Bitcoin transaction fees soar, accounting for 75% of miners’ profits after halving

Bitcoin’s fourth halving introduced long periods and halvings. short shift In terms of miner revenue composition BTC For each block mined, a 50% reward is paid to the miner. This has a direct impact on miner incentives and, by extension, the broader Bitcoin economy.

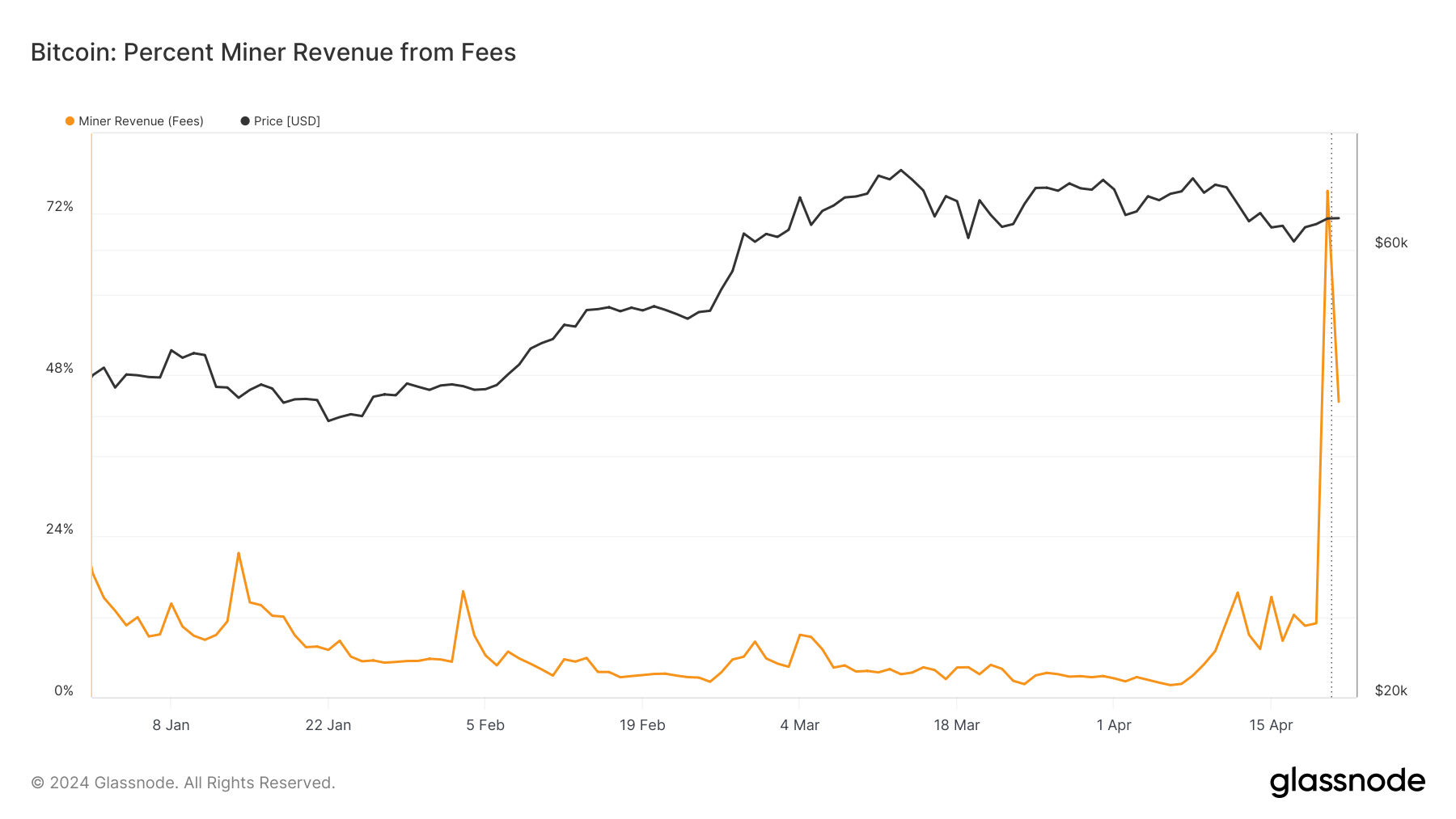

On April 19, just before the halving, transaction fees accounted for 11% of total miner revenue, a figure that has remained relatively stable throughout the year. However, the halving event on April 20 brought about significant changes, with transaction fees soaring to over 75% of miners’ profits.

The surge in fees may be the result of a combination of factors. First, a significant portion of the market may have been competing to settle trades before the halving, which drove up transaction fees.

Second, transaction demand seemed to be growing, and users wanted to be included in the halving block itself. Much of this demand can be attributed to Ordinals, as engravings for the coveted block 840,000 may be worth more on the secondary market.

