RRG indicates non-megacap tech stocks are improving | RRG chart

key

gist

- The energy sector remains on a very strong rotation path.

- A completed top formation in the healthcare sector creates significant downside risk.

- Small tech stocks are taking on giant names.

Sector rotation summary

A quick assessment of current sector rotation in the weekly relative rotation graph:

XLB: Still on a strong trajectory within the improving quadrant and heading toward the lead. The upward breakout of indirect resistance on the price chart appears to have stalled for now, which may slow its strength relative to the S&P 500. Overall, the trend remains upward, both in price and relative terms.

XLC: Continues to lose relative strength and momentum within the weakening quadrant and rotates lagging in the negative RRG direction. On the price chart, XLC is fighting resistance and this is depressing its relative performance.

XLE: It has the strongest rotation in the universe. It is inside the improvement quadrant, which has the highest RS-Momentum readings and is driven by the longest tail in the universe. The upward breakout on the price chart is well maintained and the sector can handle even a small pullback to the previous resistance area (just below ~95) without harming the uptrend.

XLF: Weakened It was on its way back to the leading quadrant after curling back inside, but this week’s decline has thrown the tail off its course. This means we will have to watch this sector closely later this week and early next week to see if this is a temporary problem or a real change in direction. A severe decline on the price chart would push XLF below its previous resistance level, which is generally not a strong signal. caution!!

XLI: This is currently the only sector within the leading quadrant, moving in the direction of strong RRG, taking the sector higher on both axes. The uptrend on the price chart is intact but likely to remain stagnant at current levels for 3-4 weeks. There is ample room on the chart for a corrective move in this sector without damaging the uptrend.

XLK: The sector’s poor performance (mainly sideways movement) since late January has flattened relative strength and the sector has rolled over and rotated into RRG’s weakening quadrant. Today’s (Thursday, April 11) gains have boosted relative strength, but much more is needed to get the sector back to the lead.

XLP: It failed to reach horizontal resistance near 77.50, but set lower highs after last week’s severe reversal. The raw RS-line continues lower, with RRG’s tail remaining short and appearing on the left side of the graph, indicating a steady relative downtrend.

XLRE: After the rally late last year, XLRE ended up in a sideways pattern that could lead to a double top after the rally. These highs are confirmed below the low of 37 set for the week beginning February 12th. If that happens, a decline back to the lows in late 2023 would be possible. The relative trend is back to the downside after a very short period of time crossing the leading quadrant in late January.

XLU: Moved from lagging to improving quadrant but still maintaining very low RS ratio levels. The raw RS-line continues to show a steady downward trend, making it difficult for the tail to reach the leading quadrant. The price broke through the downward resistance line but immediately stalled in the area of the September 23, December 23, and January 24 highs. Pressure remains on both price and relative terms.

XLV: After a brief rotation through the improving quadrant that lasted roughly two months, XLV is now back in the lagging quadrant and moving deeper into the negative RRG direction. On the price chart, XLV has completed a (double) top formation and has moved back below its previous overhead resistance level, creating significant downside risk.

XLY: It has been in a sideways pattern since mid-February, but is still in a very shallow upward trend. Relative strength has continued to decline but is now approaching its relative lows at the end of 2022 and the RRG line is showing early signs of improvement.

