I like gold, but I’m buying silver (NYSEARCA:SLV)

Nisha Sharp

I Love Gold (Reference to Gold members)

I may not be as obsessed as the Austin Powers supervillain, but it’s pretty clear that gold is having its moment. The central bank is quoted by Bloomberg as saying, “Central banks, especially large institutions, are buyers.” And traders preparing for the transition to looser interest rates. “Chinese consumers are worried about declining returns on other assets and a depreciating currency.” According to the same Bloomberg article, central banks have been buying massive amounts of gold since last summer. Additionally, individuals are buying more physical gold and less ETFs. This tells us that developing countries like India have buyers who are traditional buyers of the yellow metal, as well as concerned Chinese consumers who are creating a steady base for gold to continue to flow. Now American consumers are also buying physical metals.

Gold ETFs are showing outflows, but I believe this will change once money managers become active.

What’s interesting, as the article points out, is that the Gold ETF (GLD) is experiencing outflows. So what’s really surprising is that investors in developed countries are buying the physical metals that support prices. I think the gold rally is sustainable and ETFs will catch up. The main thrust of the article is the question of why gold is soaring now, a mystery after central banks have been buying huge amounts of gold for months… The article lists the “usual suspects” as pension funds. Investment banks, sovereign wealth funds, along with central banks. They note that futures contracts are rising and point to money managers betting on a long-term rally. This is where I want to build a case for gold and, by extension, silver, which I have been trading in the form of a silver ETF (NYSEARCA:SLV). Money managers will start with futures but will expand their trading to stocks and ETFs as the gold rally expands. – Furthermore, as silver continues to outperform gold, they will likely move into SLV. The U.S. is growing and manufacturing has finally raised its manufacturing PMI to 50.3%. The March 2024 figure was reported this week, up 2.5 percentage points from February’s 47.8%.

At the same time, because consumers are still spending, jewelry is also in high demand, and anecdotally, Costco is selling as much as $100 million worth of gold bars last quarter, as many media outlets reported. I have no doubt that similar amounts are in motion this month. So there is more futures being purchased by money managers and physical gold being purchased by central banks as well as institutions and individuals. Technically, gold has broken out after months of sideways consolidation. As chartists know, this consolidation will give gold even more power. This is of course my opinion, but I will use a chart to explain it so that there is no doubt for the readers.

So why trade silver and not gold?

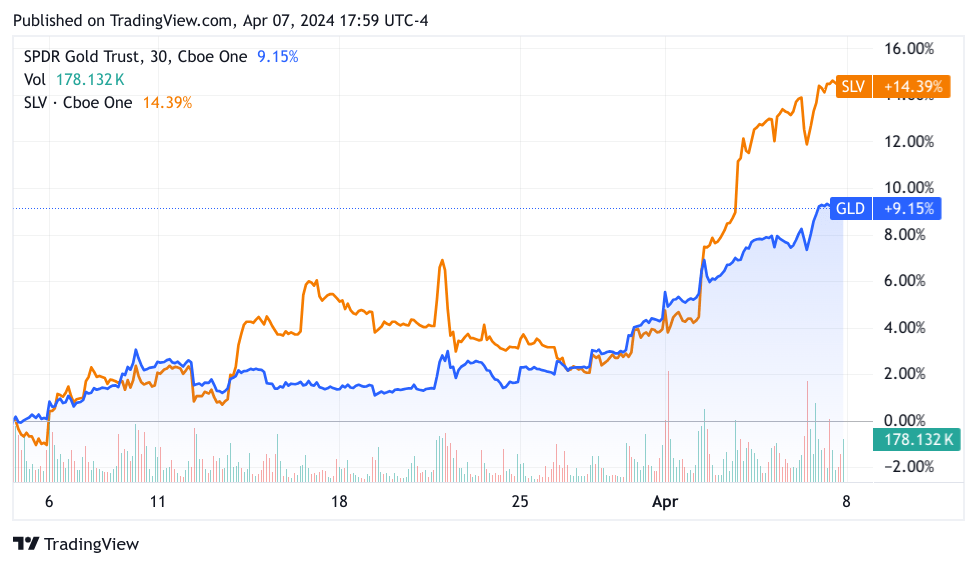

Gold is more valuable than ever, but silver is still lagging. I believe silver will catch up with gold. Silver doesn’t need to reach new highs, it just needs to outperform gold. Silver is starting to outperform gold. Below is a one-month chart showing both metal ETFs. SLV is orange and GLD is blue.

