MoneyControl India Stocks of the Day (February 2024)

money control It is India’s leading financial and business portal that does the job in short. (about 4 minutes) Stock of the Day Video Presentation Indian Stock Recommendations.

Indian stocks were introduced. february Today’s videos covered in this post (from newest to oldest) are:

Royal Orchid Hotels Ltd, ICICI Lombard Insurance, Cochin Shipyard, PG Electroplast Ltd, Faze Three Ltd, Global Health Limited (Medanta), Gabriel India, Aarti Industries, Kaynes Technology, Blue Star Ltd, Navin Fluorine International, Titan Company, Britannia Industries Ltd , Rategain Travel Technologies Ltd, BSE Ltd (Bombay Stock Exchange), Bharat Electronics, Kajaria Ceramics, Repco Home Finance & Krsnaa Diagnostics.

India will hold general elections over six weeks starting April 19, with votes being counted on June 4.

📰 JP Morgan believes that foreign investors are flocking to Indian stocks after the election. (Economic News) March 2024

Rajiv Batra of JPMorgan Chase & Co said the position of global funds in the $4.3 trillion Indian stock market remains shady and investors would use any correction as an opportunity to increase their holdings. His views come as foreign fund flows become more volatile ahead of the national vote due to concerns about expanding valuations.

📰 Foreign investors like Indian stocks, but they don’t like India as much. (Nikkei Asia) March 2024

The power of local conglomerates such as clubs hinders companies from entering the market.

However, there has been a recent market decline that investors should be aware of.

📰 What investors who are hurt after the small-cap crash should do now (Economic News) March 2024

Indian stock markets have experienced significant declines, especially in small-cap indices, impacting individual investors. If the stock falls 20%, you would need a 25% gain to cover your losses. Investors must consider these factors to manage their portfolio effectively.

🎥 What caused the Indian stock market crash: Everything you need to know | Favorable Situation with Palki Sharma (1st post) 6:49 minutes (March 2024)

