Bitcoin Storage: Enough Positives to Keep Things Interesting (NASDAQ:BTM)

Michael M. Santiago/Getty Images News

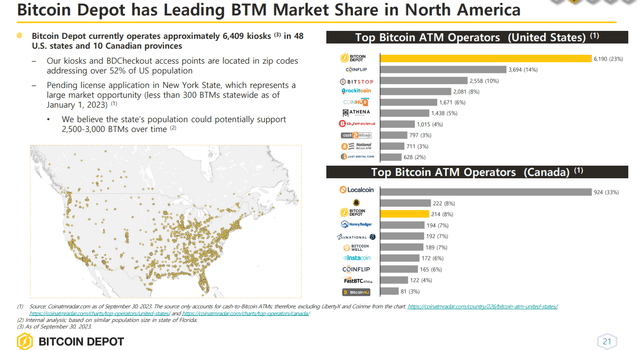

Bitcoin Depot Inc. (NASDAQ:BTM) operates North America’s largest cryptocurrency ATM network with over 6,400 kiosks. The company has been publicly traded since its SPAC merger IPO earlier this year.

The idea of converting cash to Bitcoin is Although it may seem rudimentary, Bitcoin Depot has a real business that is currently profitable and capable of conducting over $700 million in transactions this year. That said, growth has been disappointing and there are many reasons to be skeptical about this model.

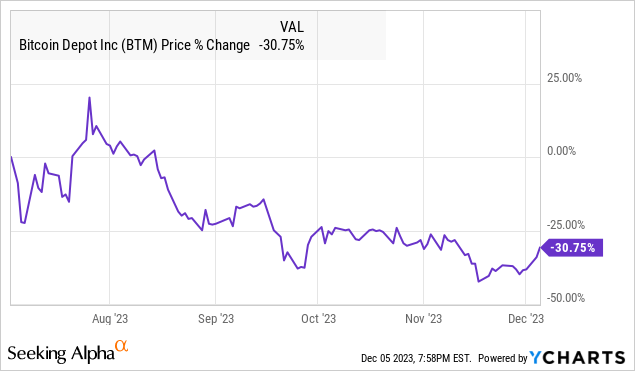

When it comes to stocks, BTM is a small player with a current market capitalization of about $150 million, down more than 30% since August. Still, we took a look and decided there were enough positive developments to keep this story interesting. Ultimately, Bitcoin Depot is highly speculative, but we believe 2024 will be an important year for the company to define its long-term strategy.

BTM Financial Summary

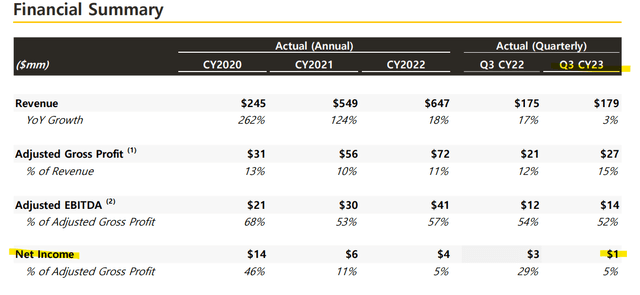

BTM reported third-quarter revenue of $179 million, up 3% year-over-year. Keep in mind that this figure captures the transaction volume of total customer Bitcoin purchases, while adjusted gross profit is a better measure of “fee income” minus Bitcoin sourcing costs. For context, Bitcoin Depot offers Bitcoin at up to a 23% markup from the quoted spot price while charging $3.00 per transaction fee.

Fortunately, adjusted gross profit of $27 million was up 29% year-over-year, and margins were also 15% higher compared to 12% in the third quarter of 2022. This strength was reflected in a 17% increase in adjusted EBITDA to $14 million. Meanwhile, net income was $1 million, down from $3 million last year, reflecting an accounting adjustment for lease liabilities.

Source: Company IR

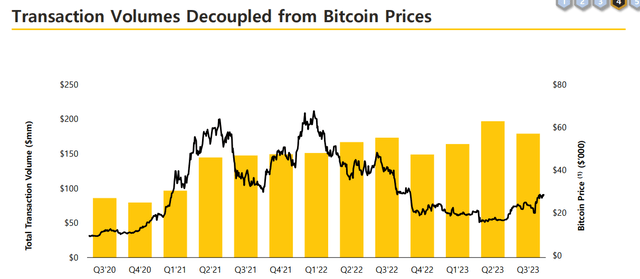

So while the numbers here are “solid,” revenue was lower than announced estimates and slowed compared to the pace in the second quarter. It is also worth pointing out that the 3% increase in transaction levels year-on-year represents a decrease in the number of transactions considering that Bitcoin (BTC-USD) price rose from ~$28,000 during the third quarter to around $21,000 in the third quarter of 2023. can. .

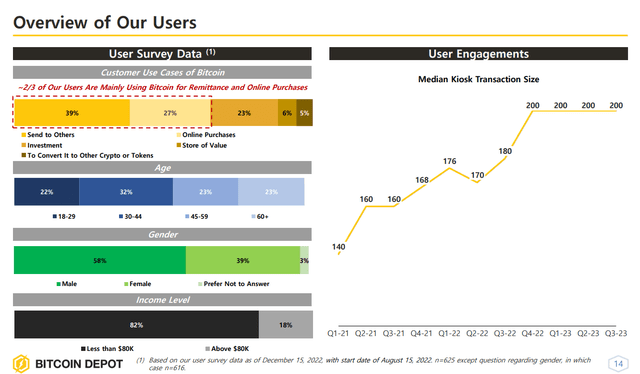

Management suggested that trading volume has historically been uncoupled or uncorrelated with Bitcoin price. While this sounds good when the Bitcoin price is falling, it would be even more encouraging to see a positive correlation, especially in an environment where the Bitcoin price is rising.