TradingView

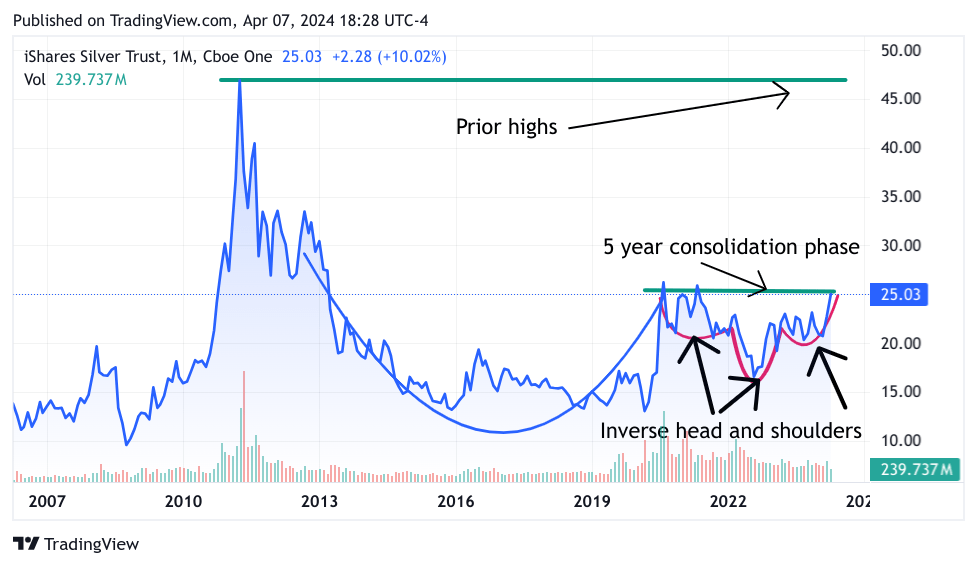

I acknowledge that Silver’s leadership is in its fairly early stages. However, although silver has more industrial uses than gold, it still serves as a store of value as it is also a very popular physical purchase in the form of silver coins, as explained in many books. Same article about Costco Gold. So SLV is so strong that I expect it to be positive at times even if GLD sells off. Check out this multi-decade chart for SLV.

TradingView

We are seeing a multi-year consolidation phase in the form of a huge inverted head and shoulders which is very bullish. Before that, to the left of SLV’s 2011 peak, we see a big round bottom, also known as a bearish-to-bullish reversal, along with the 2018 lows, rising to nearly $28 as SLV is trading just above. It’s currently at $25, and I very comfortably hold a long call position in SLV and two tranches of 24 and 25 strikes until the June expiration. I started the call on the 23rd strike, rolled it up to the 24th strike, and then added more on the 25th strike. As SLV (hopefully) rises towards its most recent high of 27.98 on February 1, 2021, I will continue to trade and profit by pushing the call higher. Let’s zoom in on the 5-year chart to see more details.

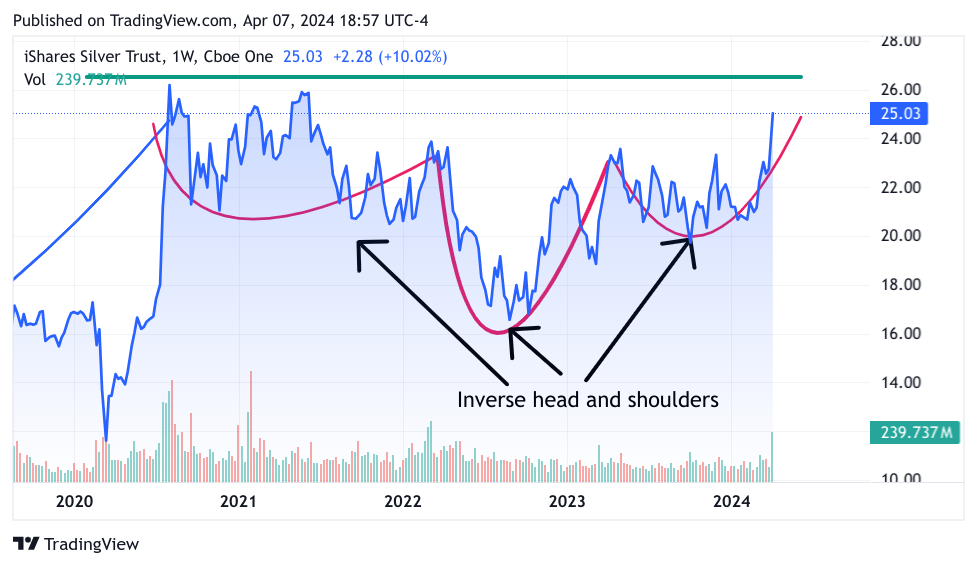

TradingView

Here we can clearly see the full inverse head and shoulders over five years. As a chart analyst, I have no doubt that this has the potential to not only reach the recent high of 27.98, but break even further. Of course, SLV relies on GLD. Because at some point, if GLD pulls back significantly, SLV will fall along with it. Now, let’s take a look at GLD’s 5-year chart below.

