Bitcoin Price Prediction: BTC surges 10% on Federal Reserve meeting as experts say this cloud mining ICO could see a 10x increase on Bitcoin halving.

join us telegram A channel to stay up to date on breaking news coverage

Bitcoin prices surged 10% to $67,314 as of 2:10 a.m. ET, on volume down 17%.

This follows positive comments from Federal Reserve Chairman Jerome Powell, who indicated that Fed policymakers will cut interest rates three times this year. Previously, at the Federal Open Market Committee (FOMC) meeting, interest rates were frozen at 5.24-5.50% for the fifth consecutive time.

Markets are rooting for a positive outcome from the FOMC meeting! At the meeting, 19 U.S. policymakers expected three interest rate cuts this year, while others expected two or fewer.

So it is very clear that the rate cuts will start in 2024. And this hint is that the market… pic.twitter.com/9km3zJ92ea

— Sahil Bhadviya (@sahilbhadviya) March 21, 2024

It was enough to boost the cryptocurrency market amid expectations that liquidity will improve in the future.

#FOMC The latest Fed dotplot indicates that the median of three rate cuts is expected to be slim in 2024. pic.twitter.com/IcaHnm3Fxu

— Wall Street Engine (@wallstengine) March 20, 2024

For the average person, there are three reasons why a potential interest rate cut could be positive for Bitcoin and cryptocurrencies in general.

Why interest rate cuts are positive for Bitcoin price

First, traditional investments like bonds and savings accounts have lower returns and are less attractive to investors, forcing them to look for alternatives.

Second, falling interest rates could reignite inflation concerns and force investors to seek hedges. BTC’s fixed supply and decentralized nature lead some investors to see it as a hedge against inflation, making it more attractive in times of economic uncertainty.

Lastly, expectations of interest rate cuts can affect investor sentiment and lead to speculative activity in the market. This could increase demand for BTC as investors look to capitalize on potential price increases.

Bitcoin Price Faces Spot BTC ETF Headwinds

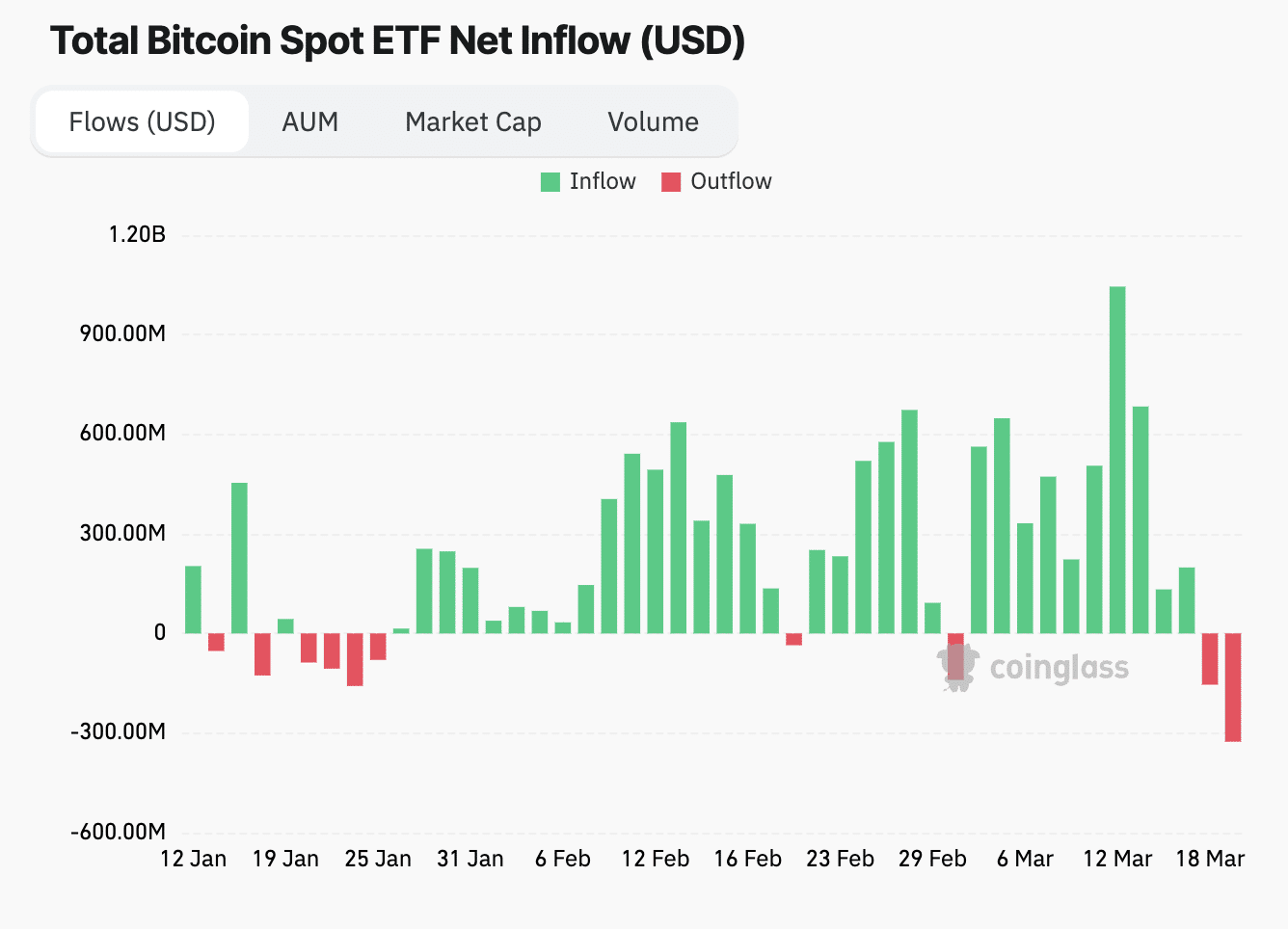

Despite the surge in Bitcoin prices, there is a headwind as ETF inflows continue to decline. According to Coinglass, data inflows are starting to decline significantly.

