Last year, Bitcoin Ordinals took the digital collectibles world by storm and have now caught the attention of financial mogul Franklin Templeton. Today, the digital asset division of the global investment company introduced an ordinal inscription in its new prospectus.

“The past year has seen a renaissance in Bitcoin innovation and development activity,” Franklin Templeton Digital Assets wrote. “The positive momentum of innovation is primarily driven by Bitcoin NFTs known as Ordinals, new fungible token launches such as BRC-20 and Runes, Bitcoin Layer 2, and other Bitcoin DeFi fundamentals. “

The company recapped the acceleration of Bitcoin NFT-related activity since Casey Rodarmor launched the Ordinal protocol last year. In 2022, Rodarmor developed the concept of “ordinal number theory,” which assigns a specific number to each satoshi, the lowest denomination of Bitcoin on the network.

“Our digital asset research team regularly examines the entire digital asset ecosystem,” a Franklin Templeton spokesperson said. decryption. “In particular, this article was inspired by the recent surge in trading volume and market capitalization of Ordinals compared to NFTs on other networks.”

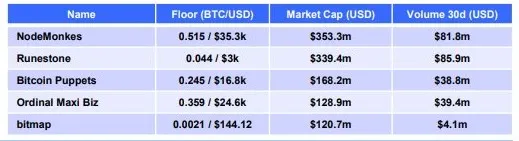

Franklin Templeton Digital Assets described the surge of Ordinal collections in terms of volume and market capitalization in the NFT market, highlighting NodeMonkes, Runestone, Bitcoin Puppets, Ordinal Maxi Biz, and Bitmap. I don’t think these terms have ever appeared in a prospectus before.

“Bitcoin Ordinals has seen a surge in trading volume over the past few months,” said Franklin Templeton Digital Assets. “This is reflected in its increasing dominance, which began surpassing ETH in trading volume from December 2023.”

Franklin Templeton’s digital assets team has been an active advocate for cryptocurrency and blockchain technology on social media, following the U.S. Securities and Exchange Commission’s (SEC) approval of the first Bitcoin ETFs, including the Franklin ETF. It was described as likely to be “completely degenerated” in January. Bitcoin ETF (EZBC).

“Franklin Templeton has been very forward-thinking when it comes to digital assets, and their venture firm has been investing in Ordinals infrastructure startups behind the scenes,” said Leonidas, a Runestone project contributor and pseudonymous NFT historian. decryption On Twitter. “It’s no surprise that Runestone is on the digital asset team’s radar.

“Runestone fell just three weeks ago and just today became the third-largest collection of NFTs by market capitalization across all blockchains,” he added.

Franklin Templeton wasted no time turning his attention to Ethereum and Solana after the Bitcoin ETF hit the market. Last February, Franklin Templeton submitted a proposal for a spot Ethereum ETF to the SEC.

The response to Franklin Templeton Digital Assets’ optimistic tweet sparked an enthusiastic response from the Ordinals community.

🫡🫡🫡🫡

— Bitcoin’s Magic Eden 🟧 (@MEonBTC) April 3, 2024

“Ordinal numbers, ordinal numbers, ordinal numbers,” one account tweeted in response.

NFT archaeologist Adam McBride responded with a meme called “Ladies and gentlemen, we got him”, taken from the US capture of Saddam Hussein.

Last week, Magic Eden co-founder and chief operating officer Z Yin said that the Rune protocol, a new fungible token standard launched by Casey Rodarmor during the Bitcoin halving later this month, will “strengthen the Bitcoin ecosystem.”

“We believe Runes will further strengthen the Bitcoin ecosystem, opening up new builders and asset types previously only possible on other layer 1 chains,” Yin said. decryption. “Adding Runes to the existing Ordinals marketplace makes sense to double down on this ecosystem, which is already on track to hit $1 billion in 2024 alone.”

Edited by Ryan Ozawa.