Emerging Market Links + The Week Ahead (March 25, 2024)

Vietnam has seen the second president ousted in 14 months – although its not yet clear if this due to the continued anti-graft drive. Unlike in China where President Xi Jinping has consolidated power, the gloves have been coming off in the battle for power between various factions of Vietnam’s Communist Party. As with the anti-China protests that turned into riots ten years ago, this sort of instability could impact Vietnam’s attractiveness as a friendshoring and investment destination.

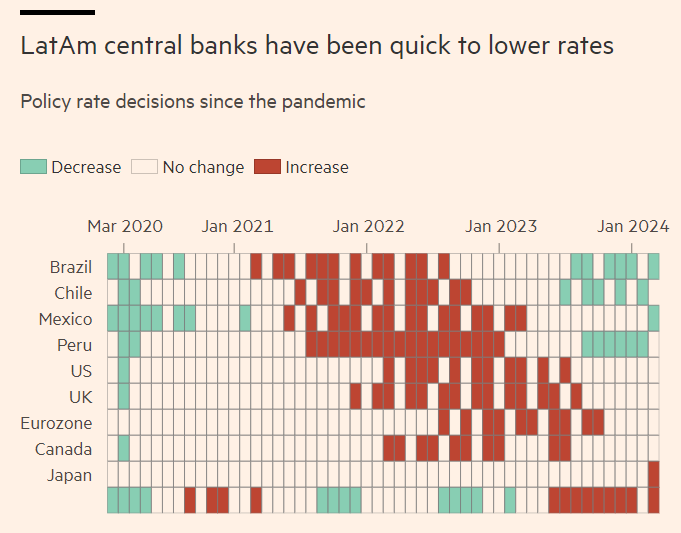

Mexico becomes the latest major Latin America economy to cut rates. However, there is some concern that Mexico’s perceived nearshoring advantages are fading as costs rise.

Finally, I have updated the ETF launch and liquidation sections at the end of this post. Global X has liquidated approximately ten China ETFs (many have experienced large outflows) plus their Pakistan ETF. Two more emerging market ESG ETFs, one from BNY Mellon (“investor behavior has shifted…”) and another from WisdomTree (“lack of investor demand…”), have also liquidated as ESG becomes more toxic. Most of these ETFs also had less than $10 million in assets and were likely unprofitable for their big global asset managers.

$ = behind a paywall

-

🇮🇳 moneycontrol India Stock of the Day (February 2024) Partially $

-

Royal Orchid Hotels Ltd, ICICI Lombard Insurance, Cochin Shipyard, PG Electroplast Ltd, Faze Three Ltd, Global Health Limited (Medanta), Gabriel India, Aarti Industries, Kaynes Technology, Blue Star Ltd, Navin Fluorine International, Titan Company, Britannia Industries Ltd, Rategain Travel Technologies Ltd, BSE Ltd (Bombay Stock Exchange), Bharat Electronics, Kajaria Ceramics, Repco Home Finance & Krsnaa Diagnostics

-

-

🇰🇷 Mirae Asset Securities’ Korean Stock Picks (February 2024) Partially $

-

Focus on tangible book value + LX Hausys Ltd, Dentium, KoreaGasCorp, HYBE, Kolmar Korea, Hanwha Systems, Hanwha Aerospace, KEPCO, InBody, Hanwha Solutions, Iljin HySolus, Hyundai Livart Furniture, JejuAir, SOCAR, SK Oceanplant, CS Wind Corp, Ray Co Ltd, Seegene, HD Hyundai Electric, Korea Aerospace Industries, Dong-A ST Co Ltd, PearlAbyss Corp, Kakao, Classys, Neowiz, Vieworks, Pan Ocean, CJ Logistics, SM Entertainment, Krafton, KT Corp, NCSoft Corp, CS Bearing Co, Kakao Games, LIG Nex1 Co, Lotte Rental, LG Uplus, Lotte Chemical, Netmarble Corp, Wemade, OCI Holdings, SoluM Co Ltd, Yuhan Corp, SK Innovation, SKC, Vatech, Hankook Tire & Technology, HL Mando Corp, SK Telecom, Daewoong Pharmaceutical, Koh Young Technology, Hanmi Pharma, LX International, S-Oil Corp, NAVER, ST Pharm, Hyundai Rotem, DL E&C Co Ltd, GS Engineering & Construction Corp, CowinTech, LG H&H, Samsung Electro-Mechanics Co Ltd, Samsung C&T Corp, Posco International Corp, Samsung Electronics, LG Chem & Samsung SDI.

-

-

🌏 EM Fund Stock Picks & Country Commentaries (March 24, 2024) $

-

Confident outlook for Asia dividends, robust earnings for some SE Asia stocks, key drivers of sovereign bond ratings, Greek banks, value to be found in South African banks (Standard Bank), EPAM, etc.

-

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 Alibaba’s Strategy Reset (Investing in China)

There is a striking contrast between JD.com (NASDAQ: JD) and Alibaba (NYSE: BABA), especially in their strategic approaches to business adjustments and market challenges.

Alibaba’s strategic realignment marks a pivotal moment in the company’s history, as it seeks to navigate through the challenges posed by delayed adjustments and leadership missteps. The good news is that current management has recognized the problems, albeit late. It’s time to execute the changes now that their competitors made some time ago. However, the good news is that at current levels, most of the bad things are priced in, and any progress should push the stock upwards. I’m not aiming for a detailed valuation at this point as this article is already too long, but it seems clear to me that the cash position and Chinese e-commerce alone should be equal to the current market capitalization.

