Broadstone net lease stock is discounted to a 7.4% yield (NYSE:BNL)

Hwaseong Bar

Investing doesn’t have to be a popularity contest, and the reality is that buying quality names that have temporarily fallen in price can produce great results, especially if they pay a high dividend yield.

This may also be the case REITs, and income stocks in general, continue to trade near 52-week lows even as broad market indexes are near all-time highs.

This results in Broadstone Net Lease (New York Stock Exchange: BNL) was last covered in May last year, when it noted the attractiveness of its 7% yield and its solid portfolio profile, including its high market share.

The stock has since fallen 5.5% since the last piece (-0.2% total return including dividends) and is currently priced at $15.44, below the current 2020 IPO price of $16.

Pursuit Alpha

In this article, we revisit BNL with a key update on business fundamentals and portfolio transformation and discuss why now is a good time to pick this name for high returns while it is out of favor in the market. So let’s get started!

Why BNL?

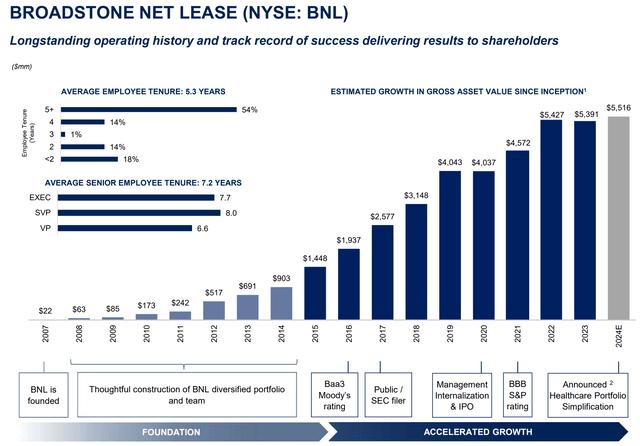

Broadstone Net Lease is self-managed and one of the newest publicly traded net lease REITs on the block. The company has a diversified portfolio of 796 net rental properties across 44 U.S. states and Canada (7 properties in 4 states). As you can see below, BNL has grown its real estate portfolio significantly since its founding in 2007, but growth has slowed since early 2023 due to rising costs of capital.

investor presentation

It also has a long weighted average lease term of 10.5 years, putting it on par with most other net lease REITs, and receiving financial reporting from 94% of its tenants allows BNL to address tenant issues before they become bigger.

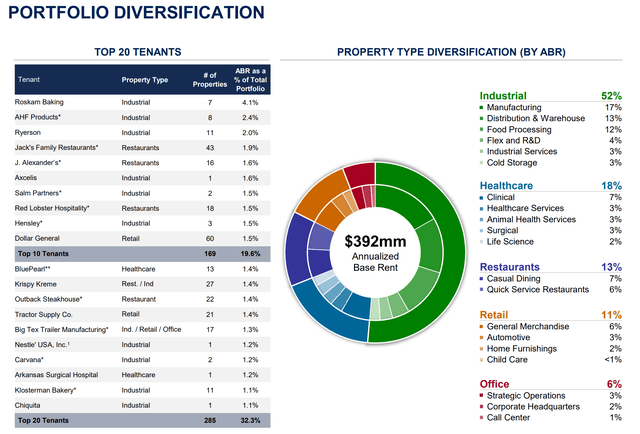

One of the advantages of being a recently formed REIT is that BNL can create a portfolio that fits the times. This includes high exposure to fast-growing industrial properties, which account for more than half (52%) of BNL’s annual base rents. As you can see below, Healthcare (18%), Restaurants (13%), Retail (11%), and Office (6%) make up the remainder of BNL’s portfolio.

investor presentation

Meanwhile, BNL continues to maintain a high leasing rate of 99.4% as of the end of the fourth quarter of 2023, and the results were announced on February 21. This is on par with other high-quality net rental REITs like Realty Income Corp. (O), unchanged from the last time we visited the stock following its Q1 2023 results. BNL also made strategic investments during the fourth quarter, including $64 million in three industrial properties and two restaurant properties.

The new properties have a weighted average lease term of 12.7 years, which is longer than the aforementioned portfolio average of 10.5 years and offer an attractive weighted average cap rate of 7.5%. These acquisitions were partially funded by a $16.5 million portfolio disposition of five properties, with a low cash cap rate of 6.7%, implying an 80 basis point investment spread on recycled capital.

Looking ahead, investors can expect significant changes to BNL’s asset portfolio over the next 12 months as management seeks to reduce its exposure to healthcare assets. This may be a smart move, considering that the healthcare sector is more nuanced than other real estate sectors and requires more specialized knowledge to succeed.

