Break and Retest – Guide – Analysis and Forecast – April 23, 2024

Stop and Retest It is one of the most complex indicators, with over 1,400 lines of coding. This is one of the best strategies available in your trading tool because it is based purely on price action!

⚠️ To make sure your break and retest are working properly, here’s what you need to check in the top left corner of your MT4 chart:

Health: I’m good at my job…

Status: Retrieving discontinued and retested items…

What is discontinuation and retest?

B’s core ideaLeak and retest The strategy is to wait for the price to fall Pass through a support or resistance level and then return to that level. condition that. Now before entering a trade our indicator looks for a wick rejection. This indicates that traders are actively defending this retest level. After the wick is successfully rejected, we wait for the candle continuation to finally receive buy and sell signals to enter the trade!

Typically, when there is a trend, there is always a retest level before the market continues the trend. We wait for a rejection of the retest level to show a signal that the trader wants to maintain the trend and not break it. If you see multiple rejection signals at the retest level, wait for a candle continuation to form before entering the market with a trade! Examples include:

Once you see a continuation candle moving in the direction of the main trend in the retest area, enter the trade! Once you start trading, you need to know your take profit and stop loss levels. In the case of a stop loss, the stop loss is usually placed on the breakout candle that breaks the support line and becomes a new resistance area. For take profit, take profit is usually set at the previous low or previous high candle. Examples include:

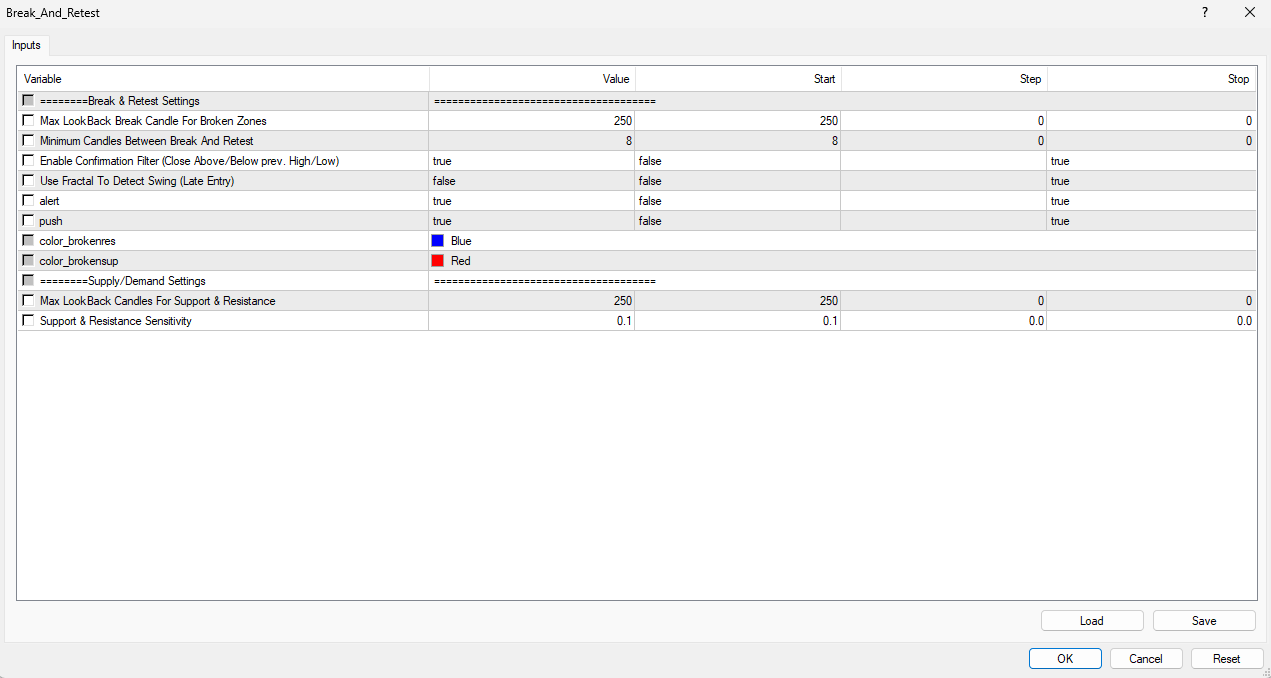

Stop and retest parameters

When attaching Stop and Retest The main settings shown in the chart are: See below for descriptions of each input.