🇨🇳 (PDD Holdings (PDD US, BUY, TP US$159) TP Change): Bargain Valuation, Even if Temu Disappears (SmartKarma) $

PDD Holdings (NASDAQ: PDD) or Pinduoduo reported C4Q23 top-line, non-GAAP EBIT, and non-GAAP net income (2.4%), 12.4%, and 24% vs. our est., and 11.6%, 37.0%, and 50.3% vs. cons., respectively;

We estimate the beat was driven by (1) improved take rate on the China platform following ad tool adjustments, and (2) Temu margin expansion;

We remove Temu US from our model from 2025+, as restrictions seem more than likely following the TikTok ban and cut TP to US$ 159 to reflect this;

🇨🇳 PDD (PDD): 4Q23, Time for Low Price Goods, Revenue up by 123% YoY (SmartKarma) $

Both advertising revenue and commission revenue grew dramatically in 4Q23.

Chinese consumers are seeking low price goods, after the economy went weak.

PDD Holdings (NASDAQ: PDD)’s overseas brand, TEMU, is expanding rapidly in the U.S.

🇨🇳 Pinduoduo (PDD US): Growth Worries Overdone (SmartKarma) $

Concerns around slowdown in growth are behind the disconnect between PDD Holdings (NASDAQ: PDD)’s stellar 4Q23 results and lackluster share performance, in our view.

We have seen this before. If history is a guide, its valuation will improve after growth hits bottom in 1Q24.

We expect PDD to deliver 50% plus growth for 2024 and generate US$14 billion adjusted net profit. Reiterate US$240 billion target market cap or 50% upside.

🇨🇳 🇰🇷 China’s ecommerce groups make inroads in South Korea with lure of low prices (FT) $ 🗃️

🇨🇳 Xiaomi builds in-house sales network for first electric car (Caixin) $

Chinese smartphone giant Xiaomi (HKG: 1810 / FRA: 3CP / OTCMKTS: XIACF) (小米集团) said that it is building a three-layered sales network centered on its own retail stores for its first electric vehicle (EV), the SU7, which will be available for purchase next week.

The sales network is made up of company-run delivery centers that incorporate the functions of showrooms, sales, services and customer engagement, as well as repurposed Mi Home retail stores originally designed for selling only Xiaomi-branded electronics, but that will also sell the cars, Xiaomi President Lu Weibing said Tuesday.

🇨🇳 ATRenew polishes recycling credentials to record first profit (Bamboo Works) $

The recycling specialist has been profitable on a non-GAAP basis for the last two years, but made its first GAAP net profit in last year’s fourth quarter

ATRenew (NYSE: RERE)’s revenue rose 30% in the fourth quarter, as its non-GAAP operating margin improved by 0.9 percentage points on growing efficiencies

The company’s iPhone recycling collaboration with Apple generated an additional 300 million yuan in revenue during the fourth quarter

🇨🇳 Pop Mart (9992 HK): International Expansion Is For Real (SmartKarma) $

The thesis for Pop Mart International Group (HKG: 9992 / FRA: 735) (known for selling collectable ‘designer’ toys) is the successful expansion of its international business, which made up 13% of sales in 1H23 but is growing exponentially.

This has been proved true in the latest announced 2023 results, with a 135% growth in 2023 for the international business, and a further >100% growth guidance for 2024.

The company is trading at 24x 2024 earnings, assuming a 35% net profit growth in 2024.

🇨🇳 Xtep International (1368 HK): Valuation Too Cheap For A >10% Growth Stock (SmartKarma) $

(Sports equipment maker) Xtep (HKG: 1368 / FRA: 4QI / OTCMKTS: XTEPY / XTPEF) announced in-line 2023 results, with net profit up 12% yoy and sales up 11% yoy. 2024 outlook was also satisfactory.

The company paid out 50% of its earnings in dividend, which amounted to a 5% dividend yield at current share price of HKD5.04.

The company is currently trading at 10x 2024 PE (assuming a conservative 10% net profit growth in 2024).

🇨🇳 (Kuaishou (1024 HK, BUY, TP HK$81) TP Change): Prime Beneficiary of Playlet Induced Traffic (SmartKarma) $

Kuaishou Technology (HKG: 1024 / 81024 / LON: 0A74 / OTCMKTS: KUASF / KSHTY) reported C4Q23 revenue, IFRS OP, and IFRS net income in line, 31%, and 51% vs. our estimates; and in line, 43%, and 67% vs. consensus.

The significant profit beat was mainly due to the rich content supply on the platform that led to organic traffic influx, resulted in marketing costs reductions.

We raised our TP by HK$2 to HK$81, implies 20X PE, vs. current trading at 13X PE for 2025.

🇨🇳 KS / Kuaishou (1024 HK): 4Q23, Historical High Operating Profit (SmartKarma) $

Operating profit and its margin reached historical high in 4Q23.

Monthly active user base continued to expand, which is rare for other apps.

GMV (Gross Merchandise Value) of the live broadcasting sales increased rapidly by 29% YoY in 4Q23.

🇨🇳 Investors unimpressed by massive dividend from shrinking Lufax (Bamboo Works)

The online lender’s American depositary shares rose by just $1.11 in the two days after it announced a special dividend of $2.42 per ADS

Lufax Holdings (NYSE: LU) announced a massive special dividend of $2.42 per ADS, equal to about half of its Friday closing price of $4.48

The company slashed the size of its loan portfolio by 45% last year, and expects to reduce it by another 32% this year as it focuses on higher quality borrowers

🇨🇳 Forget about growth. Qifu shows it’s all about giving back to shareholders (Bamboo Works)

In reporting its earnings for the fourth quarter of 2023, the online loan facilitator unveiled a plan to sharply ramp up its share buyback program

Qifu (NASDAQ: QFIN)’s revenue grew 13% year-on-year in the fourth quarter, and its net profit rose by more than 20%

The company announced plans to repurchase up to $350 million worth of its shares, far more than the $132 million in repurchased from last June to March this year

🇨🇳 Ailing property market got you down? Not if you’re KE Holdings (Bamboo Works)

The integrated online and offline real estate broker returned to the black last year and paid a generous dividend despite operating in China’s weak property market

KE Holdings (NYSE: BEKE) posted a net profit of 5.89 billion yuan for 2023, returning to the black after losing 1.4 billion yuan in 2022

The leading property broker paid a generous final dividend of $0.351 per American depositary share

🇨🇳 Tencent Posts Weaker Quarterly Results Amid Gaming Challenges (Caixin) $

Tencent (HKG: 0700 / LON: 0LEA / FRA: NNND / OTCMKTS: TCEHY) (腾讯) reported weaker-than-expected results in the fourth quarter of 2023, as the Chinese internet behemoth faced challenges growing its gaming business, particularly in China’s domestic market.

