Similar Web: Slowing growth and poor maintenance of profits (NYSE:SMWB)

Pyromia Intawongpan

proposition

We recommend a ‘Hold’ rating for Similarweb (New York Stock Exchange: SMWB) due to slowing growth, poor earnings maintenance, and modest valuation.

Company Overview

Similarweb is a software company that provides digital intelligence solutions to customers. Their products help customers Research online traffic trends, prospects for new leads, stock research, and more. Our core clients include agencies, consulting firms, publishers, and investment firms (hedge funds, quant funds, and venture capital).

SimilarWeb was part of the 2021 IPO boom. It was listed in May of that year. They started trading at about $20 per share. Their stock price was close to $25 and fell below $5 per share in November 2022.

Similarweb was founded in 2009 and is headquartered in Israel. A company’s CEO and CPO are the company’s original founders. with individuals Insiders have a vested interest as investors, as they own a significant stake of 26.6% of the outstanding shares. This amounts to a market value of $188.7 million.

finance

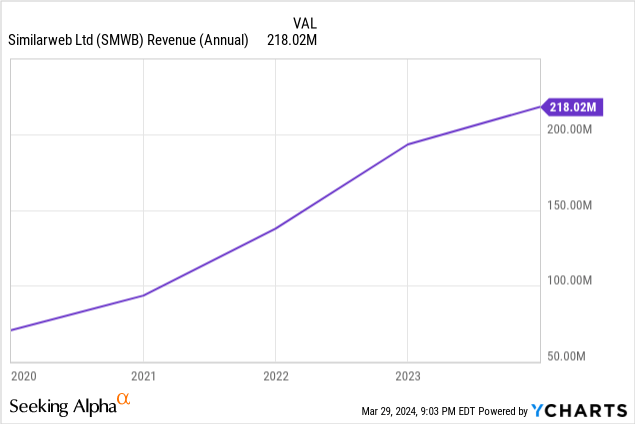

Similarweb ended 2023 with revenue of $218 million, up 12.8% from the previous year. However, this growth is several times lower than the 40.4% year-on-year growth from 2021 to 2022. This slowdown in growth encapsulates much of the current story of the Similarweb. They are taking their foot off the gas pedal and entering the next phase of their life cycle. They are no longer focused on growth at all costs, but rather focus on profitability and cash generation at all costs.

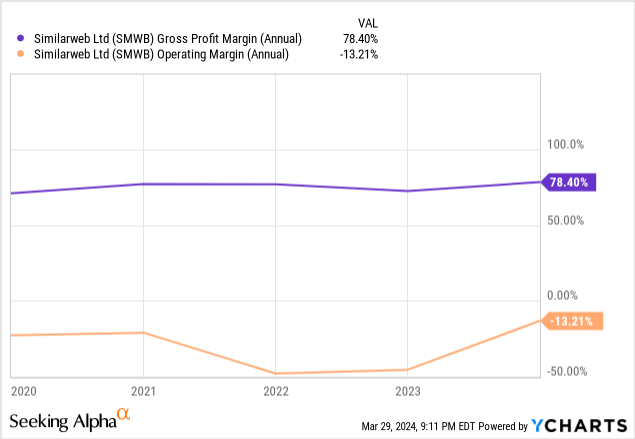

Similarweb’s 2023 gross margin is healthy at 78.4%, which is more than 600 basis points higher than the previous year. But despite its significant gross margins, Similar Web is still not profitable on a GAAP basis. In 2023, operating profit was -$28.8 million and net profit was -$29.4 million.

