Nigerian Binance Executive Escapes Detention, Intensifies Continued Discord

The following is an excerpt from the latest edition of Bitcoin Magazine Pro, Bitcoin Magazine’s premium markets newsletter. To be the first to get these insights and other on-chain Bitcoin market analysis delivered to your inbox, Subscribe now.

In Nigeria, home to Africa’s largest digital asset economy, there is a growing feud between the government and Binance, which culminated in one of its executives fleeing the country to avoid house arrest.

The Federal Republic of Nigeria, the sixth most populous country in the world, has a significant economic influence on the African continent and a significant presence in the wider global market. The future of Nigeria’s economic development has been a topic of great interest to global financial institutions, but what is of particular interest is the country’s apparent affinity for Bitcoin. For example, Nigeria ranks among the top countries in Google searches related to things like “investing in cryptocurrency.” Additionally, due to classic reasons such as rampant inflation and local currency depreciation, Nigeria also has the largest volume. For this reason, the potential Bitcoinization of Nigeria would be of great benefit to Bitcoin users around the world, and Nigeria could one day become a true hub for the industry.

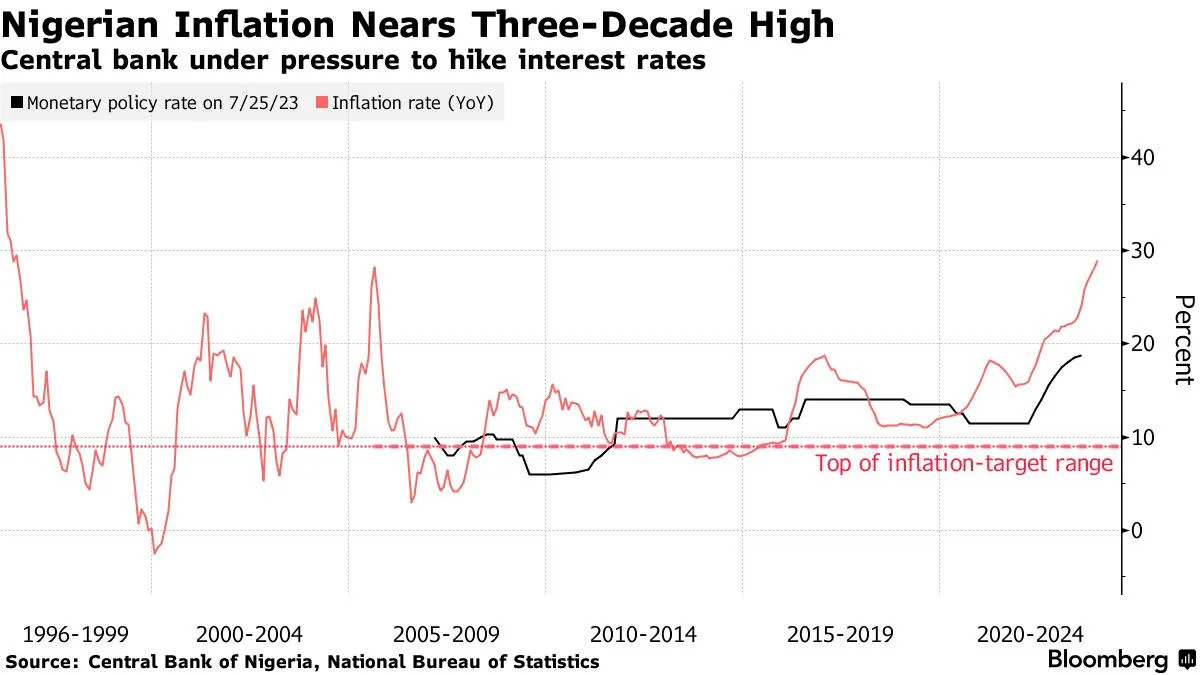

Therefore, Bitcoin users today should certainly be concerned about the deepening feud between Binance and the Nigerian government, and pay particular attention to the possibility of a broader crackdown on the industry. The fight began in earnest in February 2024, when a “glitch” in Binance’s peer-to-peer (P2P) trading platform caused prices to drop for users. ‘Nigeria’ is ‘attempting to manipulate our currency to ground zero’. The Central Bank of China (CBN) considered the widespread use of peer-to-peer Bitcoin transactions to be the cause of the naira’s performance decline and sought to take action against Binance. Given that inflation in Nigeria is rising at the fastest rate in decades, the issue seemed particularly worrisome to authorities.

To this end, a rather confusing series of events unfolded. In February, reports circulated that the government was blocking services from major exchanges such as Binance, Coinbase, and Kraken. Coinbase claimed at the time that it had never had any such problems with the Nigerian government. The government made its position clear when the CBN singled out Binance, announcing that approximately $26 billion in “untraceable” funds appear to have passed through the company’s operations in Nigeria. This amount of cash represents a significant capital outflow for the overall economy. And of course, these large numbers clearly reflect the relatively high levels of interest and adoption among the wider population. After Binance refused to cooperate with claims that it facilitated various financial crimes on its platform, the government took aggressive action, detaining two executives, a British citizen and a US citizen.

