Latest Trends on Jones – How Weakness in This Index Could Foreshadow a Broader Market Correction | MEM edge

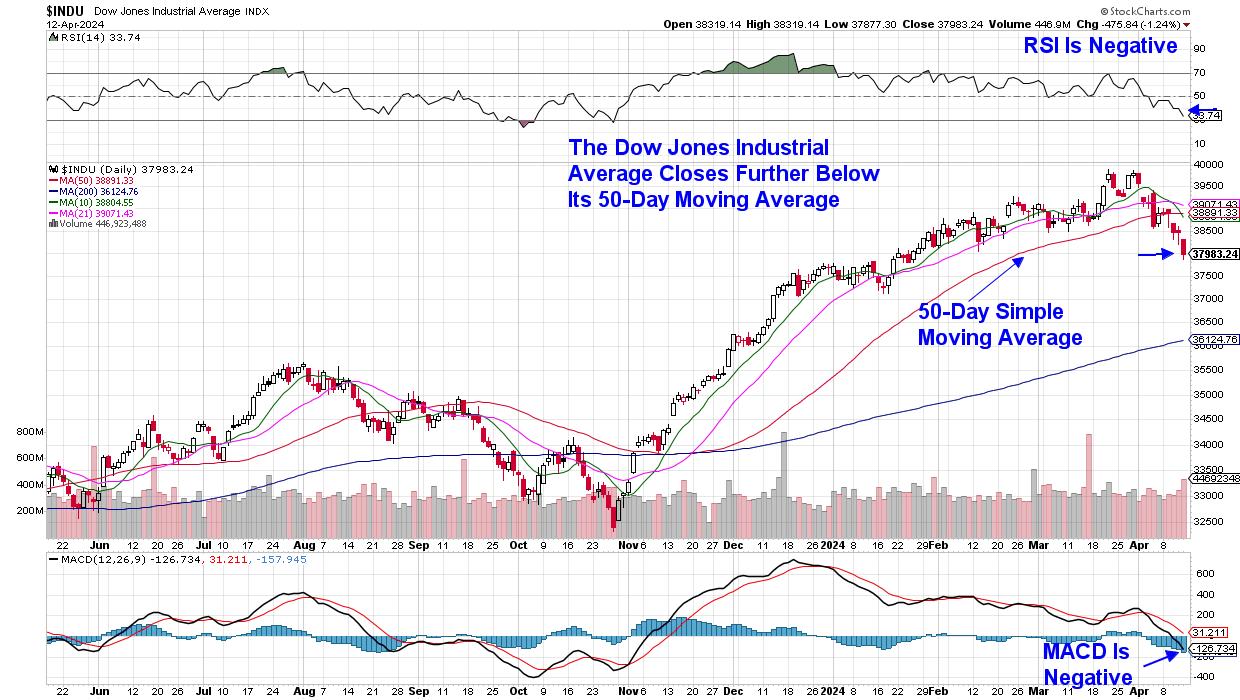

The Dow Jones Industrial Average fell 2.4% last week, a move that pushed the index further below its key 50-day simple moving average. Although not the most widely followed index, the Dow has continued to evolve so that its 30 components more closely reflect the current economy. The inclusion of Amazon (AMZN) in late February is the latest revision, joining Apple (AAPL), Microsoft (MSFT), and Salesforce (CRM) to name a few with higher weights.

Dow Jones Industrial Average Daily Chart

Dow Jones Industrial Average Daily Chart

Leading the index’s decline last week was JP Morgan Chase (JPM)’s 7.4% decline, which fell after reporting first-quarter results on Friday. Although the company performed well, CEO Dimon’s lukewarm outlook for future growth sent the stock price down. Among the risks cited by management were high inflation and the potential for the Federal Reserve to tighten monetary policy. Geopolitical risks were also mentioned.

But the most notable thing about the JPM chart was the fact that JPM was trading at a new high prior to the report’s release. In other words, stocks were priced based on perfection, so any hint of a possible slowdown in growth caused their prices to fall sharply.

We’re currently in the beginning stages of earnings season, and if we see a similar reaction to big-name companies reporting results while their stock prices are reaching near-term highs, we could be in for a tough spot. The next well-known company scheduled to release a report next week is Netflix (NFLX), followed by Microsoft (MSFT), Alphabet (GOOGL), and Metaplatform (META) next week. Each of these stocks is trading at near-term highs and is likely to weaken amid talk of rising interest rates.