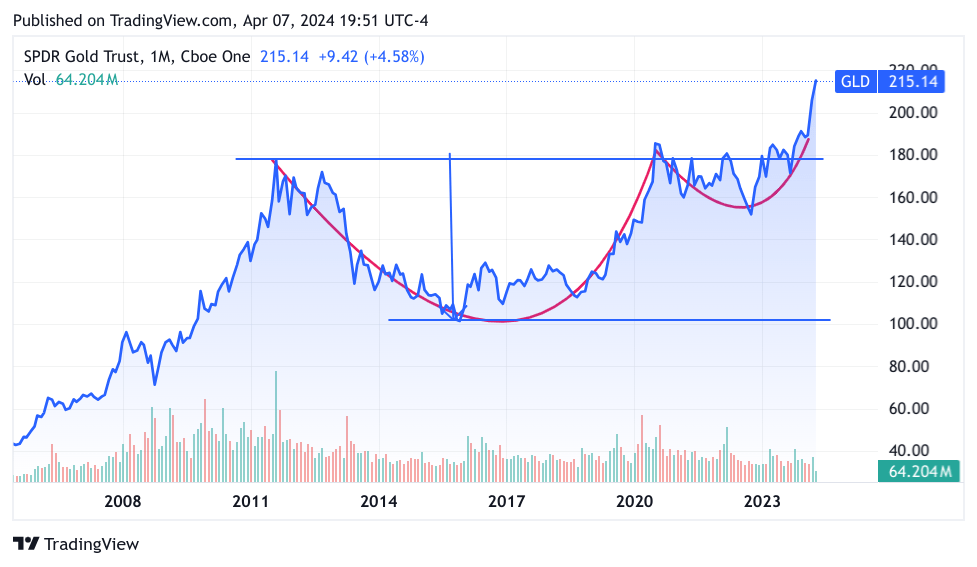

TradingView

Above is the 20+ chart, which reached its first peak in 2011. The lowest point was set in 2015. The chart shows a huge cup and handle that is very bullish. If we scroll back to SLV and look at the multi-decadal chart, we see a similar pattern, but no breakout yet. GLD’s breakthrough has begun. Long-time readers have seen me perform careful moves. Here I drew two huge parallel lines and measured the difference. And we add 80 dots to the top line and we get 260. If you were to plot a chart for physical gold like this, you would probably get closer to 2800 for gold. Highest possible score. Of course, nothing is set in stone, but all things being equal, this means that the Fed will continue to commit to cutting interest rates and the economy will continue to move along with the precious metal and do very well.

My optimism is rooted in consistent data demonstrating low inflation and growth.

The March employment numbers were fantastic! Nonfarm payrolls jumped to 303,000, but the unemployment rate fell from 3.9% to 3.8% and the labor force participation rate increased to 62.7%. Higher participation rates mean lower inflation as more individuals rejoin the labor force. Average hourly earnings increased 0.3%, or 3.6% on an annualized basis. However, the previous 12-month real growth rate was 4.1%, which is also disinflationary as employment costs have declined. We’ve seen productivity pick up over the past few months, which can support higher wages or cover higher material costs to curb inflation. As long as we stick to the narrative that the Fed will cut interest rates at some point, I think the risk appetite of investors and traders remains. This means that risky assets such as GLD and SLV will rise.

Besides gold and silver, other metals also shine.

I actually invested in metal stocks, purchasing Century Aluminum (CENX) based on a huge $500 million subsidy it received from the U.S. government. The press release title is: “The U.S. Department of Energy selected Century to invest $500 million to build a new green aluminum smelter to accelerate the decarbonization of the aluminum industry.” Of course, I believe CENX will build the new aluminum smelter for free, or at least at a $500 million discount. I read this because there is. This is the first smelter built in the U.S. in 45 years, and I think there’s a lot of money to be made with this new, high-efficiency smelter. Aluminum is in high demand, and copper is in high demand, so Teck Resources ( TECK also sells metallurgical coal used to make steel to Swiss-based Glencore. To me, TECK is a value play because it is still considered a coal company with copper and zinc assets. TECK ‘s CEO Jonathan Price said the sale should be completed by the third quarter of this year, giving me plenty of time to accumulate shares of TECK at a nice discount. The copper stocks everyone uses are Freeport-McMoRan (FCX) and its P/E is 38.65x while TECK’s P/E is 13.62 Now, I wouldn’t expect TECK to nearly triple to match the FCX PE, but somewhere between 13.62 and 38.65 is what I think is a very satisfactory valuation. The risk seems to be that TECK somehow sells its coal mining business or that copper crashes, both of which seem unlikely at the moment.

Demand for copper and zinc isn’t going away, and copper could move higher once China starts growing again. But as TECK evolves away from coal, it doesn’t need copper to rise faster to be a good investment. As always, we will invest slowly over time, and with TECK the deal closes in the summer, so there is no rush.

Okay, have a brilliant trading and investing week everyone!