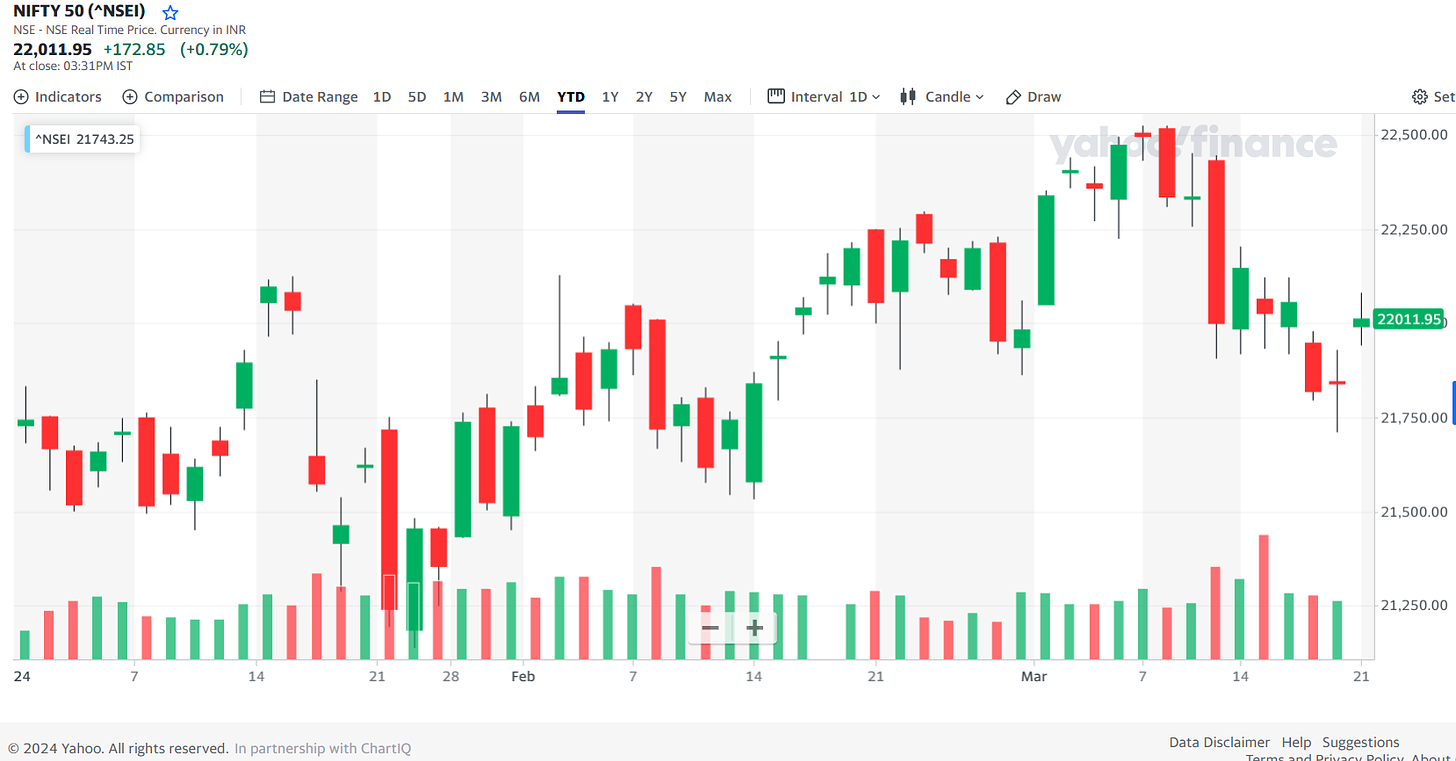

Amid the stunning recession, the Indian stock market experienced a severe collapse, with the Nifty falling by over 300 points and the Sensex plunging by nearly 1000 points. The sharp decline stands in sharp contrast to recent performance, including India overtaking Hong Kong to become the fourth-largest global stock market. Despite continued optimism from the International Monetary Fund (IMF) on India’s economic growth, stock markets witnessed widespread selling. What factors contributed to this sudden market downturn? Palki Sharma tells us.

