Preferred Stocks Weekly Review: Spread Differences Drive Redemption

Pgiam/iStock via Getty Images

Welcome to another installment of the Preferreds Market Weekly Review. Here we discuss preferred stock and infant bond market activity, both bottom-up, highlighting individual news and events, as well as top-down, providing a broader overview. market. We also try to add some historical context as well as relevant topics that appear to be driving the market or that investors should keep in mind. This update covers the period up to the first week of April.

Check out our other weekly updates covering the Business Development Company (“BDC”) and Closed-End Fund (“CEF”) markets for perspective on the broader income space.

market activity

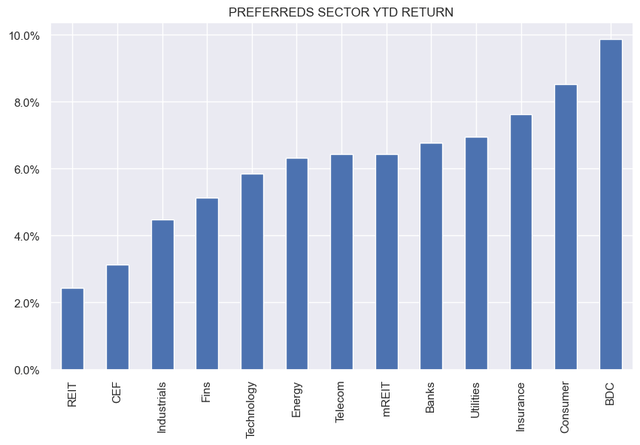

Preferred stocks were flat during the week and outperformed most other income sectors due to further narrowing in credit spreads. All preferred subsectors have risen since the beginning of the year. Here’s what banks prefer: Even with residual concerns about exposure to the CRE sector, we didn’t bat an eye.

systematic income

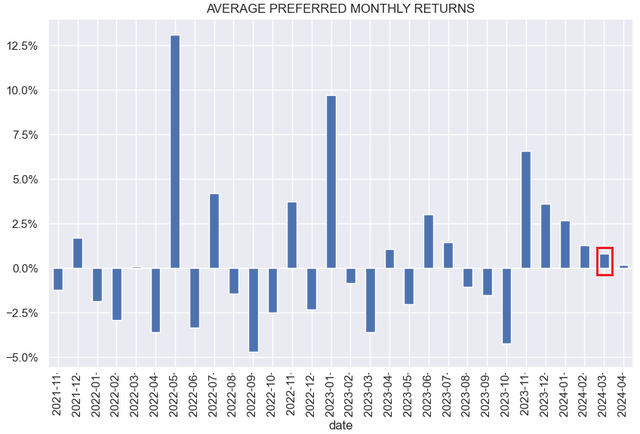

March marked the fifth highest monthly total return, but as the chart clearly shows, the pace of returns has continued to decline. Very tight spreads leave less room for capital gains in the future.

systematic income

market theme

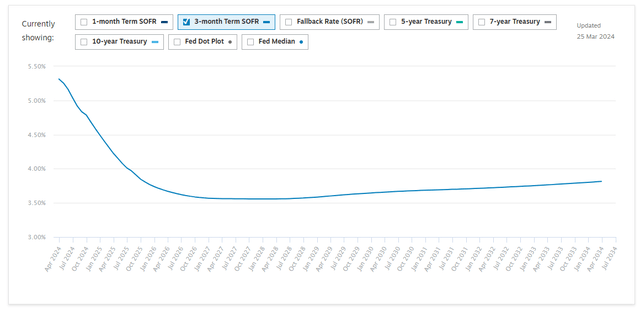

There is a common view that rising yields, especially for Fix/Float stocks, are driving buybacks across the sector. Here’s an example of what we mean when we talk about rising yields. First Horizon Series D (FHN.PR.D) is preferred with a first call date of May 1, 2020 and has a flat coupon of 6.1% until then. As it happens, these shares will be redeemed on the first call date. However, if not redeemed, the coupon will convert to a 3-month period SOFR + 4.12% or approximately 9.4% as of that date, an increase of 3.3% or an increase of over 50% of the coupon.

In our opinion, this is not the best way to measure redemption probability. That’s because a rise in coupon doesn’t tell you whether a company can refinance a particular preferred stock at a better rate. Calling a preferred company to try to reissue at a similar rate is just a waste of money (because of the issuance fee) and work. And few companies have the extra cash to pay off priorities without refinancing.