During the three-month period, Hong Kong-listed Tencent generated 155.2 billion yuan ($21.9 billion) in revenue, up 7% from 2022, according to its earnings report released Wednesday. That missed the average estimate of 157.4 billion yuan by analysts surveyed by Bloomberg.

🇨🇳 Why JL Mag came unstuck, but is getting back on track (Bamboo Works)

The company is going through a difficult adjustment after a plunge in the price of neodymium, a key ingredient in the rare earth permanent magnets that are its core product

Jl Mag Rare-Earth Co Ltd (SHE: 300748 / HKG: 6680 / FRA: 3KLA)’s profit and revenue fell sharply last year, as neodymium prices fell by 40% over that time

China expanded its production quotas for rare earth three times in 2023, driving prices down and creating a supply glut

🇨🇳 Solar storm takes the shine off JinkoSolar (Bamboo Works)

The solar panel maker’s revenue rose just 9.4% in last year’s fourth quarter, far slower than its 66% jump in product shipments, as the industry suffered from tumbling prices

JinkoSolar Holding Co., Ltd (NYSE: JKS)’s margins plunged in the fourth quarter due to sinking prices, and the company may have only remained profitable with help from government subsidies

The company predicted consolidation in the solar sector will accelerate this year, with the top 10 producers controlling 90% of the market by year-end, up from 70% in 2023

🇨🇳 China’s hard liquor remains a hard sell overseas (Caixin) $

Kweichow Moutai (SHA: 600519) / ZJLD Group (HKG: 6979)

Baijiu-makers ramping up efforts to expand their customer base outside China are facing a tough sell among drinkers of non-Chinese descent, who prefer Western tipples such as gin and whisky, with global shipments of the fiery grain-based liquor that is so ubiquitous at business banquets and weddings slipping last year.

In 2023, China’s baijiu exports slid 5.5% year-on-year to 15,000 kiloliters

(4 million gallons), which accounted for only 0.3% of the total baijiu output that year, data from the General Administration of Customs and the National Bureau of Statistics showed

🇨🇳 Pre-IPO Sichuan Baicha Baidao Industrial – High Profitability and Growth May Not Be Sustainable (SmartKarma) $

Baicha Baidao’s business model is similar to MIXUE, but MIXUE has more heavy-asset model with own supply chain, while Baicha Baidao is more of a “transfer station” for raw materials.

Single store data of Baicha Baidao showed varying degrees of decline. It’s uncertain whether Baicha Baidao would maintain current market share/revenue growth/high gross margin in front of fierce homogeneous competition.

When Baicha Baidao submitted prospectus last year, its valuation was already about RMB18 billion.We think its valuation would be lower than MIXUE, close to Guming and higher than Auntea Jenny.

🇨🇳 Carote cooks up big growth with own-brand strategy (Bamboo Works) & Carote Ltd Pre-IPO Tearsheet (Smart Karma) $

With a young, second-generation management team in charge, the kitchenware maker has filed for a Hong Kong IPO to keep fueling its recent recipe for strong growth

Carote’s revenue and profit have grown explosively over the past three years, including 118% profit growth last year to 237 million yuan

The kitchenware maker has been shifting its focus to higher-margin own-brand products, which contributed 87.2% of its revenue last year

🇨🇳 China’s luxury tastes are changing (FT) $ 🗃️

Europe’s high-end houses are being challenged by the rapid growth of local brands

Shopper preferences are shifting away from affordable, mass market luxury to less frequent but higher-end purchases. With that comes a tendency to favour classic products, meaning a smaller number of brands are getting more demand. As share prices of European luxury companies fell this week after Kering SA (EPA: KER / OTCMKTS: PPRUF)’s warning, LVMH Moët Hennessy Louis Vuitton (EPA: MC / OTCMKTS: LVMUY / LVMHF) and Hermes International (EPA: RMS / OTCMKTS: HESAF) fared best.

🇨🇳 China will be a huge market for weight-loss drugs (FT) $ 🗃️

There is an opportunity for local pharma groups, which Nomura says could take a fifth of the market by 2033

These locally-made drugs are not far off hitting the market. Those from Chinese groups Shanghai Benemae Pharmaceutical and Huadong Medicine (SHE: 000963) have recently received approval. Suzhou-based biotech group Innovent Biologics (HKG: 1801 / FRA: 6IB / OTCMKTS: IVBXF / IVBIY) has the Chinese rights to a promising next generation obesity drug from Eli Lilly called Mazdutide. It announced positive late-stage trial results in January.

🇨🇳 Slowing revenue growth hurts online drug platform YSB (Bamboo Works)

The B2B drug distributor posted higher annual revenues and swung to an adjusted profit, but disappointed investors still sent the firm’s stock down 9% on the day after the earnings

The gross margin on the company’s proprietary drug distribution business, its main revenue source, edged down to 6.1% last year

With the pharma market already well developed, several distribution giants have muscled onto YSB Inc (HKG: 9885)’s turf as suppliers to pharmacies and smaller clinics

🇨🇳 GenScript losses shrink on strong growth for cancer cell therapy (Bamboo Works)

The pharma company’s losses narrowed 58% last year, as its life sciences and cell therapy businesses experienced strong growth

Genscript Biotech Corp (HKG: 1548 / FRA: G51 / OTCMKTS: GNNSF)’s cell therapy revenue grew by 143.7% last year as a CAR-T cell therapy developed by its Legend Biotech subsidiary gained traction

Legend’s Carvykti is expected to hit annual production capacity of 10,000 doses by the end of 2025

🇭🇰 Samsonite (1910 HK)- another homecoming queen (Alex’s Investment Memo)

Samsonite International SA (HKG: 1910 / FRA: 1SO / OTCMKTS: SMSOF) is the sole luggage leader in the world, with 15% market share and a world-renown brand portfolio consists of Samonite, Tumi, American Tourister, Gregory, etc. Other than Rimowa and the special product line of those super luxury fancy brands, the market is just Samsonite and a bunch of cheap unbranded products. (TBH I don’t care about the brand of my luggage at all, but my wife bought two Samsonites last year. Perhaps that explains why the market structure looks like that. Yet I don’t mind to buy a Samsonite or Rimowa if I don’t have to pay my kids’ tuition. LV? My Uniqlo tee shouts Nooooo!) Conclusion: it’s definitely an above-average business with some branding moat (80-90% GPM on direct sales) and 15% ROIC in the long run, with good momentum.