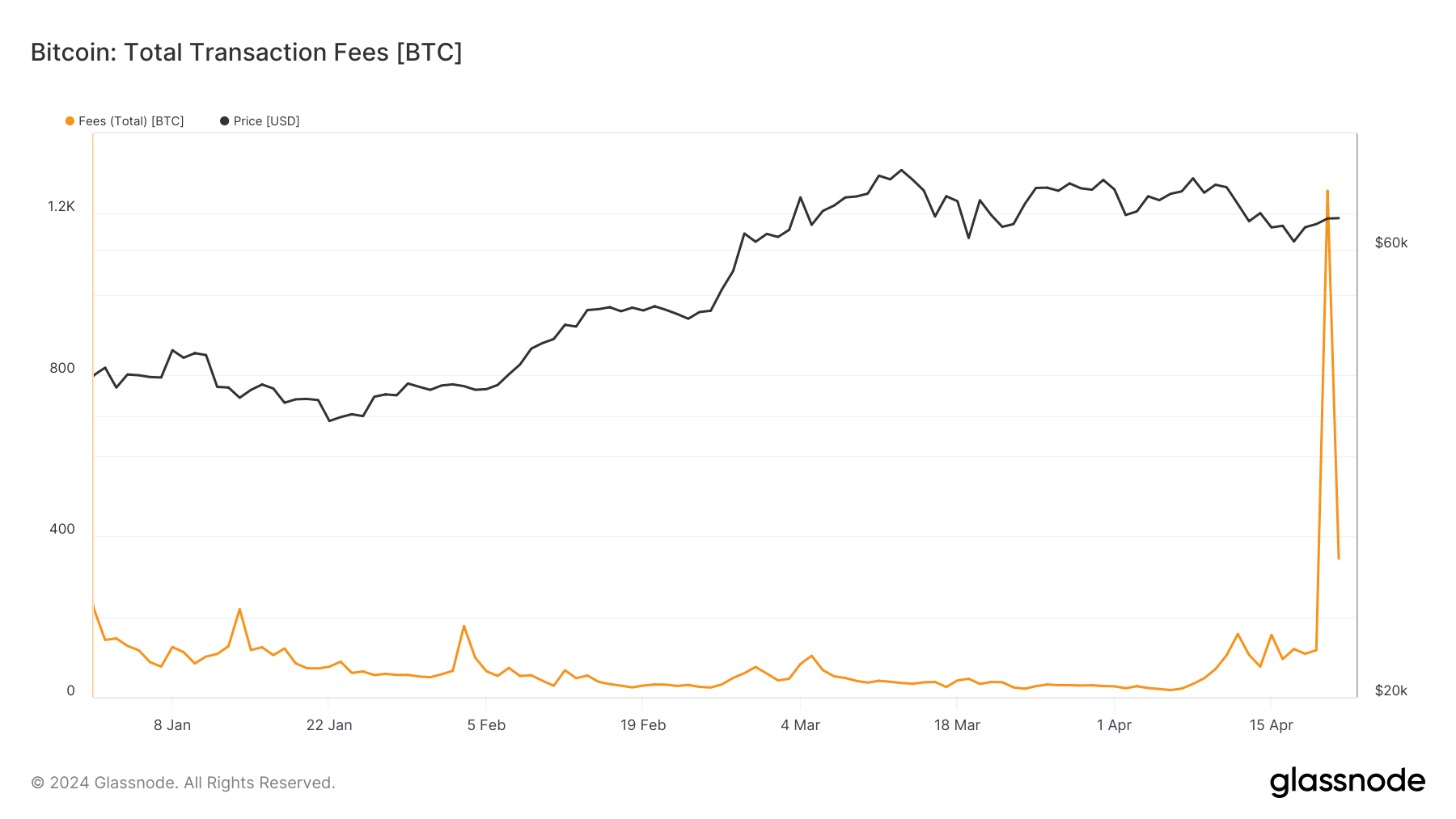

This demand for limited block space drove transaction fees to their highest levels in history, with 1,257 BTC paid out to miners on the day of the halving. On April 19, one day before the halving, the total fees paid to miners was 116 BTC, showing how large the increase in transaction costs was.

The drop in fees to 344 BTC on April 21, while still well above pre-halving levels, indicates that the market is beginning to normalize and adapt to the new mining economy.