Source: Company IR

The company’s theme was to expand its “BDCheckout” program, which is currently available in 5,400 retail stores across 29 states. Instead of a traditional “ATM kiosk,” BDCheckout allows customers to purchase Bitcoin with cash at partner retailers via an app-generated QR code. The idea here represents a new driver of growth with relatively limited capital expenditure requirements.

Keep in mind that for the kiosk network, approximately 32% of all transactions are made through locations linked to ‘Circle K’ gas stations and convenience stores. It is a subsidiary of Alimentation Couche-Tard Inc. (OTCPK:ANCTF). technology with a deployment of over 1,400 kiosks.

The plan is to work with new retailers following a similar model in the future as part of its growth strategy. In particular, Bitcoin Depot has pending applications to enter New York State, one of the few markets it currently has no access to.

Source: Company IR

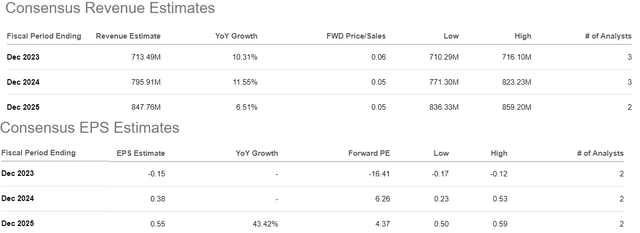

For full fiscal year 2023, pending fourth quarter results, management is targeting consolidated revenue between $700 million and $730 million, an increase of 8% to 13% compared to 2022. Adjusted EBITDA is expected to be between $56 million and $59 million for: Confirmed figures will increase by around 40% by mid-2022.

On its balance sheet, the company ended the quarter with $30 million in cash against approximately $34 million in total debt. Considering the current positive cash flows, we believe the balance sheet position is stable. There is also authorization for a $10 million share buyback through June 2024.

What’s next for BTM?

The good news is that Bitcoin’s continued rise above $40,000 is helping to reignite interest in the sector after a historically volatile 2022. The bullish case for Bitcoin Depot in the near term is that sentiment is starting to approach a speculative fever. As we saw in 2020, or even back in 2017 on a large scale, there is an influx of new buyers and demand into the market.

Based on current market conditions, we expect Bitcoin Depot to rise somewhat by 2024, but the projected revenue growth of around 10% leaves much to be desired.

pursue alpha

What we’d like to see is not only expansion efforts, but a re-acceleration of conversion volume that shows ATMs are being used more frequently and by more people.

In that regard, consumers have a variety of options when it comes to how they acquire Bitcoin and cryptocurrencies, which means physical ATMs are simply losing importance compared to fintech players.

Management explains that nearly two-thirds of users are using Bitcoin Depot kiosks for money transfers as a way to send “money” to others. With all due respect, there are better ways than paying a 23% increase.

Source: Company IR

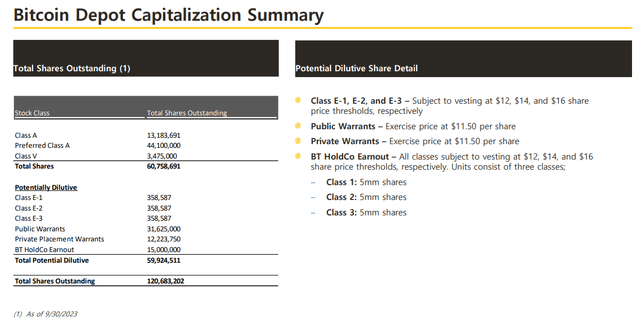

We mentioned that the stock’s current market cap is $150 million. This figure takes into account the current outstanding shares of 60.8 million. Keep in mind that Bitcoin Depot retains outstanding stock warrants and profits that are considered potentially dilutive above a certain strike price and vesting level.

By this measure, we calculate the stock’s current enterprise value to be closer to $300 million. This means BTM is valued at approximately six times future EBITDA, based on management’s annual adjusted EBITDA guidance.

While this level may be considered “cheap,” there are arguments to be made that the level of risk and uncertainty about the long-term viability of the business model justify a discounted valuation.

Source: Company IR

It is difficult to be confident that Bitcoin ATMs will still be a “thing” five or ten years from now. It’s not that Bitcoin will fail, but more the fact that there are many other viable alternatives for consumers to acquire Bitcoin digitally more effectively. Considering the competitive environment, it can be said to be a difficult business to invest in for the long term.

final thoughts

We rate BTM a Hold, taking a Neutral view on the stock at current levels. Strengths here include a path to profitability, a strong balance sheet, and consistent growth to support at least the stock’s intrinsic value. On the other hand, we believe that there are better investment opportunities in the broader cryptocurrency sector.

A key risk to consider is the possibility of operating and financial metrics underperforming over the next few quarters. A scenario where the price of Bitcoin falls significantly lower for a variety of reasons could limit demand for ATM transactions and even open the door to a decline in stocks. Financial margins and cash flow trends will be key monitoring points in the future.