Truist Financial Stock Is Rising: Should You Buy?

If the bank is an indicator of the direction and tone of its quarterly earnings, other stocks may not have heard it yet. That’s because the big banks that reported earnings for the quarter ended March 31 all performed quite well, beating estimates even while the overall market was struggling (at least last week).

But now a new state has come and another big bank, Truist Financial (NYSE:TFC), the seventh-largest bank in the U.S., reported solid earnings that beat expectations amid a lack of revenue.

Truist shares rebounded after Monday’s earnings, rising about 4%. First, let’s look at the first quarter performance.

Mixed bag for Truist

The stock was up 4% on Monday, so the good outweighed the bad from the perspective of investors overall. But the report wasn’t all sunshine and rainbows.

Revenue decreased approximately 8% year over year to $4.9 billion, down approximately 13% to $3.4 billion due to lower net interest income. The decline was partly due to higher deposit costs due to higher interest rates as banks were forced to pay higher interest rates in an environment where consumers demanded them.

Another big factor was low loan balances. Average loans held for investment fell about 6% year over year to $308.5 billion. Overall, Truist’s net interest margin fell 28 basis points year-over-year to 2.89%.

The bank benefited from a rise in non-interest income, which rose to $1.45 billion from $1.42 billion in the year-ago quarter. This was driven by investment banking and trading revenue of $323 million, up 24% year over year. Wealth management revenue also increased 5% to $356 million.

All in all, Truist Financial reported net income of $1.1 billion (81 cents) per share, down from $1.05 per share in the first quarter of 2023 but better than estimates. Adjusted net income was $1.2 billion, or 90 cents per share, well above expectations of 78 cents per share. Profit increased due to a decrease in non-interest expenses. Overall, the efficiency ratio rose to 61.3% in the first quarter of 2024 from 57% a year ago.

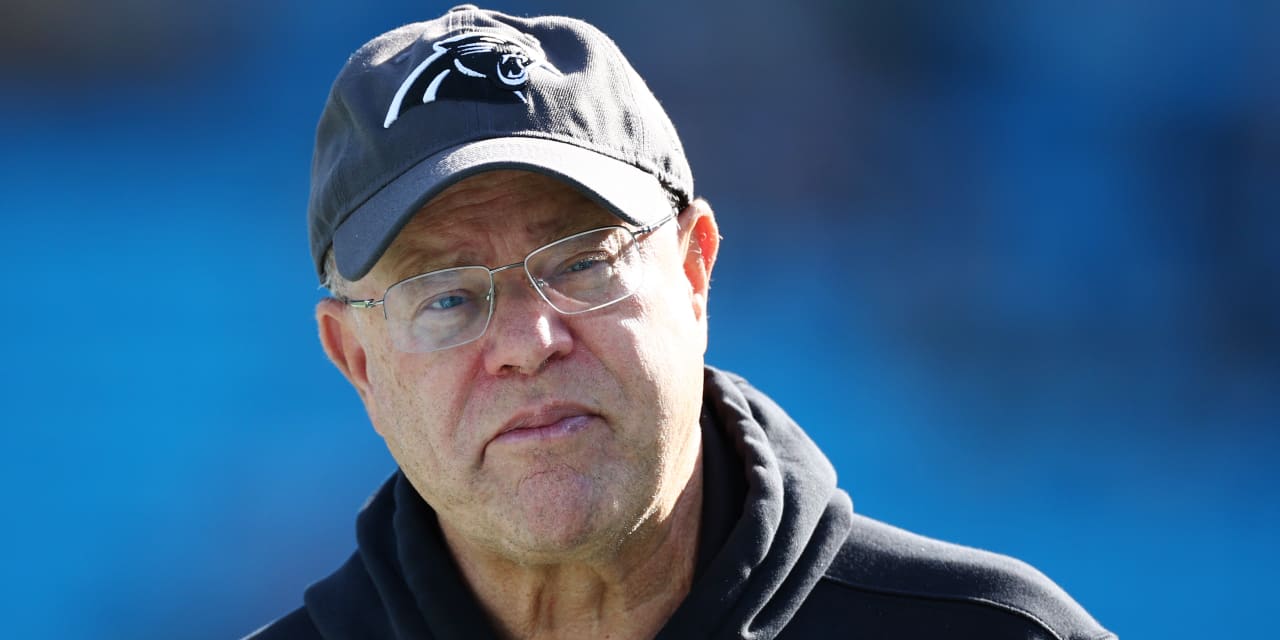

“We are pleased with the progress and momentum of our business in the first quarter. Our cost discipline has been clear and reflects the important decisions we made last year. “Our investments in our investment banking business have delivered strong results in improving markets.” said Bill Rogers, Truist Chairman and CEO.

Provisions for credit losses were flat year-over-year, but the bank saw net charge-offs rise 65% to $490 million, driven by increased write-downs of its commercial real estate, credit card and indirect auto portfolios.

Truist lowered its revenue guidance.

Truist Financial’s outlook is somewhat worrisome, with the company forecasting a 2% decline in second-quarter sales and a 4-5% decline in overall revenue for fiscal 2024. The full-year guidance is higher than the previous estimate of 1%. %~3% reduction in profits.

This may be due to expectations of continued lending growth and perhaps the belief that the Fed may not be as aggressive in lowering interest rates as previously thought. The path of interest rates will be an important factor not only for Truist but for all banks.

These estimates do not include proceeds expected from the $15.5 billion sale of Truist Insurance Holdings (TIH) to Stone Point Capital and Clayton Dubilier & Rice. The sale is expected to be completed in the second quarter.

Rogers said the deal will strengthen the bank’s capital position, provide more support to the bank’s customers, reposition its balance sheet to replace TIH’s profits and return capital to shareholders.

“Our strengthened capital position will enable us to better respond to any economic environment and, importantly, to be more aggressively positioned toward our core banking franchises. I am optimistic about our future as we operate Truist from a position of increased financial strength in some of the nation’s best markets,” said Rogers.

Truist Financial has a cheap forward P/E of 10, and its median price target of $42 per share is 10% higher than its current price. However, given that outlook, I’m not sure there’s enough earnings certainty to buy it, given that there are better bank stocks to consider.

disclaimer: All investments involve risk. Under no circumstances should this article be taken as investment advice or constitute liability for investment profits or losses. The information in this report should not be relied upon for investment decisions. All investors should conduct their own due diligence and consult their own investment advisors when making trading decisions.