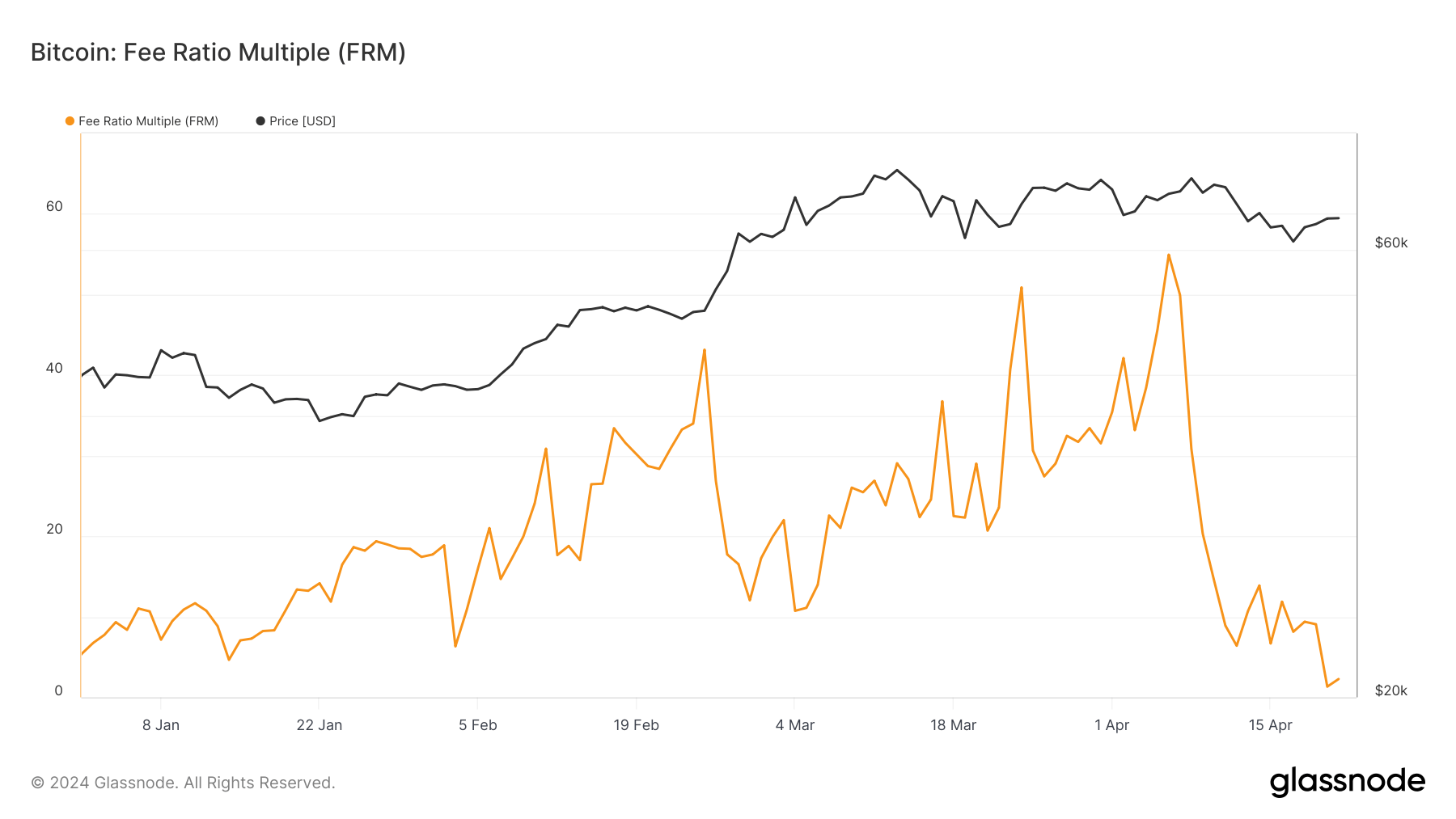

The Fee Rate Multiplier (FRM) clearly shows the impact of these increased fees. This indicator is used to evaluate the economic security of a blockchain. This is especially true when switching from block reward-based miner rewards to transaction fee-based rewards. FRM is calculated by dividing total miner revenue, consisting of block rewards and transaction fees, by transaction fees.

This metric helps evaluate how much mining income is derived from transaction fees rather than block rewards, and provides insight into the sustainability of the blockchain when block rewards are no longer a significant factor.

On April 19, the day before the halving, FRM was 9.01. This indicates that total miner revenue was approximately nine times the amount earned from transaction fees alone, with the majority of miner income still heavily reliant on block rewards.

As block rewards were halved and transaction fees increased, FRM fell to 1.325, showing how dramatic the change in fee dependence is. As block rewards decrease, transaction fees take up a much larger portion of overall miner revenue, reducing FRM value.

A low FRM value means that the blockchain is theoretically getting closer to a state where it can be sustained primarily by transaction fees. This is critical to long-term security and survivability, as the block reward continues to be halved until it stops.

However, this could have a negative impact on a significant portion of the network. If transaction fees start to take up a larger portion of miners’ revenue, costs to users could increase, potentially impacting how transactions are prioritized and user behavior. This can result in higher fees during times of peak demand.

The post Bitcoin transaction fees soar, accounting for 75% of miners’ revenue after halving appeared first on CryptoSlate