Bitcoin Halving 2024 Analysis: Implications and Predictions for Bitcoin Miners

The significant Bitcoin halving event is scheduled for April 19, 2024. This quadrennial event reduces the block subsidy for Bitcoin miners from 6.25 BTC to 3.125 BTC, halving the reward miners receive for their efforts. These events have historically resulted in massive changes to the mining landscape and potentially impacted various economic and operational aspects of Bitcoin mining.

Economic outlook and market outlook

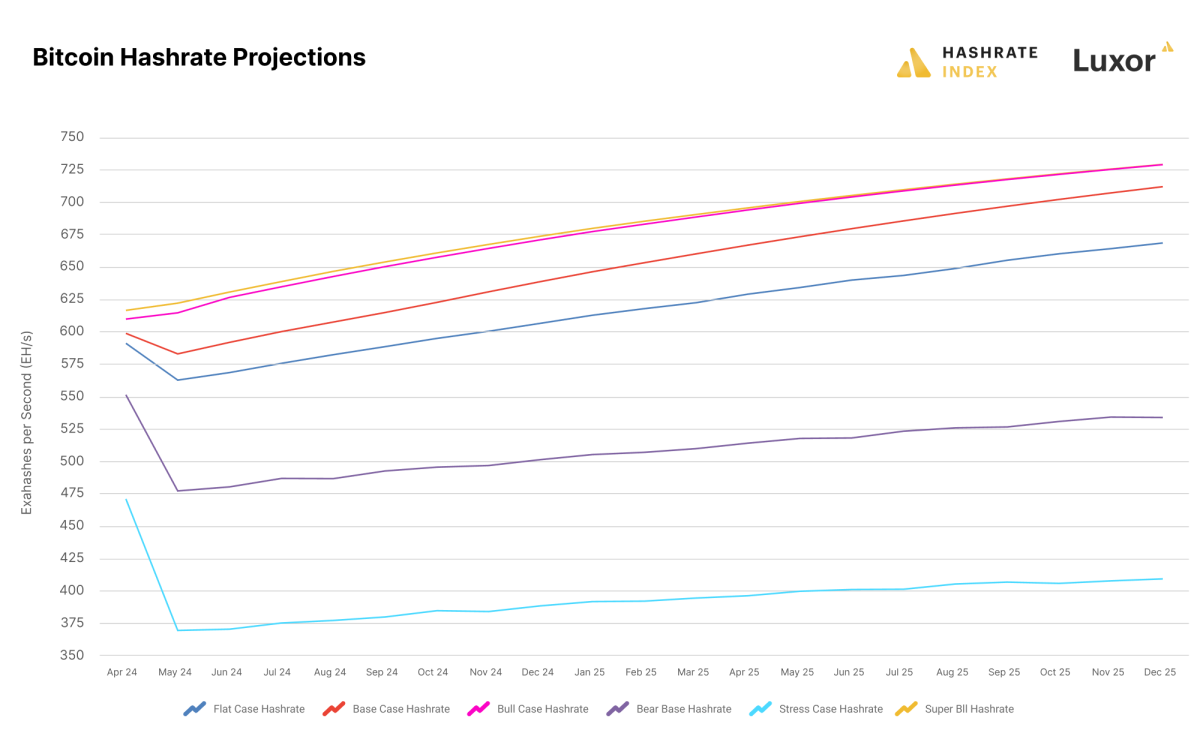

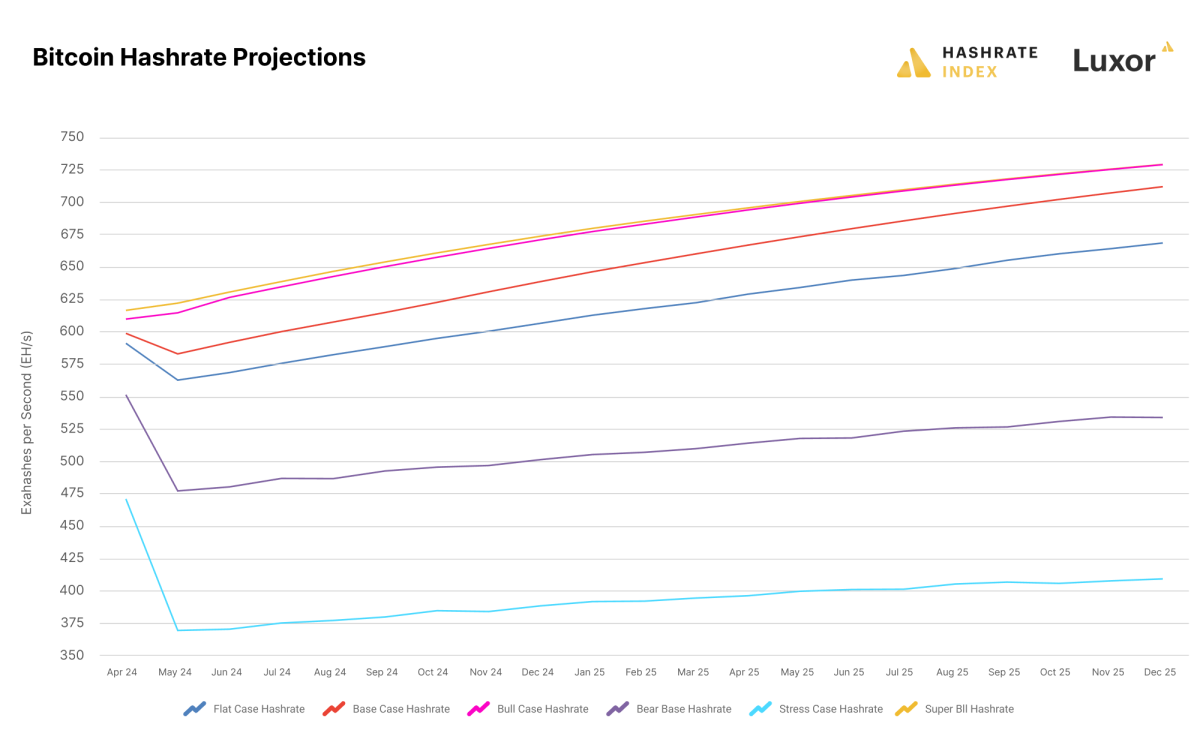

The immediate impact following the halving is a significant reduction in miner revenue due to reduced block subsidies. Hashrate may decline as less efficient miners may become unprofitable and leave the network. Luxor’s Hash Rate Index research team estimates that approximately 3-7% of Bitcoin’s hash rate could go offline if the Bitcoin price maintains current levels. However, if the price falls, a hashrate of up to 16% could become economically unviable, depending on the trajectory of the Bitcoin price and transaction fees after the halving.

