Digital Asset Valuation: How to Value Cryptocurrency Investments

Sir John Templeton (another Sir John) is often called “the greatest global stock picker of the century.”

He built his wealth by swimming against the flow, focusing on undervalued assets, and using strategy rather than intuition. A mathematical approach to finding good deals.

Sir John is famous for his investments in Japan when the country was in ruins after World War II. Imagine purchasing a building for a fraction of the cost of rebuilding it. This was the idea that eventually led Sir John to rise from the ashes and find a great Japanese company that would bring him great profits.

Sir John is famous for his investments in Japan when the country was in ruins after World War II. Imagine purchasing a building for a fraction of the cost of rebuilding it. This was the idea that eventually led Sir John to rise from the ashes and find a great Japanese company that would bring him great profits.

Templeton would have loved cryptocurrencies. Because these kinds of undervalued cryptocurrency assets are everywhere these days.

why? because Few investors think of cryptocurrencies as “companies” and tokens as “stocks.” This is a huge plus for people like us. (See our investment approach.)

Most cryptocurrencies operate on the basis of FOMO and FUD, but we are investing in more than emotion. We invest in Facts and basics.

This gives us a huge investment advantage, especially during cryptocurrency bear markets (which always happen). While everyone else is running for the exits, we can buy great cryptocurrency companies at huge discounts, just like Sir John did in Japan.

Quantitative analysis of cryptocurrencies doesn’t require advanced math. – Just the ability to engage with some numbers and compare different companies.

In an industry where few people look at numbers beyond “price increases,” a little effort goes a long way.

In this article, I will provide an overview. three simple numbers It can be used to identify cryptocurrency companies with a strong user base and a clear path to future revenue generation.

(Remember that quantitative analysis is only one side of the coin. The other side is qualitative analysis, which we cover here.)

Where can I find this number?

One of the advantages of blockchain technology is that you can view cryptocurrency numbers in real time. You can’t do that in a traditional public company.

For example, if you want to know how many daily active users Facebook has, you’ll have to wait for the company’s quarterly earnings report in a few weeks or months.

Blockchain allows users to be visible. real time.

This kind of radical transparency would be very interesting to investors. Because there is nowhere to hide. Either the numbers look good or they don’t.

There are many platforms that provide these numbers, Our current favorite is Token Terminal, which provides this information in an easy-to-use dashboard. (Their investment philosophy also matches ours.) Let’s use their data to look at: These are the three most important metrics.

Metric 1: Daily Active Users

If a cryptocurrency is like a company, its daily active users are equal to the number of its customers.

Imagine a busy coffee shop. The more customers that come through your door each day, the more successful your store is likely to be. However, it is difficult for a coffee shop with few customers to stay in business for long, no matter how popular it was when it first opened.

It’s so simple that I don’t need to explain it. If a cryptocurrency company doesn’t have users, it’s not a good long-term investment. Companies need customers, and cryptocurrency companies are no different.. But few people think this way.

The metrics we use are daily active users, which is a number that indicates how many people use a cryptocurrency project or platform every day. The DAU of Ethereum (ETH) is as follows:

In the long term, Ethereum DAU (i.e. customers) is healthy, strong, and growing.

The DAU of Uniswap (UNI) is as follows:

DAU shows that Uniswap has developed a real product and found a real market.

Another reason DAU is the most important metric is the principle of network effects.