🇭🇰 Pentamaster International (1665 HK) (Asian Century Stocks)

The operating company in the Pentamaster group at 6.1x P/E

A few weeks ago, Olivier at Emerging Value wrote about Pentamaster International Ltd (HKG: 1665 / OTCMKTS: PNMRF) (US$246 million) and his write-up caught my attention.

Pentamaster is one of the largest manufacturers of automated test equipment (ATE) for electronic devices. Such devices include non-memory products such as semiconductor chips, electro-optical sensors, power modules and LED lights. In the past, such work would have been done manually, but since the 1980s, machines from Pentamaster and others perform this task automatically at high speed.

The company is also involved in factory automation projects.

🇭🇰 Giordano under attack – please vote! (Apollo Asia Fund)

Giordano International (HKG: 0709 / FRA: GIO / OTCMKTS: GRDZF) shareholders, our company is under attack: please ensure that you vote at the Special General Meeting on 3rd April. Other readers, please help us to spread the word, about the importance of the vote and the interesting situation now emerging.

The Chow Tai Fook group (CTF), controlled by Henry Cheng, made a lowball bid for the company in 2022. It had made its bid conditional on reaching a shareholding over 50%, and did not, so the bid lapsed with no change in its ownership. Now it seeks control without paying at all, through resolutions to oust CEO Peter Lau and appoint four new directors to the board. (It now has 2 of 8 directors; its proposals would give it 6 appointees on a board of 11.)

Garment retail is tricky, but Giordano has made a loss in only one of the 33 years since IPO (Covid-year-1), and has never omitted a dividend. It supplies affordable everyday clothing to a wide range of consumers in some of the world’s most promising markets.

🇭🇰 CK Asset: Too Early To Be Bullish (Seeking Alpha) $

CK Asset Holdings (HKG: 1113 / FRA: 1CK / OTCMKTS: CHKGF)‘ key headline financial numbers and dividend distribution for FY 2023 were not as good as what the sell-side analysts expected.

Notwithstanding the below expectations results, CK Asset has a strong financial position, and the stock is trading at a substantial discount to book value.

I maintain my Hold rating for CK Asset, as it is too early to turn positive on the stock’s prospects given that the Hong Kong property market outlook is mixed.

🇭🇰 AIA Group: Solid Income Stock, Positive Outlook (Seeking Alpha) $

AIA Group (HKG: 1299 / FRA: 7A2 / OTCMKTS: AAIGF)

The stock is being unfairly punished.

The Group’s growth story has been impeccable.

Dividends are stable and will keep growing.

🇲🇴 Dividends surprise from MGM China, Wynn Macau Ltd: JPM (GGRAsia)

In what a brokerage described as “a surprise”, two Macau casino operators respectively announced on Thursday annual dividends for the first time since the 2019 trading year preceding the Covid-19 pandemic.

The dividend move was “a year earlier than… the Street (investment community) had expected,” said JP Morgan Securities (Asia Pacific) Ltd in a Friday note.

“This means three out of six (Macau) operators are now paying dividends, including Galaxy Entertainment (HKG: 0027 / OTCMKTS: GXYEF) and we expect Sands China (HKG: 1928 / FRA: 599A / OTCMKTS: SCHYY / OTCMKTS: SCHYF) to follow suit next year… while Melco Resorts & Entertainment Ltd (NASDAQ: MLCO) and SJM Holdings (HKG: 0880 / FRA: 3MG1 / KRX: 025530 / OTCMKTS: SJMHF / SJMHY) may prioritise deleveraging for some time,” wrote analysts DS Kim, Mufan Shi, and Selina Li.

🇰🇷 Magnachip Semiconductor: An Intriguing Stock On A Bad Streak (Seeking Alpha) $

The stock hit a new multi-year low after a Q4 report that might have been the worst ever, but Magnachip Semiconductor Corp (NYSE: MX) has been on the move lately.

MX is on an awful streak with the stock losing ground for almost three years, which might nonetheless be an opportunity for some.

MX is calling for a return to growth in 2024 after many years, but how sustainable it is is up for discussion for several reasons.

Long MX will find its supporters, and not without reason, but there will also be those who are not yet convinced now is the time.

🇰🇷 Magnachip Semiconductor Corp Is A Hold Opportunity While Insiders Buy (Seeking Alpha) $

Magnachip Semiconductor Corp (NYSE: MX) faces risks including low sentiment, declining revenue, and fierce competition in the semiconductor industry.

The company’s valuation shows potential with insider buying, no debt, low levered/unlevered Beta and perhaps a buyout by a Chinese company.

However, the overall outlook for Magnachip is negative per growth, earnings and sentiment. It is a risky investment for retail value investors.

🇰🇷 LG Corp: Updated NAV Analysis Amid Ongoing Corporate Value Up Program in Korea (Douglas Research Insights) $

Our NAV analysis of LG Corp (KRX: 003550) suggests an implied market cap of 16.3 trillion won or 103,781 won per share which is 16% higher than current share price.

For holdco discount, we used a 50% holdco discount. If investors perceive improvement in value (such as through corporate governance improvements), the holdco discount on LG Corp would decline.