This phase has led to a flurry of activity as the situation between Nigeria and the cryptocurrency economy becomes increasingly chaotic. Did the government target Binance because of its rebellious attitude? Or is this just the first step in a planned crackdown on the wider Bitcoin world? The government has shut down the country’s largest P2P exchange, so what’s next? Will peer-to-peer Bitcoin trading itself become a practice? Nigerian regulators have released an updated list of guidelines for forex traders to follow, and the government has additionally entered into a new partnership to test the feasibility of launching eNaira, a CBDC. In the United States, the Digital Chamber of Commerce pressured the White House to intervene in the situation and demanded the release of U.S. Binance officials.

This tense and ambiguous situation became highly unexpected when Nadeem Anjarwalla, a dual British-Kenyan citizen and arrested Binance executive, escaped Nigerian custody with a “smuggling passport” and fled Nigeria on March 25. It has reached its peak in a way that has never been done before. Although his family has insisted Anjarwala’s departure was entirely legal, Nigeria has asked Interpol to issue an international arrest warrant for him. Apparently, Anjarwala’s guards allowed him to escape house arrest and visit a nearby mosque and attend worship, from where he disappeared. Not only were the security guards arrested pending investigation, but the government also formally charged Binance with tax evasion. Anjarwala’s American associate, Tigran Gambaryan, is in federal custody and has been named as a defendant on the charges.

This certainly looks like a bleak sign for the Nigerian Bitcoin market. However, Binance is already embroiled in legal issues, so it remains possible that this is an attempt by the government to specifically strengthen Binance. In addition to its struggles in Africa, the company also faced major challenges on three continents. The most famous of these are fines from the U.S. Department of Justice. The company had to pay $4.3 billion and CEO Chengpeng Zhao had to resign as he was likely to face jail time. Binance.US was spun off to better accommodate US legal requirements, but even this subsidiary is mired in a series of class action lawsuits and SEC battles that could lead to its demise. This wouldn’t be the first time, as Binance’s successor in Russia, CommEX, shut down on March 25 after a similar exodus. The company was also blocked in the Philippines the same day after the government accused Binance of operating without a license.

In other words, the Nigerian government may have chosen this as a golden opportunity to attack a beleaguered rival that has long been the target of Nigeria’s securities watchdog. Certainly, there are some worrying signs of a possible Bitcoin crackdown, with a Nigerian court ordering Binance to hand over data on its biggest traders and rumors that street cryptocurrency traders are being targeted by police. Investigations into eNaira, a CBDC that could replace demand for Bitcoin and other digital assets, certainly haven’t helped matters. Nonetheless, there are still many reasons to see a path forward.

For starters, Ray Youssef, former CEO of Paxful and current CEO of NoOnes, has publicly been enthusiastic about the company’s opportunities in Nigeria. Youssef said Nigeria had actually proposed to increase registration fees for exchanges operating in the country, saying the move was an invitation to “big names” like Coinbase or his own companies to operate in the Nigerian market. Youssef went on to say that the government is interested in limiting these foreign conglomerates from operating as primary venues for P2P sales due to fears of capital outflow, and should welcome exchanges with no or limited P2P functionality to operate normally.

Nigerian consumers prefer peer-to-peer as the ideal way to buy and sell Bitcoin, and the prospect of $26 billion flowing into limbo from Binance’s peer-to-peer marketplace has deeply shaken the government. Nonetheless, the actual practice of peer-to-peer Bitcoin selling is active in the Nigerian market without Binance as an intermediary. For example, in Nigeria, International Women’s Day 2024 saw a large, well-attended seminar focused on educating women from all walks of life about Bitcoin. Focused on understanding the world of decentralized finance and empowering women, the seminar was sponsored by various P2P channels, enthusiasts and businesses in the Nigerian cryptocurrency space.

From where we stand, rumors of a widespread crackdown on Bitcoin in Nigeria appear to have been greatly exaggerated. Considering that the government’s feud with Binance is rapidly escalating into an international manhunt, it’s easy to imagine that if governments were so interested, they would launch similar attacks against other exchanges like Coinbase or even the Bitcoin world. . Binance has been seen as a flouter of Nigerian regulations for some time, and the simultaneous legal battles in multiple jurisdictions seem to have given Nigeria an opportunity to join in the action. But the spirit of Bitcoin lives on, and Binance’s competitors are willing to fill niches in the market. As Nigeria’s overall economy continues to develop, it is anyone’s guess how robust Nigeria’s Bitcoin industry will be over the next five years. But one thing seems certain. It will take more than one fight to keep Bitcoin in check.