Bitcoin’s hash rate, an important security measure, can be adjusted based on difficulty to adapt to new economic realities. Luxor’s analysis presents various scenarios in which the network’s hash rate could reach 639EH/s to 674EH/s by the end of the year, reflecting an adjustment for new revenue potential after the halving.

ASIC Pricing and Break-Even Points

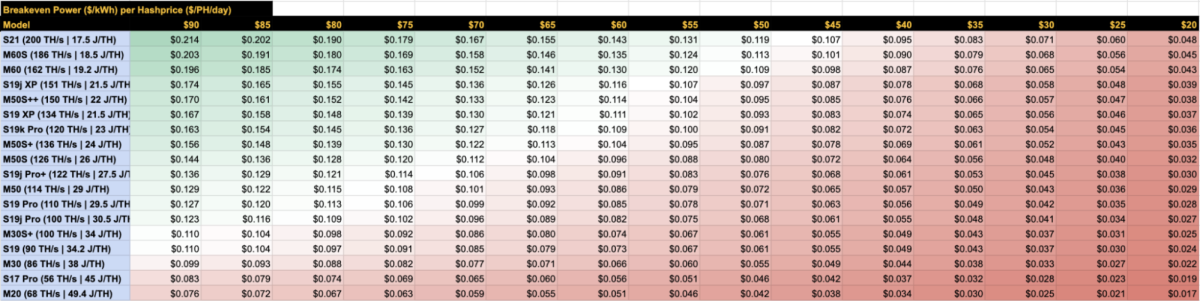

After the halving, the profitability of various ASIC models becomes important as mining rewards fall. Low rewards mean that only the most efficient machines can operate profitably unless the price of Bitcoin rises significantly. For example, according to Luxor’s predictions, next-generation ASICs such as the S19 XP and M30S++ could have breakeven power costs ranging from $0.07/kWh to $0.15/kWh, depending on the hash price after halving.

