Filter Trader Quick Start Guide – Trading System – April 15, 2024

Before using Filter Trader you will need a good signal source account. Filter Trader is basically a follower program.

Filter Trader supports both mt4 and mt5. Demo versions of the programs required for this article are provided at the end of the article.

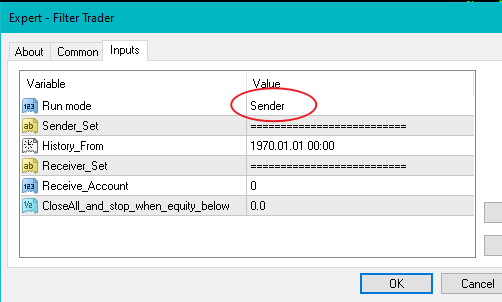

First, run the sender program in your signal source account.

Filter traders read past orders from signal sources to further adjust follow-up strategies.

If your signal source has too many past orders and the previous past orders have lost their reference value, you need to set up a record to filter out the past orders.

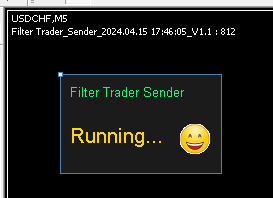

Then click OK and you will see a smiley emoji below. This means that the Sender program runs normally:

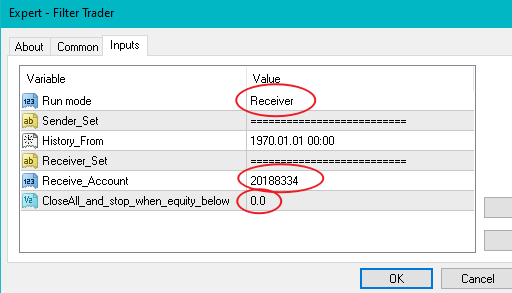

Now run the receiving program using a different account.

It’s easy too!

In run mode, you select a listener.

For Receiver_Account, enter the account that just ran the transfer program.

The last one is the asset protection program, which means that if your account asset value is lower than the set value, the program will stop running and all orders will be deleted.

Now click OK next.

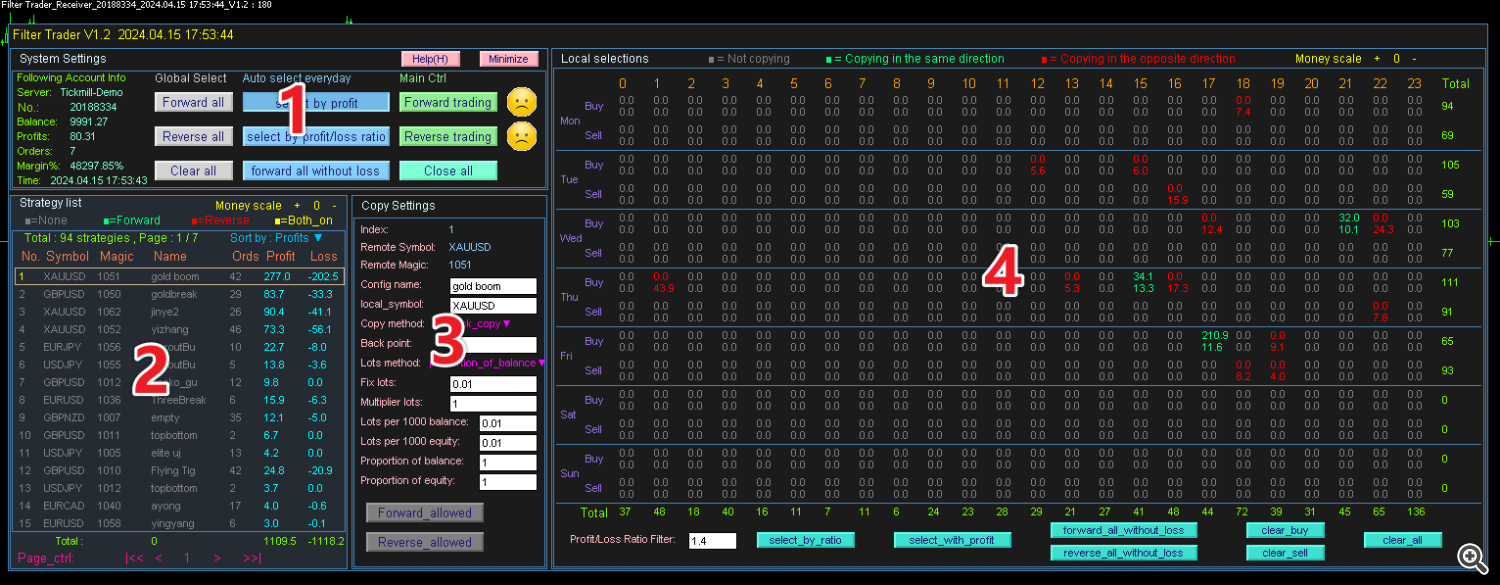

At first you can see a UI like this

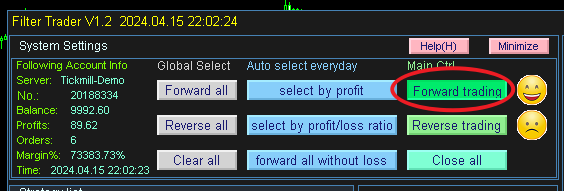

1 is the main operation panel that operates and controls the overall situation.

2 is the strategy list information of the signal source account.

3 is copy configuration information for the selected strategy and can be modified at any time.

4 is the time setting panel for the selected strategy, which can be configured using the mouse.