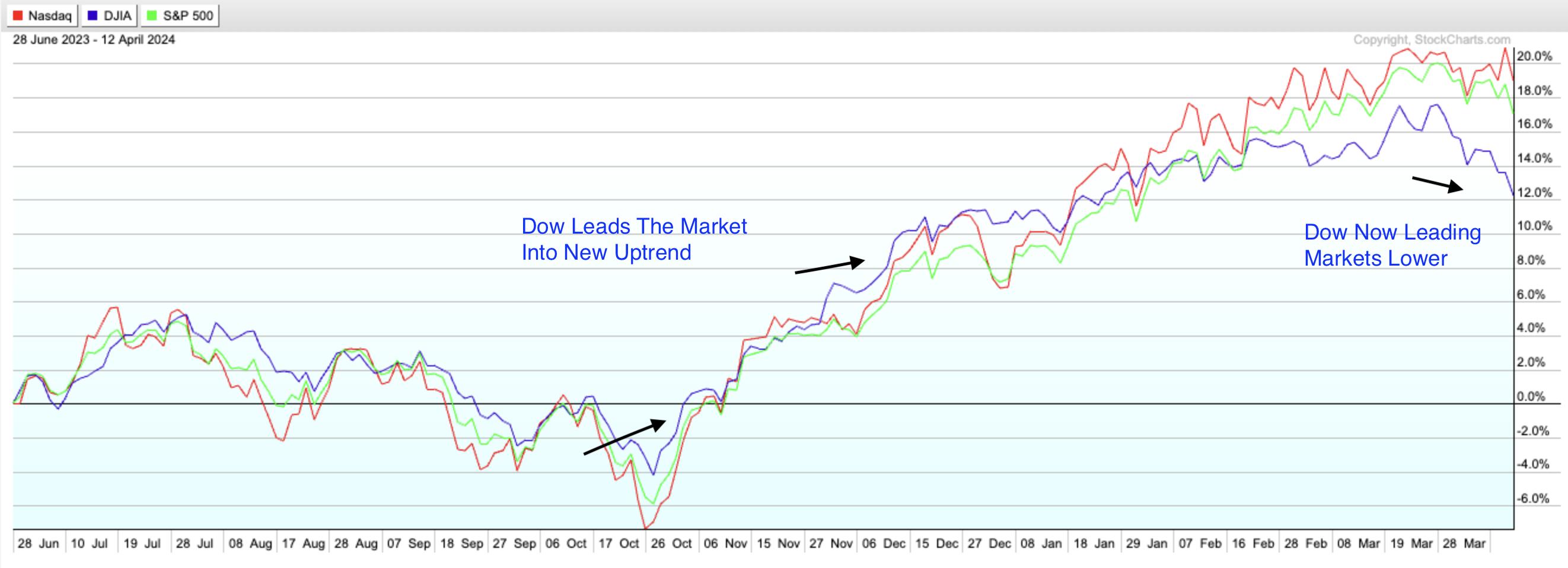

Dow, S&P 500 and NASDAQ Comparison Chart – June 2023 – Present

Dow, S&P 500 and NASDAQ Comparison Chart – June 2023 – Present

Above is a chart comparing the Dow Jones Industrial Average, S&P 500, and NASDAQ Composite Index. As highlighted, the Dow led the market into a new upward trend that began in early November. Many stocks that have recently been on the rise in the Dow are now trending lower after closing below their key 50-day simple moving averages.

These winners were from a variety of sectors, including industrials, financials, and consumer discretionary, and included companies like Home Depot (HD) and JP Morgan (JPM). With the removal of several retailers from the MEM Edge report’s recommended holding list over the past few weeks and the removal of bank stocks earlier this week, my screening has revealed widespread weakness in these sectors. The deterioration of discretionary, financial and healthcare stocks in the Nasdaq and S&P 500 can be harder to spot because there are so many names in those indices. However, my MEM Edge report has been detailing the weaknesses for several weeks now.

The most important thing right now is that both the Nasdaq and S&P 500 are hovering above key support levels and will want to preserve profits if a downtrend develops. Interest rates are a major factor in determining investor sentiment, but earnings reports have proven to be more influential. If you want to stay up to date on the wider market and how stocks are doing over your investment horizon, use this link here to access reports twice weekly for four weeks for a small fee.

warmly,

Mary Ellen McGonagle

MEM Investment Research

Mary Ellen McGonagle is a professional investment consultant and president of MEM Investment Research. After working on Wall Street for eight years, Ms. McGonagle left the company to become an experienced stock analyst, where she worked with William O’Neill, where she identified sound stocks with the potential to take off. She has worked with clients around the world, including renowned firms such as Fidelity Asset Management, Morgan Stanley, Merrill Lynch, and Oppenheimer. Learn more