Why Cheesecake Factory’s growth did not lead to a rise in stock price (NASDAQ:CAKE)

Elsvandergan

Cheesecake Factory (Nasdaq:Cake) operates restaurants under brands such as The Cheesecake Factory, North Italia, and Fox Restaurant Concepts, as well as several restaurant concepts such as Grand Lux Café, Blanco, and Culinary Dropout. The company has 331 restaurants under the brand and several others across North America. Internationally licensed venue.

Despite good growth across restaurants, CAKE’s stock price has not risen over the past decade. The stock has a negative rating of -21% at the time of writing, and the current dividend yield of 2.95%, which has historically fluctuated significantly during the Covid pandemic with no dividend paid, does not make for a good total return. period. Before the last decade, stock prices had very good returns, but the trend has become serious.

10 year stock chart (Look for alpha)

Good growth of alternative concepts

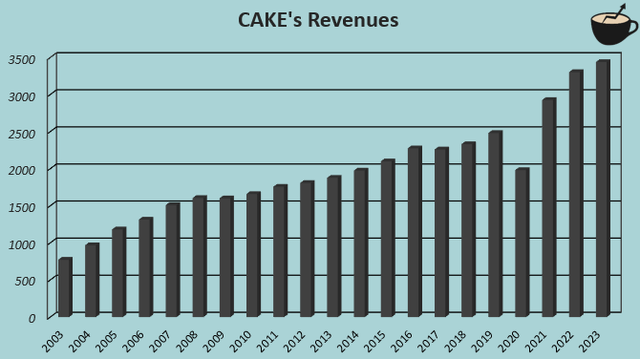

CAKE has achieved consistent profits. growth From 2003 to 2023, the compound annual growth rate (CAGR) is 7.7%. The company continues to increase its restaurant count, with 13 new restaurants opening in 2022, 16 in 2023 and up to 22 new restaurants in 2024. 4th quarter investor presentation.

Author’s calculations using TIKR data

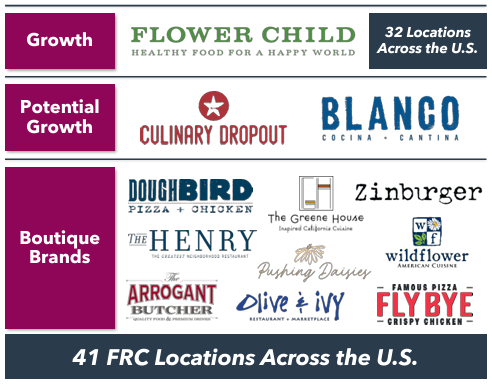

CAKE’s most notable growth opportunity appears to be its alternative brands. In 2023, only six of the 16 new restaurants were under the Cheesecake Factory brand. While the company sees potential in its Northern Italian concept, which currently has 37 restaurants, CAKE executives see potential in 200 domestic locations, adding significant future growth potential. The company also tests new concepts at Fox Restaurant Concepts and expands on concepts where CAKE sees potential. In 2023, the company will open one Flower Child location and six FRC concept restaurants.

CAKE 4th quarter investor presentation

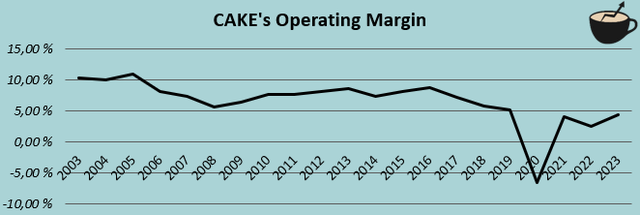

Revenue growth deteriorates due to falling margins

Worryingly for CAKE, the company’s operating margins have fallen sharply over the past decade, falling from 7.4% in 2014 to 4.4% in 2023. As a result, restaurant location growth has not materialized into significant revenue growth. In 2014, CAKE achieved operating profits of $145.4 million, which is $4.3 million less than its 2023 operating profits of $149.7 million. During the same period, sales increased by approximately $1.5 billion, or approximately 74%.

Author’s calculations using TIKR data

Below, sales at existing stores seem to be sluggish. As of the end of fiscal 2014, the company had 189 operating restaurants and generated same-store sales of $10.5 million for the year. The company currently has 331 company-owned restaurants and generates $10.4 million in same-store sales. This is low despite inflation over the past decade and does not include revenue from the 32 internationally licensed restaurants.

Positively, operating margins increased in 2023 and are likely to increase slightly again in 2024. On the fourth-quarter earnings call, CFO Matt Clark said the company expects a net profit margin of 4.25% based on revenue of about $3.6 billion. , cost inflation in the low to mid-single digits has resulted in flat SG&A as a percentage of sales. The net profit margin in 2023 was slightly lowered to 4.1%, excluding unusual items such as asset write-downs. Nonetheless, poor long-term margin trends, which appear to be driven by poor same-store sales trajectory, are a major risk and have been a large reason for the lackluster stock price performance over the past decade.