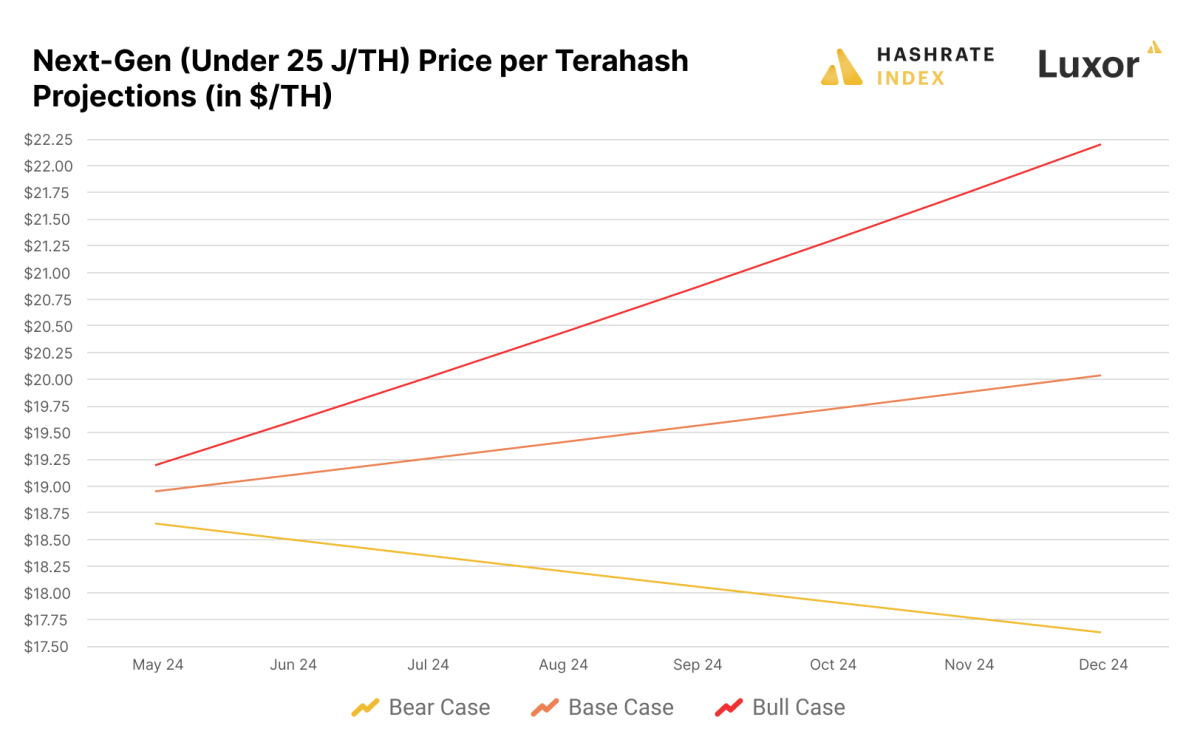

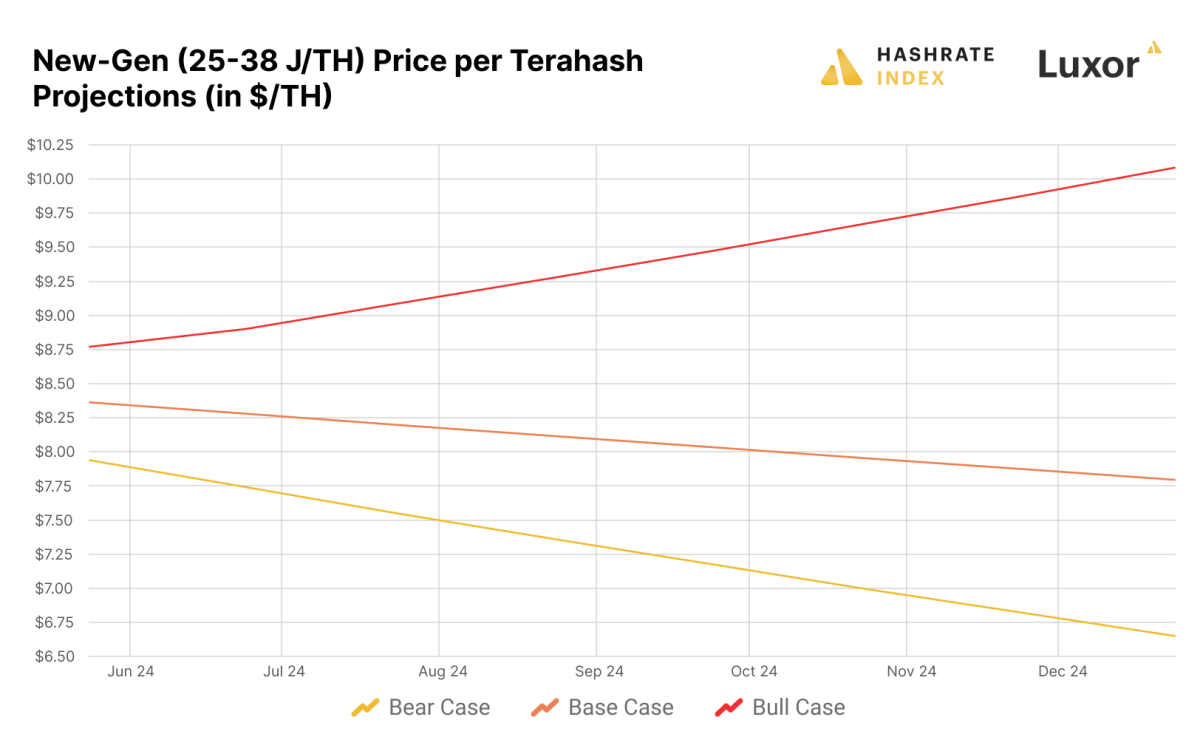

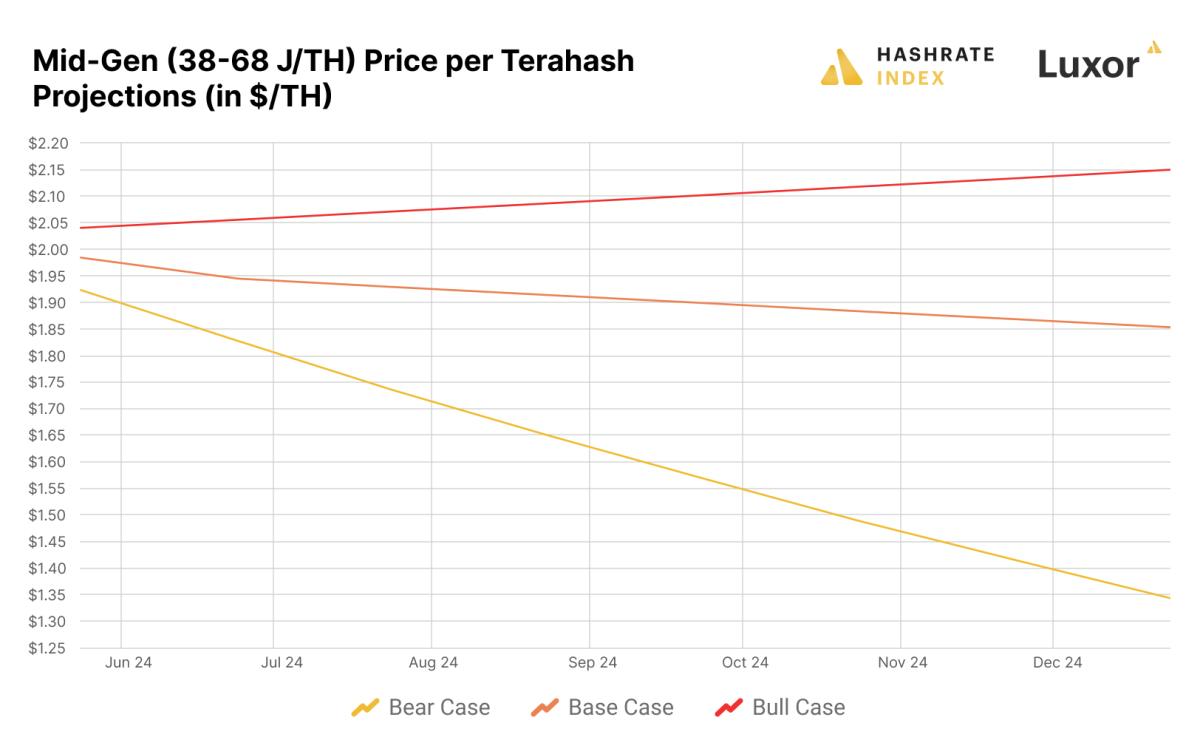

These changes in profitability will likely lead to a repricing of ASIC equipment. Historical data shows that ASIC prices are highly correlated with hash prices. Therefore, the expected decline in hash prices will trigger a downward adjustment in ASIC value. This will particularly impact older, less efficient models, potentially phasing them out of the market.