Next, I will explain how this program works.

At this point, your original account information will be displayed in the upper left corner, and your strategy list will display one or more strategies.

Let’s choose a strategy and go through the list.

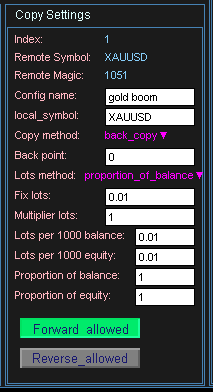

Remote symbols and remote magic cannot be changed, and local magic numbers and remote magic numbers remain the same. This makes it easier to compare the effect of running the source and copy accounts.

config name: Can be modified as desired

Local symbol: You can change it to another symbol on the platform, such as XAUUSD –> Gold , XAUUSD–> XAUUSDm or XAUUSD–>XAUEUR.

Copy method:

back_copy: This means that the order can only be followed if the original account order has a floating loss. There are many benefits to this. For example, you may earn more than your original account. Or, when orders become profitable, you can terminate them manually without worrying that the program will fill them immediately. Of course, there are also disadvantages. Some spells are missing. Of course, I recommend this method. After all, this program is a very special spell follower.

Direct_copy: Indicates following the order directly, regardless of order time and price.

Back points: If you choose back copy, the floating loss distance between copy order price and source order price is calculated in points. You can choose positive numbers or change them to plural numbers depending on your strategic needs.

Many ways:

Edit a lot: I have nothing to say.

Multiplier Lot: Indicates a multiple of the source order lot.

Lots per 1000 balance: It has nothing to do with the original account, only the current account. If you set it to 0.02 and your current account balance is 5000, the final lot size will be (5000/1000)*0.02=0.1 lots.

Lots per 1000 equity: Same as above. You can calculate it using equity.

Balance Ratio: For example, if this is set to 1.3, the original account balance is 1000, the order lot size is 0.02, and the follower account balance is 2000, then the final order lot size is (2000/1000). )*0.02*1.3=0.052, don’t worry about the 0.002 on the back. The program will handle it automatically.

Equity Ratio: Same as above, calculated using equity.

Allow forwarding: This is a switch that indicates whether forward copying is allowed. It turns gray when off and green when on.

Allow reverse: This switch indicates whether to allow reverse copying. It becomes gray when off and red when on.

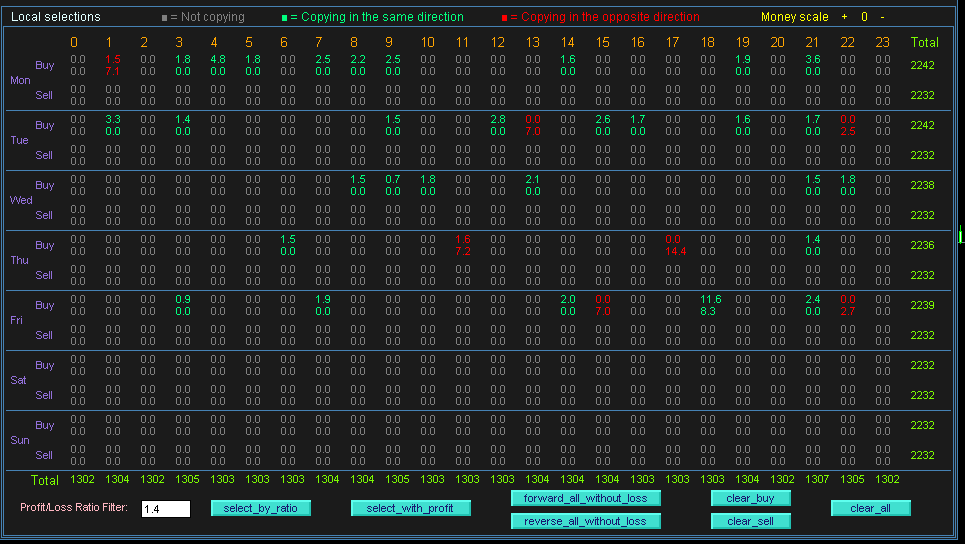

Now let’s talk about local choices.

The main purpose is to be able to decide how long to follow an order, how long to not follow an order, and how long to follow the reverse order based on the source account’s past order statistics.

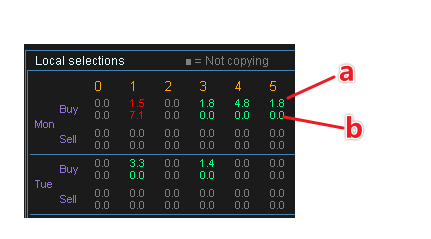

The horizontal axis represents 24 hours a day, the vertical axis represents 7 days a week, and distinguishes between long and short positions.

a: Monday, buy side, historical profit 1.8

b: means Monday, buy side, historical loss = 0.

Therefore, historical statistics are profitable during this period. When you click “a”, the color of a and b will change from gray to green, indicating that orders for this period will continue to process.

You can also click b and the color will change from green to gray to indicate that no commands will be followed during this period. Clicking b again changes the color from gray to red, indicating that backtracking is required during this period.

Now you understand that you can freely configure the copy situation on a 7*24 hour basis. Under normal circumstances, there is no need for manual configuration. There are several options at the bottom to help you configure it automatically.

At this point, you will notice that the process is more complicated. But there is only one step left to succeed.

Click Forward Trading in System Settings. When you see the emoticon next to it change to a smiley face, it means the program ran correctly.

Finally, we would like to remind you that the reverse copy situation is very complex. Please do enough testing before making an actual offer.