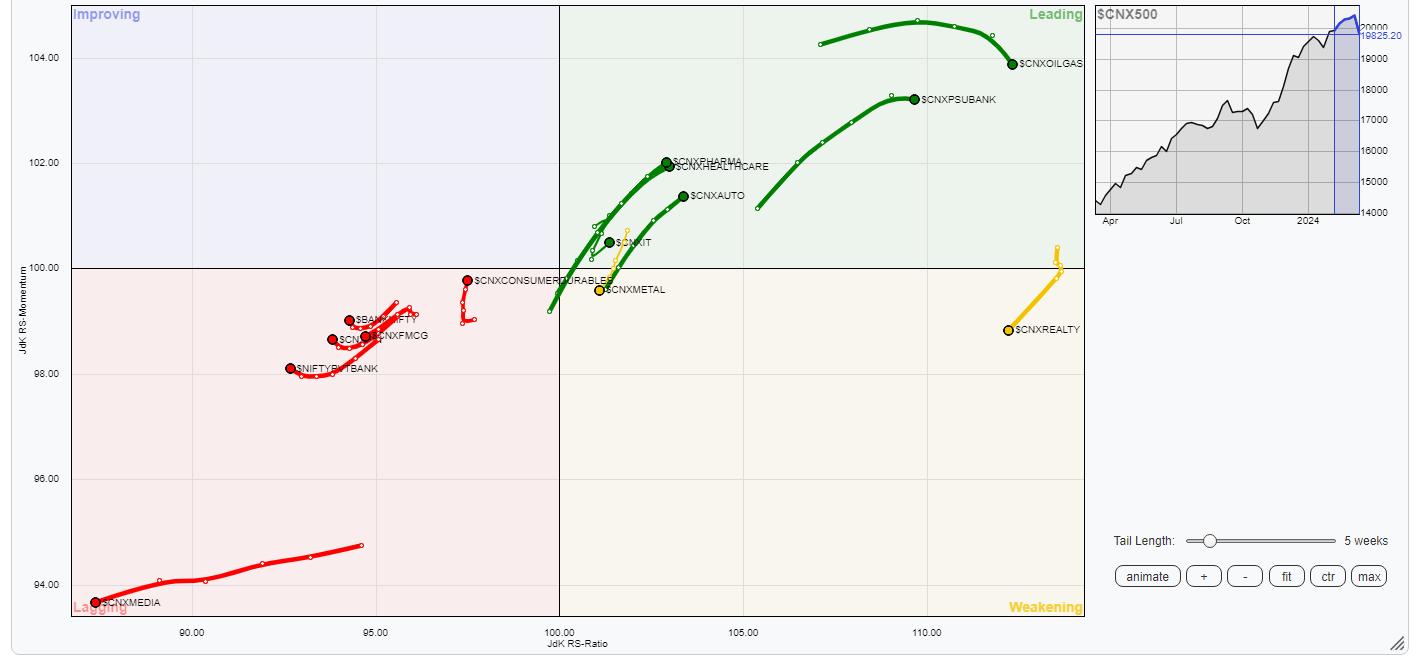

With Relative Rotation Graphs®, we compared various sectors with the CNX500 (NIFTY 500 Index), which represents over 95% of the free float market capitalization of all listed stocks.

Relative Rotation Graph (RRG) shows that Nifty Commodities, Energy and PSE sectors are within the leading quadrant but their momentum is slowing. Apart from this, Nifty Pharma, PSU Bank, Infrastructure, IT and Automobile indices are also included in the leading quadrant. These groups are likely to outperform the broader market.

Nifty Metal Index rolled inside the bearish quadrant. The broader Nifty MidCap 100 index is also within the bearish quadrant.

The Nifty Media Sector Index appears to be depressed within the lagging quadrant along with the FMCG Index. However, apart from being in the lagging quadrant, the financial services, Banknifty and services sector indices appear to be improving their relative momentum to the broader market.

Nifty consumption index moved inside the improving quadrant.

Important note: RRG™ charts show the relative strength and momentum of groups of stocks. The above chart shows relative performance against the NIFTY500 index (broad market) and should not be used directly as a buy or sell signal.

Milan Vaishnav, CMT, MSTA

Consulting Technology Analyst

www.EquityResearch.asia | www.ChartWizard.ae

Milan Vaishnav, CMT, MSTA is a capital markets expert with nearly 20 years of experience. His areas of expertise include portfolio/fund management and advisory services consulting. Milan is the founder of ChartWizard FZE (UAE) and Gemstone Equity Research & Advisory Services. With over 15 years of experience in Indian capital markets as a consulting technology research analyst, he has been providing India-focused, premium, independent technology research to his clients. He currently contributes daily to ET Markets and The Economic Times of India. He also writes A Daily/ Weekly Newsletter, one of India’s most accurate “daily/weekly market forecasts”, now in its 18th year of publication. Learn more