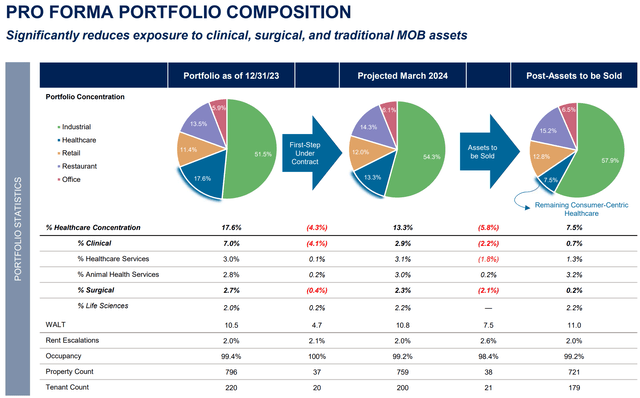

Healthcare currently accounts for 18% of BNL’s total ABR, and 75 healthcare assets, or 11% of ABR, have been confirmed for sale. Half of those properties (37 properties) entered into sales contracts in the first quarter of this year alone, with the remaining healthcare asset sales scheduled to be completed by the end of the year.

As shown below, BNL’s Pro Forma medical real estate mix is expected to decrease from 17.6% to 7.5% by the end of this year, while industrial real estate is expected to increase from 51.5% to 57.9%.

investor presentation

Risks to BNL include execution risk associated with the aforementioned portfolio changes. This is because capital redeployment may take longer than expected, resulting in short-term dilution to final FFO/equity. Moreover, there is no assurance that BNL will be able to deploy capital at the same cash cap rate as the healthcare assets disposed of, which also poses revenue dilution risk.

Over the next few quarters, I will be looking at BNL’s progress with capital reallocation and whether it can achieve a cash cap ratio of 7% or higher. This, in my view, is ideal and on par with what has been achieved in new property acquisitions. Fourth quarter of 2023. They will also look for favorable interest rates, as the Federal Reserve has stated its goal of cutting interest rates three times this year. This could reduce BNL’s debt costs for new property acquisitions.

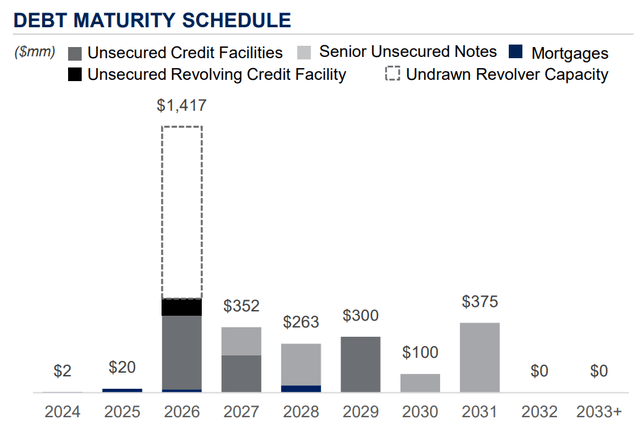

Importantly, in this high interest rate environment, BNL has a strong balance sheet to support portfolio transformation. This includes BBB/Baa2 credit ratings from S&P and Moody’s and liquidity of $929 million. BNL also has a safe net debt to EBITDAre ratio of 5.0x and a fixed charges ratio of 4.5x. As shown below, BNL has minimal debt maturities between now and the end of 2025.

investor presentation

For income investors, BNL boasts a 7.4% dividend yield, which is significantly higher than peers like Realty Income and WP Carey (WPC). Dividends are also covered at a payout ratio of 77%, leaving some reserved capital to fund growth.

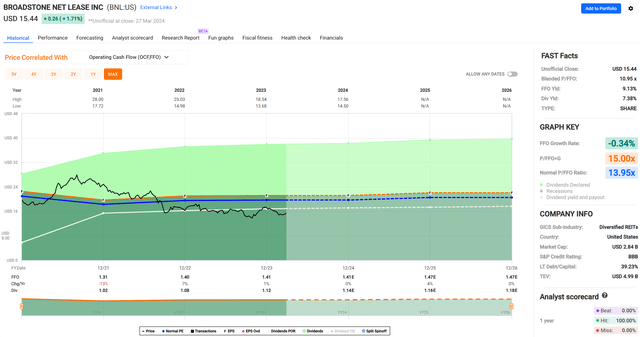

Returning to valuation, I believe BNL continues to be attractive with its current stock price of $15.44 and a forward P/FFO of 10.4. That’s cheaper than the 10.8 P/FFO the last time I visited the stock. At this valuation, BNL is cheaper than its closest peer (by real estate composition) WPC, which delivers a forward P/FFO of 11.9. As you can see below, BNL is currently trading below its normal P/FFO of 13.95.

FAST graph

BNL believes it is still undervalued by the market as income stocks remain at a disadvantage compared to growth stocks. Additionally, the market is pricing in slower growth because higher interest rates and a lower stock price mean BNL’s cost of capital to fund acquisitions is higher. Nonetheless, BNL has an average rental escalator of 2% in its portfolio and could resume external growth if interest rates fall. In the meantime, investors receive a generous 7.4% yield to wait for BNL’s growth prospects to recover.

Investor Implications

Overall, BNL remains a solid choice for income investors seeking exposure to the net rental REIT sector. There is high exposure to industrial assets and this sector will grow as BNL looks to divest its healthcare real estate exposure. It currently offers an attractive dividend yield of 7.4% and has a strong balance sheet to support future growth if opportunities arise. Although there are some risks associated with portfolio transition and the interest rate environment, we believe BNL’s current valuation provides an attractive entry point for long-term investors with good compensation during the REIT transition period. Therefore, we maintain a ‘buy’ rating on BNL.