LG Corp’s shares are up 5.9% in the past six months, outperforming all the major LG Group related companies including LG Chem, LG H&H, LG Electronics, and LG Energy Solution.

🇰🇷 Korea Small Cap Gem #27: Wins Co. (Douglas Research Insights) $

Wins Co (KOSDAQ: 136540) is engaged in the business of developing and supplying information security solutions and developing software related to network security to protect networks from cyber threats and viruses.

The company has a consistent growth in sales and profits. It also has a strong balance sheet. At the end of 2023, it had a debt ratio of 15.4%.

Wins Co is trading at EV/EBITDA of 1.7x, P/E of 7.8x, and P/B of 0.9x in 2024 which are 75%, 26%, and 25% lower than the historical valuation multiples.

🇰🇷 Jeil Machine & Solution IPO Valuation Analysis (Douglas Research Insights) $

Jeil Machine & Solution (JMS KS) was founded by CEO Lee Hyo-won as Jeil Machinery in Seongsu-dong, Seoul in 1981. Jeil M&S started out by supplying specialized equipment for food and pharmaceuticals and is currently expanding its business to rechargeable batteries, defense industry, and chemicals.

The company had order backlog of 303.3 billion won at the end of 2023, up 155% YoY. The company generated sales of 143.2 billion won, up 131.4% YoY.

🇸🇬 Haw Par: The Sleepy 4% Yielder in 2024. (Inve$tment Moat$)

My friend Xiaoboi has a very, very short commentary on Haw Par (SGX: H02 / OTCMKTS: HAWPF) results where he say spinning out the Tiger Balm may help.

Haw Par feels like a sort of junk, high-yield bond masquerading as a stock. Some may not like me calling it a junk bond but that is what junk bond feels like: some sort of equity with a good income angle. I am not sure whether an investor will get a good capital appreciation out of this, much like a junk bond. It is not as interest rate sensitive as the typical bonds, just like junk bonds.

🇸🇬 Seatrium Aims for a Return on Equity of More Than 8% by 2028: 5 Highlights from its Latest Investor Day (The Smart Investor)

The oil rig manufacturer and shipbuilder set lofty targets for 2028 during its recent Investor Day.

Seatrium Limited (SGX: S51 / FRA: S8N / OTCMKTS: SMBMF) may have reported a downbeat set of earnings for 2023, but the blue-chip group is looking at the future rather than the past.

Here are several highlights from Seatrium’s inaugural Investor Day.

A four-prong strategy

Strong oil and gas demand expected

Blown away by wind power

Large and attractive market for repairs and upgrades

Lofty financial targets for 2028

🇸🇬 SATS Announced an Upbeat Business Update Along with an Acquisition: Can its Share Price Soar? (The Smart Investor)

The airline food caterer’s financial numbers are improving. Can its share price perform well this year?

SATS Ltd (SGX: S58 / FRA: W1J / OTCMKTS: SPASF) is upping its game.

Not only did the airline ground handler and food caterer report a sparkling set of numbers for its latest business update, but management also followed up with an acquisition and divestment.

A healthy set of financial numbers

Robust operating metrics

Acquiring capacity to grow further

Effective capital recycling

Get Smart: Patience is required

🇲🇾 GEN Malaysia 2024 forecast dip amid mass rejig: analyst (GGRAsia)

An investment bank expects 2024 revenue at Genting Malaysia (KLSE: GENM / OTCMKTS: GMALY / GMALF), the operator of Resorts World Genting (pictured in a file photo), Malaysia’s only casino resort, to rise by only 1.7 percent year-on-year. That is due to the closure – possibly for at least nine months – of two mass-market gaming floors at the Genting Highlands complex.

Maybank Investment Bank Bhd now expects full-year revenue at Genting Malaysia to be MYR10.36 billion (US$2.20 billion), compared to 2023’s just under MYR10.19 billion.

The casino company also has gaming business in the United States, the Bahamas, the United Kingdom and Egypt, but gets the bulk of its revenue from the Malaysia operation.

🇮🇳 Cisarua Mountain Dairy (CMRY IJ) – Increasingly Accessible Protein Provider (SmartKarma) $

Cisarua Mountain Dairy (Cimory) (IDX: CMRY) held an analyst call after its results, revealing a positive outlook for dairy products and premium consumer foods, with potentially higher margins ahead.

The company launched several new products in 2023, with more of a focus on affordability through yoghurt sticks. It will launch more affordable Kanzler Singles in 2H2024.

Cisarua Mountain Dairy will expand distribution through general trade and Miss Cimory MCM, with ongoing sales & marketing spending. Valuations remain attractive relative to growth and returns.

🇹🇷 TAV Havalimanlari Holding Remains An Appealing Buy (Seeking Alpha) $

TAV Havalimanlari Holding AS (IST: TAVHL / OTCMKTS: TAVHF)‘s stock price significantly recovered, gaining 45% compared to broader markets.

Risks for TAV include natural disasters, inflation, and exchange rate fluctuations.

TAV Airports’ cost growth exceeds revenue growth, but the company’s guidance suggests a bullish future with the potential for higher margins.

🇪🇬 The US$35bn Ras El-Hekma Deal: A Boon For These Listed Firms? (Capital Markets Africa)

Egypt’s infrastructure and financial firms are likely to be big winners from the development, offering stock investors compelling long-term ROI.

eFinance Investment Group (EGX: EFIH) is a holding company that owns and operates in the fields of finance, digital payments, business process outsourcing (BPO), and point of sale (POS) systems.

EFG Holding (EGX: HRHO) is one of Egypt’s largest financial firms.

Elsewedy Electric Company (EGX: SWDY) is an Egyptian engineering household name.

Talaat Moustafa Group Holding (EGX: TMGH) is a real estate developer. The company builds hotels, touristic and residential projects in Egypt.

State-owned Telecom Egypt (EGX: ETEL) has been in existence for over 160 years.

