A week ago: NIFTY may continue to find resistance at higher levels. These sectors may perform relatively well | India Analysis

A previous technical note asserted that the market may attempt to inch higher, but may not form anything beyond a slight incremental high and may largely continue to remain consolidated. Analysis shows that Nifty hit a new lifetime high but eventually continued its upward trend and avoided a strong rally. The trading range in the market was moderate. The index has fluctuated in a range of 315 points over the last five sessions. Volatility has decreased further. India Vix fell 11.65% to 11.34. The headline index closed with a slight weekly gain of 186.80 points (+0.84%).

From a technical perspective, NIFTY needs to move beyond the 22550-22600 area with strong momentum for a sustainable move to occur. Additionally, options data suggests that strong call OI in this area could continue to provide resistance to the market. A sustainable upward trend begins only after the index crosses this zone. Until this happens, we may see the market discover higher levels of selling pressure and the need for vigilant profit protection increase until a new breakout is achieved.

A quiet start to the new week is expected. The 22600 and 22790 levels act as potential resistance levels. Support is provided at the 22380 and 22100 levels. The trading range is likely to remain moderate over the next week.

Weekly RSI is 69.81. It continues to show a slightly bearish differential relative to the price. Weekly MACD is trending lower and trading below the signal line.

The candle has a top. These candles are usually small in actual size because there is little difference between the open and close prices. This shows the indecisiveness of market participants. These formations often have the potential to delay an uptrend if they occur near a high.

Analysis of patterns on the weekly charts shows that the market is in a solid upward trend. However, the market is showing signs of fatigue at higher levels. It is also showing some loss of internal strength, with gradual peaks with some negative differences. All in all, it is likely that the market will remain in some level of consolidation while the trend continues. The nearest support level for Nifty is the 20-week MA located at 21691.

Overall, we may see some risk-off setup in the market. One can expect that defensive pockets such as Pharma, IT, FMCG, etc. will provide comparatively better strength than other pockets. However, the banking space is also likely to remain resilient. Unless Nifty achieves a strong breakout of the 22550-22600 area, it is recommended to use every upward move to protect profits at higher levels. Low levels of VIX also remain a concern and could lead to a spike in volatility. We recommend a cautious approach next week with one eye on profit protection.