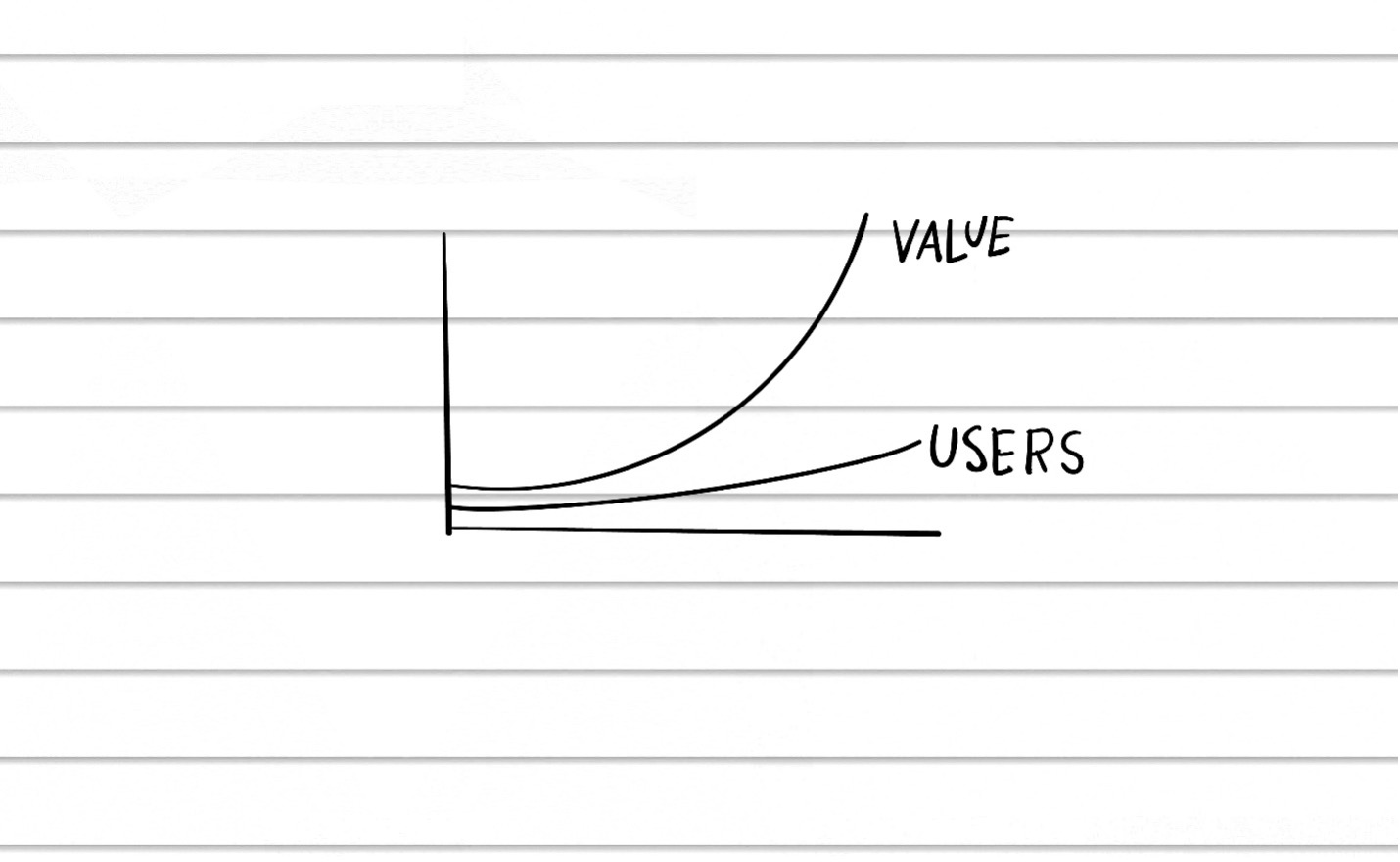

A classic example of a network effect is social media platforms such as Facebook. When Facebook started at Harvard with Zuckerberg and a few friends, it wasn’t worth much. But as more people participated, its value grew.

In fact, the more people signed up, the more valuable Facebook became. For everyone who already uses Facebook.

This is a very important, kind of magical concept, so I’ll repeat it. The more people who join a network company, the more valuable the network becomes to everyone in it..

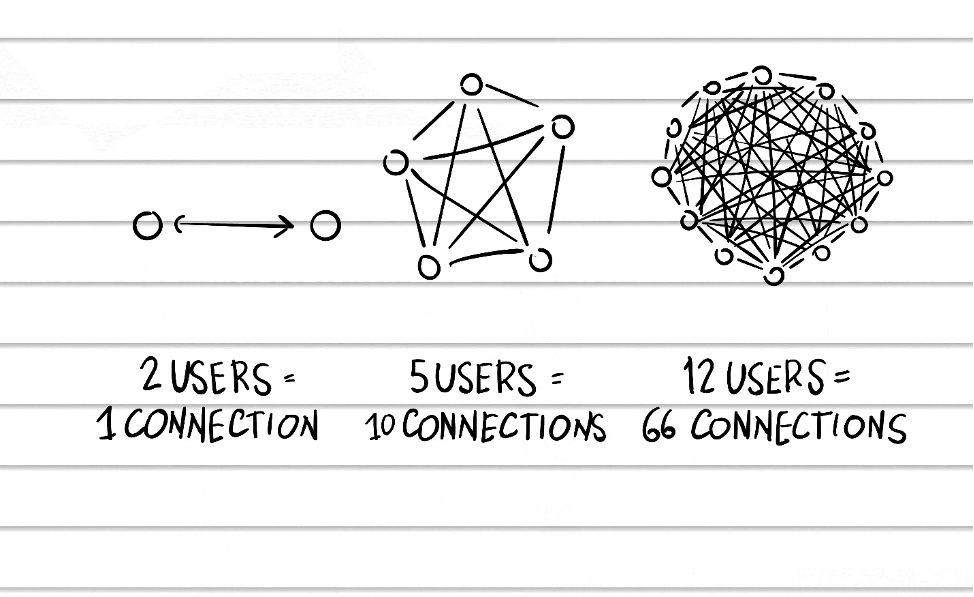

Think of a telephone system. If you have two phones, only one connection is possible. But if you have 5 phones, you will have 10 connections, not 5. And this number continues to grow quadratically.

