Impending Halving Creates Chaos and Opportunities for Bitcoin Markets

The following is an excerpt from the latest edition of Bitcoin Magazine Pro, Bitcoin Magazine’s premium markets newsletter. To be the first to get these insights and other on-chain Bitcoin market analysis delivered to your inbox, Subscribe now.

As Bitcoin halving approaches, the pressures of surging demand and decreasing supply have combined to create an unusual market, turning historically positive signs into explosive profit opportunities.

The approval of the Bitcoin ETF changed the face of Bitcoin as we know it. Since the SEC made its fateful decision last January, the results have caused upheaval around the world. Billions of dollars have flowed into these new investment opportunities, and regulators in many countries are considering Bitcoin’s role in financial institutions. Despite some early setbacks, the market has comfortably reached new all-time highs and prices have maintained a very impressive range despite the volatility.

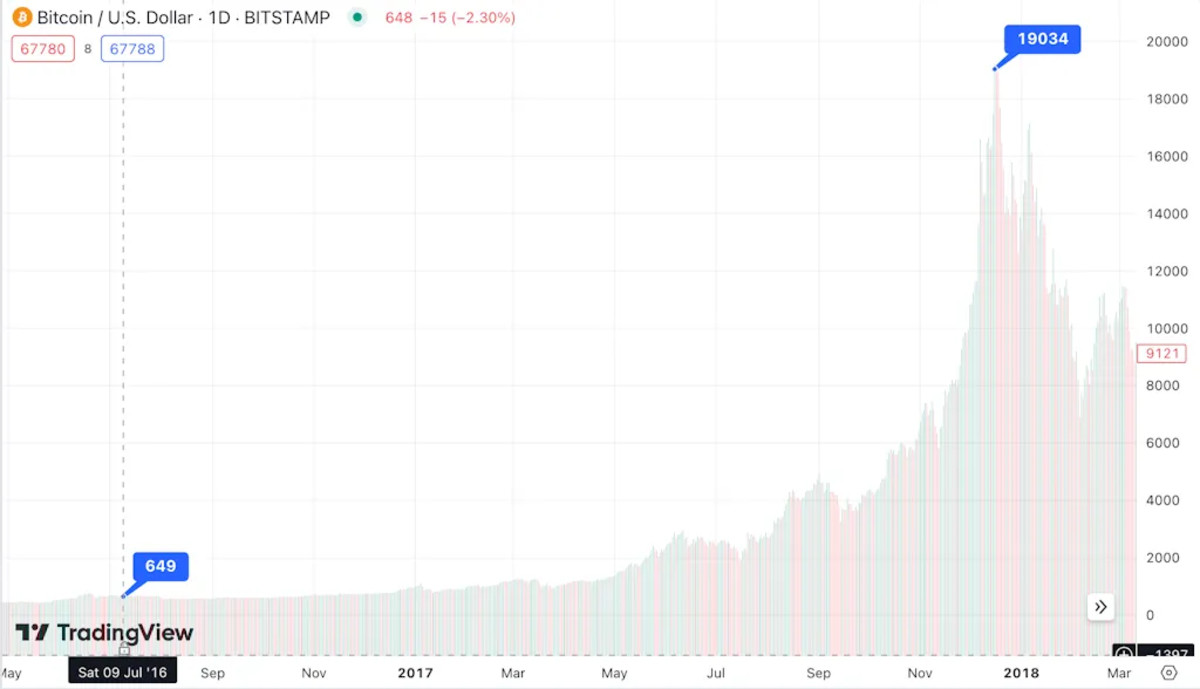

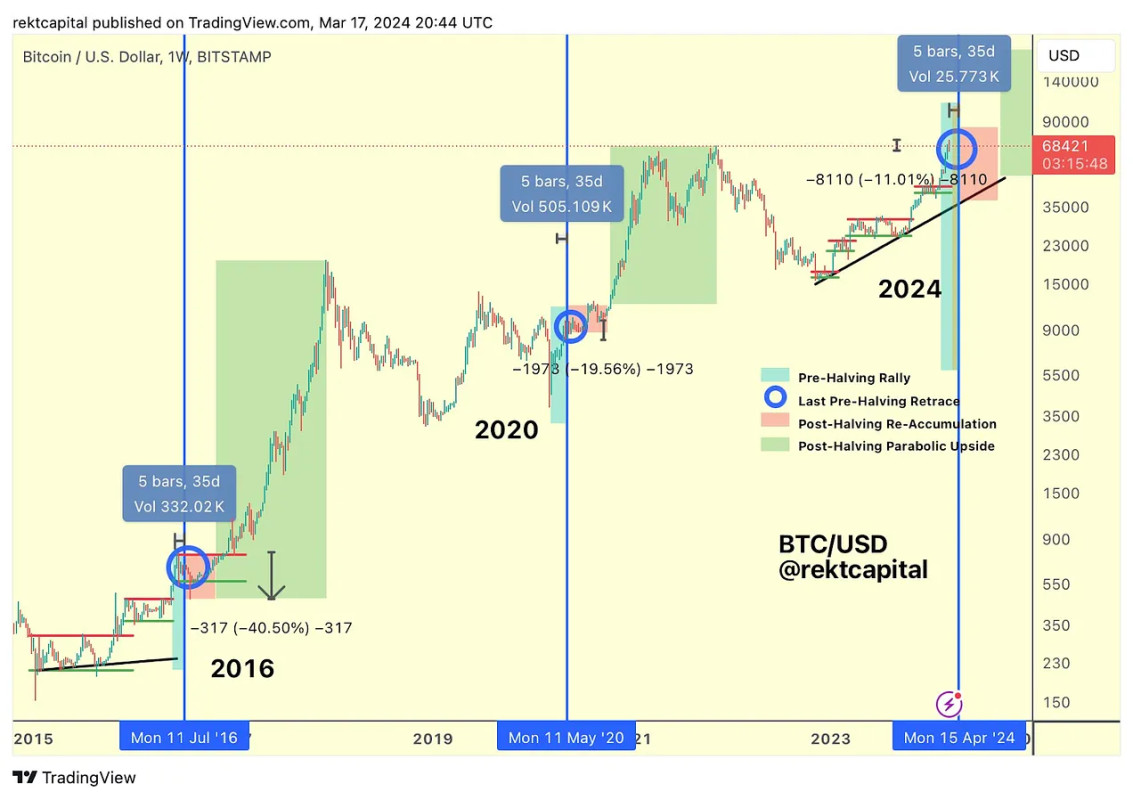

Nonetheless, we find ourselves in a very unique situation that can impact markets in unpredictable ways. Bitcoin’s next halving is scheduled to arrive in April, marking the first time in its entire history that a halving coincides with an all-time price high. There were significant differences between each major half-life, but a general trend was noticeable. Even if there are consistently massive gains, it will take between a year and 18 months for Bitcoin to break all records with a true halving. Price surge. One year after the June 2016 halving, Bitcoin has more than doubled. But after a few months, the growth was closer to 30-fold.

There is plenty of optimism coming from major industry players, such as Standard Chartered’s bold prediction that Bitcoin’s value will more than double to $150,000 before the end of the year. However, their analysis of the situation is mostly based not on the halving trend but on the runaway success of the Bitcoin ETF, and that success has also thrown us a curveball. As quickly pointed out in community discussions, these major ETF issuers have poured billions of dollars into Bitcoin, purchasing at incredible prices and amassing the world’s largest Bitcoin supply almost overnight. If they collectively buy more than the global community, how will they react as the spigot on new coins slowly closes?

In other words, demand is at an all-time high, but we are heading towards a situation where supply is insufficient to meet it. business insider The ETF called the upcoming halving a “significant event” considering it brings “permanent changes to Bitcoin’s underlying infrastructure.” Coinshares echoed this sentiment, with head of research James Butterfill warning that “Bitcoin’s launch could result in a positive demand shock.” On January 11, multiple spot Bitcoin ETFs pushed average daily demand to 4,500 Bitcoin (as of the trading day). ), while on average only 921 new bitcoins were minted per day.” And this only takes into account mining rates prior to the halving. ETF issuers are already relying on the sale of used Bitcoin to fill their coffers, and this trend seems certain to increase in the near future.

