Best Interest Rates: Stablecoins and Fiat

summary

Stablecoins (digital currencies pegged to traditional assets) have fueled cryptocurrency adoption by mitigating volatility and facilitating access to digital assets. Leading stablecoins USDT, USDC, and BUSD, which account for 11% of the cryptocurrency market, have remained stable over the long term despite the downfall of some algorithmic stablecoins.

| stablecoin | Best rates (and locations) |

| USDT | 100.00% (KuCoin) |

| USDC | 14.00% (Nexo) |

| die | 14.00% (Nexo) |

| BUSD | 12.00% (Jukhodler) |

| USD savings | Best rates (and locations) |

| 1 year CD | 6.18% (Bayer Heritage FCU) |

| 3 year CD | 5.32% (Luana Savings Bank) |

| 5 year CD | 5.25% (high BMO) |

| bank savings | 5.40% (Popular Direct) |

| money market | 5.35% (Brilliant Bank) |

Stablecoins have served as an important link between the traditional finance and cryptocurrency spaces and have fueled the expansion of the decentralized finance (DeFi) sector. Although stablecoins and fiat currencies have different roles, combining them creates a more versatile and interconnected global financial environment.

In this analysis, we explore the impact and importance of stablecoins in the evolving financial landscape and compare them to traditional fiat currencies. We also discuss its potential role as a global reserve currency and examine how it could contribute to a more diverse and technology-driven global financial ecosystem.

A brief history of stablecoins

A stablecoin is a blockchain-based digital currency or token whose value is designed to be linked to a collection of traditional fiat currencies, commodities, or assets.

In most cases, stablecoins reflect the value of a specific fiat currency, with the US dollar being the most widely used. Typically, stablecoins maintain a 1:1 support ratio with their corresponding fiat currencies. The token’s primary goal was initially to mitigate the high volatility of cryptocurrencies, but it also fulfilled many other important roles.

Stablecoins have contributed significantly to the adoption of cryptocurrency assets among institutional and retail investors by providing easy access to a variety of digital currencies and assets while virtually eliminating volatility. They have acted as a connecting point or gateway between traditional finance and the cryptocurrency ecosystem, facilitating a seamless entry and exit system for investors.

It has also become a driving force behind the explosive growth of decentralized finance (DeFi), one of the most important trends in blockchain.

As of this writing, the top three stablecoins by market capitalization are USDT, USDC, and BUSD. These three stablecoins are among the top 15 cryptocurrencies, accounting for approximately 11% of the total cryptocurrency market, with a combined market capitalization exceeding $120 billion at the time of this writing.

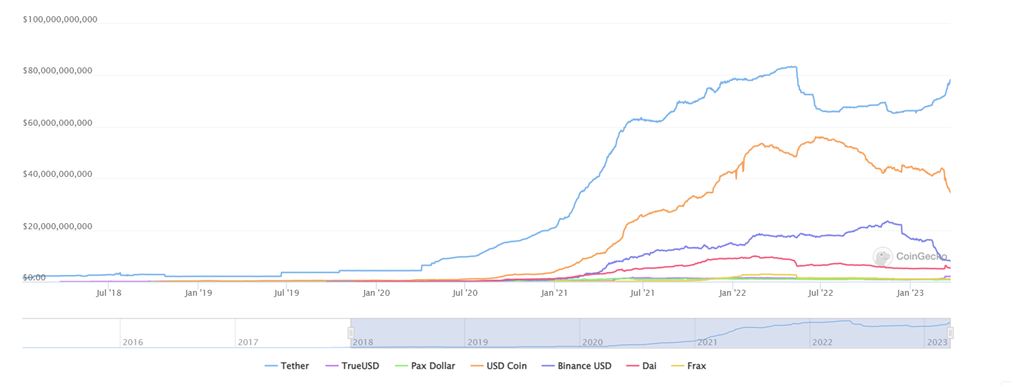

The stablecoin boom emerged in 2020-2021 along with the DeFi craze. In this time, total market capitalization has increased from less than $7 billion in March 2020 to more than $60 billion in March 2021. By March 2022, it had surged 2,500% to over $180 billion. Within two years.

The success of stablecoins lies in their ability to combine the stability and liquidity of traditional currencies with the unique characteristics of blockchain technology such as decentralization, security, speed, and transparency. These tokens can be integrated into existing financial use cases such as payments, international transactions, and remittances.