🇸🇦 Investec trades well in 2023, also benefits from rand depreciation (IOL)

Investec Group (LON: INVP / JSE: INL / INP) will report a solid financial performance for the year to March 31, based on diversified revenue streams and the success of its client acquisition strategies.

The international bank and wealth manager in the UK and South Africa said in a trading statement on Friday that the average rand/pound exchange rate depreciated by about 15% for the 11 months to February 2024, resulting in a big difference between reported and neutral currency performance.

🇵🇱 Spyrosoft – A Fascinating Player in the IT Solutions Space (WSE:SPR) (Active Balance) 7:11 Minutes

Note: Spyrosoft SA (WSE: SPR / FRA: 2NP) operates as a software engineering company

🇵🇱 Wittchen – A Polish luxury leather goods retailer (WSE:WTN) (Active Balance) 8:37 Minutes

Note: Wittchen SA (WSE: WTN / LON: 0RCI) is a manufacturer of luxury leather goods, shoes, handbags, fashionable accessories and high quality luggage

🌎 🇺🇾 DLocal: The Problem Is Its Guidance, But There’s More (Rating Downgrade) (Seeking Alpha) $

Dlocal (NASDAQ: DLO)‘s stock has experienced a sell-off due to decelerating growth rates and uncertainty surrounding foreign fintech businesses.

The company’s balance sheet is strong, with no debt and 10% of its market cap made up of cash.

DLocal’s near-term prospects are bolstered by its strategic initiatives, diversified business verticals, and strong relationships with major tech companies.

🇦🇷 YPF Stock: A Shale Oil Boom In Argentina (Seeking Alpha) $

Ypf Sa (NYSE: YPF) is trading at a 6-year high amid improving sentiment toward the Argentine economy.

The company’s latest quarterly result was highlighted by strong shale oil production growth.

We expect the momentum in the stock to continue.

🇦🇷 Despegar.com: Strong Growth In Revenue And Gross Bookings Led By Brazilian Market (Seeking Alpha) $

(Online travel stock) Despegar.com Corp (NYSE: DESP) has experienced strong growth in gross bookings and revenue, particularly in the Brazilian market.

The company’s recent earnings report showed a 31% increase in gross bookings as compared to the previous year.

Despegar.com also continues to maintain a strong balance sheet overall.

I continue to take a long-term bullish view on Despegar.com.

🇦🇷 Pampa Energia’s Q4 Decoded, Still A Hold (Seeking Alpha) $

Pampa Energia Sa (NYSE: PAM) is an integrated Argentinian energy market player involved in natural gas, energy generation, and petrochemicals.

The company’s forecasted operating income ranges for each segment are still valid, but there is an increase in operating expenses that could impact profitability long-term.

PAM’s segments, including natural gas, generation, and petrochemicals, have limitations and are not expected to experience significant growth.

🇦🇷 Bioceres Needs To Add Clarity Around Borrowings (Seeking Alpha) $

Bioceres Crop Solutions Corp (NASDAQ: BIOX) is an agricultural supply company with growth potential in seed genetics and biopesticides markets.

The company’s 2Q24 results showed revenue growth and stable cost structure, leading to profitability. These were expected, given the Argentinian drought in 2023.

Concerns remain about the company’s high debt maturities and lack of clarity on its debt and refinancing plans.

The company’s valuation is that of a high growth company, and yet Bioceres is not showing a growth trend.

🇦🇷 Loma Negra: Better To Avoid Now (Seeking Alpha) $

🇧🇷 Afya Is Performing Well And Is A Buy (Seeking Alpha) $

Afya (NASDAQ: AFYA) is one of the leading private medical education providers in Brazil.

The company’s model has several quality characteristics including high pricing power, and resiliency to economic cycles.

Afya has a significant runway to grow organically and inorganically, via seat expansions, price adjustments and acquisitions.

The current stock price represents a low multiple of FY24E free cash flow adjusted for CAPEX. This leaves most growth potential as additional upside.

🇧🇷 Vale faces £3bn legal action over 2015 Mariana dam disaster (FT) $ 🗃️

🇧🇷 Eletrobras’ Q4: Turnaround In Full Swing At A Potential Discount (Seeking Alpha) $

Eletrobras Participacoes S/A (BVMF: LIPR3) has undergone a successful turnaround process post-privatization, marked by strong results in Q4 2023.

Key achievements include increased installed capacity, successful implementation of transmission projects, and reduced operating costs.

The company’s discounted cash flow model indicates a significant margin of safety and potential for cash generation growth.

Despite legal and regulatory risks, including pending lawsuits and energy price fluctuations, the bullish stance on Eletrobrás stock is maintained.

Eletrobrás’ consistent progress in its turnaround process and diminishing political risks further support the positive outlook for the company.

🇧🇷 B3: Strong Balance Sheet And Macroeconomic Tailwind – Buy (Seeking Alpha) $

B3 (BVMF: B3SA3 / FRA: YBV0 / OTCMKTS: BOLSY) is the dominant player in its stock exchange market in Brazil, and with its long history and strong investments in infrastructure, it has irreplicable assets.

The company has a strong balance sheet, dividend paying cash cow profile, high margins and an excellent return on equity.

Additionally, it is trading at a large discount compared to its international peers, which have marginally worse financial indicators than the company.

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 Global CEOs flock to China as tensions mount over export glut (FT) $ 🗃️

🇨🇳 China Issues 24 New Measures to Attract Foreign Investment (China Briefing)

China’s legislature has released a new plan to attract foreign investment after a year of falling foreign direct investment inflows. The plan, the latest in a series of efforts to boost foreign capital in China, proposes measures to improve the business environment, ease administrative burdens, expand market access in key industries, and even the playing field for foreign companies. We outline the policy proposals that could benefit foreign companies in the coming years.

🇨🇳 Abu Dhabi fund offers to buy out investors fleeing China private equity (FT) $ 🗃️

🇨🇳 China issues stringent rules to tighten listing controls and tackle financial fraud (Caixin) $

China’s stock regulator issued two sets of rules Friday that will tighten listing requirements, crack down on financial fraud by listed companies, encourage listed firms to increase dividend payouts and buy back shares.