Still, isn’t this a good thing? Positive demand shocks are generally associated with price spikes. Additionally, Bitcoin is not yet an essential component of the overall global economy, even though shocks like this to critical commodities like oil could lead to inflation. It is unlikely that the same drawbacks will apply yet. That said, the answer is generally yes, but circumstances can still lead to worrying trends. For example, on the night of March 18th there were some truly puzzling developments. After hitting a high of around $70,000, the value of Bitcoin on BitMEX fell below $9,000 in the blink of an eye. The price recovered quickly, and although it was confined to this exchange anyway, it is still an unprecedented development.

BitMEX announced that the negative price surge was caused by a series of large sell orders placed in the middle of the night and that it is investigating the activity. Several anonymous whales in particular have emerged as prime candidates for such sales. We still don’t know who exactly they are or who was buying Bitcoin at such a massive rate. But this is just an example of how massive selling can erode market confidence. In any case, this episode is just a sharp example of a general trend. Bitcoin price suffers nosebleeds, resulting in “continuous” spot selling. The market hit a low of $62,000 Tuesday afternoon and reached nearly $72,000 last Friday morning.

Nonetheless, traders were thoroughly optimistic that this price decline was nothing more than a “bear trap” related to the pre-halving environment and that it was not the only one. Prominent executives, including Binance CEO Richard Teng and Crypto.com CEO Kris Marszalek, have supported the view that this kind of price decline is a perfectly natural and temporary component of the planned halving. A significant downward price trend of 20-40% was clearly observed in the weeks leading up to the most recent halving. Nonetheless, the price bounced back quickly and perfectly to hit a new all-time high.

That said, some of the recent sharp price plunges can be fully explained using data from Bitcoin’s history. The relevant question for us then is whether the future of Bitcoin will follow the same lines. The fact of the matter is that all available signs point to an optimistic long-term forecast. ETF acquisitions and the positive demand shock from the halving could make it more difficult for the average consumer to purchase Bitcoin, but how will that difficulty manifest itself? higher price. Furthermore, the selling point of ETFs is that many average consumers will use them to seek exposure to Bitcoin returns rather than direct custody. This alone will encourage ETF issuers to keep buying pressure high. It’s impossible to say how long this market situation will continue or what it will mean for Bitcoin’s use as a real currency, but as things stand now, there is nothing to suggest that Bitcoin will not continue to grow.

Is it any wonder, then, that the community is preparing for the halving with bated breath? Prominent industry figures are taking great care to prepare for “Bitcoin’s biggest celebration” with live broadcasts and gathering events in seven countries (and counting), with the halving not expected until next month either. If January’s surprising regulatory victory translates into unprecedented growth by December, 2024 will very likely be remembered as the year Bitcoin was truly intertwined with the global financial infrastructure. In fact, the most important concern is whether Bitcoin’s use as a currency will decline when its fiat value is so high. Nonetheless, the current signs seem very clear. Bitcoin is set to pave the way for the future.