The role of custom ASIC firmware after halving

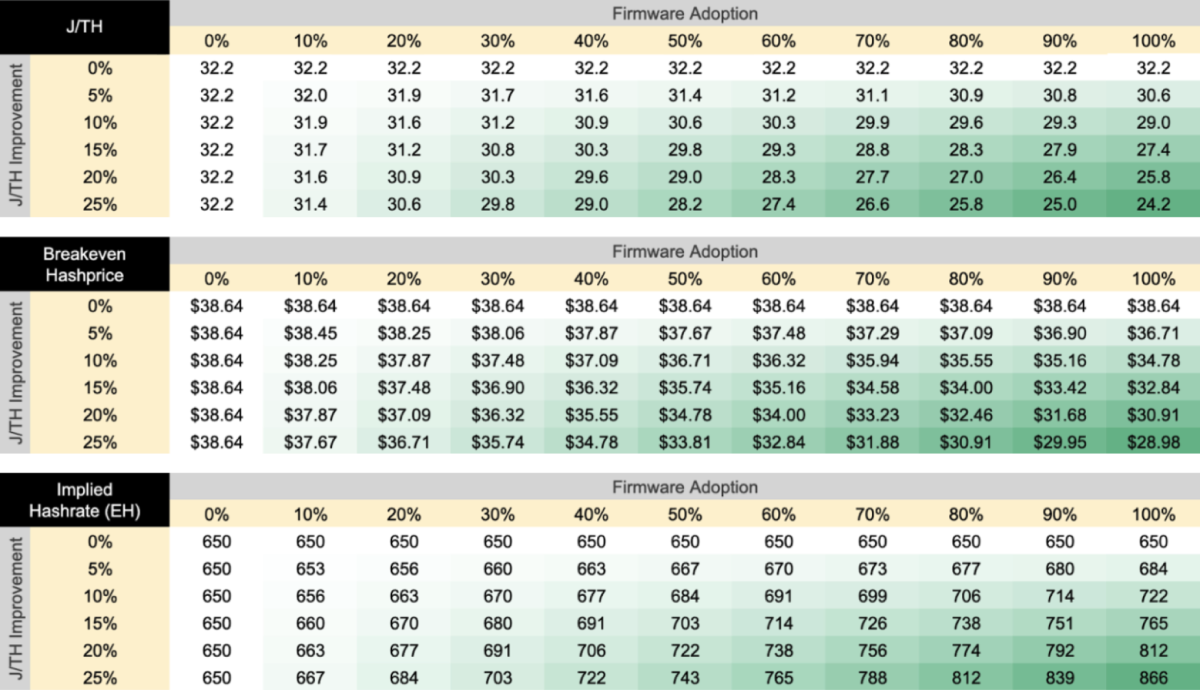

To combat declining profitability, miners are increasingly turning to custom ASIC firmware to improve hardware efficiency. Firmware such as LuxOS and BraiinsOS can improve machine performance by optimizing power usage and hash rate output, lowering the break-even point on electricity costs. For example, underclocking the S19 with custom firmware can extend its operational potential by reducing power consumption, thus maintaining profitability even at lower hash prices.

In particular, public miners are adopting custom firmware to increase the efficiency of their miners. Companies such as CleanSpark and Marathon have reported improved operational efficiency using custom solutions. This trend is expected to grow as more miners seek to maximize production and minimize costs in the face of declining block rewards.

Bitcoin Halving in 2024 and Beyond

The Bitcoin halving in 2024, like previous halvings, is set to significantly reshape the mining landscape. Although the exact outcome is uncertain, this event will undoubtedly present both challenges and opportunities. Miners who plan strategically, considering both economic forecasts and operational efficiency, will be better positioned to navigate the post-halving environment. For those working in the Bitcoin mining industry, staying informed and adapting will be key to using the halving event as an opportunity rather than a setback. With the right preparations, especially ASIC management and firmware optimization, miners can continue to grow even in difficult economic times.

This is a guest post by El Sultan Bitcoin. The opinions expressed are solely personal and do not necessarily reflect the opinions of BTC Inc or Bitcoin Magazine.