The rules came shortly after Wu Qing, chairman of China Securities Regulatory Commission (CSRC), promised to strictly hold the IPO threshold and make every effort to block fraudulent companies from the capital market, at a press conference during the national legislative meetings known as the Two Sessions.

🇨🇳 Cover Story: China’s Challenge to Fill the Multibillion-Dollar Insurance Blackhole & Risk now determines how strictly China’s life insurers get regulated (Caixin) $

Nearly eight years after China launched a sweeping crackdown on aggressive practices among insurers, efforts to dismantle risks in troubled institutions are still far from over, leaving by some estimates 1 trillion yuan in problematic assets.

Targeting insurers backed by private conglomerates which leveraged their sprawling reach in the finance sector to fuel risky expansion, the crackdown has led to the downfall of freewheeling giants like Anbang Insurance Group Co. Ltd. and Tomorrow Holding Co. Ltd.

At stake is an industry that constitutes more than 23% of the country’s GDP. China’s insurance industry, the world’s second-largest, had total assets of 29.6 trillion yuan by the end of September 2023, according to data from the National Administration of Financial Regulation (NAFR).

🇨🇳 In Depth: How a greying China is challenging the health care system (Caixin) $

Amid an unprecedented demographic shift, China is embracing a revolutionary transformation in health care for the elderly.

The number of Chinese people at age 60 or older tops 300 million. That group by itself would be the world’s fourth-largest nation, behind India, China and the United States. The total may exceed 400 million by 2040, according to the World Health Organization.

In response, the government has been pushing to expand health care services for the elderly, including the establishment of more geriatrics departments in hospitals. Nearly 6,000 hospitals across the country had set up geriatrics departments by 2022, a threefold increase from 2018.

🇰🇷 Korean Government Announces Tax Incentives for Shares Cancellation and Dividends (Douglas Research Insights) $

On 19 March, Choi Sang-Mok announced that the Korean government plans to provide corporate tax reduction benefits to companies that cancel their treasury shares.

The separate taxation of dividend income is also expected to be promoted. All of these are law amendment issues and must go through the legislative process of the National Assembly.

At this time, the Korean government did not provide the entire details about the exact amount of corporate tax reductions from share cancellation and separate taxation of dividend income.

🇰🇷 Back-Testing the Impact of National Assembly Elections on the Korean Stock Market (Douglas Research Insights) $

In this insight, we provide a back-testing analysis of the impact of the National Assembly Elections on the Korean stock market.

KOSPI tends to display positive price performance one month and three months prior to the election date leading up to the election date.

On the other hand, KOSPI tends to decline one month and three months post the election date. We believe that post National Assembly Election, KOSPI could face greater headwinds.

🇲🇾 Malaysia best in overall investment conditions among Asia’s emerging nations — Milken Institute (The Star)

🇲🇾 Smart Thought Of The Week: Malaysia (The Smart Investor)

According to Milken Institute, Malaysia has claimed the top spot for investors who are looking to put money into emerging and developing markets. It ranks higher than Thailand, China, Indonesia and Vietnam. The report reckons that Malaysia performed well on institutional frameworks, which has been thanks to its strong investors’ rights.

A few years ago, I felt that Malaysian shares were ostensibly cheap. I didn’t think the hefty discount was justified. It has, however, taken a while for the thesis to play out. But now it has. It only goes to show that investing is never about timing the market but time in the market.

🇻🇳 Vietnam political star’s downfall shocks nation as graft purge widens: ‘who will be next president?’ (SCMP) $ 🗃️

Vo Van Thuong quit over than a year into the presidency after seemingly falling to a sweeping ‘blazing furnace’ anti-corruption campaign

The sudden resignation comes as Vietnam, one of Southeast Asia’s fastest-growing major economies, prepares to set its new leadership in 2026

🇻🇳 Vietnam president’s resignation suggests party power struggle (Nikkei Asia)

Some see Thuong’s fall from grace as a sign of Trong’s waning influence. The 79-year-old Trong, a hard-core adherent to Communist Party principles in office since 2011, has thwarted political rivals pushing for market reforms, including former Prime Minister Nguyen Tan Dung. But he is rumored to have health problems and has drastically reduced his public appearances.

A power struggle could discourage investment by global companies in Vietnam, part of whose attractiveness as a destination for capital lay in political stability. Thuong is the second president to leave office in as many years.

🇻🇳 ‘Political Earthquake’ Shakes Up Succession Battle in Vietnam (Bloomberg) 🗃️

🇮🇳 Inevitable in India: Crowds, cricket and capital gains tax (Franklin Templeton)

India’s vibrant economy and structural growth opportunities continue to be the envy of many emerging markets. But somewhat unique to this market are tax implications that investors should be aware of. Our Franklin Templeton Global ETF team examines these structural issues in Asia’s third-largest economy.

🇲🇽 Mexico becomes the latest major Latin America economy to cut rates (FT) $ 🗃️

🇲🇽 Mexican wave of nearshoring firms is all at sea (Reuters)

That’s concerning because Mexico’s perceived advantages are fading fast. The scramble for industrial space is driving up costs which were already rising. According to the Mexican Chamber of the Construction Industry, the price of cement and reinforced steel surged by up to 25% since the end of 2021 to mid-2022. Meanwhile, land prices are ballooning. In Santa Catarina in the northeastern state of Nuevo Leon, the cost of land has increased by 25% since Tesla announced it will be building a factory there in March 2023. It’s also becoming more expensive to employ staff. In January, the minimum wage increased 20% to nearly $22 for the free zone near the northern border and $14.50 for the rest of the country. And the surge in the Mexican peso, which was the best-performing currency in the world last year, according to Trading View, opens new tab, is also driving up local costs. The danger for the Mexican government is that these factors could soon start to deter companies.