Rest and retest settings

- Maximum lookback break candle for damaged area: By default it is 250. How many previous break candles do you want the indicator to remember for possible retesting?

- Minimum candles between rest and retest: There are 8 by default. What is the minimum number of candles needed between rest and retest? The higher the number, the more room there is for a clear retest.

- Activate confirmation filter (close previous above/below. high/low): True by default. True means that when there is a retest, the indicator waits for a confirmation candle after rejecting the wick.

- Swing detection (late entry) using fractals: It’s basically false. If set to true, the entry signal will appear after a few confirmation candles after a retest. Fractals mean we wait to have them. The highest high or lowest low of a candlestick. This means that you enter the trade after a late retest.

- inform: True by default. If a new signal appears after the retest, you will receive a buy or sell notification in your MT4 terminal.

- push: True by default. If a new signal appears after the retest, you will receive a push notification to your phone from the Metatrader 4 app.

- color_brokenres: It’s blue by default. Here you can change the color of the resistance zone.

- color_brokensup: default red. Here you can change the color of the support area.

Supply/Demand Settings

- Maximum lookback candles for support and resistance: 250 by default. How many candles do you want to remember support and resistance zones in the actual price? It makes sense to lower this number if you are trading on smaller time frames and raise it higher if you are trading on higher time frames. However, 250 is a one size fits all solution for all periods, so there is no need to change that!

- Support and resistance sensitivity: By default it is 0.10. This is the thickness of the support and resistance lines. if you want thin line, we can lower the number per example to 0.07. if you want thick line, you can increase the number per example to 0.20. we chose 0.10 Basically because we personally feel that’s the perfect line width. These parameters can be adjusted to suit your trading objectives!

period adjustment

The break and retest strategy works on any time period. By default, this indicator uses a lookback of up to 250 candles and a break lookback of 250 candles. This is a one size fits all solution for all time periods. However, if you want to hone your trading skills even further, I recommend trying out the files (attached below) set up for each period! Here’s how to change from default settings:

- M1: 50 candles

- M5: 100 candles

- M15: 150 candles

- M30: 250 candles

- H1: 250 candles

- H4: 500 candles

- D1: 1,000 candles

- Weekly: 2,000 candles

- Monthly: 4,000 candles

To use the files set for each period, you must click the Load button in the indicator settings.

How do you find good breaks and retest bad breaks?

When a retest occurs at a support or resistance zone, you need to visually check that this new zone has not collapsed below or above the level. If an area is broken by a candle or wick, this simply indicates that the area is not a good candidate for retesting. Wait for other settings. Here are examples of good and bad retests.

✅ The left side of the photo is a good retest because the new support area was not broken before the retest warning was triggered. That’s right. There may be a consolidation candle around the retest zone as long as this candle does not break the support or resistance zone. Consolidation is a good sign because it shows traders are defending the current level. We wait for consecutive candles and then enter trades based on the warnings provided by the indicator.

⛔ The right side of the photo shows a bad retest. This is bad because the resistance zone has already been broken by several wicks before receiving the retest warning. Even if the market falls, I would not enter this trade because I need to see a clear unbroken resistance area before retesting. It removes any doubt about the level itself and allows you to trade with more confidence!

How to trade breaks and retests with the trend?

If you want to become a trading master, you must remember that the trend is always your friend! when Stop and Retest When that happens, you want to make sure you’re on the right side. This is where the Katana indicator comes in handy. Katana uses moving averages to provide key trends. When Katana visually shows an upward trend Stop and Retest Once you have a buy signal, it’s time to start trading with these two powerful indicators!

Examples include:

get Stop and Retest Here: https://www.mql5.com/en/market/product/115398

get katana here: https://www.mql5.com/en/market/product/74631

Thank you for reading the manual guide. If you have any questions, please feel free to contact me!

Cheers,

what