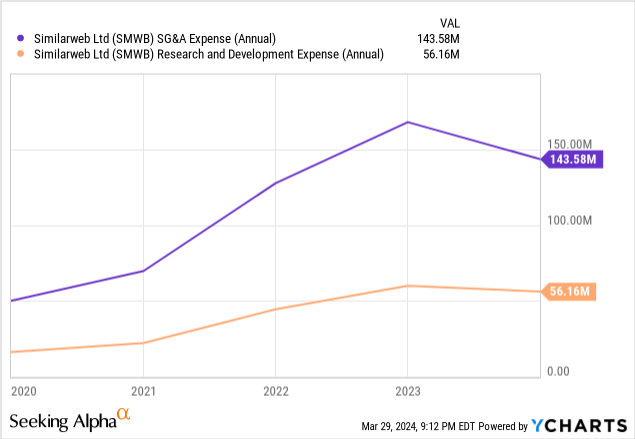

It is important to point out that Simplyweb has begun reducing operating costs as part of optimizing cash generation. The company’s 2023 SG&A expenses were $143.6 million. This is a decrease of nearly 15% compared to the 2022 total of $168.7 million. The same trend applies to R&D spending. R&D expenses in 2023 total $56.2 million, compared to a total of $59.9 million in 2022.

Some of these cost savings can be attributed to layoffs that SimilarWeb enacted in May 2023, laying off 6% of its workforce. These layoffs follow a 10% headcount reduction that occurred in November 2022.

Cutting costs has helped Simplyweb move closer to profitability. The fourth quarter of 2023 was the closest Sameweb came to profitability on a GAAP basis. They ended the quarter with net income of -$4.8 million.

Despite being unprofitable, Similarweb finished 2023 with positive free cash flow in the first quarter. Leveraged free cash flow in the fourth quarter of 2023 amounted to $3.7 million. Although this is a small amount, it is a positive step forward for the company.

Similarweb’s balance sheet is reasonably healthy and doesn’t show any cause for concern. The company currently has $71.7 million in cash and equivalent assets. This aligns well with total debt of $67.4 million. Although the current ratio is not ideal at 0.79, it is important to note that $100 million of the $184 million in current liabilities will be recognized as deferred revenue next year.

Overall, Sameweb presents a healthy financial picture. But their story of slowing growth and cutting costs signals the beginning of a new chapter for the company. Growth will continue to be important, but profitability and cash generation will be most important. The ability of similar webs to execute new stages of their life cycle will be critical for the future.

evaluation

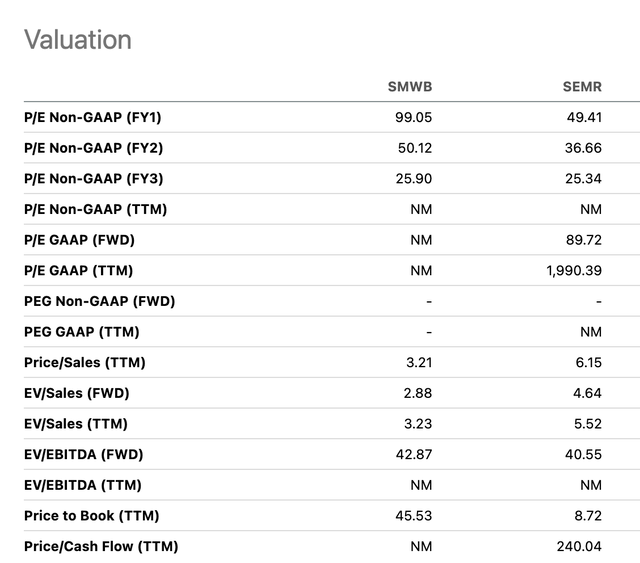

At first glance, a comparable web EV/Revenue multiple of 3.2x might lead you to believe it’s a cheap SaaS opportunity. While this may be true, there is a reason why they are so cheap.