After recording a peak inflow of $1.04 billion on March 13, net outflows reached $154 million on March 18 and $326 million on March 19.

BTCETF flow

Bitcoin price forecast

Increased inflows into the BTC spot ETF investment product could push the Bitcoin price north to a new all-time high above $73,777. The interest rate story has already played a role in revitalizing the market, setting the tone for the continuation of the recovery.

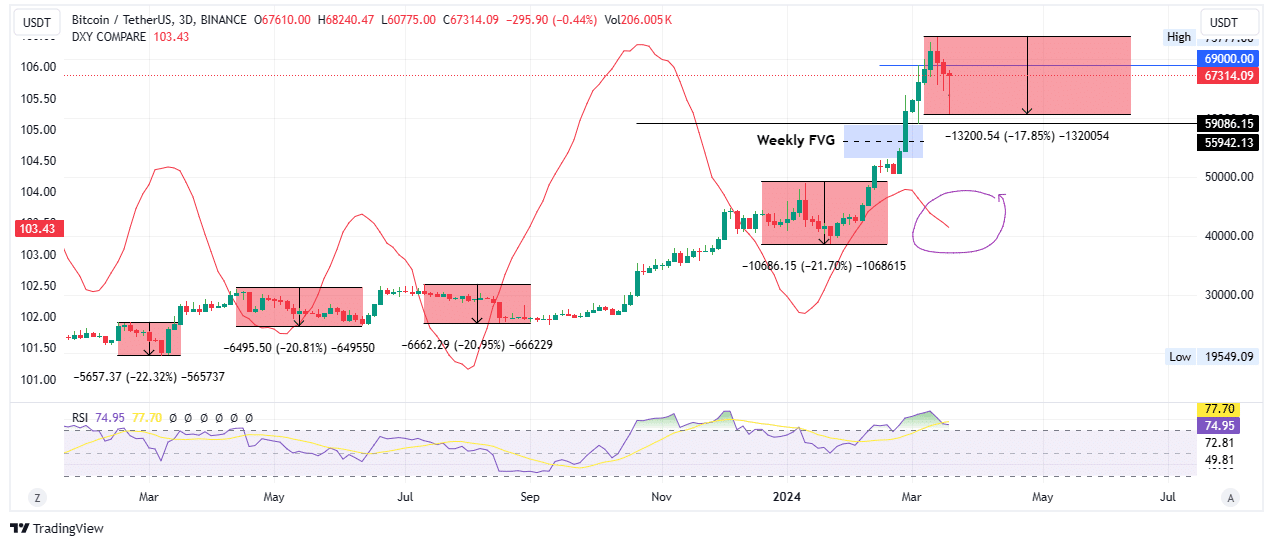

From a technical perspective, the odds are still in favor of the bulls as the position of the Relative Strength Index (RSI) is well above 50, supporting the bullish thesis. Additionally, the DXY indicator is falling, which is another signal for BTC holders. Looking back, whenever this overlay comparison goes down (bearish), the results are almost always bullish for Bitcoin.

By doing this, the Fed likely saved the Bitcoin price from further downward momentum.

TradingView: BTC/USDT 3-day chart

On the other hand, since the bull market began in 2023, the price of Bitcoin has recorded several declines, all averaging 20% declines. If history repeats itself, or at best rhymes, Bitcoin price could still fall to test the weekly imbalance in the fair value gap (FVG), which extends from $52,985 to $59,005. Late bullish and underprivileged investors may have the opportunity to buy corrections to this order block.

Meanwhile, with the price of Bitcoin soaring, experts say BTCMTX is perfectly placed for a 10x due to the Bitcoin halving in April.

A promising alternative to Bitcoin

Bitcoin Minetrix is a cloud mining project that allows ordinary people to acquire Bitcoin ownership. This allows users to stake the native token, BTCMTX, and receive credits that can be used to mine Bitcoin itself.

explore possibilities #Bitcoin Metrics!

✅ Smooth start for newcomers.

💵 Cost-effective with no initial hardware costs.

🌈 Say goodbye to worrying about location, noise, and temperature!

🔁 Easy improvements with little hassle. pic.twitter.com/uKo48Ug9h2

— Bitcoin Minetrix (@bitcoinminetrix) March 20, 2024

It is currently in the pre-sale phase, so interested investors can purchase BTCMTX for just $0.0141 once phase 32 is over.

To date, the pre-sale goal has reached $12.472 million out of $13.302 million.

@MarathonDH Strengthen your infrastructure by: #BitcoinA code update is imminent, aiming to remain competitive amid revenue cuts. 🔧

How do you think miners will navigate the changing landscape following the halving? 🤔#Bitcoin Metrics We’ve also reached a new milestone, surpassing $12,400,000! pic.twitter.com/vDDa2zgGXa

— Bitcoin Minetrix (@bitcoinminetrix) March 18, 2024

To learn more about the project, visit the website and purchase BTCMTX tokens here.

Also read:

Green Bitcoin – Gamified Green Staking

- Coinsult’s contract audit

- Early Access Presale Now Live – greenbitcoin.xyz

- Profit Forecast – Cointelegraph Feature

- Staking Rewards and Token Bonuses

- Over $7 Million Raised – Ending Soon

join us telegram A channel to stay up to date on breaking news coverage