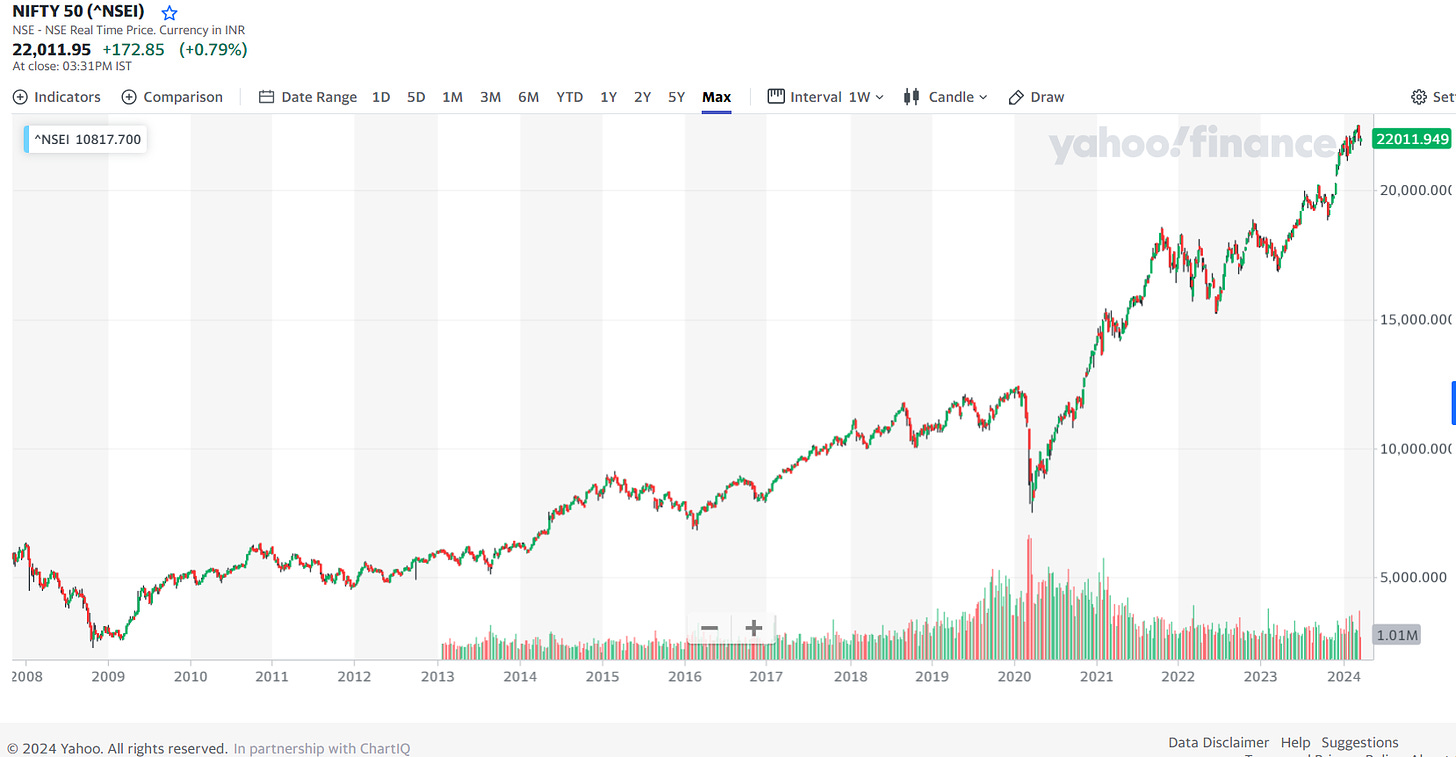

However, NIFTY 50 (which represents the weighted average of India’s 50 largest companies listed on the National Stock Exchange) is still in positive territory.

As we have repeatedly noted in the past, India has tended to have high valuations. However, this is somewhat reasonable considering the large number of domestic retail and domestic institutional investors. This means that the stock market is not dependent on fickle foreign investors or foreign capital inflows.

But this also means investors have to dig deeper beyond the big names to find value. Therefore I added Price/Book (most recent quarter) Data from Yahoo! Finance the template for this post – Of the stocks covered in this post, only one has a ratio below 1.00 (indicating it is potentially undervalued)..

To make your life easier, this post includes:

-

IR page link and Yahoo! This is a brief explanation of stock prices. Jae Won.

-

Link to Wikipedia page (for what it’s worth…)

-

that much MoneyControl stock headlines of the day and their summary What makes stock picking interesting.

-

embedded video (Again, they are usually 4 minutes long).

-

It is the price/book value (most recent quarter) ratio plus the forward or trailing P/E plus the dividend yield tied back to Yahoo! This is a financial statistics page.

-

The latest long-term technical charts financial resources linked back to Yahoo!

And as always, this post Provided for informational purposes only (And to make your life easier by providing relevant information, links and charts). This does not constitute investment advice and/or recommendations…

Royal Orchid Hotel Ltd (NSE: ROHLTD / spring: 532699) It has a strong portfolio covering over 100 properties across the country, Sri Lanka and Nepal. In 2001, the pioneering Mr. Founded by Chander K Baljee, the brand has evolved into a trusted name known for excellence and innovation in the hospitality sector.

-

Price/Book (most recent quarter): 5.08

-

Trailing P/E: 20.93 (no forward P/E) / Annual Dividend Yield: 0.59% (Yahoo! Jae Won)

ICICI Lombard Insurance (NSE: ICICIGI / spring: 540716) It is India’s largest private sector non-life insurance company and a joint venture of the following companies: ICICI Bank (NYSE: IBN) canada based Fairfax Financial Holdings Limited (this: FFH /OTCMKTS: FRFHF). The company offers comprehensive and diverse products through multiple distribution channels, including automotive, health, crop, fire, personal accident, marine, engineering and liability insurance.

-

Price/Book (most recent quarter): 6.91

-

Trailing P/E: 44.05 (no forward P/E) / Annual Dividend Yield: 0.61% (Yahoo! Jae Won)

cochin shipyard (NSE: cochinship / spring: 540678) silver Largest shipbuilding and maintenance facility In India. It is part of maritime-related facilities in Kochi, a port city in the Indian state of Kerala. Among the services provided by the shipyard are the construction of platform supply vessels and double-hulled tankers. The Indian Navy’s first indigenously built aircraft carrier, INS Vikrant, was built.

-

Price/Book (most recent quarter): 4.91

-

Trailing P/E: 40.97 (no forward P/E) / Annual Dividend Yield: 1.42% (Yahoo! Jae Won)