While the rapid collapse of several algorithmic stablecoins, such as Terra USD (UST), has had a negative impact on the cryptocurrency market, fiat-backed and cryptocurrency-backed stablecoins have proven resilient despite the recent USDC crisis.

Advantages and disadvantages of stablecoins

| Advantages/Benefits | Disadvantages/Risks |

| Stablecoins virtually eliminate volatility, which has been a major problem in the cryptocurrency market. | Algorithmic stablecoins use smart contracts to manage their pegs and are vulnerable to smart contract bugs, hacking, or market manipulation. The collapse of UST is a relevant example of how algorithmic stablecoins can fail. |

| They provide liquidity to the cryptocurrency market, making it easier to trade, invest, and convert between digital currencies and fiat currencies. | Fiat-backed stablecoins rely on a centralized entity to maintain the peg, which goes against the decentralization principles of cryptocurrencies. |

| Stablecoins serve as a bridge between traditional finance and the cryptocurrency ecosystem, enabling a seamless entry and exit system for investors. | There is still regulatory ambiguity in many jurisdictions when it comes to stablecoins. |

| Stablecoins offer faster and cheaper cross-border transactions compared to traditional financial systems. |

fiat currency

Fiat is government-issued legal tender that is not backed by a physical commodity such as gold or silver. Instead, its value is derived from people’s trust and confidence in the stability of the issuing government and the economy. The United States dollar (USD), euro (EUR), Japanese yen (JPY), and British pound (GBP) are examples of fiat currencies. It is primarily used as a medium of exchange for goods and services, a store of value, and a unit of account.

Fiat currency plays an important role in the global economy as it facilitates domestic and international trade and commerce. It is used for everyday transactions such as buying groceries, paying bills, and settling debt, as well as more complex financial transactions such as investments, loans, and borrowing.

Central banks are responsible for issuing and regulating fiat currency. They rely on monetary policy tools such as interest rates and open market operations to control the money supply and maintain price stability within their respective economies.

Recently, as digital payment methods have become more common, the use of physical cash has been decreasing. To put this in perspective, the supply of M0, which includes notes, coins and bank reserves, was $5.3 trillion as of January 2023, compared to $21 trillion of M2, which also includes securities and other bank deposits.

The shift toward digitalization has led central banks to explore the development of so-called central bank digital currencies (CBDCs) inspired by stablecoins. CBDC is a digital form of fiat currency issued on a permissioned blockchain, i.e. a private network controlled by central bank members.

CBDCs aim to provide a safe, efficient and cost-effective alternative to existing payment systems while maintaining the stability and trust associated with fiat currencies. However, many economists are concerned about privacy issues and the fact that CBDCs will lead to centralization of the economy by making banks unnecessary.

Currently, more than 100 countries, including the United States, are exploring the benefits and capabilities of CBDCs.

CBDCs have the potential to transform the financial landscape by offering a number of benefits, including faster and cheaper cross-border transactions, increased financial inclusion, and improved monetary policy implementation.

Advantages and disadvantages of fiat currency

| Advantages/Benefits | Disadvantages/Risks |

| Fiat currency is universally accepted for transactions and is therefore used as the primary medium of exchange. | The value of fiat currency may erode over time due to inflation, reducing its purchasing power. This drawback also affects stablecoins due to their 1:1 peg. |

| Fiat currency comes in physical form, making it convenient for direct transactions. | Fiat currencies are controlled by central banks and therefore prone to misuse, corruption or political interference. |

| Fiat currency is issued and regulated by the government, providing trust and security to users. | Fiat currency is vulnerable to counterfeiting, which can undermine its value and credibility. Additionally, storing and handling physical currency can be cumbersome. |

Stablecoins and Fiat: Investor Use Cases

Investors can use stablecoins in several ways to take advantage of the unique opportunities the cryptocurrency space offers.

- Stablecoins are a gateway to the blockchain world and a bridge between traditional financial systems and cryptocurrencies.

- This allows investors to increase or decrease their exposure to cryptocurrencies such as Bitcoin without fiat interaction. This allows investors to speculate on cryptocurrency prices while leveraging the risk management benefits of stablecoins.

