Here are some rookie mistakes millennial and Gen Z investors make:

What are young investors doing wrong these days?

Our call of the day Jessica Rabe, co-founder of data provider DataTrek, points out seven rookie investing mistakes millennial and Gen Z investors are making. She Rabe is only 29 years old, but she has been writing about and analyzing capital markets for 10 years.

Here it is:

-

Trying to pick a single stock. It may be a winner in the short term, but “over the long term, it doesn’t beat yields on mostly low-risk U.S. Treasury bonds,” Rabe says. He added that picking a winner requires fundamental research and discipline. From 1990 to 2020, only 2.4% of global stocks were responsible for the rise in global stocks, but the big indices always come back and create value. A better option is to invest in the SPDR S&P 500 ETF Trust, an exchange-traded fund (ETF) that tracks the S&P 500.

— or Invesco QQQ Trust

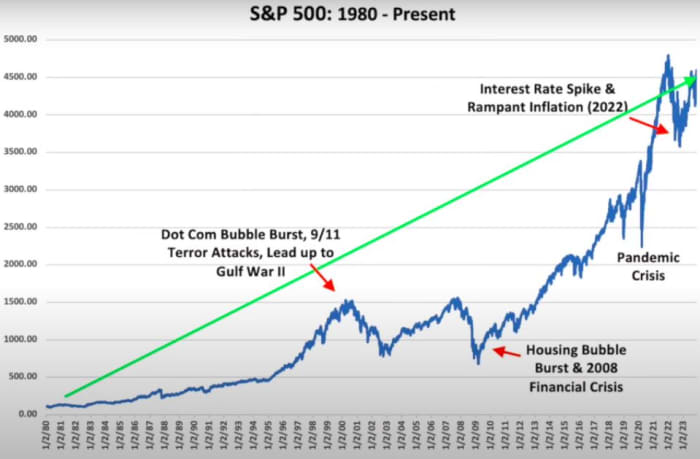

For the NASDAQ 100. - Treating investing like gambling. “Most investors can make money by sticking to a major U.S. stock index for at least a few years,” she says. And despite all the crises over the past two decades, the S&P 500 is on the verge of breaking a new record, she added.

-

I don’t think I have enough room to invest. Look into building an emergency fund and then buying penny stocks in your brokerage account. Invest $100 in the iShares Core S&P 500 ETF

If the S&P 500 earns its typical 10% annual return today, you could earn $50 a month over 30 years to $100,000. -

Invest only in companies you “believe” in. iShares Global Clean Energy ETF

It’s down 26.5% year to date, meaning investors will need more savings and aggressive investments elsewhere to reach their financial goals. Rabe says it’s important to keep in mind that many thematic funds or ESG products invest heavily in energy or big tech. - “Big profits cloud your judgment.” Risk management should always be a priority. So, don’t make future decisions based on big cryptocurrency wins. And always diversify in the stock market as well as digital currencies.

- Fear of missing out (FOMO). Social media is full of young investors making money with cryptocurrencies during the pandemic, leaving everyone else worried they’ll miss out on the next big boom. “They were very lucky in unique circumstances,” says Rabe. “It’s not a fair benchmark for their own success.” Cryptocurrencies are volatile and speculative, so invest only as much as your delicious lunch would cost. Cryptocurrencies are attractive to young people because they trust technology more, but they lack a solid regulatory structure to support long-term investments in U.S. stocks. So invest sparingly and invest in a variety of other places.

- Option Investment: “You see your peers at TikTok or Instagram discussing how they have made money with these strategies and want to get in on the action, but inexperienced investors need to understand that most stock-linked options are ultimately useless,” Rabe said. It’s an especially bad idea for young investors because all that money will “likely disappear.” If the S&P 500 index stays at 10% for the next 40 years as it has for the last 40 years, investing $1,000 today instead of options would give you $45,000 in 40 years.

Over time, the S&P 500 has consistently overcome all kinds of crises and continued to rise, says DataTrek’s Rabe.

datatrek

plus: ‘Is this the stock market or a casino?’ A new 4X leveraged S&P 500 ETN has caught my attention.

market

Stock Futures ES00

YM00

NQ00

The Dow is on the rise after consecutive losses.

and S&P 500

.

bond yield

It is steady and the price of gold is rising slightly to $2,040. OilCL

There is a 1% discount. german stocks

It’s rising after Tuesday’s record close.

buzz

ADP’s private sector salary came in at 103,000 compared to expectations of 120,000. Revised third quarter productivity and trade deficit figures will be released at 8:30 a.m.

In the cloud space, Box shares BOX.

MongoDB MDB is seeing a decline due to its poor sales guidance.

The decline broke expectations.

and: Apple again became a $3 trillion company for the first time since August.

CEOs of Wall Street banks, including JPMorgan’s JPM;

Jamie Dimon is scheduled to appear before Parliament on Wednesday and is expected to warn of tighter regulation of lenders.

British American Tobacco BTI

It valued the U.S. cigarette brand at $31.5 billion, and the news also weighed on Altria MO, sending its shares down 8%.

And Philip Morris PM

inventory.

A backlash against fast fashion retailers is looming, Deutsche Bank has warned.

best of the web

How Russia blew an $11 billion hole in Western oil sanctions.

How toys become the coveted ‘it’ gift this Christmas season.

Inflation is coming down, but interest rates will remain high for much longer.

Chart

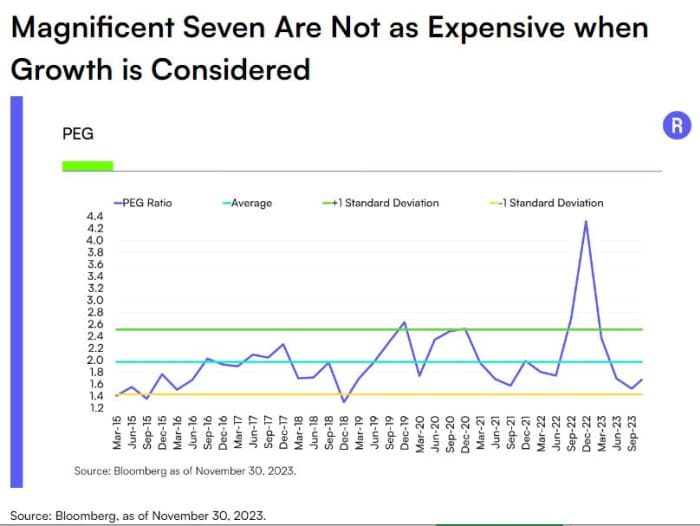

What are the Magnificent 7 Stocks? — Alphabet GOOGL,

Amazon AMZN,

Apple AAPL,

when when,

Microsoft MSFT,

NVIDIA NVDA,

And Tesla TSLA

— Is it actually cheaper? Take a look at the following chart from Dave Mazza, Chief Strategy Officer at Roundhill Investments.

Mazza focuses on the PEG ratio (price/earnings to growth), which can indicate a company’s true value, with a lower ratio meaning the stock is undervalued. The tech giant’s PEG surged to 4.32 at the end of 2022, but has now fallen to 1.68 in the third quarter. Because it’s below the historical average of 1.97, Seven “may actually be undervalued when considering revenue growth,” he wrote.

best price

The most searched stocks on MarketWatch as of 6 a.m. are:

random read

Gaelic football team battles curse of 72-year-old

A woman sells her home for her dream luxury cruise, only to have it cancelled.

What You Need to Know starts early and is updated until the opening bell rings, but if you sign up here you’ll get it delivered to your email box just once. The email version will be sent around 7:30 a.m. ET.