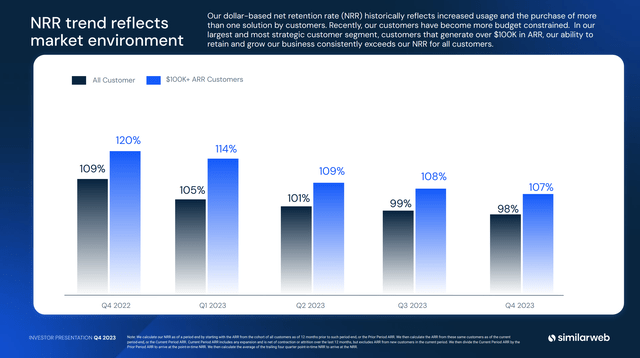

For the most part, Sameweb’s products are nice-to-haves, not must-haves. This reality is illustrated by the profit retention indicator. In their investor presentations, they are quick to highlight specific aspects of positive revenue retention, such as 107% net revenue retention for customers generating more than $100,000 in annual recurring revenue. But if we look one step deeper, a worrying trend emerges. Similarweb’s net revenue retention rate for all customers during the fourth quarter of 2023 was 98%. This is a decrease from the 3rd quarter level of 99%, and a significant decrease from the 4th quarter of 2022 level of 109%. Current revenue retention levels for similar webs are similar to SMB software rather than enterprise software.

SimilarWeb 4th Quarter 2023 Investor Presentation

It is now possible to attribute this downward trend in profit retention to the macroeconomic environment. In fact, Similarweb titled its Earnings Retention slide in its investor presentation: “NRR Trends Reflect Market Environment.” While this may be true, it’s still not a good admission for Sameweb’s business. Poor retention rates during the recession mean Sameweb’s business is damaged by cyclicality. This is an untrue reality for the world’s most powerful enterprise software company. Once again, these dynamics show that Sameweb’s products are nice to have, but not necessary to have.

This revenue maintenance statement is important because one of the key factors in evaluating enterprise software companies is revenue retention. Companies with a strong ability to sustain earnings are worth several times more than struggling companies.

One of the closest comparisons on the similar web is Semrush (NYSE:SEMR). Semrush offers many similar features as its web counterparts and also serves the same customers. Semrush’s EV/Revenue multiple is 4.6x, compared to 3.2x for similar webs. However, there are several factors that contribute to Semrush deserving the higher multiple of the two.

pursue alpha

First of all, Semrush is bigger than Sameweb. Semrush’s 2023 revenues were nearly $100 million greater than Sameweb’s. Secondly, Semrush has superior profitability metrics between the two. Semrush’s gross margin is 83%, essentially breaking even relative to its net profit margin. Additionally, Semrush’s net revenue retention rate for the fourth quarter of 2023 was very high at 107%. Add in the fact that Semrush is on track to grow revenue by nearly 20% this year and boast a bulletproof balance sheet, and it’s easy to see that Semrush deserves a higher multiple.

Unless there is a meaningful change in the competitive dynamics between the two, Sameweb’s valuation will likely always be limited by that of Semrush. For this reason, the current valuation of SimilarWeb seems appropriate.

catalyst

Similarweb’s profit maintenance trend has followed its cost-cutting trend in 2023, so the indicator could spike if the Federal Reserve begins to cut interest rates throughout 2024. Lowering interest rates can create new growth in markets and help businesses grow. You are more likely to spend on nice-to-have products and services rather than must-have products and services. If these market dynamics occur, it’s possible that Sameweb could exceed its 2024 revenue guidance.

Another possible catalyst for the stock could be fueled by its return to profitability on a GAAP basis. In some ways, it gives the market another opportunity to value the company as it transitions to meaningful profitability. No longer are investors limited to valuation based solely on key metrics and potential. But rather, when it is profitable, investors can value the company based on actual cash generation.

This phenomenon allows similar webs to re-price stocks in the market. Of course, this assumes that the company can transition to meaningful profitability in the near future. But if this happens, it could act as a catalyst for stocks.

danger

As mentioned earlier, one of Sameweb’s key risks is poor revenue retention. The holding trend over the past few quarters has been concerning and should be monitored closely by investors going forward. It will be interesting to see if their retention rates can rebound next year. If not, the value of similar web could fall significantly.

conclusion

Overall, Sameweb has built a strong business. They experienced rapid growth in the years preceding and following their IPO. But now, with growth slowing, management needed to transition the business to the next stage of its life cycle. Going forward, the focus will be on cash generation. At the same time, management has the problem of maintaining profits. It remains to be seen whether the decline in profit retention is entirely due to macroeconomic trends or if there are deeper catalysts. But it’s a trend that’s nonetheless making investors wary. For these reasons, I recommend a ‘Hold’ rating for SimilarWeb.