Blockchain has a large network effect. As the number of Daily Active Users increases, the value of the network increases quadratically.:

Again, few investors think this way. They look at price and market capitalization to make their decision. But if you look at it userWe can determine if the higher price is justified or if the lower price could be a huge discount.

We want to shout this from the rooftops: To evaluate the value of investing in cryptocurrency, first look at how many people are using it..

Of course, DAU itself doesn’t provide much information. You must:

- Compare DAU to other cryptocurrency companies (especially similar ones).

- Analyzing whether DAU will rise or fall in the long run

- We typically consider “bullish” or “bearish” markets that drive DAUs higher or lower (again, we’re looking for DAUs that look healthy and growing over the long term).

The more you look at DAU, the more you can get a feel for whether the cryptocurrency company has real customers or if it’s just a wave of empty users. Serious investors don’t need DAU.

Note: Token Terminal also lists Weekly Active Users and Monthly Active Users. This works fine. You should use the same metrics when comparing investments.

Metric 2: Fees

Fees show whether users are willing to pay to use a cryptocurrency product.

Like all traditional companies, every cryptocurrency company needs a way to make money.

Typically, these costs are incurred through “fees.” For example, when you make a transaction on the Ethereum network, you pay a “gas fee” which acts like a service fee to the Ethereum “company”.

Many cryptocurrencies can fake their daily active users by giving people free tokens (or offering free tokens in the future). This is like a company that offers free samples. This only works if you can get enough people to actually buy the product. Eventually they have to start paying fees.

Fees tell us whether a cryptocurrency product is worth enough for people to pay to use it.

Note: Token Terminal also lists “Revenue” and “Profit”, these numbers are important but outside the scope of this article. For more information, see How to Read Cryptocurrency Financial Statements.

Ethereum’s long-term fees are as follows:

Ethereum is the gold standard, generating millions of dollars in fees per day.

The fees for Binance Chain (BNB) are as follows:

As fees rise, you’ll use the product more often.

Fees, revenue, and earnings typically reflect daily active users, but you’ll see them all spike together. You can use it to ask:

- Are cryptocurrency companies making money (rather than just giving away free tokens)?

- Do the long-term financial prospects look good?

- Are they retaining profits to reinvest in future growth?

“The thing about stocks is that they sometimes sell for ridiculous prices. “That’s how Charlie and I got rich.” – Warren Buffett

Indicator 3: Market Capitalization (and Price)

Market capitalization tells you how much a company is worth, but it is primarily valuable as a comparison tool.

Price and market cap are the only indicators most people use. This is like investing in a restaurant based on menu prices.

Price and market cap are useful for: compare The relative size and cost of various cryptocurrency companies. A higher market capitalization may indicate a more established company, while a lower market capitalization may indicate higher growth potential (but more risk).

Bitcoin’s market capitalization is typical. There are many highs and lows, but it is a long-term upward trend.

However, if a growing company is off its all-time highs, it could signal a good buy.

Price and market capitalization do not reflect the true value of a cryptocurrency.. A high stock price is not a good investment, and a low market capitalization is not a bad investment.

Think of it this way. If you walked into a used car store, you would never buy a car based on the asking price alone. Instead, you’ll check mileage, engine condition, and overall functionality.

similarly, Price and market cap should be used together with DAU and fees., helps you identify amazing investment opportunities. It all works together.

put together

Let’s say you heard about a cool new project called HypeCoin. All the cryptocurrency influencers are talking about it. People are becoming billionaires overnight. Should I buy it?

- First, let’s take a look at HypeCoin’s daily active users.. We compare it to other similar projects as well as existing cryptocurrency companies such as Bitcoin and Ethereum. We ask how long they have been around. Do you have a meaningful track record of DAU growth?

- Next, let’s look at HypeCoin’s fees. (and perhaps revenue and profits). Are they bringing in meaningful money, and are that money growing over time? Or will it all be paid out as token incentives (e.g. free samples)?

- Finally, we compare HypeCoin’s price and market capitalization with similar projects.. We are not impressed by high prices or high market caps, we simply ask: Is the high price justified?? Is there a “there” there? Is it a real and meaningful business? Or is HypeCoin actually just hot air?

And remember: quantitative analysis is one side of the coin. We also run HypeCoin through qualitative analysis using our blockchain investor scorecard.

Investor Implications

When you do quantitative analysis (looking at the numbers), you get: amazing investment opportunity For those willing to take the time. Because almost no one takes the time.

This won’t last forever. As more people realize that “cryptocurrencies are companies” and “tokens are stocks”, eventually this approach will become common sense, the way things are done.

But for now, it gives us a huge competitive advantage. If you know the numbers, you will know the truth.