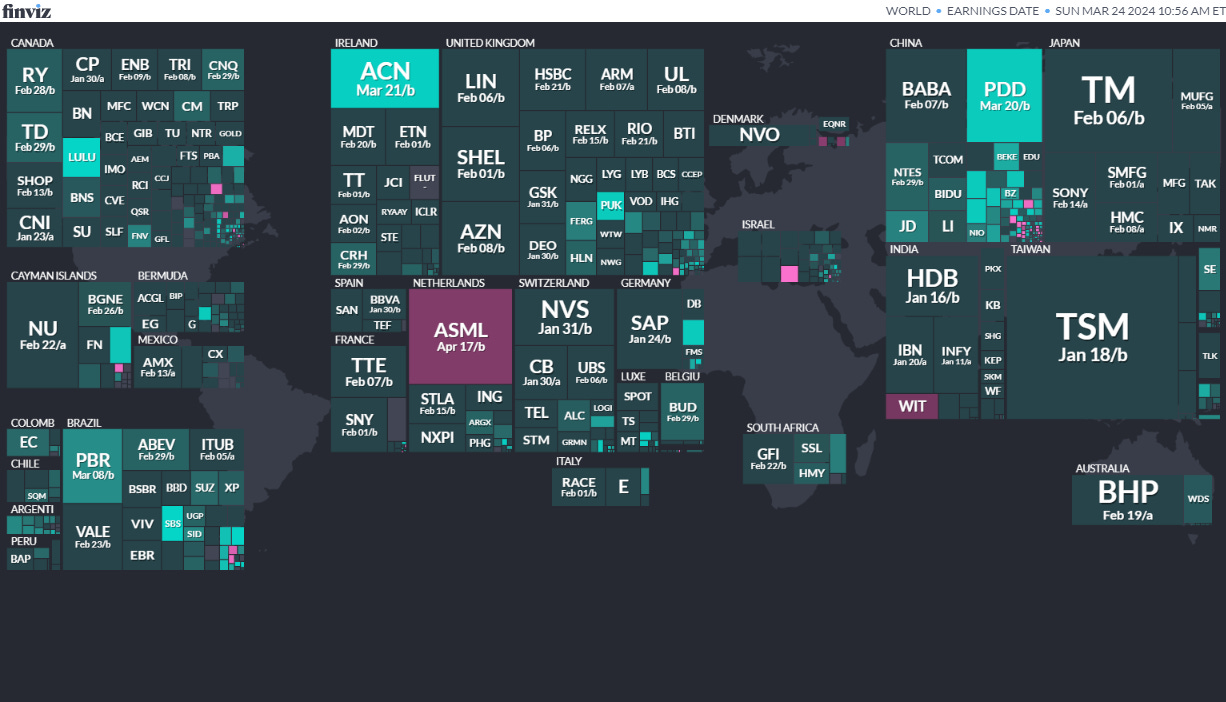

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

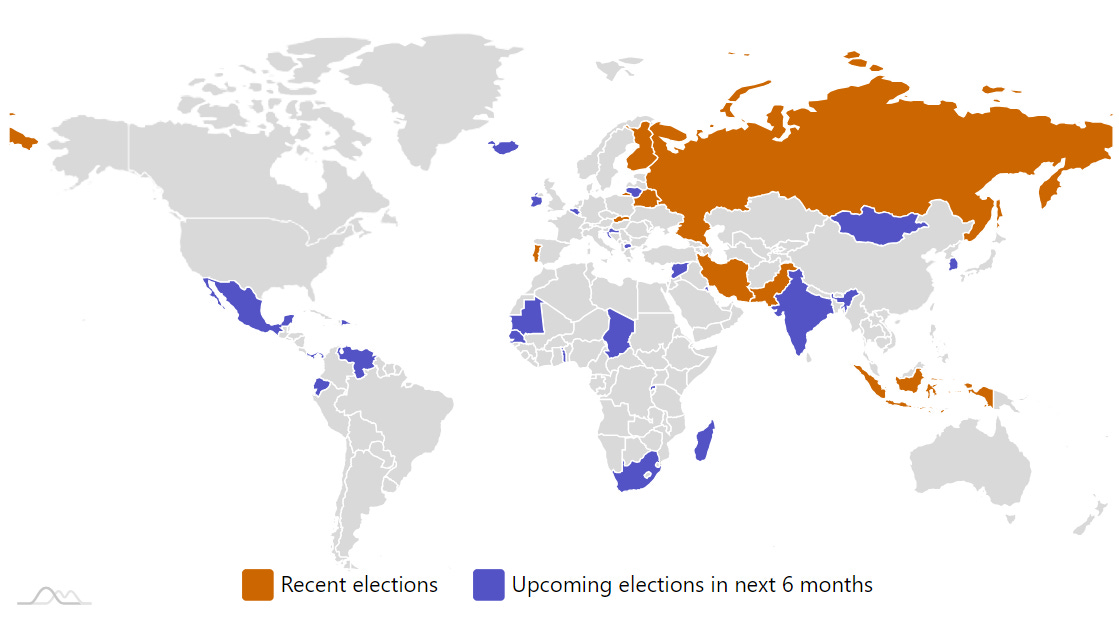

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

-

Russian FederationRussian PresidencyMar 17, 2024 (d) Confirmed Mar 18, 2018 -

Kuwait Kuwaiti National Assembly Apr 4, 2024 (d) Confirmed Jun 6, 2023

-

South Korea South Korean National Assembly Apr 10, 2024 (d) Confirmed Apr 15, 2020

-

Croatia Croatian Assembly Apr 17, 2024 (d) Confirmed Jul 5, 2020

-

Ecuador Referendum Apr 21, 2024 (d) Confirmed Aug 20, 2023

-

India Indian People’s Assembly Apr 19, 2024 (d) Date not confirmed Apr 11, 2019

-

Ecuador Referendum Apr 21, 2024 (d) Confirmed Aug 20, 2023

-

Panama Panamanian National Assembly May 5, 2024