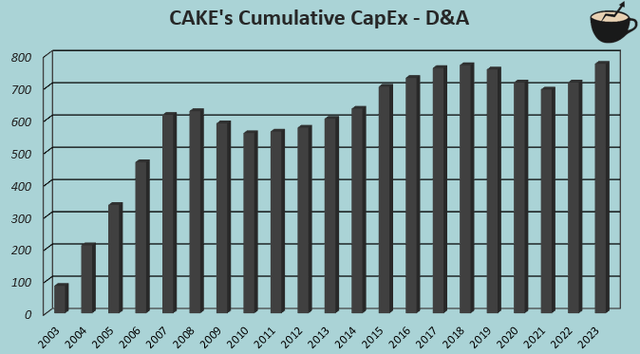

Cash flow deteriorates due to investments

To fuel restaurant growth, CAKE has had to make quite extensive investments. From 2003 to 2023, the company spent $2.3 billion on capital expenditures, which is $774 million more than the company’s depreciation and amortization expenses over the same period. Investment slowed due to the Covid pandemic but has picked up again with a significant number of new stores planned. The company’s current return on equity is only 4.34%, making growth expensive.

Author’s calculations using TIKR data

Over the past decade, operating margins have declined and significant revenue growth has not been achieved, so investments have been churning out cash without increasing shareholder returns. Although the company has performed a large amount of share repurchases over the past decade, CAKE’s EPS is still up very slightly, from a normalized $1.78 in 2014 to $1.83 in 2023, while ongoing capital expenditures have resulted in cash flow being worse than revenue.

Valuation is not a reason to invest now.

CAKE’s forward P/E multiple currently stands at 12.0. The multiples look reasonable overall, but in my opinion they don’t really offer any upside, especially considering CAKE’s historical earnings growth and investments.

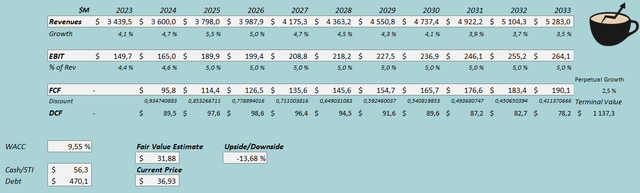

We built a discounted cash flow model to estimate the fair value of the stock. Under the DCF model, CAKE’s revenue growth is expected to remain fairly good, with 4.7% growth in 2024 and 5.5% growth in 2025, based on management’s current outlook. Afterwards, it is estimated that there will be a gradual slowdown and continued growth. At 2.5%, the compound annual growth rate (CAGR) from 2023 to 2033 is 4.4%.

Although the historical margin trajectory has been poor, we estimate some margin leverage in our DCF model because CAKE demonstrated better margins in 2023 and gave reasonably good guidance for 2024. Forward to 2025. The expected growth will require capital expenditures, which are estimated to worsen cash flow conversions. Conversion rates are expected to improve as growth slows.

With the mentioned estimates and a cost of capital of 9.55%, the DCF model estimates the fair value of CAKE to be $31.88. This is approximately 14% below the stock price at the time of this writing. I don’t think it’s underrated. The assumed scenario will still assume some overestimation, and a worse-than-estimated margin trajectory is a real and notable risk to the demonstrated scenario.

DCF model (Author’s calculations)

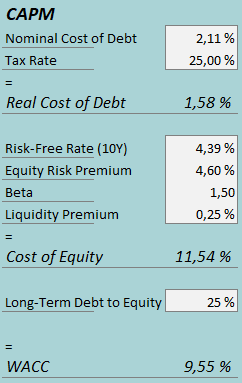

The weighted average cost of capital used is derived from the capital asset pricing model.

CAPM (Author’s calculations)

In the fourth quarter, CAKE incurred interest expense of $2.5 million. Considering the company’s current interest-bearing debt size, CAKE’s annual interest rate reaches 2.11%, securing financing at a very low price compared to the current dollar interest rate. The debt ratio is expected to remain at a similar level with a long-term debt ratio of 25%.

The US 10-year maturity bond yield of 4.39% is used as the risk-free interest rate in terms of cost of equity capital. The 4.60% equity risk premium is Professor Aswath Damodaran’s latest US estimate, updated on the 5th.Day In January. Yahoo Finance estimates CAKE’s beta to be 1.50. Finally, we add a small liquidity premium of 0.25%, resulting in a cost of equity of 11.54% and a WACC of 9.55%.

How I Become Optimistic

CAKE’s margin trajectory would need to improve for me to be more bullish on the stock. With sluggish same-store sales appearing to be a problem, the company will need to become more attractive to customers going forward. The company has already made significant improvements in 2023 on the back of much better 2024 margins, but we still see high caution as warranted for the time being. However, if margins continue to improve, the stock could become a more valuable investment.

takeout

CAKE has expanded its restaurant presence through constant new openings, with the alternative restaurant concept being a key driver of future growth. However, despite healthy sales growth, the stock has underperformed due to worrying margin trends, which appear to be driven by sluggish same-store sales trends. The company’s growth investments continue to eat up its cash flow, while it achieves very mediocre earnings growth. Current valuations do not seem to offer a good risk-reward for entry unless clear margin improvement is achieved. I’m fairly pessimistic on the stock for the time being, but I maintain a Hold rating as some margin improvement has occurred in 2023 and guidance has been provided for 2024.