Ceiling weighting vs equal weighting

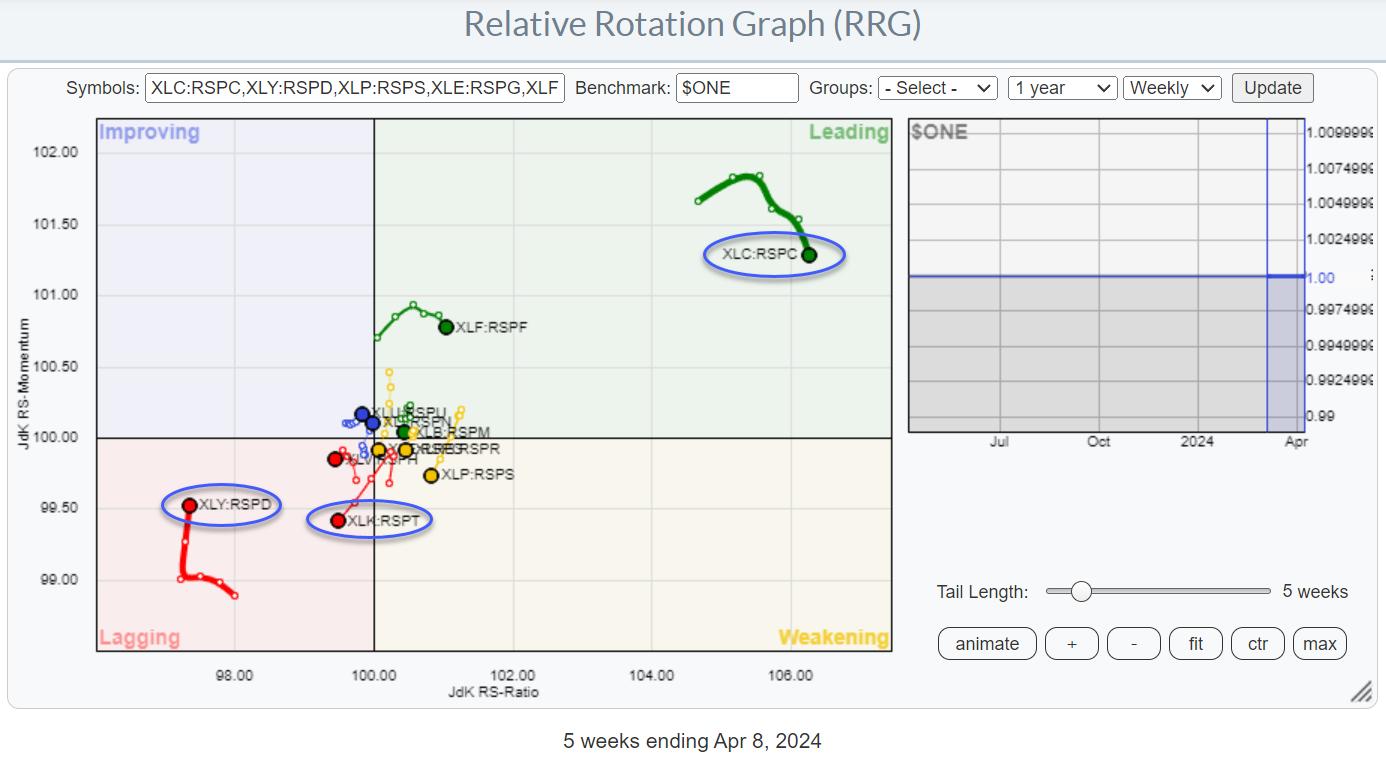

The RRG above shows the relative rotation of the relationship between market capitalization weighted sector ETFs and equal weighted sector ETFs.

The more interesting information comes from the far tail of the benchmark. In this case, it’s the Telecom Services sector moving inside the leading quadrant and the Consumer Discretionary sector just emerging inside the lagging quadrant.

This suggests that large-cap communications services stocks are now starting to underperform their lower market cap counterparts. For consumer discretionary, the opposite is true. The opposite is happening here, with larger market cap stocks taking over lower market cap stocks.

A similar observation can be made about the technology sector, which is heading straight into the lagging quadrant, suggesting that large-cap technology is giving way to small-cap stocks.

This information will be helpful when looking at RRGs for individual stocks within the sector.

#StayAlert: –Julius

Julius de Kempenaer

Senior Technical Analyststockchart.com

creatorrelative rotation graph

founderRRG research

owner of: Spotlight by sector

Please find my handle. social media channels It’s under Bio below.

Please send any feedback, comments or questions to Juliusdk@stockcharts.com.. We cannot promise to respond to every message, but we will ensure that we read them and, where reasonably possible, utilize your feedback and comments or answer your questions.

To discuss RRG with me on SCANHey, please tag me using your handle. Julius_RRG.

RRG, Relative Rotation Graph, JdK RS-Ratio, and JdK RS-Momentum are registered trademarks of RRG Research.

Julius de Kempenaer is the creator of Relative Rotation Graphs™. This unique way to visualize relative strength within the world of securities was first launched on the Bloomberg Professional Services Terminal in January 2011 and made public on StockCharts.com in July 2014. After graduating from the Royal Netherlands Military Academy, Julius served in the Dutch army. Airmen of various officer ranks. He retired from the military in 1990 with the rank of captain and entered the financial industry as a portfolio manager at Equity & Law (now part of AXA Investment Managers). Learn more