- Stablecoins have become an integral part of the rapidly growing DeFi ecosystem. Here, investors can access various financial services such as lending and borrowing without intermediaries such as banks.

- The blockchain lending platform allows users to borrow stablecoins to earn interest or borrow existing cryptocurrency assets. The interest rates are typically higher than those offered by traditional savings accounts.

US Dollar: Global Reserve Currency

The U.S. dollar has enjoyed its status as a global reserve currency since the Bretton Woods Agreement of 1944, when 44 countries agreed to form a new foreign exchange system centered around the U.S. dollar linked to gold.

Even after the USD lost its gold peg and became a floating currency in 1971, the dollar maintained its global reserve currency status thanks to U.S. foreign policy initiatives, including convincing Saudi Arabia and other oil-producing countries to sell their oil exclusively to the USD. .

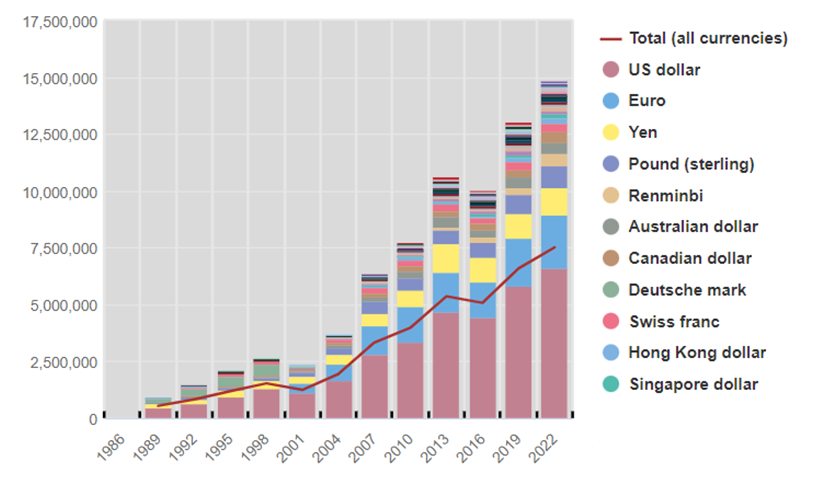

According to data from the Bank for International Settlements (BIS), over the past decade, approximately 88% of all foreign exchange transactions involved the US dollar.

Can stablecoins become global reserve currencies?

Today’s structural and geopolitical changes increase the likelihood that the US dollar will gradually lose its reserve status, especially as Russia and China plan to dethrone it.

Could stablecoins replace the US dollar as the next global reserve currency? Not likely to do it. These claims were popular when UST was at its peak, but as UST collapsed, such ambitions were muted.

A more likely scenario is that another fiat currency, CBDC, or a basket of fiat currencies or CBDCs, becomes the next standard for global reserves.

Investor Implications

Stablecoins and fiat currencies are complementary financial products, each serving different purposes in the world of finance. With volatility virtually eliminated, Stablecoins serve as a gateway to the cryptocurrency ecosystem, enabling a seamless entry and exit system for investors. They have played a key role in fostering the growth of decentralized finance (DeFi), cryptocurrency payment systems, and other use cases.

Fiat currency, on the other hand, is universally recognized and regulated by governments, providing trust and security in everyday transactions. The emergence of central bank digital currencies (CBDCs) highlights the continued convergence between traditional finance and the digital realm, offering potential improvements to cross-border transactions and monetary policy implementation.

Stablecoins and fiat currencies serve different purposes, but when used together, they contribute to a more diverse and interconnected global financial ecosystem.

Frequently Asked Questions

Here are some questions to consider before adding stablecoins to your portfolio:

Where can I buy, sell and exchange stablecoins?

Stablecoins can be traded on centralized exchanges such as Coinbase or Binance, as well as decentralized exchanges (DEXs) such as Uniswap or Curve.

How often are reserves audited and how transparent is the reporting?

Each issuer is different. For example, Circle, the entity behind USDC, has its reserves audited by a third party every month. The company transitioned from Grant Thornton to Deloitte in January 2023.

What is the market capitalization and circulation?

The market capitalization of the roughly 100 stablecoins tracked by DeFi Llama is over $133 billion as of this writing.

Subscribe to Bitcoin Market Journal to find more cryptocurrency investment opportunities!