The reason why rising coupons are not a reason to redeem preferreds is primarily because the yield curve is unusually inverted. This means that short-term interest rates are abnormally rising relative to long-term interest rates, as you can see in the chart below. However, this is because the market expects short-term interest rates to decline sharply over the next few years compared to long-term interest rates.

systematic income

Therefore, repurchase due to coupon price increases is not necessarily a natural thing for the issuer. This is because repurchasing preferred stocks that are about to be converted to a floating interest rate does not necessarily save the issuer’s funds even if the coupon increases on the first call date. Unless the market is wrong about the direction of short-term rates (see below), long-term fixed rates are best viewed as the average of the sum of short-term rates, to a first approximation.

chatham

By this logic, paying a short-term interest rate over time isn’t all that different from refinancing to a fixed rate. Because both should end up costing roughly the same amount. Again, the market can be very wrong about the direction of interest rates, but it can also be wrong in either direction, so unless the issuer has a very accurate view of the path, amortization and amortization of short-term interest rates that deviate significantly from the market, they would prefer a different fixed rate or fixed/floating. Refinancing with is not a slam dunk.

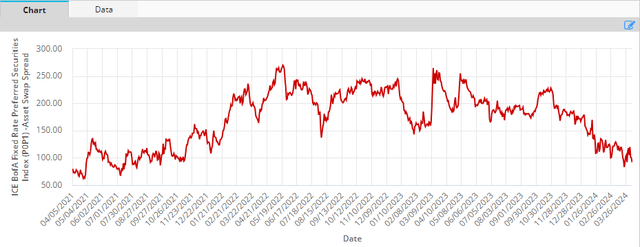

More relevant than coupon changes for issuers deciding whether to refinance is the level of spreads over floating rates and the level of spreads currently prevalent in priority sectors. As you can see in the chart below, priority spreads have fallen to around 1% overall. In particular, the spread on listed traded finance is only 0.28%, which looks quite generous. What this means is that issuers who think they can issue new preferred stock at a lower spread than the contractual spread on their Fix/Float preferred stock are very likely to do so.

ice

One of them is the FHN.PR.D highlighted above. FHN was swept up in a local bank selloff last year, sending its stock price down to $16.50. Also remember that there was a second downturn when the planned merger with TD Bank fell through. If the shares are not redeemed, you will pay a spread of over 4% over SOFR. Banks are likely to be able to raise funds at cheaper rates elsewhere, if not in priority markets.

FHN.PR.D was held in the income portfolio from April to October, being replaced by Synovus Financial Series E (SNV.PR.E). SNV.PR.E has its first call date in July with a coupon resetting to the 5-year Treasury + 4.127%. It’s still attractive because it offers a win-win, such as a nice tailwind if redeemed (trading below “par”) or a significant boost in coupons. Like FHN.PR.D, redemption is not impossible considering the high spread of more than 4% relative to the base rate. In the current environment, market demand for new issues is likely to decline.

market commentary

Commercial real estate remains the focus of the broader market. This is one of the few sectors showing a recessionary profile. The FDIC found a notable increase in non-performing loans in the non-residential non-farm sector (e.g. office, retail, hotels). This is the highest rate in over a decade. Sachem is a mortgage REIT with significant exposure to the sector, and has attracted the attention of individual investors as an indicator of the sector, as well as a number of publicly traded senior securities. The company just reported disappointing results, sending its common stock to a double-digit loss on the day, but to be fair, it wasn’t far off its year-to-date levels.

Sachem has a variety of palliatives in its portfolio. One of them is that the loans are usually for one year. This provides the ability to pivot quickly from developing sector-specific issues that slowly burn out. Second, office-related exposure is about 12%, while residential makes up about half of the portfolio and commercial mortgages are less than 40%. Third, the company acquired a design/build firm that could complete projects in-house and renovate existing properties.

Key portfolio metrics show there were $6.4 million in non-cash impairments (credit provisions) over the past year. So while revenues are up, full-year net income is down about a third from 2022 levels. This was worse than expected and led to a double-digit decline in common stock. Non-accruals are approximately 17% of the portfolio. However, leverage is reasonable at 1.6x. Preferred stocks and bonds did not react significantly.

Sachem is another example where the relative prices of bonds and preferred stocks have little meaning. The preferred SACH-A trades with a yield of 8.4%, while all bonds (see the mREIT section of the baby bond tool) save one trade with similar or even higher yields. Across the entire Sachem senior securities spectrum, short-term bonds like SACC look the best, yielding 8.3%. Bond asset coverage is approximately 1.9x.

The fact that the portfolio is relatively short-term means that there must be enough cash from interest and principal to repay the bonds at maturity. Longer maturity bonds don’t look much better and the yield pickup is rather weak. This is especially true if CRE stress worsens.

One general point about holding mortgage REIT bonds is that they do not fall under the Investment Company Act rules of 1940 and therefore have no asset coverage requirements. Therefore, issuers like CEFs and BDCs cannot have asset coverages as low as Sachem. This means that, all else being equal, mREIT bonds require more attention from investors.