Equity Income Investment Redux | pursue alpha

afternoon images

The past 12 months have been a difficult time for equity income investors. The top 20% of dividend-paying stocks in the S&P 500 index returned 13.5% in the 12 months through March. This compares to the S&P 500’s 29.9% return.

My message to equity income investors is: Please be patient. High-yield stocks are positioned to perform better next year. History, implicit bias, mean reversion, and the current market backdrop point to a resurgence.

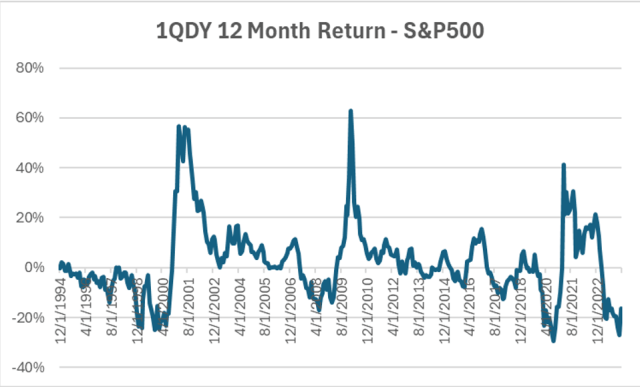

Figure 1: Top quintile of dividend yields

As of 3/31/24; Note: 1QDY or top quintile of dividend yield. Source: S&P, Bloomberg & Wealth Enhancement Group

Buying high-yield stocks over the long term has been a sound strategy. Over the past 30 years, the quintile (20%, or 100 stocks) of the highest dividend-paying stocks in the S&P 500 has outperformed. Top stocks from December 31, 1994 to March 31, 2024 The fifth quintile returned 11.9% per year. During the same period, the S&P 500 returned 10.4% per year. That’s a 1.5% premium on high-yield stocks.

The top quintile of dividend-paying stocks is more volatile than the S&P 500, but has similar Sharpe ratios and, by design, much higher dividend yields.

Because we assume a single-factor model, the stocks with the highest returns have, not surprisingly, higher volatility. It might be helpful to add a metric for dividend growth to avoid distressed companies at risk of cutting their dividends, but the focus of this article is simply yield.

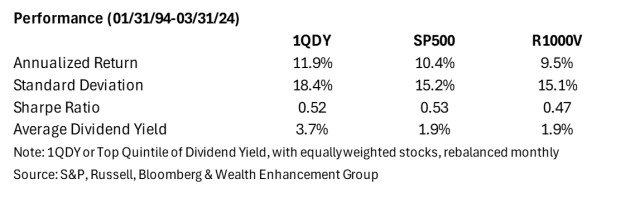

Figure 2: Top quintile of dividend yields for equally weighted stocks.

Sector-neutral strategies have also outperformed the S&P500 and Russell 1000 Value indices over the past 20 years, but to a lesser extent. Naturally, some sectors perform better with this strategy than others, depending on the level of high-yielding stocks in that sector. For example, industrials and financials perform well with sector neutral strategies, while consumer discretionary and technology sectors do not.

Why do high-yield stocks perform better?

There may be several reasons for the historical outperformance of high-yield stocks. First, behavioral economists have shown that many investors seeking a source of income prefer automatic dividends rather than self-dividends achieved by selling their holdings.

Second, Benjamin Graham pointed out that dividend payments can discipline company management to allocate capital wisely while generating attractive returns. In other words, management agency costs are reduced.

Third, non-qualified dividends are taxed at a higher rate than capital gains, so theoretically they should be associated with higher returns to reward shareholders.

Finally, it suggests that many investors are likely to exhibit a narrow framing bias, focusing only on a stock’s exciting growth story and paying little attention to the dull dividends paid out through earnings and cash flow.

That is, price targets are routinely created by assigning multiples to earnings. These targets cite growth with only vague consideration of return on capital, an equally important factor in valuation multiples. Naturally, a comprehensive discounted cash flow model or a dividend discounted model valuation is best.

The outlook for dividend stocks is favorable. Just using regression to the mean framework can point upwards. Over the past 30 years, the highest quintile of dividend-paying stocks in the S&P 500 has had a one-year leading return correlation of -0.3.

Mechanical regression to mean motion

Knowing that the 2023 return is 6.9%, the 30-year average return is 11.9%, and the 30-year correlation is -0.3, we can naively expect the 2024 return to be 13.5% (-0.3(6.9%-11.9%)+11.9). there is. %). This is a return closer to average. We can perform a similar calculation for the S&P 500, projecting a 2024 return of 10.0%.

This mechanical reversion to the mean means that high-yield stocks have performed better this year. However, it is very important to consider what average you want to revert to. Two key fundamental metrics are return on assets (ROA) and earnings growth. Over the past 30 years, the top quintile of dividend-paying stocks in the S&P 500 had an average ROA of 4.4% and an estimated one-year earnings per share (EPS) growth of 8.1%.

Current ROA is 3.6%. After bottoming out at 2.5% a year ago, EPS growth for the year ahead is now expected to be 11.9%. With ROA slightly below average and expected EPS growth above average, the underlying fundamentals are now close to normal, which points to a 30-year average return of 11.9% as a reasonable view for a regression.

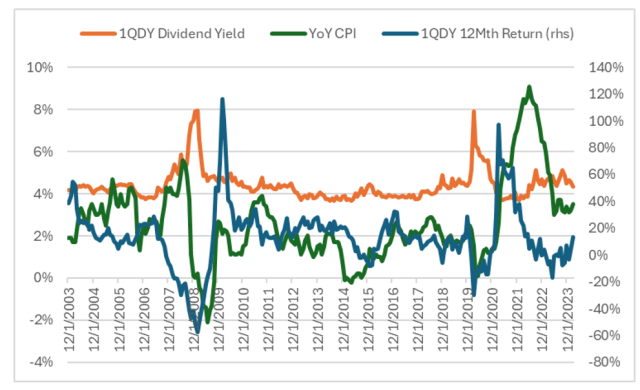

To adjust the outlook for dividend stocks, you can go one step further and model their returns on several variables. Two factors that are better at predicting the one-year forward returns of S&P 500 top quintile dividend stocks are dividend yield and annual consumer price index (CPI). The former series is a valuation measure and the latter is a rough proxy for rates. Both metrics are correlated with one-year forward dividend yield.

Currently, the dividend yield of the top quintile of dividend stocks is the 20-year average, and the CPI year-on-year is above average and showing a downward trend (see Figure 2). If consensus expectations that year-over-year CPI will continue to decline next year are correct, dividend stocks will benefit.

Figure 3: Dividend yield, CPI, 12-month return

As of 3/31/24; Note: 1QDY or top quintile of dividend yield. Source: S&P, Bloomberg & Wealth Enhancement Group

While stock income investors struggled, the situation was simple considering the historical performance of dividend-paying stocks. I have a message again for investors looking for stock returns. Please wait a minute. History, implicit bias, mean reversion, and the current market backdrop point to a resurgence.

disclaimer: The content of this site should not be construed as investment advice, and the opinions expressed do not necessarily reflect the views of CFA Institute.

original post

Editor’s note: The summary bullet points for this article were selected by Seeking Alpha editors.