Next week’s sector analysis

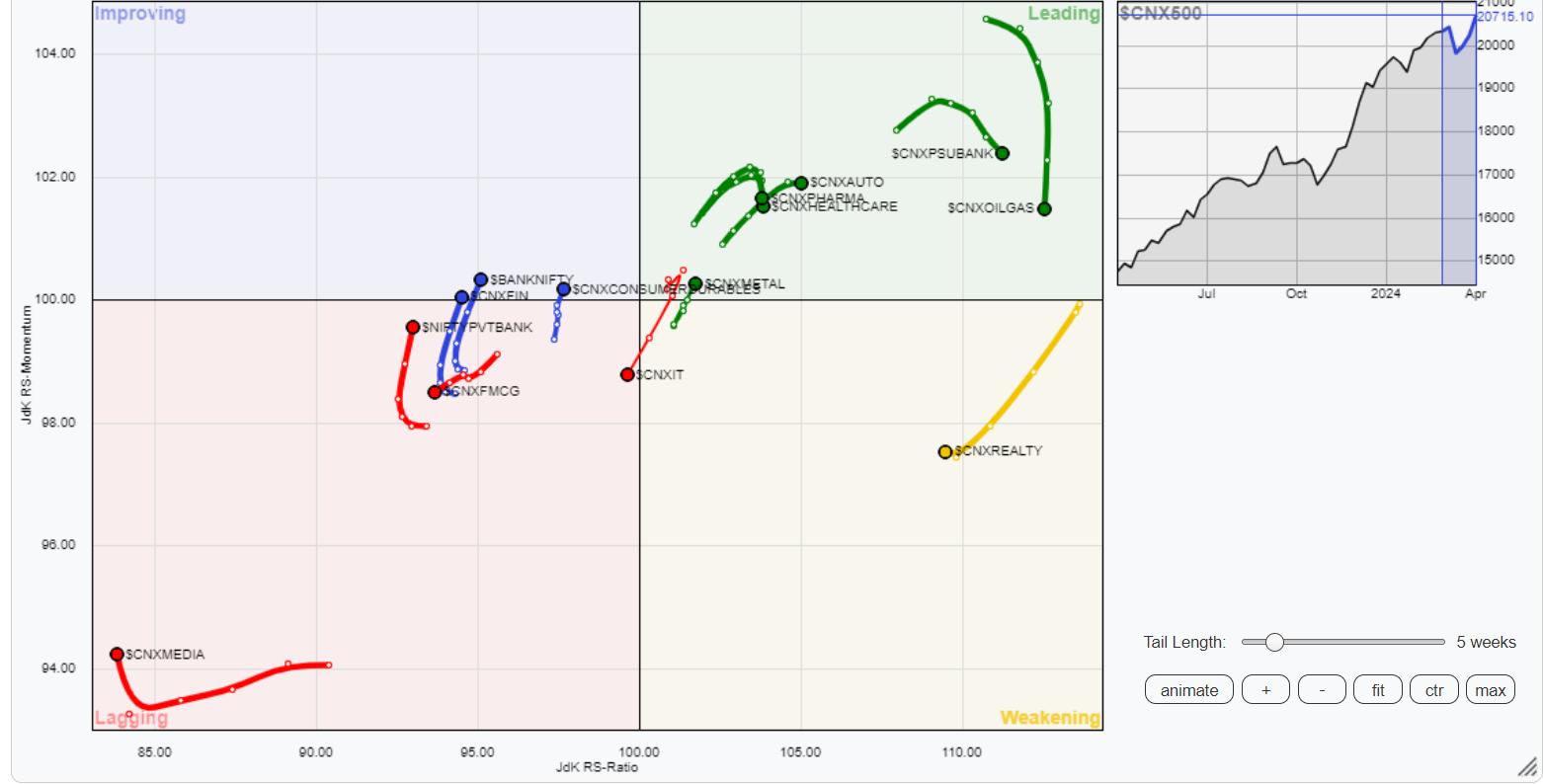

With Relative Rotation Graphs®, we compared various sectors with the CNX500 (NIFTY 500 Index), which represents over 95% of the free float market capitalization of all listed stocks.

Relative Rotation Graph (RRG) shows that Nifty Commodities, Energy and Infrastructure indices are within the major quadrants. However, it appears to be giving up relative momentum. Apart from these groups, PSU Banks, Pharma and Auto groups are present within the major quadrants. The Metal index also rolled inside the first quadrant. These groups are expected to outperform the broader market.

Nifty PSE index rolled inside the bearish quadrant. Apart from this, the Midcap 100 and the real estate index are also in the bearish quadrant.

Nifty IT rolled inside the weakening quadrant. Nifty FMCG and media indices also continue to weaken within the bearish quadrant. The services sector index is also in this quadrant, but its relative momentum appears to be improving.

While the Nifty consumption index is within the improving quadrant, the Banknifty and financial services index are rolling inside the improving quadrant, suggesting that their relative underperformance is likely to come to an end.

Important note: RRG™ charts show the relative strength and momentum of groups of stocks. The above chart shows relative performance against the NIFTY500 index (broad market) and should not be used directly as a buy or sell signal.

Milan Vaishnav, CMT, MSTA

Consulting Technology Analyst

www.EquityResearch.asia | www.ChartWizard.ae

Milan Vaishnav, CMT, MSTA is a capital markets expert with nearly 20 years of experience. His areas of expertise include portfolio/fund management and advisory services consulting. Milan is the founder of ChartWizard FZE (UAE) and Gemstone Equity Research & Advisory Services. With over 15 years of experience in Indian capital markets as a consulting technology research analyst, he has been providing India-focused, premium, independent technology research to his clients. He currently contributes daily to ET Markets and The Economic Times of India. He also writes A Daily/ Weekly Newsletter, one of India’s most accurate “daily/weekly market forecasts”, now in its 18th year of publication. Learn more